Nobody can say that 2022 was a stellar year for Solana, and it certainly did not prove to be an “Ethereum killer.” Solana had multiple issues throughout the year and was unstable when used heavily. Every time there was a network outage, the SOL price fluctuated, and users criticized it for its centralization. The coin reportedly lost 94% of its value in 2022. Other issues have come up, compounding the problems leading to the decline in SOL price. But is Solana dead? Not at the moment; in fact, it has gained traction.

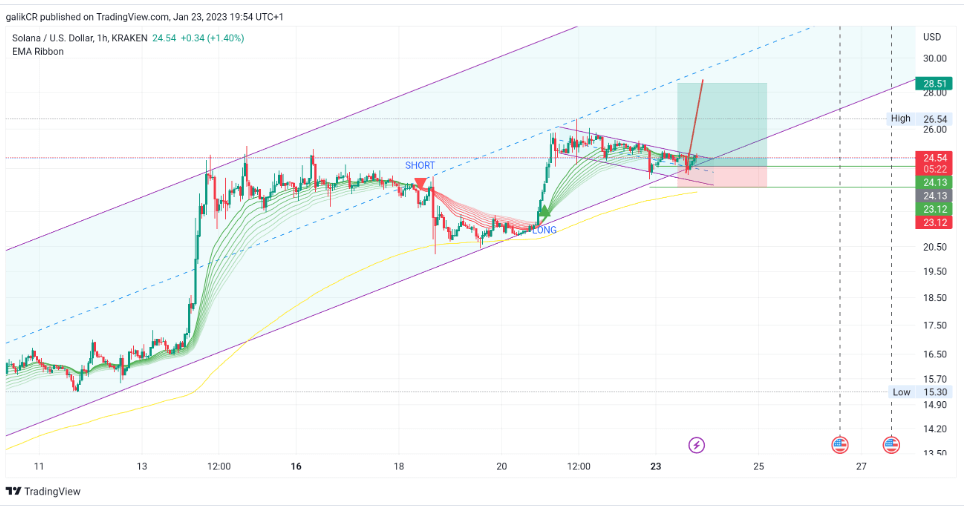

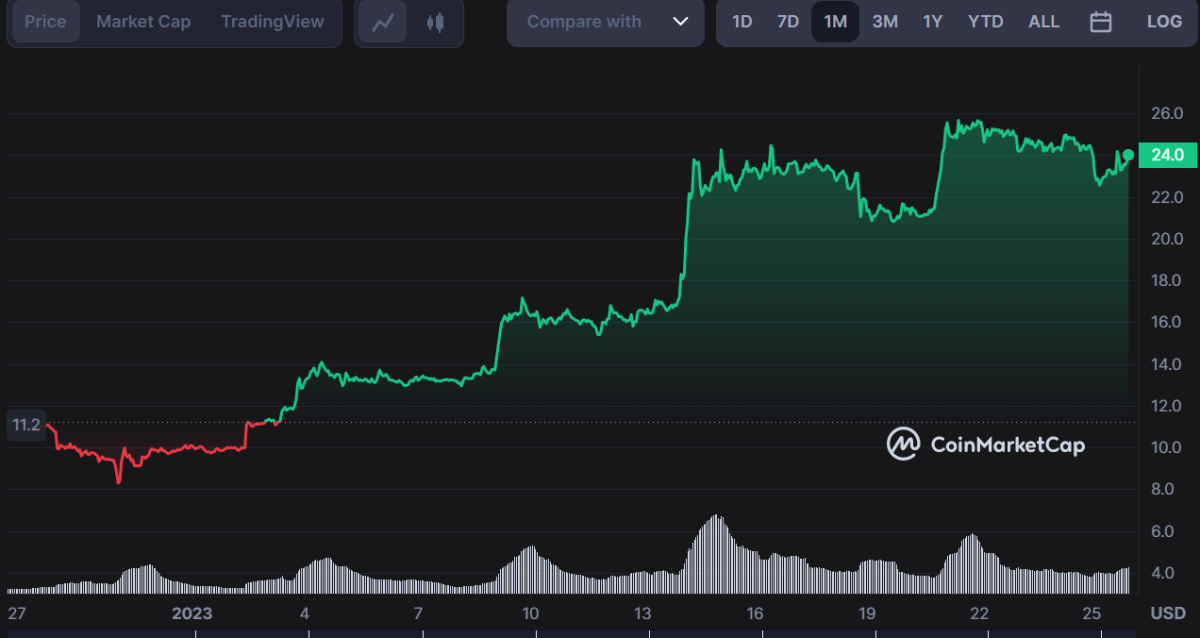

Solana price analysis shows strong signs of a continued upward run as prices rose more than 3 percent over the past 24 hours to move as high as $25.21. Since the start of January, Solana’s price has increased from $9.37 to a high of $26.54 on January 21, incurring a 183 percent rise.

Why is Solana on the downfall? 3 factors responsible for SOL’s decline

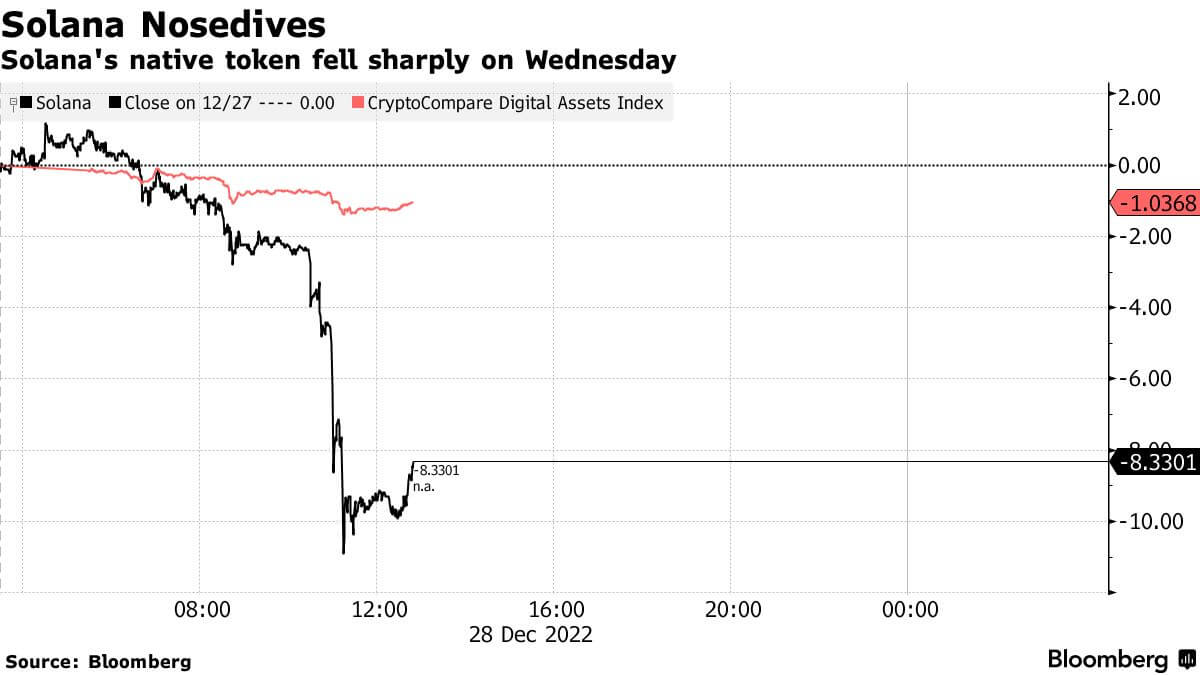

While other so-called altcoins have suffered steep declines this year, Solana has been pummeled by the bankruptcies of Bankman-Fried’s crypto exchange FTX and his hedge fund Alameda Research, which had backed the token.

The relationships looked good while the money lasted. Sam Bankman-Fried (SBF), through FTX exchange and Alameda Trading, supported Solana by providing funding for every large project built on Solana. Deeply intertwined In its ecosystem, the incorporator and corporations significantly contributed to Solana’s rise.

Alameda listed the Solana token on its front page and FTX would often be the first exchange to list Solana-based projects, and SBF would often be an early investor in these projects. They helped build the first DEX on Solana (Serum), had it on the front page (as one of only 4 tokens alongside SOL, ETH, and BTC), and would shill Solana relentlessly on Twitter, etc.

Solana predictably took a massive beating as the FTX mess unfolded. What do you think happens to Solana now? Despite the brouhaha, the network recently partnered with Google Cloud, had Instagram support Solana NFTs, and will soon launch a Solana-based “Web 3 Phone”. On top of these ambitious projects, Solana remains one of the largest blockchains in terms of projects built on it and continues to serve a massive NFT community, etc. Will Solana survive without FTX or will it slowly fade away into irrelevance?

FTX fueling Solana’s chaos

FTX’s balance sheet indicated substantial SOL tokens valued at $982 million. At the time of the collapse, the exchange had $8.9 billion in liabilities. The then CEO Sam Bankman Fried (SBF) shared the balance sheet to raise funds for the troubled platform.

Solana Foundation said they held about $1 million in cash and its equivalents on the exchange. As of 11/14/22, the Solana Foundation had exposure to assets connected to FTX/ Alameda. These included 3.24 million FTX Trading LTD common stock shares, 3.43 million FTT tokens, and 134.54 million SRM tokens.

A day before the FTX bankruptcy filing, the FTT was worth $83 million, and SRM was worth $107 million. The assets were worth $3.17 million and $20 million at press time, respectively.

Legislators are determining what will happen to these assets during bankruptcy proceedings.

On the fateful week, SRM fell by 69%, while OXY and MAPS fell by 46% and 78%, respectively. FTT lost over 90% within the same time frame. The foundation held zero SOL on the exchange.

FTX owned Serum decentralized exchange and built on Solana.

According to Solana compass, Alameda has a locked stake of 48,671,518 coins, which constitute 65.4% of the locked stake. The funds are unlikely to be moved when they are unlocked since the exchange is under bankruptcy protection. Meanwhile, the funds continue to accrue interest.

FTX and Alameda Research committed fraud and stole customer funds to invest in Solana projects. Now all the funds are gone, and users will forever associate the two negatively.

NFT projects abandon the ecosystem

In a shocking turn of events, big Solana NFT projects are now abandoning the blockchain for alternatives. The SOL blockchain has had its fair share of downtime, but it has still proven to be a game changer in terms of high scalability, fast speed, and low costs.

Boxing day 2022, the DeGods NFT art collection announced on Twitter that it was cutting ties with the ecosystem in favor of Ethereum.

DeGods is the top collection on the ecosystem, with a total value of $56.77 million. Following the announcement, the collection experienced a spike of 220% in trading volumes from the previous week.

Y00ts NFT art collection also made a similar move on the same day, revealing that they were bridging to the Polygon blockchain.

All the changes will take place in 2023.

Solana’s DeFi ecosystem problem

During the bull market of 2022, an anon launched the Sunny decentralized finance (DeFi) application on the Solana blockchain. Within two weeks, billions of dollars were flowing into this yield farm.

Ian Macalinao, the anon behind the application, worked as the single brain behind 11 purportedly independent developers. The developer had a large web of DeFi protocols to project that billions of dollars in double-counted value flowed into the ecosystem.

At its peak, the project constituted 75% of Solana’s $10.5 billion TVL, which impacted its price.

Crypto venture firms are also taking a big hit from their association with the blockchain. Multicoin Capital, once a big FTX and SOL advocate, is one such victim. In November, the firm lost more than half of its crypto holdings.

Can the “Resurrection” Push SOL 2x to $30?

Solana has become a favorite for crypto investors as the cryptocurrency market grows, with its inflows surpassing $50 million last September. The cryptocurrency has found its way into the top ten digital assets list. The token dethroned Cardano and currently ranks number 5 on the market. Most of the analysts present a bullish Solana price prediction. That means, if ever SOL “died”, it has “resurrected” and thriving. Cryptopolitan paints a bullish scenario for SOL based on previous price history and algorithms.

SOL’s price has surged 114% so far this year, slowly recovering from losses from early November. TradingView predicts that SOL will retrace to a $22 area before the next pump to $27/$28.3 area, then a big crash, 1st target $18 area. A big fall to the $5 area in the mid-term is where a new bullish long-term trend will start.

With a good potential, it is not farfetched for Solana to reach $5,000, a 10,000% increase in the next eight years. While some might find this increase unrealistic, consider that it rose more than 8,500% by January 2022 to an all-time high of $260. Solana’s sharp price increase in that time shows that anything is possible. Read through this Solana price prediction and find reasons why this might be so.

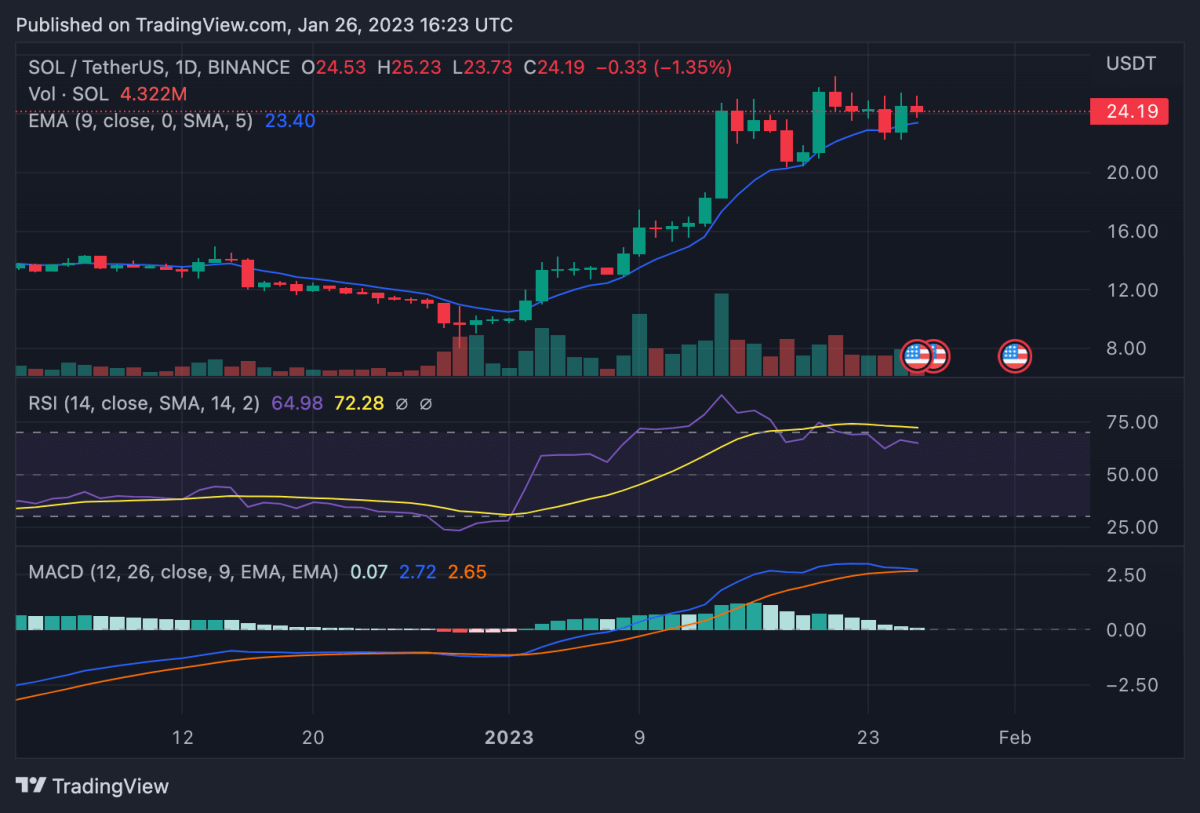

Solana price analysis: 24-hour RSI falls below the bullish threshold to indicate price correction

On the 24-hour candlestick chart for Solana price analysis, the price can be seen dwindling around the $21-$25 mark over the past 24 hours, showing increased volatility in the market. However, bulls have largely remained in control, keeping the price above support at $20 and the crucial exponential moving average (EMA) at $23.31. As the price targets resistance at $27, technical indicators suggest a correction may be in order before that.

The 24-hour relative strength index (RSI) drops off the overbought region after initially hitting highs at 80. This usually suggests an upcoming correction in price. The trading volume over the past 24 hours dropped slightly, indicating little buyer movement at the current price. Moreover, the moving average convergence divergence (MACD) curve can also be seen attempting a bearish divergence with the formation of lower highs.

Market analysts are optimistic that Solana will continue to see a rise in the coming days, given its strong fundamentals and high liquidity. For instance, a Youtuber named ”Steph is Crypto” is optimistic Solana prices will hit $100 by the end of 2023.

Various websites have a bullish outlook on Solana and have provided various reasons behind its bullishness. Cryptopolitan has a prediction for 2023 and beyond, suggesting Solana might end 2025 trading at a maximum price of $46.32.

It is, therefore, logical to assume that SOL will keep moving inside this descending resistance line for the near future, with its price hovering between $20 and $25 until a breakout occurs in either direction.SOL is also following a short-term ascending support line. The Solana (SOL) price shows signs of short-term weakness, which could cause a breakdown and retracement toward $17.34.

The applications for the upcoming Solana blockchain hackathon are now open, with the event’s previous winners including STEPN (GMT) and Dialect. Since the start of this year, there’s been an impressive 33% growth in Total Value Locked (TVL) within Solana’s decentralized finance network. This has exceeded even the sector-wide expansion of DeFi and surpassed prior levels – notwithstanding a quick dip due to the FTX crash. These numbers are well on their way back up!

Is Solana going to last?

Looking ahead, the current bull run witnessed in the entire crypto market will likely boost the Solana ecosystem. Technical analysts have predicted that the token will soon break through the $30 resistance level and could potentially test new highs.

Since August 13th, the Solana price has remained under a descending resistance line, leading to a powerful rejection at the start of November and an eventual minimum cost of $8 on December 29th. After the price had surged, it soared by an enormous 225% and continues to climb.

Despite the surge, Solana’s price could not break through the line. In fact, its weak performance is further demonstrated by a bearish divergence (purple line) in the daily RSI.

SOL Rising Like the Phoenix?

Despite the short-term bearishness in Solana, there is still much optimism about its long-term prospects. The fundamentals behind SOL are strong, with a healthy network of users and developers that are actively supporting it. Similarly, the liquidity on exchanges has also been steadily increasing, indicating solid investor confidence. SOL, like the Sunbird Phoenix. might indeed rise from the ashes.

Once portrayed as a genius wunderkind, Sam Bankman-Fried, one of the biggest frauds in the crypto industry, backed the Solana ecosystem. The association has irrevocably impacted the blockchain’s image. In 2018, the Ethereum ecosystem experienced a similar backlash and lost over 90% of its value; the coin would later rise to new records. With good traction, Solana can outrun a bad reputation.

The crypto industry is full of surprises, and 2023 may prove us right about our projection that SOL will rise to new heights despite the scandal backlash. You cannot put down a good, useful, efficient blockchain. Solana is currently ranked #3 in the Proof-of-Stake Coins sector, #2 in the Solana Network sector, and #7 in the Layer 1 sector.

If you want to know more about SOL’s background, price history, and future directions, get them here: Solana price prediction 2023-2032.