- Uniswap launches UNI token to compete with Sushiwap.

- Sushiswap token takes heavy beating in the market.

- Uniswap and Sushiswap token swapping costing heavily to miners.

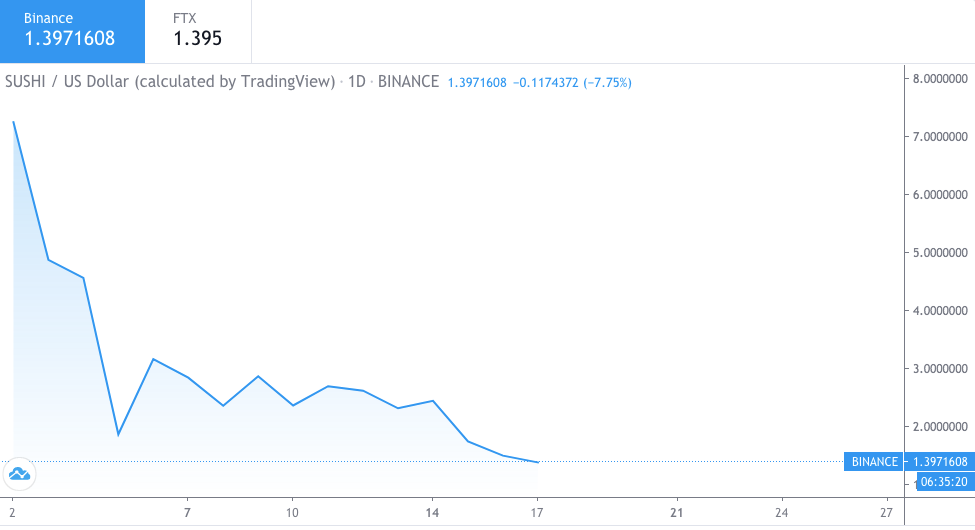

Latest in the Uniswap vs Sushiswap saga is the drastic drop in SUSHI token prices as the first sign of vulnerability since the rise after massive media uproar. The saga started when an anonymous developer decided to replicate the famous Uniswap decentralized finance (DeFi) exchanges with a simple twist, a token attached. The Sushiswap platform and the token soon took flight as the replication placed almost $1 billion at stake, the amount secured at the Uniswap platform in liquidity.

Uniswap vs Sushiswap saga continues?

After the Sushiswap saga the previously leading DeFi exchange Uniswap was also forced to launch a token that has already been listed on major exchanges such as Binance and Coinbase. Now, the cryptocurrency realm is witnessing a sharp decline in the Sushiswap token prices as it dropped from $7 to under $2 at the start of September and continues to plummet. At the time of writing SUSHI price stands at $1.397.

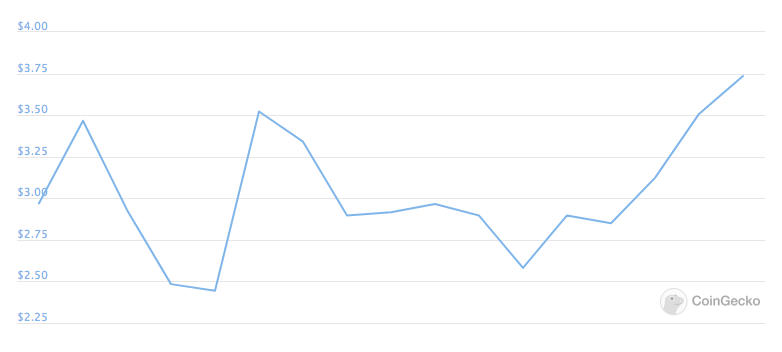

Some cryptocurrency experts are now posing the question, whether or not, Uniswap would show a similar decline over time. However, today on the day of launch, Uniswap’s UNI token is treading very strong on the price charts. The coin entered the market with a base value of $3, and after taking several plunges stands at the $3.75 mark on the first day of trading.

Uniswap vs Sushiswap: Major vulnerability in the system

Uniswap and Sushiswap have been introduced as exchanges that provide freedom to the users by maintaining the low exchange fees, and providing profit to the liquidity providers. Uniswap used the fee to distribute among liquidity providers, while Sushiswap adopted slightly different method where the fee was also used to create SUSHI tokens. These tokens acted as a bonus on the regular Ether based fee for the liquidity providers bringing a good amount of investors to Sushiswap, while the process was describes as SUSHI mining.

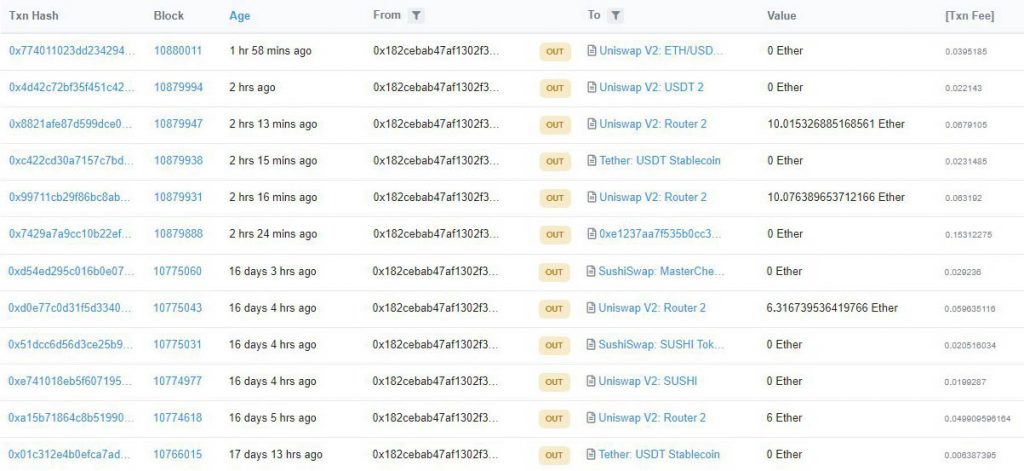

Cryptopolitan.com decided to take a swing at both the mining models to determine profitability ratio, and find out any other issues the miners are facing and the results are rather drastic. The results also support the expert opinion that after introducing the tokens, both the platforms are now at risk of losing value very quickly. But what exactly is that problem here?

Each move with these swaps takes too many transactions to actually get the process done. All the while these transactions increase Ether load on the miner. At the end of the day the transaction fee can fluctuate and tend to be very highat times, from a few cents to as much as 150 dollars. As a miner puts it

It feels like a never ending loop of mess. Stake it to earn from gas -> But staking takes 6 transactions -> Making higher gas price

SUSHI/UNI Miner

Now that Uniswap has entered the same model with its UNI token, miners are now wondering that who is ultimately reaping the benefits of their provided liquidity and why should they continue to support either models? On side note, Uniswap being the first mover and a rather community oriented platform has better standing in the community than the latter. This reputation can keep the project afloat, but is to become of the token, only time can tell.