Zcash Price Prediction 2023-2032

- Zcash Price Prediction 2023 – up to $56.95

- Zcash Price Prediction 2026 – up to $169.81

- Zcash Price Prediction 2029 – up to $530.92

- Zcash Price Prediction 2032 – up to $1,696.16

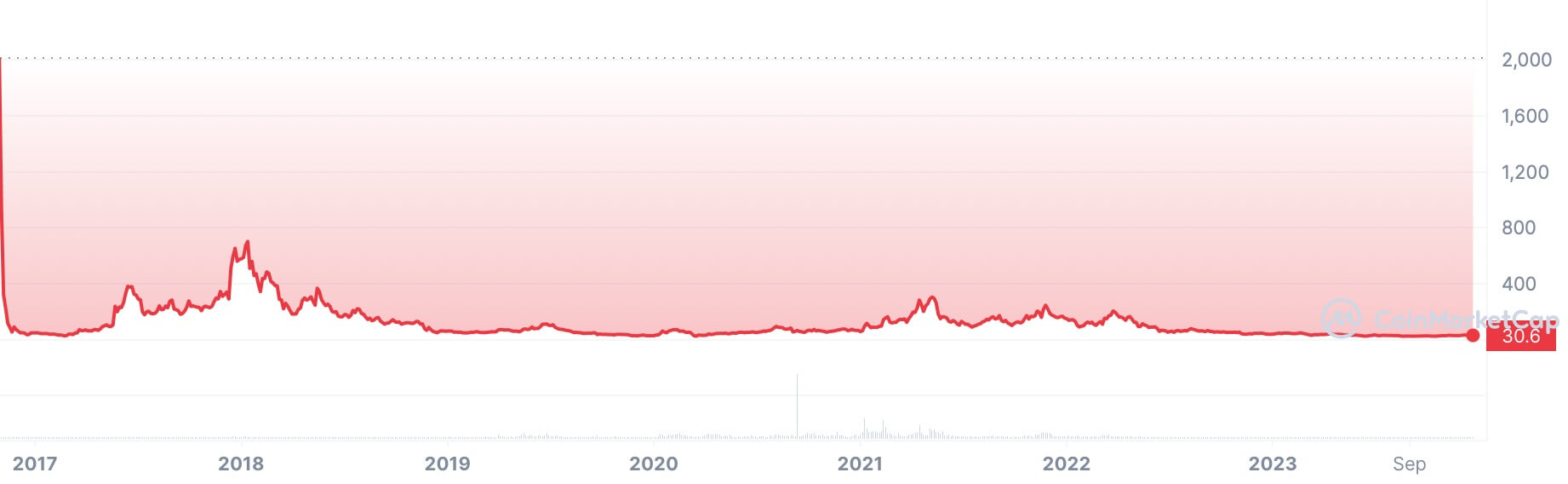

The proliferation of cryptocurrencies means they all don’t get the same publicity. There are even those that get no publicity at all. The common ones are usually those with the highest value or market caps, like Bitcoin, Ethereum, Tether, XRP, Litecoin, etc., or the ones that the internet has hyped, such as Dogecoin. Zcash has seen better days, hitting an ATH of $5,941.80, but currently struggling to stay above the $30 mark. In the advent of a resurging altcoin market, can Zcash recapture its ATH? Let’s get into the details.

How much is Zcash worth?

Today’s Zcash price is $30.79 with a 24-hour trading volume of $71,185,954. Zcash is up 1.94% in the last 24 hours. The current CoinMarketCap ranking is #115, with a live market cap of $502,758,469 USD. It has a circulating supply of 16,328,269 ZEC coins and a max. supply of 21,000,000 ZEC coins.

Read also:

- ZEC price has increased 20% in the last 24 hours

- ZEC price analysis: ZCash breaches resistance at $147.6, turns bullish

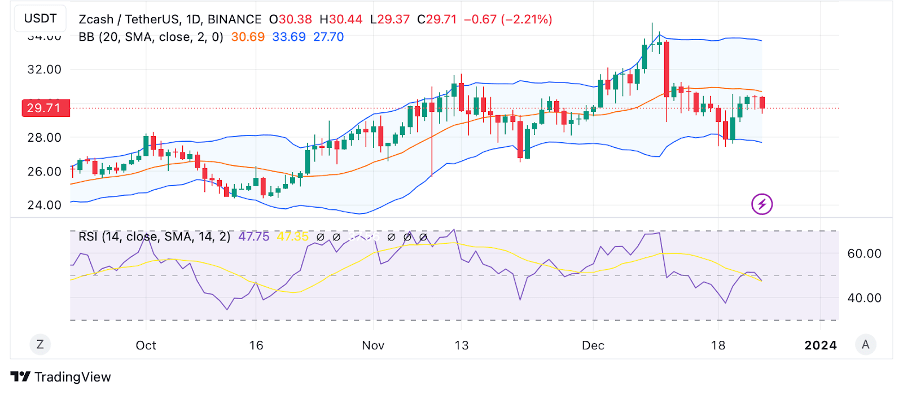

ZEC/USD 1-day price chart analysis: Zcash remains neutral amid market volatility

As seen on the 1-day chart, the Bollinger Bands indicate heightened volatility, with the upper band at $33.69, the middle band (basis) at $30.69, and the lower band at $27.70. ZEC’s current price of $29.71 falls between the upper and middle bands, suggesting a neutral to slightly bullish sentiment.

The wide Bollinger Bands imply increased market volatility, and traders may pay attention to key levels such as the upper band at $33.69, acting as resistance, and the lower band at $27.70, serving as support. A breach of the upper band could indicate a potential bullish trend, while a drop towards the lower band may present a buying opportunity. Simultaneously, the RSI stands at 48.36, indicating a neutral position in the market.

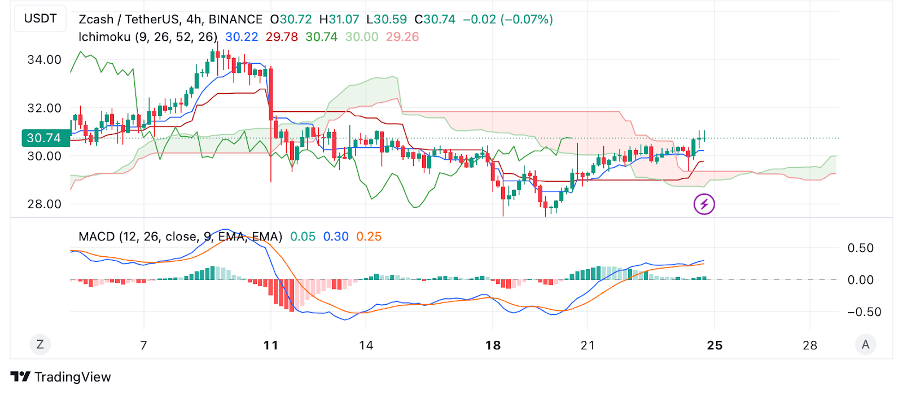

Zcash price analysis 4-hour price chart analysis

On the 4-hour price chart, the Ichimoku Conversion Line (Tenkan-sen) stands at $30.22, serving as a short-term trend indicator, while the Baseline (Kijun-sen) is at $29.78, representing the medium-term trend. Leading Span A, averaging $30.00, and Leading Span B, averaging $29.26, play crucial roles in providing a comprehensive view of market sentiment. Currently, Leading Span A is above Leading Span B, indicating a potential bullish trend. Similarly, the MACD indicator shows a continued bullish momentum in the short term, which could drive Zcash to $34.

Zcash Recent News/Opinion

Zooko Wilcox Steps Down as CEO of Electric Coin Company, Josh Swihart Takes Helm

Zooko Wilcox, founder of Electric Coin Company (ECC), the entity behind Zcash (ZEC), has announced his resignation as CEO. Effective December 18, Josh Swihart, former Vice President at ECC, will assume the role. Swihart briefly worked outside the firm as a part-time investor.

ECC expressed confidence in Swihart’s leadership, emphasizing his success in product-market fit, partnerships, and Zcash usability. Wilcox, reflecting on his tenure, highlighted the decision to separate his identity from Zcash’s, stating that the cryptocurrency’s role in history surpasses any individual. Wilcox will continue as a director on the Bootstrap Project board, ECC’s parent company.

Zcash (ZEC) Price Predictions 2023 -2032

Price Predictions by Cryptopolitan

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2023 | 27.99 | 30.62 | 31.49 |

| 2024 | 44.72 | 46.25 | 52.25 |

| 2025 | 66.67 | 68.52 | 78.34 |

| 2026 | 97.79 | 100.53 | 117.05 |

| 2027 | 143.92 | 148.95 | 171.66 |

| 2028 | 216.83 | 222.79 | 252.56 |

| 2029 | 324.33 | 333.24 | 371.26 |

| 2030 | 470.83 | 484.16 | 562.31 |

| 2031 | 684.14 | 703.50 | 799.86 |

| 2032 | 964.68 | 992.82 | 1,153.02 |

Zcash (ZEC) Price Prediction 2023

Our Zcash price prediction for 2023 expects the token to reach a maximum price of $31.49, a minimum of $27.99, and an average market value of $30.62.

Zcash (ZEC) Price Prediction 2024

By 2024, our price predictions indicate ZEC would have a maximum price of $52.25 and an average price of $46.25. The expected minimum market value is $44.72.

Zcash Price Prediction 2025

In 2025, Zcash could reach a maximum price of $78.34 and a minimum value of $66.67. The predicted average market price for 2025 is $68.52.

Zcash (ZEC) Price Prediction 2026

Our Zcash (ZEC) price prediction for 2026 expects the token to reach a maximum price of $117.05, an average price of $100.53, and a minimum price of $97.79.

Zcash Price Prediction 2027

In 2027, we predict Zcash to trade at an average price of $171.66, with the potential to reach a maximum price of $216.83. Traders can anticipate the coin’s support to consolidate at $148.95.

Zcash Price Prediction 2028

According to our Zcash price prediction for 2028, ZEC is expected to have a bull market, resulting in a maximum market price of $252.56, an average trading price of $222.79, and a minimum price of $216.83.

Zcash Price Prediction 2029

By 2029, Zcash could trade well above $300, reaching a maximum value of $371.26. The token is expected to have a minimum price of $324.33 and an average value of $333.24.

Zcash Price Prediction 2030

By 2030, the ZEC market is expected to witness a continuous uptrend leading to a maximum market price of $562.31 and a minimum price of $470.83. We expect an average trading value of $484.16.

Zcash Price Prediction 2031

By 2031, ZEC could attain a maximum price of $799.8, an average price of $703.50 and a minimum value of $684.14.

Zcash Price Prediction 2032

According to our analysis, traders could expect Zcash market prices to trade at a maximum price of $992.82, a minimum value of $964.68, and an average price of $1,153.02.

ZEC Price Prediction by WalletInvestor

WalletInvestor anticipates a notable decrease in Zcash (ZEC) value within the next year, potentially dropping to $2.147. This suggests a bearish perspective on its long-term investment viability.

ZEC Price Prediction by Technewsleader

Technewsleader envisions a robust upward trajectory for the value of Zcash (ZEC). According to their predictions, ZEC is anticipated to climb to $43.14 within a year and could reach $125.99 in five years, surpassing its current price of $29.98. Technewsleader suggests that by 2032, the value of ZEC might experience a substantial surge, potentially reaching $589.

ZEC Price Prediction by Digitalcoinprice

Digitalcoinprice projects significant future growth for Zcash (ZEC) in the coming years. According to their forecasts, the price is expected to reach $77.84 in 2024, $105.38 in 2025, and $137.59 in 2026. The average price for 2028 is predicted to be $155.99. Moving into 2029, ZEC could fluctuate between $202.75 and $222.14. Looking further ahead, there is a possibility that the long-term price could exceed $500 by 2032, reaching a maximum of $584.41.

Zcash Price Prediction by Industry Experts

Coin Central provides an overview of Zcash’s historical journey and its current status in the cryptocurrency market. Their analysis reflects on Zcash’s significant decline, positioning it as an alternative to Ethereum and emphasizing challenges in detailing recent developments. There’s skepticism about Zcash reclaiming its ATH of $5,941.80 and acknowledgment of a slow development pace, which has raised concerns in the community. Despite these challenges, Coin Central sees potential for growth in Zcash, noting its resilience and opportunities within the broader crypto market. The analyst underscores the need for a long-standing presence in the crypto space to fully understand Zcash’s complexities and concludes with cautious optimism about its prospects.

Zcash Overview

Zcash Price History

When Zcash was first launched in 2016, it garnered attention which worked in its favor. Within the first few weeks, it reached an incredibly high price of around $6000. But this didn’t last long. It fell drastically to stabilize at between $40 and $70. The price of Zcash has always fluctuated; for instance, it was worth about $900 in 2018.

To understand a cryptocurrency’s price history, one needs to know the factors that influence the increase in value. Generally, the excitement of its launch and similarities with Bitcoin must have helped it achieve an incredibly high value during its launch.

After that, the token would have a quiet year till May 2017. The developers partnered with JP Morgan to introduce Zcash privacy technology to the JP Morgan blockchain platform this year. The partnership led to a spike in price, with Zcash trading for about $400 by June of that year. Its market value also increased and entered the top ten cryptocurrencies through market capitalization. The price later returned to its regular value of below a hundred.

In 2018, the price increased again thanks to the crypto boom that started in late 2017. The price increased to about $900, but this didn’t last long. With the end of the crypto boom also came a fall in the currency’s value. In June 2018, it rose above $100 again.

It took until February 2020 for the price to increase again, thanks to the efforts of crypto bulls. By August, it has again managed to cross the $100 mark. It will later drop in value but maintain stability at a level above its previous lows.

Throughout this period, the ZEC protocol has improved tremendously. However, the first halving in 2020 significantly affects the price, just like it does with other cryptocurrencies. After exponential 2021, where ZEC topped $300, the token fell to much lower levels the following year 2022, trading as low as $39. At the start of 2023, Zcash regained some momentum and touched $50, but soon declined to $24 in mid-June. Currently, ZEC is trading at around $30.

More on Zcash

What is Zcash?

Zcash is not your popular digital asset, and unless you are looking for it, you are unlikely to come across a piece of news about its price. That is why it is necessary to explain what it is all about before examining its price prediction.

ZEC coin was introduced as a digital currency with its first mining in October 2016. But development started as far back as 2013. It was led by Matthew Green – the John Hopkins professor – and some graduate students. Later on, the Zcash Company, led by Zooko Wilcox, will complete the work with over $3 million raised from venture capitalists.

The initial hype surrounding the digital asset was very high. Within a week of its first mining, a token was already worth $5000. Zcash was developed using the Bitcoin codebase, so it is not surprising that it is similar to bitcoin in many ways. For example, it has a maximum supply of 21 million tokens too.

However, what Zcash uses as a unique selling point is the anonymity of transactions. According to the creators, the privacy of transactions on Zcash is exceptional. While it also posts transaction data on a public blockchain, there is an option for confidentiality.

This option comes in the form of a shielded transaction that makes it possible to have financial privacy. It integrates Zero-knowledge proof, a feature that makes it possible to verify transactions without knowing how much is sent, the recipient, or the sender. This feature is an optional one as transparent transactions are also very possible. It is also possible to have selective disclosure where users can determine which transaction details they wish to make public or share.

The Zcash Company changed its name to Electric Coin Company in 2019. It did this, claiming its official name has always been Zerocoin Electric Coin Company, which is now known as ECC.

Although the creators have said the privacy features of the currency are not designed for illegal activities, the privacy features continue to be investigated. In a paper titled Alt-Coin Traceability, released in May 2020, it remains questionable whether Zcash is as private as it claims to be. Recently, ECC announced plans to donate all the company shares to a non-profit organization known as the Bootstrap Project.

According to the creators, Zcash is built on rigorous science. The tokens fall into either the shielded pool or transparent pool. Observations show that most users do not use the privacy options available on the network. It is why it is regarded as a privacy coin.

ZEC addresses are of two types – the T-addresses and the Z-addresses. The T-addresses are transparent, while the Z-addresses are private. Beyond the privacy of Zcash, another significant feature is its fast transactions that attract very low fees.

The man behind ZCash, Zooko Wilcox, was also in close contact with Satoshi Nakamoto and who also wrote the first blog on Bitcoin that was embedded into the Bitcoin.org website. He claims that it is time for the project to move from the Proof of Stake consensus.

Factors influencing Zcash Price

Volatility is a dominant feature of digital assets. However, this volatility doesn’t just happen; it is motivated by certain variables. Identifying and observing these variables will help in predicting the prices.

The factors could be external or internal. For Zcash, here are the factors motivating its prices

- Demand and supply

Nothing affects any market like demand and supply. The effect is visible for a digital asset like Zcash with a limited supply. These two factors work hand in hand to determine the worth of Zcash.

However, demand and supply are influenced by other factors. Thus, it can be seen as an overarching factor. It is important to study and pay attention to demand and supply, especially when you are investing.

When more people are looking to buy than sell, the price will increase and vice versa. Ironically, the higher the price, the more interested people are in buying, and the more people want to hold.

- Investor confidence and social buzz

The public or media attention on a crypto asset usually affects its price. An easy way of seeing this is with Dogecoin, which increased in value solely on the back of internet mentions and tweets.

The logical explanation is that the more people talk about it, the more they are interested. Cryptocurrencies have thrived on social buzz, which spikes investors’ interest and confidence.

Zcash’s entry into the market represents a textbook example of this. The expectations and excitement were incredibly high. In the end, it influenced the price massively.

- Halving

Halving is a phenomenon that applies to cryptocurrencies that are mined. It means that the reward for mining would be slashed by half every four years to control inflation and the total units in circulation.

The first halving for Zcash happened in November 2020. Generally, halving increases price as the supply will decrease with Bitcoin on multiple occasions.

Zcash’s first halving also experienced something similar as the price increased from $61.50 to $76.39 between November 9 and 23.

- Technological improvements

Another factor that influences the price is the updates of the underlying technology for the cryptocurrency. It has been observed that even the mere announcement of future updates could drive the price up.

- Adoption

Closely related to social buzz is adoption. One factor that has continued to increase the price of Bitcoin is its adoption. The price increases as more investors, especially institutional ones, get involved.

An increase in demand also increases the confidence that many investors will get from such adoption. Those who are not already invested too will want to get involved to avoid missing out.

Conclusion

Long-term gains on Zcash are possible, and algorithmic analysts anticipate that it will increase. However, cryptocurrency assets are quite erratic; hence the need to approach the market with caution.

Due to the high level of privacy and anonymity that Zcash offers, its vast community of users is bound to keep growing as the demand for privacy-oriented token grows. Recently, Bitcoin of America, the fourth biggest crypto ATM provider in the U.S., added Zcash to its list of accessible cryptocurrencies, the reason being the “increase in popularity” of the digital coin.

We expect the interest in the Zcash Network to skyrocket in the coming years, thereby making its token a favorable investment tool in the long term. Price predictions are a good place to start when investing, but it is important to know that the market can change anytime. The market’s volatility means it is important to stay up-to-date if you’re planning to invest. Look also at how to mine Zcash.

In the end, it all boils down to taking calculated risks. You can study the forces that influence prices and study the market before making the final decision.

Make sure to check out other coins, wallets, mining, how to, and where to buy them using our GUIDES.