Money can be made in various creative ways. One thing the internet taught us (through years of experience) is to stay away from shady investment opportunities. Lately, scammers dedicate themselves to a new trend of releasing cryptocurrencies and issuing false ICOs.

You might’ve come across the fiery discussion around LAToken. LAToken sounded too good to be true from the first time I came around it. And my concerns turned out to be true. I don’t usually invest my time in reviewing such poor ICO campaigns and tokens, but this one deserves the attention it got from me.

Briefly about LAToken

LAToken stands for Liquid Asset Token. It’s a Russian based cryptocurrency, and it has a specific niche. LAToken holders can purchase art and real estate, primarily illiquid property. If you’ve been following LAToken news, read their whitepaper and are familiar with their benefits, you’ll realize how unrealistic their prognosis and transaction fees are.

It’s risky to step into the crypto community while not knowing a thing. With such projects like LAToken and others, you might come across something you’d better avoid. It’s nearly impossible for a newbie to distinguish the scam from a real blockchain project, and that’s why I decided to create this piece, and give you an example.

Red flags flying all over

As an experienced investor, you wouldn’t invest in a project that’s too superficial. In fact, you’d have to spend most of your time researching about this particular project, digging deeper into their whitepaper, their community management platforms, and others.

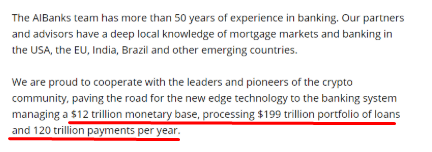

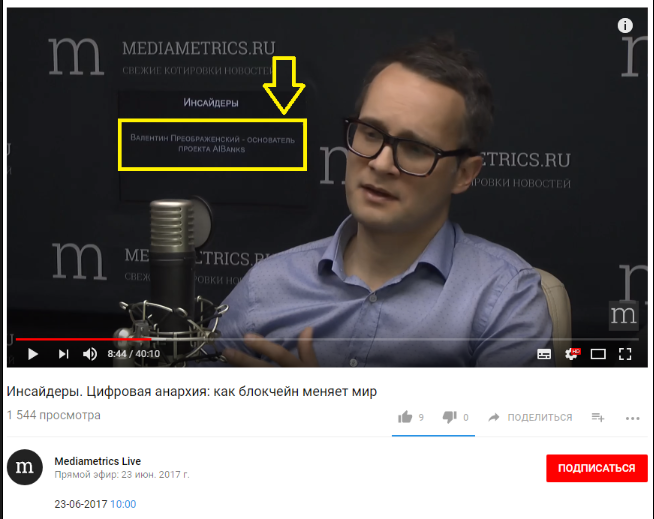

A few minutes into the research is enough to squint your eyes with suspicion and ask yourself if this project is realistic or not. Look at the start of the mystery tour of LAToken – AIBanks

The essence of the AI Banks project is as follows: banks have problems with scoring and credibility of credit histories when issuing loans, the cost of settlement around which due to fraud and regulatory requirements, they have to pledge into a loan rate or just take on expenses.

We can imagine Valya Preobrazhensky appearing in an “AI Banks suit with a blockchain in his hand, an API behind his back and an artificial intelligence under his arm”. Look closely at the bank’s loans through chatbot and smart contracts, resale of loans, blockchain on guard from fraudsters. And of course, the sale of tokens for collateral with loans and mortgages instead of any debt instruments, which are described well in the “Short Game”.

Unrealistic approach

Valentin Preobrazhenskiy, CEO of LAToken, announced their prognosis of the token price. According to him, by 2025 LAToken should grow 1000 times and their assets will be worth 1.2 trillion. Well, if you will closely look at the paper of AIBanks, where he was CEO, he’s done it before and repeating his old “shell game”.

Let’s take a look at these promises and see if they are realistic. A project like this will be depended on their transaction fees. People won’t be buying and selling illiquid products daily, so they need to make the transaction fee high in order to achieve the proposed numbers. Their Whitepaper, on the other hand, states that they will offer 0.0001% transaction fees.

If you calculate roughly, their plan won’t be able to deliver the results to achieve 1.2 trillion by 2025. They are asking the community to trust their words and believe in their project, believe in their numbers and success. We’ve seen enough to know that such a strategy won’t work.

Funny how they’re associated with Blockchain but won’t make their business processes transparent

One of the things I’ve noticed researching this project is that they refuse to make their business processes public. Usually, when a company wants to attract investors, they’d release a plan of their business processes for investors to be sure that the company will do well on their own.

In fact, LAToken holders won’t even be able to receive voting rights. The founders, when asked, say that the price of LAToken will depend on the previously mentioned fund that they refuse to make public.

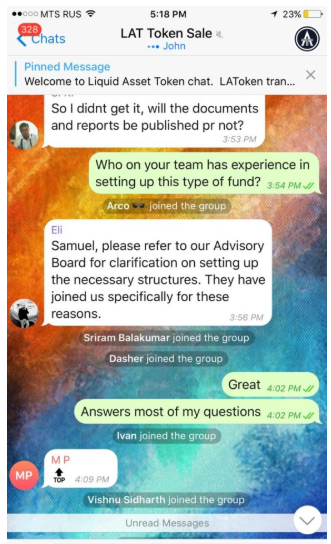

Poor community management

Community management is essential in this business, and there’s no excuse in messing up things. However, LAToken CMs manage to be unprofessional. With several cases on my desk, I can safely say that they avoid deep questions, they delete the messages they can’t answer properly and will try to do everything to make the chat seem positive in the eyes of other members.

The community is what keeps the project alive and bounded. LAToken CMs and people associated with this project don’t care about this and use their Telegram channel for advertising and branding purposes.

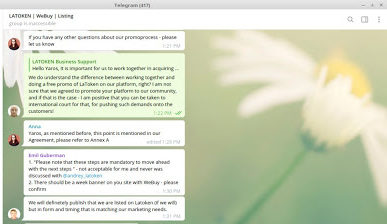

How they handle their corporate partners

It’s easy to scam a newbie, and scammers usually target newcomers of the crypto community. Bur trying to deceive and toy with corporate clients is another level.

You won’t be able to get a hold of the corporate details and chats, but this particular case shows how LAToken community treats its’ clients – corporate partners.

Delayed answers are quite a red flag if you ask me, but the fact that they avoid sending API documents for weeks (which you will see in the following screens) is what grinds my gears.

They need constant reminders to answer questions from corporate clients. Some might find this as a sign of a busy and successful company, but professionals will see how poor their community management is.

It’s March 21, and there’s no sign of the API documents or the answers from the support team.

And here we are, on to the most interesting part of this poor collaboration – their marketing strategy, or should I call it the LAToken promotion strategy?

Read the requirements carefully, and understand how this strategy represents mandatory LAtoken promotion tactics, ignoring the whole concept of the partnership.

After a long and tiring conversation, they finally agreed to implement some of the changes, but would continuously forget in the next several weeks when asked. And needless to say that with every strategy offered, they’d implement a way to promote LAToken.

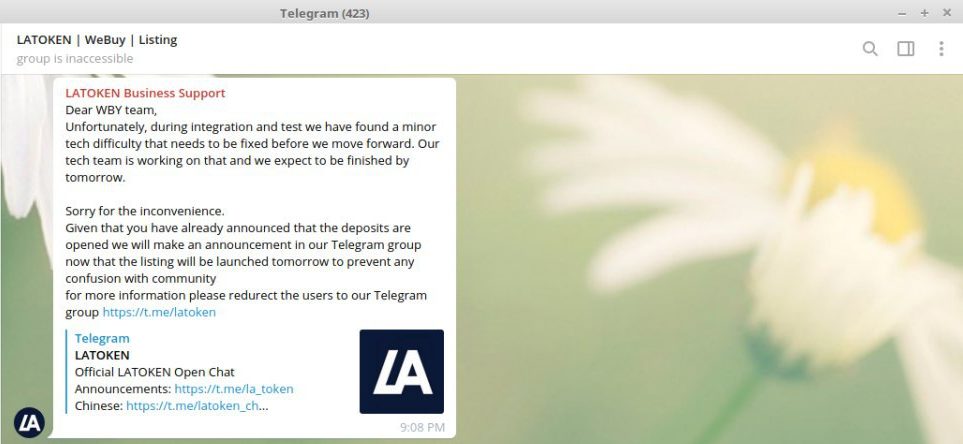

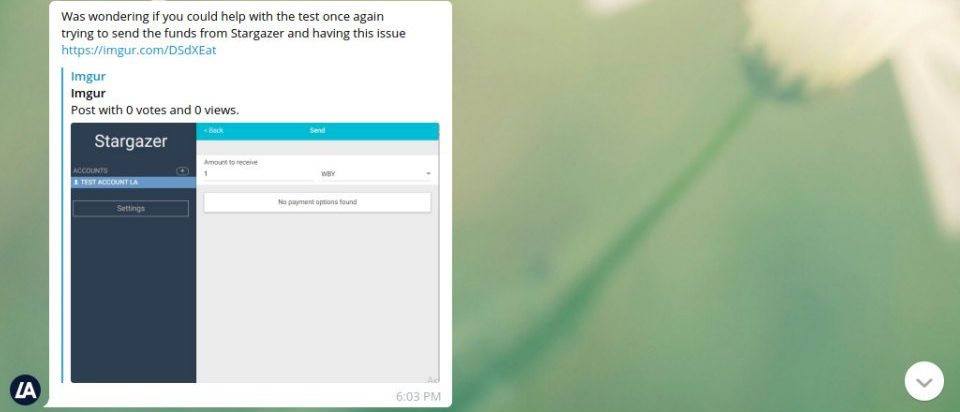

Not to mention thousands of “Technical Issues” that postponed the launch date from March 25 to April 4 and then April 5.

![]()

The sequence of having issues and delaying the launch event continues from March 25 to April 8.

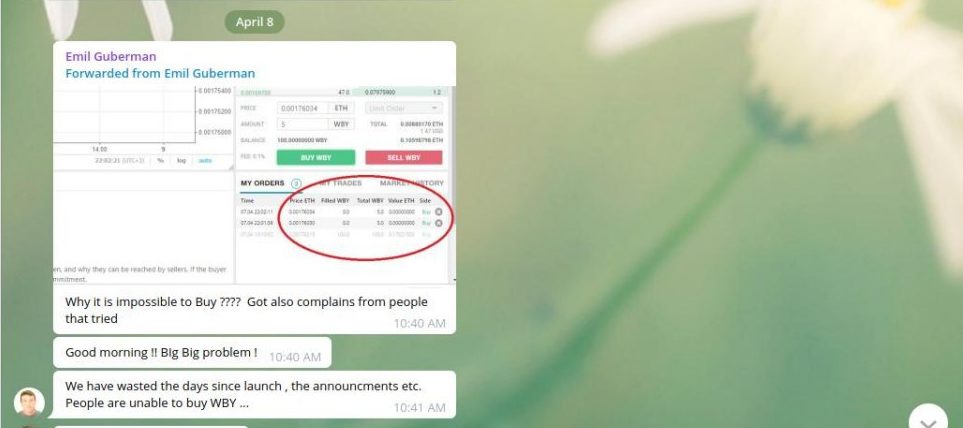

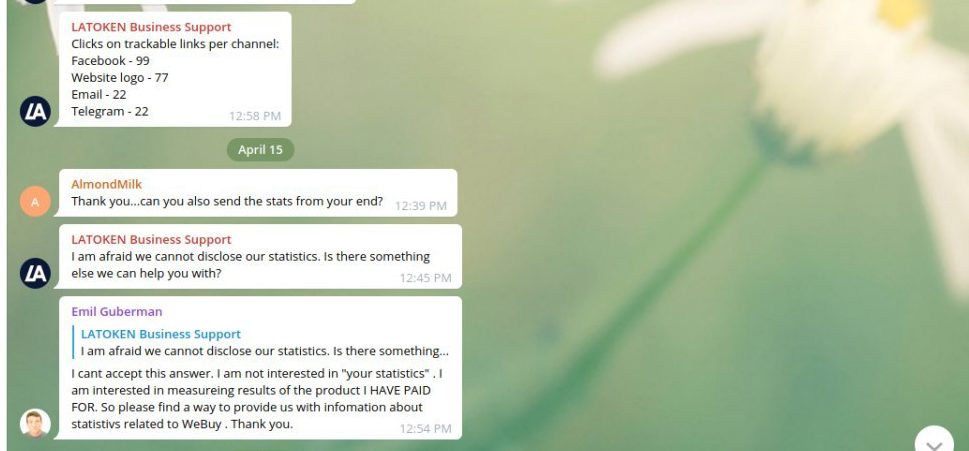

Finally, when the project launched, and trading was possible, the team members asked for the statistics (obviously). You can see how they treat their corporate partners by sending poor results and answers.

The golden middle is the compromise from both companies but after a long line of chat. And who knows? When do they change their minds, conditions and strategies?

Other missing pieces or loopholes in their project

One thing I think is unusual and ridiculous is that they offer to sell the art, real estate or other illiquid objects in pieces. You can see Valentin Preobrazhensky telling us that they can sell tokenize the pieces of illiquid products and sell them on their platform in this interview. Imagine buying a part of The Starry Night by Vincent Van Gogh and sharing it with 3-4 other people who bought the tokenized version of the product.

BUT – here’s the best part. WeBuy paid 3BTC for listing and generating 100 visits from LAToken famous “300 000 trader community” and they got close to 0 sales, despite the fact that they did SMM posts, mailing to their base and even banner on their homepage. As they say in the street lingo, their goose is cooked.

The meaning of “your goose is cooked” is nominally “you are in big trouble” but it can include “you caused yourself big trouble.” It’s somewhat similar in meaning to another expression: “you’re a dead duck.” Trouble begets trouble as such, don’t trouble trouble or it will trouble you.

Hijacking trouble or getting into the same room with it could earn you the notoriety you need but the results can come out to be the opposite of what you expect. A wrong association could harm your own profile and it will take some years, or a good social media manager to fumigate a misimpression about what kind of business you have.

No leverage available

This exchange does not provide leveraged trading in cryptocurrencies, which is the case with most similar venues. Those who wish to speculate on their prices, without owning them, can open an account with a others instead. Almost all brokers who offer trading in crypto CFDs provide leverage, and the levels are usually higher than the ones offered by some exchanges

Selling art by pieces is not just ridiculous and unimaginable, it’s practically (legally) impossible to do. Safety and legal issues correlated with buying and selling arts don’t come in agreement with their method of buying and selling pieces of art.

Not to mention that the founders also speak about the tokenization of other illiquid objects. They promise that their platform will be able to tokenize illiquid objects, therefore making them more liquid (doesn’t make any sense, does it?). Valentin, when asked difficult questions, avoided answering them or showing his face at all.

Here’s the thing. In the Merkle report mentioned by Valentin, he mentioned that “the market capitalization of all cryptocurrencies has surged by 830% from last August, reaching US$165 billion. The adoption rate of cryptocurrencies may eventually be as high as that of cell phones and broadband Internet, thanks to the advantages of blockchain technology including low transaction costs, security, transparency, ease of cross-border transactions, and the like.” There was even a graph to show what the market will be like in 2025.

According to LAT Crypto Research, trading volume of asset cryptocurrencies could exceed US$40 trillion by 2025, while in the longer term, it could exceed the capitalization of the corresponding traded assets by 10+ times. Valentin might actually be doing the crypto market a great service with this prediction.

So, what’s it gonna be? Feed your illusions with this trillion prediction?

Conclusion

It doesn’t take too long to realize that you have faced a fake blockchain project with no answers from the CEOs and no actual plan of action when you face LAToken. Their heart might be in a good place, but their business plan and brand recognition sure aren’t. I’d spend more time on finding answers for the questions from the community and media than to hide behind other projects and startups.

Their project seems to be shady, fake and unreasonable, according to the findings I have got. They do have a great marketing campaign that shouts loudly about their “benefits” and how LAToken is revolutionary. But there’s nothing backing their shoutings up.

My advice to the people associated with this project (besides not making fake blockchain projects) would be to address their community and answer their concerns. And for you, my future investors, keep looking for a project of your desire.

Disclaimer: This is a guest article. The views, opinions and positions expressed within it are those of the author alone and do not represent those of Cryptopolitan. The accuracy, completeness and validity of any statements made within this article are not guaranteed. We accept no liability for any errors, omissions or representations. The copyright of this content belongs to the author and any liability with regards to infringement of intellectual property rights remains with them.