Ethereum options are shining brighter as compared to Bitcoin options, as per the Institutional Newsletter of Deribit. Even though the first quarter of 2020 has been a lackluster period, the events from March onwards have the crypto analysts glued to their seats.

Source: Deribit

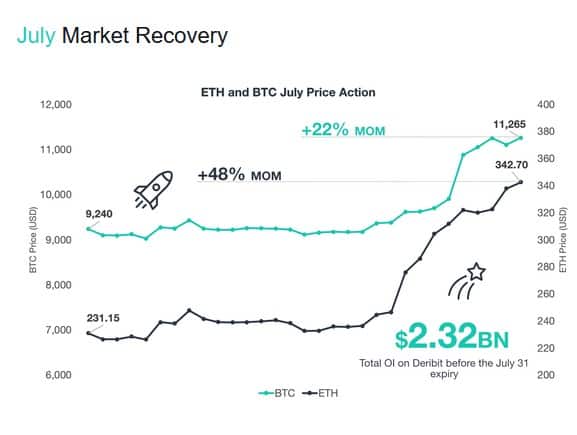

In July, both Bitcoin and Ethereum made remarkable gains and made HODlers rich. As per the newly released Institutional Newsletter of Deribit, BTC jumper by 22 percent and ETH made a 48 percent move in the last ten days of July. No wonder crypto traders are busy trading this volatile yet rewarding market.

Ethereum and Bitcoin trading witnessing a steady increase

DeFi has been a prime contributor to the rise in ETH price. The value of ETH locked in DeFi apps has increased significantly in the past few months, and it was only a matter of time before the same was reflected in the price as well. Volatility in the ETH chart almost tripled in the last few days and touched 60 percent to fuel the latest ETH rally.

Source: Deribit

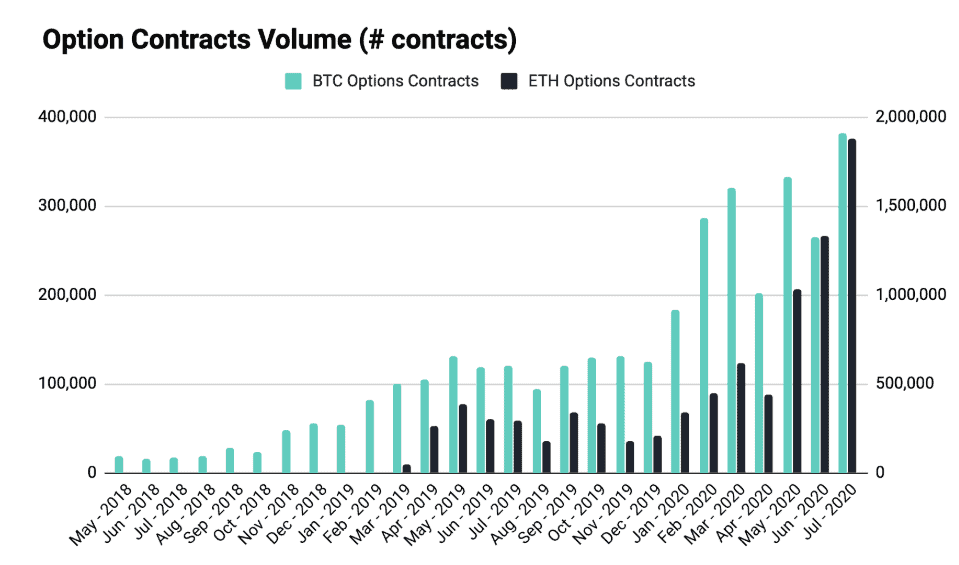

Both Ethereum options and Bitcoin options also registered an upsurge in July 2020. The drastic rise signifies the rising derivatives market for these top-rated cryptocurrencies. In fact, the figures represent the largest volume on record since Deribit started in May 2018.

Ethereum options set to rise with ETH 2.0 and Medalla testnet launch

Statistically, ETH options trading in July stood at 1,878,362 contracts. On the other hand, 380,804 Bitcoin options contracts were traded in July. Overall, the options segment provided $4.3 billion turnovers in the last month. This represents a significant jump of 52 percent when compared to June.

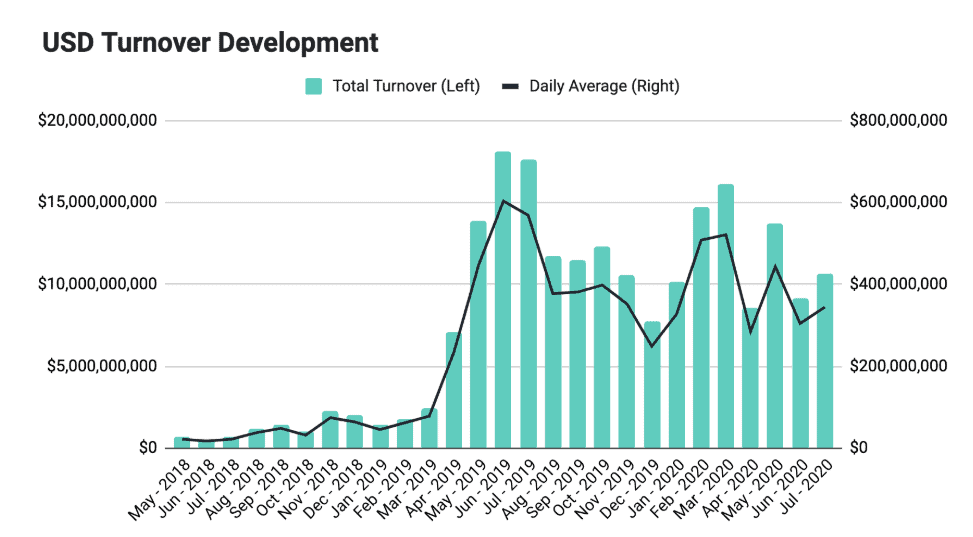

The total turnover in USD stands at $10.7 billion. Even though the spike in options turnover signifies an increased trading interest, the investors remain cautious as February trading figures remain much higher. Investors are still hesitant to tread into crypto waters, especially after the March crypto rout. It would take some time to return to pre-pandemic volume levels.

Source: Deribit

August has seen muted price action so far after explosive rallies in the late July period. Bitcoin options have seen muted interest in August so far. However, Ethereum options have registered a slight increase in the last few days following a minor dip earlier.

The upcoming Ethereum 2.0 and launch of Medalla testnet will further boost investor’s interest in the Ethereum options market. It remains to be seen if Ethereum options can outshine Bitcoin options in the long run.