Solana Price Prediction 2024-2033

- Solana Price Prediction 2024 – up to $199.75

- Solana Price Prediction 2027- up to $592.95

- Solana Price Prediction 2030 – up to $1,769

- Solana Price Prediction 2033 – up to $5,768

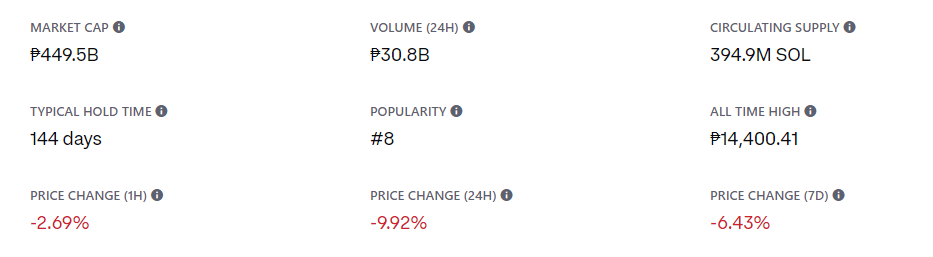

How much is SOL worth?

The live Solana price today is $172.40 USD with a 24-hour trading volume of $3,044,489,975 USD. We update our SOL to USD price in real-time. Solana is up 1.96% in the last 24 hours. The current CoinMarketCap ranking is #5, with a live market cap of $76,862,620,275 USD. It has a circulating supply of 445,849,433 SOL coins and the max. supply is not available.

Solana price analysis: Bullish momentum builds as bulls aim for $134.47 resistance

TL;DR Breakdown

- The Solana price analysis is bullish today

- Strong support for SOL/USD is present at $168.82

- The resistance level is seen at the $134.47 level

Solana price analysis is going strongly bullish today as the price has crossed above the $131.57 mark again. The price has been on a steady rise since the beginning of the day and it looks like the bullish momentum is not slowing down anytime soon. Though some bearish traces were seen in the last few hours, it was just a minor correction as the price quickly recovered and continued its upward trend. The overall market sentiment is also bullish for SOL, as the cryptocurrency has been in a strong uptrend for the past few days.

Solana price analysis: SOL forms an ascending triangle pattern

According to the 1-day chart for SOL, the bulls are clearly in control as the price continues to move upward. Yesterday’s bullish engulfing candlestick proved to be a strong support level and has pushed the price towards new highs. The market has formed an ascending triangle pattern as the price is moving toward the upper trend line.

The Relative Strength Index (RSI) for SOL/USD is currently at 61.09, indicating that there is still room for growth before reaching over. The CMF (Chaikin Money Flow) indicator is also showing strong buying pressure, with a reading of 0.23. This suggests that investors are confident in the bullish momentum and are pouring more money into SOL.

SOL/USD 4-hour price chart: Bullish momentum pushes the price of SOL past the $190 mark

The 4-hour Solana price analysis chart shows a small dip in the price, which was quickly bought up by investors. This minor correction was followed by another bullish candlestick, indicating that the bulls are still in control and any dips are being seen as buying opportunities. The support level at $180 has proven to be strong yet again during this dip, and it is likely to continue holding if there are further corrections in the near future.

The technical indicators for the 4-hour chart also support the bullish momentum, and the CMF is also showing healthy buying pressure, suggesting that investors are not losing confidence in SOL despite any minor dips. The relative strength index (RSI) is currently at 82.81, indicating strong buying pressure.

Is SOL A Good Investment?

The Solana price analysis shows a clear bullish sentiment in the market as the price continues to move upward. The support level at $180 has proven to be strong, and any corrections are being quickly bought up by investors. The technical indicators also support this bullish momentum and suggest that the price may soon break through its current resistance level and reach new highs in the near future.

Recent News/Updates on Solana

Solana recently announced the winners for the Solana Scribes hackathon by LamportDAO in an X post.

🔥✍️1000+ participants.

— Solana (@solana) April 12, 2024

🔥✍️2700+ submissions.

🔥✍️Countless hours.

The winners are in for the first Solana Scribes content hackathon by @LamportDAO, @mtndao, @SolanaCollectiv, @Cubik_, & @heliuslabs!

Congratulations to the legends who contributed! See who won👇 https://t.co/XWK4pRMQd3

Solana Price Predictions 2024-2033

Price Predictions by Cryptopolitan

At the beginning of 2024, there was a recovery in the price of cryptocurrencies, but recent events have shown that bears are now in control of price dynamics, slowing growth. Solana (SOL), which has seen its value fall by 3.16% today, has also been affected by this trend.

Our pricing projection indicates that the maximum price for Solana will be $30.78 by the end of 2024. The coin’s value will rise and hit $213.69, its highest level in five years. Future prospects and potential are bright for Solana. We anticipate that Solana will continue to appreciate in value until 2033 when it will reach $855.78 at its highest price.

| Year | Minimum | Average | Maximum |

| 2024 | $166.37 | $171.58 | $199.75 |

| 2025 | $232.93 | $239.80 | $285.64 |

| 2026 | $342.26 | $351.85 | $403.74 |

| 2027 | $483.78 | $501.37 | $592.95 |

| 2028 | $722.60 | $742.66 | $840.30 |

| 2029 | $1,018 | $1,048 | $1,272 |

| 2030 | $1,485 | $1,538 | $1,769 |

| 2031 | $2,130 | $2,192 | $2,572 |

| 2032 | $3,354 | $3,442 | $3,765 |

| 2033 | $4,767 | $4,905 | $5,768 |

Solana Price Prediction 2024

Solana prices, cryptocurrency experts expect that the SOL rate might reach a maximum of $199.75. It might, however, drop to $166.37. The forecasted average of Solana is nearly $171.58.

Solana (SOL) Price Prediction 2025

Solana price is forecast to reach a lowest possible level of $232.93 in 2025. As per our findings, the SOL price could reach a maximum possible level of $285.64 with the average forecast price of $239.80.

Solana Price Prediction 2026

According to our deep technical analysis on past price data of SOL, In 2026 the price of Solana is forecasted to be at around a minimum value of $342.26. The Solana price value can reach a maximum of $403.74 with the average trading value of $351.85.

Solana Price Prediction 2027

After the analysis of the prices of Solana in previous years, it is assumed that in 2027, the minimum price of SOL will be around $483.78. The maximum expected SOL price may be around $$0.3467. On average, the trading price might be $501.37 in 2027.

Solana Price Prediction 2028

According to our deep technical analysis on past price data of SOL, In 2028 the price of Solana is predicted to reach at a minimum level of $722.60. The SOL price can reach a maximum level of $840.30 with the average trading price of $742.66.

Solana (SOL) Price Prediction 2029

Based on the analysis of the costs of Solana by crypto experts, the following maximum and minimum SOL prices are expected in 2029: $1,272 and $1,081. On average, it will be traded at $1,048.

Solana Price Prediction 2030

Solana price is forecast to reach a lowest possible level of $1,485 in 2030. As per our findings, the SOL price could reach a maximum possible level of $1,769 with the average forecast price of $1,538.

Solana Price Prediction 2031

Every year, cryptocurrency experts prepare forecasts for the price of Solana. It is estimated that SOL will be traded between $2,130 and $1,572 in 2031. Its average cost is expected at around $2,192 during the year.

Solana Price Prediction 2032

As per the forecast price and technical analysis, In 2032 the price of Solana is predicted to reach at a minimum level of $3,354. The SOL price can reach a maximum level of $3,765 with the average trading price of $3,442.

Solana Price Prediction 2033

After years of analysis of the Solana price, crypto experts are ready to provide their SOL cost estimation for 2033. It will be traded for at least $4,767, with the possible maximum peaks at $5,768. Therefore, on average, you can expect the SOL price to be around $4,905 in 2033.

Solana Price Prediction by Coincodex

According to Coincodex’s most recent price estimate. Indicating a moderate degree of investor mood, the Fear and Greed Index is currently at 61. The present market prognosis for Solana is bearish (Greed), nevertheless, according to technical indicators from Coincodex. Solana’s price has fluctuated by 6.25% over the last 30 days, with 18 of the 30 days (or 60%) being upbeat (green).

Looking ahead to the future, Coincodex’s Solana forecast suggests that now might not be the best time to purchase Solana, as the indicators point to negative market sentiment. However, it’s important to consider various scenarios. Under the best-case scenario, assuming significant growth similar to that of Facebook, the price projection for Solana in 2026 is estimated to be $982.75. On the other hand, if Solana follows the expansion pattern of the Internet, the projected price for 2026 would be $112.74.

These projections highlight the potential for significant growth in Solana’s value over time, but it’s essential to note that these estimates are speculative and subject to market dynamics and unforeseen factors. As with any investment, thorough research and careful consideration of market conditions are recommended before making any decisions.

Price Prediction by DigitalCoinPrice

According to the latest forecast from DigitalCoinPrice, it is anticipated that the value of Solana cryptocurrency will experience a significant increase of 234.20% by the end of 2025, reaching $74.02. The Fear & Greed Index is currently at a reading of 8.21, indicating a high level of fear among investors. Additional technical indicators also suggest bearish market sentiment. Based on DigitalCoinPrice’s prediction, it is considered risky to sell Solana at this time.

In April, Solana witnessed a substantial price surge of 110.04%, with the cryptocurrency approaching the $42.61 mark. Presently, all indicators are pointing toward a bearish market trend, and the fear & greed index is registering a high level of concern at 8.21. DigitalCoinPrice’s forecast advises against selling Solana at the moment.

As per the technical indicators, it is projected that the 200-day simple moving average (SMA) will decline and the price of Solana will reach approximately $21.67 by the end of December. This trend is expected to continue in 2024, with the short-term 50-day SMA, indicating a price of $21.65. However, it is important to remember that these projections are subject to market fluctuations and unforeseen circumstances.

Price Prediction by Industry Influencers

The future price of Solana is now expected to increase, achieve higher highs in the upcoming years, and possibly reach a high of $23.83 by the end of mid-year 2024, according to YouTube market researcher Cryptonomics. According to Cryptonomics, the SOL currency will rise and reach a high of $29.84 at the end of 2024.

Solana owners might not be able to keep their currencies in the coming few months, according to CryptoZX. The analyst thinks SOL has excellent potential and strong fundamentals despite the massive fight between the bulls and the bears.

Solana Overview

Solana’s intrigue appears to stem from a perceived quality shift among crypto investors and developers. Is Solana Dead? SOL Resurrects at 114% They only used the opinion that SOL is dead as VC exit liquidity. Is it time to buy?

As a leading Layer-1 network, investors are watching how Solana performs as this network is one of the most vibrant in terms of its non-fungible token volumes, as well as other DeFi-related projects relying on low transaction costs and high speed. Helium’s decision to join the Solana network rather than stick it out indicates blockchains like Solana can cause a stampede.

Nothing in life is perfect. That means no blockchain is perfect. The valid criticisms of Solana are fundamental to how it works. Solana seems faster and functionally the same as ETH. Here is a healthy discussion about the furor that Solana is Dead. Apparently, it is not currently.

Solana has lost over $50 billion in value since the beginning of 2022, a year marked by outages, overloads, and significant exposure to Sam Bankman-Fried’s FTX exchange.

Solana blockchain (also commonly referred to as Solana protocol) was introduced to compete with the Ethereum blockchain, which brought the current revolution, especially with its smart contract technology that has to go ahead to enable the inventions of decentralized finance (DeFi), Non-Fungible Tokens (NFTs), decentralized applications (DApps), and all the other concepts like yield farming, liquidity mining, staking, etc., that accompany these inventions.

Today, Solana is fulfilling its purpose as more and more people continue adopting cryptocurrency. Its native token SOL is now priced at about $218, 43203.94%, up from its initial price at launch.

The blockchain revolution assured investors of digital coins that would offer privacy and confidentiality through the sturdy cryptographic algorithm that ensures that even if transactions are recorded in the public blockchain network, the identity of the sender and the receiver is always hidden behind some addresses.

Solana is considered one of the most effective, secure, fast, and censor-resistant blockchains worldwide. It offers an open-source infrastructure making it easy for global adoption.

Solana (SOL) Coin Price History

2020

Solana was launched in April 2020 and has gained popularity over the last 18 months. The price of Solana has surged from $0.75 to a high of $214.96 in early September.

2021

Following NFT hype and growing demand in the DeFi community, the price of cryptocurrency Solana or SOL more than tripled during the summer of 2021. Solana (SOL) token became the fastest-growing cryptocurrency and is currently ranked at position five with a live market cap of $66.4 billion. It has overtaken the likes of the once-popular Dogecoin, DAI, DASH, Polkadot, VeChain, Eos, and many others. It is closely behind Binance Coin (BNB) and Tether (USDT).

2022

The collapse of crypto trader FTX in 2022 especially impacted the cryptocurrency, as FTX and its sister firm Alameda Research sold a large amount of the coin in order to avoid bankruptcy.

Solana’s price briefly surged to a four-week high of $38.48 on 6 November 2022 after Google Cloud announced it had become a validator on the blockchain. Google Cloud has been working with @solana to bring Blockchain Node Engine to the Solana chain next year, so it will be easy for anyone to launch a dedicated Solana node in the cloud.

Also Read:

- How To Buy Solana?

- Mila Kunis` production company launches a Solana NFT-centered

- Civic Technologies unveils an anti-bots tool on the Solana network

More on Solana

What do I have to know about the Solana network?

The main thing about the Solana network is an innovative blockchain system. The main aims of this system are security and decentralization. Sol token has also soared and added significant gains to its bag in this situation.

What is the mission of the Solana project?

Solana Blockchain aims to make the situation convenient for decentralized apps and democratize the global financial setup. It provides a high-speed blockchain system that facilitates speedy transactions and secure communication.

What is Proof-of-History in Solana?

Proof-of-history in Solana is derived from Proof-of-Stake. It is one of the innovative additions to the Solana blockchain that relays more on time-based on the happening of a specific action. Using this protocol, Solana makes it possible to keep a historical record of the transaction.

Where to store SOL

Once you purchase SOL coins, store them in a secure place. Most of the exchanges where you can buy SOL offer in-built crypto exchange wallets. Other wallets that allow storage of SOL coins include the atomic wallet and Ledger hardware wallet.

What blockchain projects are on Solana?

Solana has smart contracts functionality, and a blockchain developer can develop and deploy a decentralized application (DApp) on the blockchain. Several blockchain projects have been launched on Solana, and they have also contributed to Solana’s fortunes. These blockchain projects include:

- Solana Beach — a Solana blockchain explorer.

- UPFI — a stablecoin.

- Phantasia — a fantasy sports platform.

- HydraSwap — a DEX.

- CropperFinance — a yield farming service.

Conclusion

Solana has proved that blockchains can be environmentally friendly, fast, and cheap. Solana Pay is the future of payments. The blockchain is cutting out the path for future developments in the blockchain space. Solana, with its innovative features, rivals those of Bitcoin and Ethereum. It also has a vast community. These advantages will propel Solana’s market capitalization to the top.

Solana has had a good run since its inception. Its blockchain rivals that of Ethereum and Bitcoin because it is environmentally safe, has low transaction costs, and is relatively very fast. This saw Solana perform very well at the beginning of the year before crypto prices began going down.

The question is whether SOL suffered long-term damage due to the FTX turmoil or only saw a temporary correction. Aside from the FTX fallout, SOL is still vulnerable to the risks associated with all cryptocurrencies, such as broader economic uncertainty and an inconsistent regulatory framework. SOL was hit harder than other digital currencies because of its connection to FTX, but its ecosystem is robust, and its developers continue to innovate.

Indeed, SOL was launched as an innovative cryptocurrency. Its developers have laid out ambitious plans, such as smartphones with built-in, Solana-connected crypto wallets and a fee-free store for decentralized applications. There is also a collaboration with Alphabet, the parent company of Google.

This partnership has resulted in developments such as Google Cloud becoming a validator to assist with processing Solana network transactions and a storage agreement that will increase developer accessibility to Solana data. Overall, even though SOL has experienced some unfavorable headwinds, it will likely continue to appeal to investors learning about cryptocurrency investing in the long run.

Solana Labs was once accused of irregular sales of its initial sales before being publicly available. If the news is anything to go by, it may impact Solana’s development, just like the lawsuit on XRP. Even though we are bullish on Solana, it is advisable to do your research before investing in this cryptocurrency.