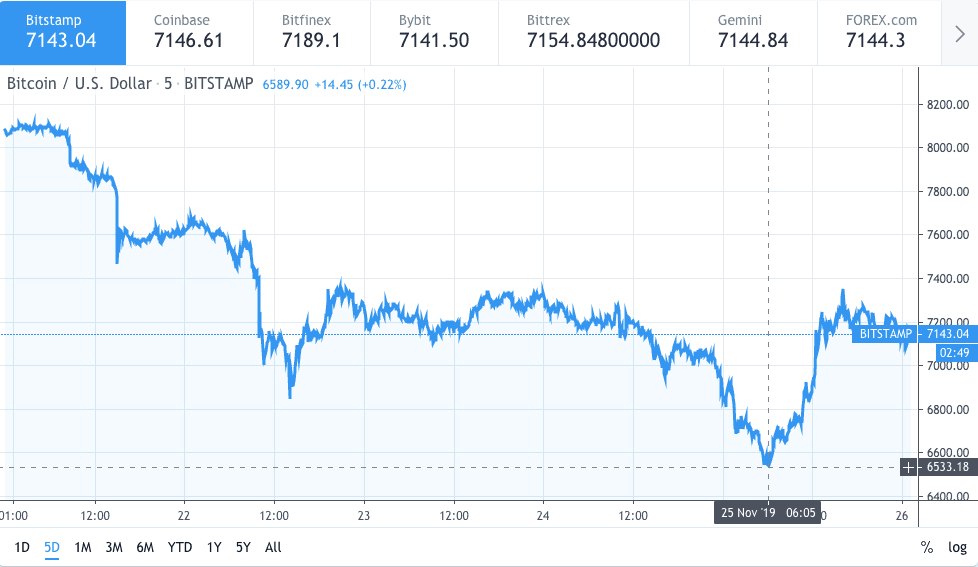

The king of cryptocurrency Bitcoin is in deep perils, and the Bitcoin price crash continued with its downtrend from the previous weeks. The cryptocurrency broke under $7000, right at that time when the U.S market opened, sliding to about $6791.46.

Bitcoin price chart by Trading View

Bitcoin price chart by Trading View

Right after the crash, the market stabilised back up to $7400 mark on the same day it fell, i.e. the 22nd of November. The price movement remained slow the following day while the Bitcoin price moved between $7000 and $7400 price marks.

Soon after another price crash brought Bitcoin price down to $6533.18 mark today, however, in a similar reverse head and shoulder kind of position the price is back up to $7143 at the time of writing.

Bitcoin price crash came from 1 Whale’s movement?

The probable reason for BTC price crash could be the wallet of Plus Token scam, which is once again observed selling its haul via Huobi. For a couple of months, the scale and size of the scheme became well-known as one of its main wallets contained 38,000 BTC.

While the mainstream bloggers are busy writing click bait headlines about Chinese miners the elephant…

*cough*

*cough*… whale in the room is slowly dumping through Huobi.https://t.co/Luaq1Afh67 https://t.co/gfnZBiCu0U pic.twitter.com/KKT57IzkSj

— 🏴∴manual data entry specialist∴🏴 (@ErgoBTC) November 8, 2019

This Plus Token Scam was not known until Q2 of 2019, as it was being spread mainly via Chinese channels. The scam took away BTC worth $2.9 billion.

Up till now, Plus Tokens wallets were only sending regular transactions ranging from 600-1000 BTC daily, gradually liquidating haul, but as soon as a BTC moved in a bearish setup, the selling speed up. As per the reports, Plus Token has accumulated 200,000 BTC and around 800,000 ETH.

UPDATE:

35,000 BTC whale funds dormant since mid-August on the move again.

Via ANON-2374835914https://t.co/iE1LhhYumP pic.twitter.com/4uxRFRlSuB

— 🏴∴manual data entry specialist∴🏴 (@ErgoBTC) November 6, 2019

The decision of selling comes at the time when the Chinese authorities became aggressive towards the cryptocurrency projects and the attempts of selling the tokens.

👀👀👀 just a rehash

Overreaction follows with correction

Violent delights have violent ends https://t.co/dZD4TELIBp

— Dovey "Rug the fiat" Wan (@DoveyWan) November 22, 2019

The People’s Bank of China has also made announcements and stated that they would crackdown on the cryptocurrency exchanges and also outlined the sale projects of tokens pushing their products violently.

The present correction could be because of the over-reaction, which ended up pushing Chinese enthusiasm for BTC on top.

Featured Image by Elements Envato