VTHO Price Prediction 2024-2033

- VTHO Price Prediction 2024 – up to $0.0052

- VTHO Price Prediction 2027 – up to $0.0167

- VTHO Price Prediction 2030 – up to $0.0504

- VTHO Price Prediction 2033 – up to $0.1651

VTHO crypto fanciers consider VeThor an “offshoot coin” to the “wildly successful” VeChain network. How can the VTHO price prediction help you regain footing on the crypto ground?

The VTHO token is paid as a form of a dividend to every holder of VET tokens, the native currency of the VeChain ecosystem. That said, we will look into the potential of VTHO if it’s worth owning today.

How much is VTHO worth?

The current price of VTHO is $. Here are more statistics at press time:

| 24 Hour Trading Volume | |

| % change in 24 hours | |

| Market Capitalization | |

| Circulating supply | |

| Maximum supply |

VTHO Technical Analysis

The current VeThor token price was up 123.51% in the last 12 months but down 19.30% over the previous 30 days, at press time. Like most altcoins, VTHO’s price movements, recovery began in October 2023, affected by market macroeconomics, such as the spot Bitcoin ETF approval and halving. The coin performance, however, reversed in April amid high price fluctuations.

The chart below shows VTHO’s movement in the last three months. The MACD indicator shows the coin is experiencing negative momentum, while the relative strength index is trending neutral. The VTHO price analysis suggests a gradual price decline.

Image Source: Live stock, index, futures, Forex and Bitcoin charts on TradingView

Is VTHO a Good Investment?

VTHO had an impressive performance in the early 2024 bull cycle as it rose by over 300% from 2023’s lows. The performance was mainly tied to the market sentiment rather the coin’s inherent utility. Any high records by Bitcoin will mean more returns for VTHO investors. However, remember the market is still highly volatile.

Recent News

UFC announced a redesign of the UFC fight glove that integrated the VeChain blockchain. The integration will enable anyone verify the authenticity of the glove, including its previous owners and bouts in which it has won.

VTHO Price Prediction

VTHO Price Prediction By Cryptopolitan

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 0.0045 | 0.0046 | 0.0052 |

| 2025 | 0.0066 | 0.0069 | 0.0078 |

| 2026 | 0.0096 | 0.0099 | 0.0115 |

| 2027 | 0.0138 | 0.0142 | 0.0167 |

| 2028 | 0.0202 | 0.0209 | 0.0236 |

| 2029 | 0.0289 | 0.0297 | 0.0348 |

| 2030 | 0.0430 | 0.0445 | 0.0504 |

| 2031 | 0.0637 | 0.0659 | 0.0741 |

| 2032 | 0.0931 | 0.0958 | 0.1115 |

| 2033 | 0.1371 | 0.1419 | 0.1651 |

VTHO Price Prediction 2024

VTHO will rise above $0.005 at its peak to reach $0.0052. It will, however, drop below the mark, reaching $0.0045 at its worst.

VTHO Price Prediction 2025

VTHO will trade at the $0.0069 mark on average. It will rise above $0.007 at its peak to reach $0.0078. It will, however, drop below the mark, reaching $0.0066 at its lowest.

VTHO Price Prediction 2026

VTHO will trade at $0.0099 on average. It will rise above the 2025 resistance at its peak to reach $0.0115. It will, however, drop below the mark, reaching $0.0096 at its worst.

VTHO Price Prediction 2027

VTHO will trade at the $0.0142 mark on average. It will, however, drop below the mark, reaching $0.0138 at its lowest.

VTHO Price Prediction 2028

VTHO will trade at $0.0209 on average. It will rise above the previous resistance at its peak to reach $0.0236. It will however drop below the mark, reaching $0.0202 at its lowest.

VTHO Price Prediction 2029

VTHO will trade at the $0.0297 mark on average. It will rise to $0.0348 at its peak. It will, however, drop below the mark, reaching $0.0289 at its lowest.

VTHO Price Prediction 2030

VTHO will trade at the $0.0445 mark on average. It will rise to $0.0504 at its highest. It will, however, drop below the mark, reaching $0.0430 at its worst.

VTHO Price Prediction 2031

VeThor token’s price will trade at the $0.0659 mark on average. It will rise above $0.07 resistance at its peak to reach $0.071. It will, however, drop below the mark, reaching $0.0637 at its lowest.

VTHO Price Prediction 2032

VTHO will trade at the $0.0958 mark on average. It will rise above $0.1 at its peak. It will, however, drop below the mark, reaching $0.0931 at its worst.

VTHO Price Prediction 2033

VTHO’s price will trade at the $0.1419 mark on average. It will rise above $0.15 at its peak. It will, however, drop below the mark, reaching $0.1371 at its lowest.

VeThor Price Prediction by WalletInvestor

The platform gives VTHO a past performance index rating of C and adds that VTHO would make a very good one-year investment. It will average at $0.00427 next year. The platform provides predictions in terms of return on investment (ROI). The ROI is negative over the entire period and is in double digits. It ranges from 30% to 130% annually.

VTHO Price Predictions by CryptoPredictions

The site scans a coin’s exchange prices and other historical market data and analyzes it to provide VTHO price prediction. The CryptoPredictions platform is bullish on VTHO. It indicates that it will have decimal gains over the next four years, ranging between $0.004 and $0.013.

VeThor Token Price Prediction by Digitalcoinprice

Digitalcoinprice VTHO price forecast is also bullish. The maximum price for the period 2024-2033 is $0.0624. It will break the $0.01 resistance in 2026 and $0.02 in 2030. Closer home, the coin will range between $0.00687 and $0.00822 in 2025. In 2027 it will range between $0.0123 and $0.0147.

VeThor Token Price Predictions By Industry Experts

VTHO price predictions by Binance, a leading crypto exchange, are bullish on VTHO’s average price over the next six years. The coin growth is modest, with 2030 averaging at $0.003169. The average will cross $0.0025 in 2026.

VTHO Price History

After VeChain was rebranded to VeChainThor in 2018 and the VeThor Token (VTHO) was introduced, the bulls went ahead to register an imposing price movement to hit the highest Vethor token price of $0.04201 on August 01 of the same year. However, the trend was short-lived since it quickly became a bearish trend the day after.

The bearish trend continued until October 2018. The Token’s market price seemed to flatline until the 2021 bull run when the coin pumped 35X to a high of $0.245 in April. The market later reversed and by the end of 2022 it had fallen to as low as $0.0009. The 2024 cycle saw the coin recover to a high of $0.005.

Image Source: VeThor Token Price, Charts & Market Insights | Your Crypto Hub

More About VTHO

What is VeThor Token (VTHO)?

VeThor Token (VTHO) is one of the two native cryptocurrencies of the VeChain blockchain network. Like its partner cryptocurrency, the VET coin, VTHO can be stored in hot and cold wallets that allow ERC-20 tokens, including Ethereum (ETH).

VeChain was launched in 2015, and at the time, there was only one native digital coin named VeChain Token (VET) used in the VeChain ecosystem.

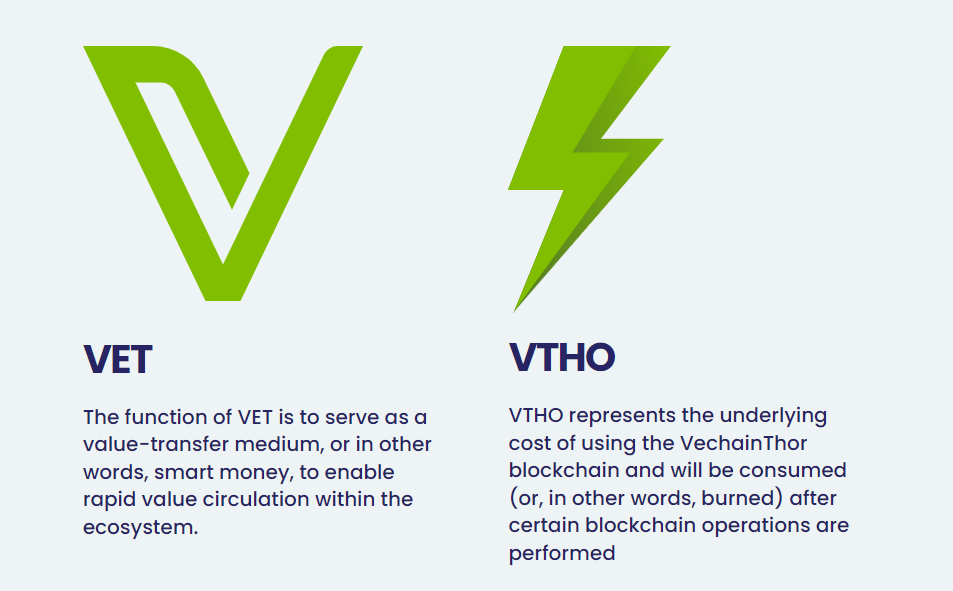

After the rebranding, VeChain maintained VET to be the primary value-transfer Token; in contrast, the newly introduced token, the VeThor Token (VTHO), was adopted as the Token for paying to use the VeChain blockchain by facilitating transactions and processes and the use smart contract deployment.

What is the VeChainThor blockchain network?

VeChainThor is a public blockchain that allows members to participate by solving real-world problems. It was founded in 2015 under the name VeChain before being rebranded to VeChainThor in 2018.

Sunny Lu established the blockchain as a subsidiary of Bitse, one of the largest blockchain companies in China. However, Sunny Lu parted ways with Bitse, and the Vechain platform stood independently.

The VeChainThor blockchain uses a proof-of-authority (PoA) consensus mechanism, which depends on authority controller nodes selected by the VeChainThor foundation to validate transactions and add blocks to the blockchain.

The PoA mechanism enables VeChainThor to process transactions at record processing speeds. The blockchain also has an open-source design that allows blockchain technology developers to pool their efforts to upgrade it.

VeChainThor also has meta-description features that allow users to conduct multi-party transactions involving multiple tasks. The blockchain also allows smart contracts to be executed using the VTHO.

Why is VeThor Token (VTHO) unique?

The VeThor Token price is correlated by traders with the VeChain price. And just like the VET, it is a VIP-180 Standard token, meaning it is a unique ERC20 token. The VTHO token is used to power transactions on VeChain and is equal to the cost of conducting transactions on its blockchain.

The dual-token design on the VeChainThor enables users to trade using two tokens, thus diversifying their investment portfolios. However, this does not mean that if you want to purchase the VeThor Token, you will have to buy the VeChain Token; you can buy one and leave out the other if you so wish.

But if you choose to invest in both, you will have to look at the VeThor token price forecast to keep up with the VET price, as you also look at the VeThor token price prediction to keep up with the VTHO price.

The two-token system further helps separate the cost of using the VeChain blockchain from crypto market speculation.

The governance mechanism stabilizes the cost of using the blockchain by destroying 70% of the VTHO paid for validating transactions on the blockchain and warding the 30% to the Authority Masternode Operator chosen by the VeChainThor foundation.

The most exciting part is that the VeThor Token supply chain is actively tied to the VET. The VTHO is derived from the VET token. About 0.00000005VTHO is generated per VET for every validated block. This, in connection with the destruction of 70% of the VTHO that is destroyed, keeps the circulating supply of VTHO at a low level at all times, keeping the demand for the token high.

Where to buy VeThor Token (VTHO)

VeThor Token is available for trading on several crypto exchanges, including Binance, Gate.io, MEXC, Crypto.com, Bitvavo, Coinbase, BitMart, and Hotbit.

To buy VTHO, you will require to open an account with any of these cryptocurrency exchanges, transfer ETH, BTC, or any other digital currency or fiat currency that the exchange allows, then perform a buy transaction to buy VeThor Token using the currency you deposited with the exchange, and then transfer the purchased VTHO tokens to a private crypto wallet or let them remain in the exchange wallet for trading.

Conclusion

The VeThor Token plays a vital role in the VeChain Thor network by enabling users to broaden their usage of the blockchain. VTHO is necessary to cover the expenses associated with network usage, and no blockchain operation can occur without it. This feature facilitates quick execution of all transactions and smart contract operations, contributing to the biggest enterprise-scale ecosystem.

As the network expands, VTHO is increasingly gaining relevance as a valuable cryptocurrency asset and a critical component of the VeChain Thor ecosystem. In addition, crypto experts note that VeThor’s transaction fees are incredibly low, which makes it attractive to businesses looking to save on costs. As a result, VeThor’s potential use cases extend beyond just powering the VeChain blockchain, making it a versatile and practical cryptocurrency.

VeThor Token’s potential is on the rise as it continues to gain traction in the cryptocurrency market. With the increasing adoption of blockchain technology and the growing demand for efficient supply chain management, VeThor Token is well-positioned to continue its growth trajectory.

For a crypto coin such as VTHO to grow consistently according to the VeThor token price prediction above, it has to be backed by a solid infrastructure and development framework that supports the growth and usage of the token itself. Since VeChainThor possesses these qualities, it provides an incredible platform for VTHO to grow and record the significant price gains discussed above.

VeThor Token is a non-mineable cryptocurrency that doesn’t need miners to validate transactions or generate blocks. Instead of using a Proof of Stake mechanism, VeThor Token uses Proof of Authority to guarantee network security and confirm actions.

The value of VeThor Token is projected to improve as scarcity drives up prices. Please keep in mind that any investment involves some risk. VeThor Token’s future greatly depends on the general performance of the crypto sector. For investing in VTHO, you ensure that you are employing the proper plan.

This investment is not appropriate for those with an asymmetric risk profile. However, it remains a fantastic investment for people with a high-risk tolerance and a stable financial situation. Aside from its speculative nature, VTHO provides exposure to worldwide technology and an ever-expanding ecosystem.

The VTHO token price is expected to rise steadily over the years as predicted by Cryptopolitan. The forecasted prices are backed by careful analysis of historical price data and current prices. Based on the current market sentiments, the price of VTHO will resume an upward trend and continue steadily, making it a good long-term investment.

The coin is expected to climb according to most algorithmic price projections, although the rate differs depending on who you ask. Always conduct your own research before making an investment.