Cryptocurrency taxation is here with us and the IRS is watching. The process of calculating crypto taxes is tedious and time-consuming. The complexity of the process requires a system that is automated and linked to exchanges that you transact with.

It is clear that crypto is a legitimate source of income but manually tracking your trades annually is not possible. However, if you are looking for a system that accurately calculates your taxable crypto income, you have come to the right place.

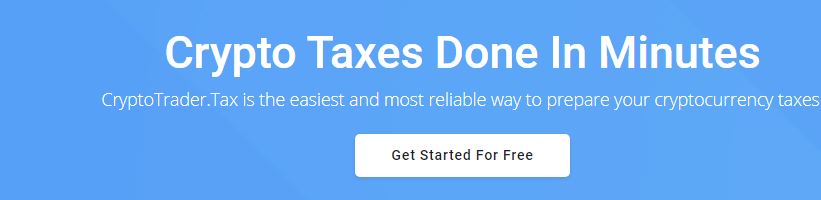

CryptoTrader.tax is a platform that provides crypto taxation services. They have over 35 high profile exchanges they support. Their goal is to ensure that your digital asset taxation problems are sorted as fast as possible. Simply put, the tool will help you calculate your digital asset gains and report your crypto taxes in minutes.

CryptoTrader.Tax Overview

CryptoTrader is an easy to use digital asset management platform. It is designed to prepare tax reports for official use. It takes away the pain of calculating taxes manually. The automated software has a huge repository of historical crypto price database. This makes the generated report accurate.

Anyone can create an account on the platform, create and send crypto tax reports within minutes. However, the platform can only avail reports on transactions done between 2010 to date. The speed and accuracy save on the cost of hiring a traditional tax preparation expert and time.

What Services Does CryptoTrader Offer?

The Cryptotrader platform enables you create four types of reports;

- Crypto Income report. This captures all digital asset gains including mining, airdrops, crypto gifts, and airdrops.

- The IRS Form 8949 which captures both your long term and short term gains resulting from cryptocurrency trading.

- Short and long term gains report which reports your net gains and or loses.

- The Audit Trail report which shows the numbers used to accurately calculate your actual trading gains.

Generating these reports is very easy. You only need to select a cryptocurrency exchange you have used in the period you are reporting. Import your trades and add your digital asset income. Confirm the accuracy of the data, create your report and download.

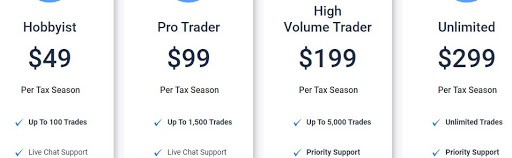

What are CryptoTrader fees?

The CryptoTrader fees are competitive and are structured according to individual needs. There are four categories but the difference is the total number of trades each tier supports. The hobbyists tier charges $49 with up to 100 trades. The pro trader fee is $99 for a maximum of 1,500 trades while the high volume trader will pay $199 with a maximum of 5,000 trades. To have unlimited access to the system, a fee of $299 applies.

Which Exchanges Does CryptoTrader Support?

The Cryptotrader platform supports over 35 crypto exchanges. However, it is important to check their list and compare it with your favorite exchanges before choosing their fee structures. Most of the partner exchanges are trusted and have a sizeable following and a global visibility.

Some of these exchanges include Coinbase, Coinbase Pro, Bittrex, Bitstamp, Gemini, Poloniex, Binance, KuCoin, Kraken, GateHub, Abra, Idex, Exodus, Gate.io, Hitbtc, CEX.io, Uphold, Huobi, Bitfinex and Changelly among others.

CryptoTrader Key Features

The value proposition points for CryptoTrader are limited. The price is however affordable and comes with two notable features;

Crypto tax form generator: The software has the ability to import your crypto transactions data from a good number of exchanges. This puts the figures together for you automatically saving you the headache of doing the math manually.

Simple crypto data import methods: The tool has a feature that allows you to import data. You can use the CSV files import method or just create an API key that you can use to import your data.

The only downside with the platform is the inability to sync your accounts. This makes it hard to track your digital asset portfolio. Lack of this feature restricts the platform to a one-off tool used only when tax returns are due.

Client Support

Should you have any issues using the platform to generate tax reports, there are several ways to contact the support team. You can head to the support tab and check out the FAQs. If this section is not helpful, you can use their chat channel.

The CryptoTrader client support portal has a section where you have all the information on getting started and how to section. However, the simplicity of the interface is self-explanatory and easy to use.

The platform has a functional email address that you can use if you feel your concerns have not been addressed to your expectations.

Pros and Cons

Pros

The platform is cost-effective since you need to generate your tax reports once every year.

The CryptoTrader account creation is fuss-free and no credit card is required. The only details you provide is your email address.

The dashboard is user-friendly and the interface highly intuitive.

Cons

The platform does not have a global face since it supports just a handful of cryptocurrency exchanges.

The system focuses on the US and the IRS Form 8949.

CryptoTrader Ratings

Although, the CryptoTrader software has been in the market for some time now its popularity is on the rise. With the increasing demand for crypto taxation services, the tool is yet to scratch the surface and rating scale, CryptoTrader rating stanza at 3 with 5 being the highest.

Conclusion

CryptoTrader saves you both time and money when it comes to calculating cryptocurrency tax. The platform is easy to navigate and you do not need to be tech-savvy to generate your crypto tax reports. By design, the tool breaks down the complex crypto tax calculation process to a single click solution. As with all online crypto transactions, do your due diligence.