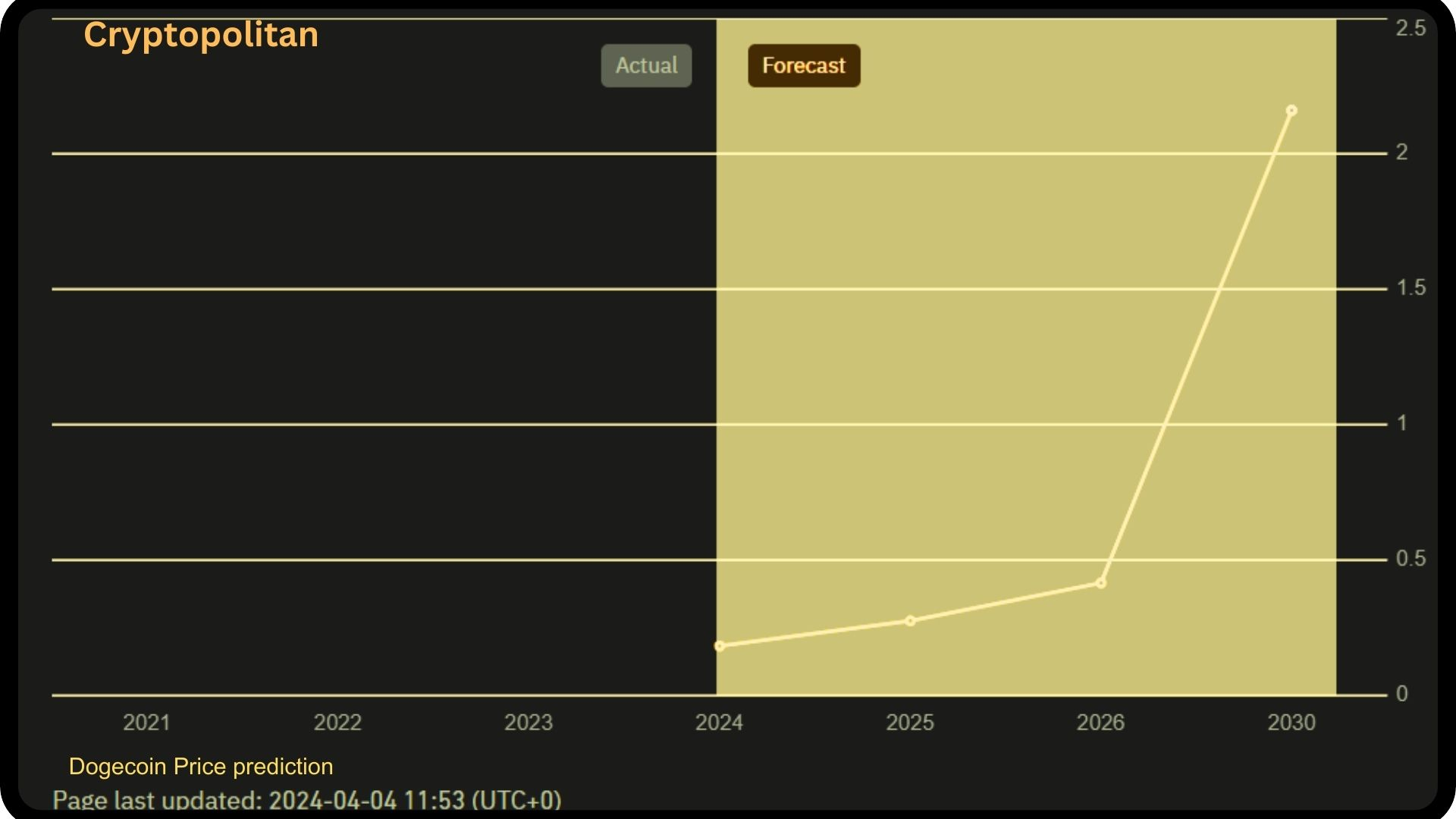

Dogecoin Price Prediction 2024-2033

- Dogecoin Price Prediction 2024 – up to $0.2314

- Dogecoin Price Prediction 2027 – up to $0.6708

- Dogecoin Price Prediction 2030 – up to $2.0460

- Dogecoin Price Prediction 2033- up to $4.407

Dogecoin used to be the best-performing in crypto market within the top 10 and the 3rd best-performing within the 100 behind FTM and LINK. Our Dogecoin Price Prediction 2024-2033 is shaping up beautifully, and that’s something to be grateful for. We need more of these price spikes, not just for DOGE!

How much is DOGE worth?

Today, Dogecoin is priced at $ 0.1303, with a 24-hour trading volume of $ 50.82B and a market cap of $ 18.90B, representing a market dominance of 0.85%. Over the past 24 hours, the DOGE price has decreased by -7.02%. The sentiment for Dogecoin price prediction is currently bearish, while the Fear & Greed Index stands at 67 (Greed). Dogecoin’s circulating supply is currently at 144.10B DOGE, with a yearly supply inflation rate of 3.61%, resulting in the creation of 5.02B DOGE in the last year. In terms of market cap, Dogecoin holds the #2 position in the Proof-of-Work Coins sector, #1 in the Meme Coins sector, and #6 in the Layer 1 sector.

Dogecoin price analysis: DOGE retraces support at $0.1303

- Dogecoin price analysis shows a bearish trend today

- Current price for DOGE is present at $0.1303

- Resistance for DOGE is present at $0.1808

On April 30, 2024, Dogecoin underwent a notable change in its recent performance spanning the last 48 hours. Initially, the meme-inspired cryptocurrency displayed a downward movement, dropping from $0.1456 to $0.1301 today. Moreover, today witnessed a significant continuation of this downward trend, with Dogecoin’s current price at $0.1303, maintaining its bearish trajectory. Despite this recent decline, Dogecoin has demonstrated resilience and robust activity throughout the day, hinting at potential for further growth, subject to prevailing bullish sentiment in the market. The cryptocurrency market’s volatile nature highlights the importance of closely monitoring trends and market dynamics to make informed decisions regarding investment strategies.

Dogecoin underwent a significant downturn in its price, falling from $0.1456 to $0.1301 over 48 hours, with a further decrease to $0.1303 on the same day. Despite this bearish trend, Dogecoin demonstrated resilience and active trading throughout the day, indicating potential for future growth depending on market sentiment. The volatile nature of the cryptocurrency market emphasizes the importance of closely monitoring trends and market dynamics to make informed investment decisions.

DOGE/USD 1-hour price chart: DOGE retraces support

The analysis of Dogecoin’s price indicates a prevailing negative market trend, characterized by heightened volatility leading to broader fluctuations in market movements. This increased volatility suggests a greater likelihood of significant price swings towards either extreme. Specifically, Dogecoin’s upper limit of the Bollinger Bands is identified at $0.1475, acting as a resistance level for DOGE, while the lower boundary is situated at $0.1289, serving as a strong support level. This distinction underscores the dynamic nature of Dogecoin’s pricing dynamics and emphasizes the importance of closely monitoring these indicators to accurately assess potential market shifts.

The DOGE/USD pair has experienced a notable decline below the Moving Average curve, signaling a bearish trend. However, indications suggest a potential upward movement towards the resistance band, hinting at a possible reversal of the current trajectory. As volatility nears stabilization, there’s a chance this shift may favor bullish investors. If there’s a breakout from this consolidation phase, it could lead to increased volatility, offering more opportunities for bullish movements. This underscores the importance of closely monitoring market dynamics and key technical indicators to respond effectively to potential shifts in momentum. Additionally, investors should remain alert for any developments that could impact Dogecoin’s price movements, such as regulatory announcements or shifts in market sentiment towards cryptocurrencies.

The analysis of Dogecoin’s price reveals a Relative Strength Index (RSI) reading of 24, which indicates a low level of stability for DOGE, positioning it within the lower neutral region. However, there is a discernible downward trend in the RSI score, reflecting an increase in selling activities within the market. This decline in RSI not only suggests a decrease in market participation but also implies a prevailing sentiment favoring selling over buying. These indicators collectively hint at the potential initiation of a downward trend in the Dogecoin market, potentially paving the way for further decline and negative price movements. In response to these signals, investors are advised to maintain a vigilant stance and adapt their strategies accordingly to navigate potential market shifts and mitigate associated risks effectively.

Dogecoin price analysis on a 1-day price chart: Recent Updates

Analysis of Dogecoin’s price reveals a downward trend in the market, coinciding with a decrease in volatility. Furthermore, there are signs of a narrowing movement, indicating a potential reduction in future volatility. This decreased volatility lowers the likelihood of significant price fluctuations for DOGE in either direction. Currently, the upper boundary of the Bollinger Bands is set at $0.1991, representing a sturdy resistance level for DOGE. Conversely, the lower boundary of the Bollinger Bands is positioned at $0.1295, serving as a robust support level for DOGE. These levels provide valuable insights for investors to gauge potential market movements and adjust their strategies accordingly.

Dogecoin is currently experiencing a bearish trend, evident as the DOGE/USD price dips below the Moving Average curve. This downward trajectory reflects an increasing market sentiment leaning towards a decline in the meme cryptocurrency. As the price approaches the support band, the convergence of these factors may trigger a breakthrough, potentially resulting in a reversal of the prevailing market dynamics. Investors should closely monitor these developments to anticipate potential shifts and adapt their strategies accordingly.

With a Relative Strength Index (RSI) score of 39, Dogecoin currently resides in a stable position within the RSI chart. However, despite this stability, a sudden downward movement has been noted. This decrease in the RSI score indicates a prevailing trend where selling activities surpass buying activities, nudging the market towards a more pronounced stable state. Nevertheless, this trend also indicates a growing confidence among investors in Dogecoin’s potential for upward movement. Investors should closely monitor these developments to assess potential shifts in market sentiment and adjust their strategies accordingly.

What to expect from Dogecoin price analysis?

The way the Dogecoin market is now performing is a result of a number of intricately intertwined elements, such as increased volatility, a pessimistic outlook, and technical signs indicating possible declines. Dogecoin has shown resilience and continuous market activity in spite of recent price falls, indicating potential for future development subject to altering market perceptions. Investors should still exercise caution, though, and keep an eye out for any new developments that might have a big influence on Dogecoin’s price trajectory, such as changes in regulations or the general opinion of the market regarding cryptocurrencies. Furthermore, keeping a close eye on important technical indicators such as Bollinger Bands and the Relative Strength Index (RSI) can yield insightful information that can be used to make well-informed decisions and use risk management techniques when navigating the ever-changing cryptocurrency markets.

Is Dogecoin a Good Investment?

Based on the provided price analysis, investing in Dogecoin may carry significant risks amidst the current market conditions. While signs of resilience and potential for future growth exist, the prevailing negative market trend, coupled with heightened volatility and bearish sentiment, underscore the need for caution. Factors such as regulatory changes and shifts in broader market sentiment towards cryptocurrencies could further impact Dogecoin’s price trajectory, necessitating thorough research and consideration of one’s risk tolerance before making investment decisions. Investors should remain vigilant, stay informed on market developments, and seek guidance from financial advisors to navigate the evolving landscape of cryptocurrency investments effectively.

Dogecoin Recent News

Emergence of DogeDay

It is hardly coincidental that bitcoin aficionados have been hearing a lot about Dogecoin recently. A portion of the excitement might be attributed to DogeDay, an exclusive event celebrated by the Dogecoin community. Understanding how Dogecoin has evolved over time is crucial before delving into DogeDay’s functionality. This historical context helps to explain the significance of DogeDay. There are indications that the Dogecoin market is seeing a DogeDay rally, since today, April 20, is the next DogeDay. DogeDay is an unofficial celebration that the Dogecoin community has embraced; it’s not your typical holiday. It was chosen on purpose to blend in with April Fool’s Day’s playful vibe.

The community responded quite positively to this strange action, making the cheerful, carefree atmosphere of the coin into a popular meme. DogeDay is a representation of the community’s solidarity and the cultural significance of this virtual money, even if it may not have broken any records. This helps to explain Dogecoin’s and other humorous currencies’ recent steady rise (particularly those using dogs as symbols).

Dogecoin Price Forecast by Cryptopolitan 2024-2033

| Year | Minimum($) | Average($) | Maximum($) |

| 2024 | 0.126 | 0.1412 | 0.2314 |

| 2025 | 0.25 | 0.26 | 0.29 |

| 2026 | 0.38 | 0.39 | 0.44 |

| 2027 | 0.55 | 0.58 | 0.67 |

| 2028 | 0.4851 | 0.4985 | 0.5738 |

| 2029 | 0.73 | 0.75 | 0.85 |

| 2030 | 1.04 | 1.07 | 1.28 |

| 2031 | 1.52 | 1.56 | 1.78 |

| 2032 | 2.14 | 2.20 | 2.56 |

| 2033 | 3.17 | 3.26 | 3.77 |

By following our Dogecoin price forecast in the cryptocurrency market, it will help in making best decisions on when to buy Doge as we provide historical data, current prices and dogecoin forecast following best market trends, news, on-chainmarket analysis. Dogecoin being a meme coin has taken the trends of cryptocurrency market building reliable doge community to leverage the risk associated with cryptocurrency prices.

Dogecoin Price Prediction 2024

Dogecoin may surge in price to a maximum price of $ 0.2314 trading with an average price of $0.1412 by the end of the year 2024. The minimum trading price of the coin is $0.126

Dogecoin Price Prediction 2025

According to our Dogecoin price forecast for 2025, Dogecoin’s price is expected to reach a maximum price of $0.29,trading at an average price of $0.26 with a minimum of $0.25.

Dogecoin Price Prediction 2026

According to our Dogecoin forecast for 2026, Dogecoin’s value will reach a maximum price of $0.44, trading at an average price of $0.39 and with a minimum of $0.38. This show a promising future of Dogecoin

Dogecoin Price Prediction 2027

According to our Dogecoin price prediction for 2027, Dogecoin might be trading at a maximum price of $0.67, average price of $0.58 and a minimum price of $0.55. If Dogecoin continues to pursue interoperability, the network might see an increase in developers and investors, driving prices to the projected levels.

Dogecoin Price Prediction 2028

According to our price prediction for most cryptocurrencies, Dogecoin is expected to trade at an average price of $0.84, minimum price of $0.81 and maximum price of $0.97 by the end of 2028 respectively.

Dogecoin Price Prediction 2029

Our Dogecoin price prediction for 2029 is a maximum price of $0.85. Our analysts project an average price forecast of $0.75 and a minimum price of $0.73 by the end of 2029.

Dogecoin Price Prediction 2030

Based on our Dogecoin price prediction for 2030, Dogecoin will have a maximum market value of $2.04 and a minimum price of $1.67. Investors could also expect an average price of $1.75.

Dogecoin Price Prediction 2031

According to our Dogecoin price prediction for 2031, the value of this cryptocurrency is expected to increase to a maximum of $2.92 by that year. Based on our price analysis, Dogecoin’s expected minimum and average price will be $2.31 and $2.5, respectively.

Dogecoin Price Prediction 2032

According to our Dogecoin price prediction 2032, Dogecoin may reach a maximum of $4.0 and an average price of $3.37. The lowest possible price is predicted to be $3.14.

Dogecoin Price Prediction 2033

Based on our Dogecoin price forecast for 2033 indicates that the coin might reach a maximum trading price of $4.44, a minimum market price of $3.42, and an average price of $3.67.

Dogecoin Price History

2013

2013 is marked as the beginning of Dogecoin price history as that the year was launched in the market. Dogecoin’s growth was slow in the beginning but over the years it has faced drastic changes. The $3.5 million market capitalization was not worth the market’s attention. However, within a few months, it began its upward trajectory and grew exponentially.

The start of Dogecoin’s price was beyond its prediction as it surged from $0 to $0.0004 in the first days of trading. Since then Dogecoin prices expected to surge more as it was a good investment.

2014

The second-year Dogecoin prediction was disappointing as Dogecoin hit new lows and felt the pain of a market-wide downturn. Also, it faced immense competition from new coins, including Stellar, Neo, and Monero.

2015

Jackson Palmer, the co-founder of Dogecoin, quit Doge, which didn’t bode well for the coin. The year saw much negative press about Dogecoin, and many analysts predicted its death.

2018

The year 2018 was bearish for cryptocurrencies, and Doge was no different. The altcoins went down significantly in a few months.

The recovery saw the Dogecoin trade near the $0.017 level, but bullish Dogecoin predictions were short-lived as the price touched a low of $0.002 and remained there for an extended period.

2020

Dogecoin traded in a strict range of $0.002 to $0.005 for most of the year. It gained steam at the end of 2020 when Bitcoin touched new highs.

2021

In January, the Dogecoin price chart saw green candles across the chart as the month ended with the price live at 0.037 USD. In just a few days, the Dogecoin price managed a 692.14% price surge, while in April 2021, Dogecoin rose by 527.6%.

Dogecoin’s price finally fell by 22% in June, and the price declined by more than 18% in July. Recent Dogecoin price predictions show that the coin’s market price has risen after Elon’s tweets.

This Dogecoin (DOGE) price currently is $0.2 as the market value of the coin experiences a surge today. In September, Doge’s price fell by more than 26%, although, recently, we have witnessed that AMC will start to accept Dogecoin for payments.

According to the Dogecoin community, the Dogecoin network is perfect for transactions. Hence, Dogecoin projections for 2021 show that one should expect abrupt Dogecoin market changes in the short term as the price journey and abrupt price changes continue beyond 2021 as Bitcoin’s price rally continues.

Compared to prices at the start of the year, DOGE has gained massive profits in 2021, over 3100% in 2021.

2022

In 2022, Dogecoin began bearishly. During that time, the bulls struggled to sustain a breakout above the $0.20 level. In the current 4-hour chart, the Dogecoin technical analysis shows that the cryptocurrency market trades above the 50-day MA but slightly below the 100-day MA. The coin price broke out of its upper Bollinger band, with resistance at $0.135. Until it breaks the resistance, it may return to the support at $0.126 in the next few days. Doge is still trading in the green zone, and it has been up by 0.61% in the last 24 hours.

2023

In 2023, Dogecoin exhibited significant fluctuations and notable influences. The year began with Dogecoin trading around $0.08, maintaining a steady position in the crypto market as the 10th-ranked cryptocurrency by market capitalization. During the year, Dogecoin experienced a series of ups and downs, reflective of the volatile nature of the crypto market. A key moment occurred when Elon Musk completed a $44 billion deal to acquire Twitter, which led to a nearly 100% surge in Dogecoin’s price. Musk has been a vocal supporter of Dogecoin, often referring to it as the “People’s Coin.”

This surge was also fueled by speculations that Musk might integrate Dogecoin into Twitter’s operations, especially following his announcement about a paid subscription model for Twitter’s blue tick verification. Over the year, Dogecoin saw a 60% rise from its October value of around $0.05, driven by bullish market momentum and investor sentiment. Despite periods of correction and a four-week-long downward trend, Dogecoin’s price remained resilient, bolstered by positive investor sentiment and its growing reputation as a viable asset in the cryptocurrency market.

More on Dogecoin price analysis

Following the introduction of the spot Bitcoin Exchange Traded Fund (ETF), the digital currency market experienced a moderate contraction, and Dogecoin (DOGE) emerged as the front runner in this decline, registering a 1.80% dip to $0.08479 over the last 24 hours. Concerns escalate as the trading volume takes a notable hit, plummeting by 27% to $609,330,772, suggesting potential challenges for Doge price.

Interestingly, the memecoin sector, encompassing Dogecoin and Shiba Inu, exhibits signs of recovery, surpassing previous setbacks. This resurgence is attributed to substantial investor accumulation, as highlighted by on-chain data. It’s essential to note that while Doge price faces challenges, the broader cryptocurrency market landscape continues to evolve, presenting varied opportunities and trends across different assets.

Dogecoin’s 2024 Price Forecast: Navigating Expectations Amidst Market Dynamics

Market Overview

As Bitcoin inches closer to the $70,000 mark, the crypto landscape is rife with optimism, particularly within the altcoin sector. Dogecoin (DOGE), renowned for its meme coin status and a market cap of $11.26 billion, is positioned to capitalize on the broader market recovery. However, recent price dynamics hint at a potential delay in significant upward momentum, raising questions about its viability and future prospects.

Influential factors and speculations

Elon Musk’s influence remains a significant factor in Doge price trajectory. The recent surge in Dogecoin’s price followed Musk’s $44-billion deal to take over Twitter, coupled with his continuous support and advocacy for Dogecoin as the “People’s Coin.” Speculations about Dogecoin’s integration into Twitter’s functionality have fueled investor sentiment and contributed to recent Doge price spikes. This has heavily influenced the current market sentiment of Dogecoin

Influencer verdict and future integration

Influencers within the crypto community express varying opinions on Dogecoin’s future. Some, like Matt Wallace and That Martini Guy, foresee Dogecoin breaking above the $1 mark. Musk’s announcements, including the potential integration of Dogecoin with Twitter, have strengthened these speculations. However, cautious optimism is advised, considering the volatile nature of the cryptocurrency market.

How do you mine Dogecoin?

Dogecoin mining differs from Bitcoin’s Proof-of-Work protocol in several ways, one of which is by using Scrypt technology. The altcoin also has a block time of 1 minute, and the total supply is uncapped, which means there is no limit to the number of Dogecoin that can be mined. You can mine Dogecoin either solo or by joining a mining pool.

With a GPU, a Doge miner can mine the coin on Windows, Mac, or Linux. As of 2014, you can also mine Litecoin in the same process of mining Dogecoin as the processes were merged.

What can Dogecoin be used for?

Dogecoin has been used primarily as a tipping system on Reddit and Twitter to reward creating or sharing quality content. You can get tipped Dogecoin by participating in a community that uses it or get your Dogecoin from a Dogecoin faucet.

A Dogecoin Faucet is a website that will give you a small amount of Dogecoin for free as an introduction to the coin so that you can begin interacting in Dogecoin communities.

How can you buy Dogecoin?

You can buy Dogecoin or sell at any exchange offering, store it on an exchange or in a wallet, and tip it in any community that accepts Dogecoin. Click on our market pairs tab for this cryptocurrency’s latest list of exchanges and trading pairs.

DOGE/USDT on Binance

Two hundred part-time developers and an army of internet admirers support DOGE’s operations. Many look like Ross Nicoll, a fundamental contributor who works for free to keep an ever-expanding system running smoothly. There aren’t enough resources to create proprietary code, which is why so much of its code is copied from other coins. Dogecoin’s tens of thousands of social media followers are a good example: They regularly beg the currency’s developers to limit the supply.

Dogecoin’s price will rise to $10 if investors do more than buy the currency and tweet about it. Improvements may only be made with the support of a generous donor.

Several high-profile backers have already expressed interest in the currency. Elon Musk said sometime back that his SpaceX company would launch a penny to the moon. By forming a “Dogecoin Foundation,” he may have a greater effect on the future of cryptocurrency. So far, he’s blamed the “Dogecoin Whale” for everything. Instead of hounding developers, regular investors might aid by making a financial contribution. There is a potential that Dogecoin might rise to $10 if the community comes together one day.

Conclusion

Dogecoin (DOGE) has surged to a two-year high, exceeding $0.17, driven by a substantial increase in new wallet addresses and a remarkable uptick in on-chain fees. The surge is reminiscent of the 2021 bull run, with transaction fees soaring by an impressive 739% since the start of 2024. Notably, DOGE has surpassed the milestone of 6 million wallet addresses, a significant increase from its previous all-time high in May 2024.

As the bullish momentum continues, technical analyses reveal an oversold condition with an RSI of 36.13 while the upper Bollinger Band at $0.2011 acts as a resistance level, caution is advised for potential corrections or consolidations.

Note that Doge market experience high volatility and traders should closely monitor these key levels and adjust their strategies to navigate potential market fluctuations effectively.