Optimism Price Prediction 2024-2033

- Optimism Price Prediction 2024 – up to $5.50

- Optimism Price Prediction 2027 – up to $16.90

- Optimism Price Prediction 2030 – up to $47.16

- Optimism Price Prediction 2033 – up to $155.09

Imagine a world where Ethereum, the second largest cryptocurrency by market cap, is not just a giant because of its support for smart contracts, but also a fast, affordable, and efficient platform. This is the world that the Ethereum community dreams of, a world where decentralized apps (dApps) and decentralized finance (DeFi) platforms thrive without the burden of high transaction fees. But alas, this dream is yet to be realized.

Enter Optimism, a shining knight in the world of Ethereum, here to rescue us from the dragon of slow and costly transactions. This layer-2 scaling solution, powered by the innovative technology of Optimistic rollups, is like a super-efficient postman who bundles large amounts of transaction data into manageable parcels, delivering them swiftly and affordably.

Optimism is not just a solution, it’s a revolution. It’s cheaper, faster, and is gaining popularity faster than a viral dance challenge on social media. It stands tall among other layer 2 solutions, like Arbitrum, and is becoming a favorite among the Ethereum community.

But what’s a revolution without its own currency? The Optimism network is governed by its very own token, charmingly named OP. In a move that caused quite a stir, a chunk of OP tokens was generously airdropped to early Optimism users in late May 2022. And the best part? The developers behind Optimism have promised to continue this airdrop, making it rain OP tokens for its users.

So, while we wait for Ethereum to roll out its planned upgrades, Optimism is here, making Ethereum transactions faster, cheaper, and well-optimized!

How Much is Optimism Worth?

The live Optimism price today is $2.25 with a 24-hour trading volume of $224,964,438 USD. We update our OP to USD price in real-time. Optimism is up by 5.87% in the last 24 hours. The current CoinMarketCap ranking is #41, with a live market cap of $3,112,569,206 USD. It has a circulating supply of 1,006,141,600 OP coins and a max. supply of 4,294,967,296 OP coins.

Optimism Price Analysis: OP spikes high as bullish momentum inflates to $2.25

TL: DR Breakdown

- Optimism price analysis shows a bullish bias trend

- OP support is found at $2.09

- Resistance for OP is present at $2.27

Optimism price analysis indicates a bullish signal today as the price rises to the $2.25 mark and is up 5.87 percent for the past 24 hours. OP coin is trading at $2.25 after hitting an intra-day high of $2.27. The short-term technical chart shows that Optimism is in a bullish trend and is likely to rally further. The overall market sentiment is bullish, as the OP price has sustained the $2.00 level for several days now.

Optimism Price Analysis 1-day Chart: Bullish Momentum Propels OP Prices Toward The $2.25 Level

The 1-day Optimism price analysis suggests that a break of resistance at the current levels will confirm an uptrend, opening up for a retest of the $2.17 high today. If this level breaks, a further advance of $3.00 is expected. The price action in the 1-day chart suggests that the price may be forming a triangle pattern, which is generally considered to be a bullish sign. The coin is now supported by strong buying pressure and has further surged to a new all-time high of $2.25, indicating that the buyers are still in control.

OP/USD 1-day price chart, Source: TradingView

The EMA is also in a positive trajectory after crossing the 20-day EMA, which indicates that the bulls are in control. In addition, the Relative Strength Index (RSI) is currently at 32.69, indicating that the market is in oversold territory. This suggests that a bottom may be nearing, and a reversal could take place in the near future.

OP/USD 4-Hour Price Chart: Latest Development.

The hourly chart for OP/USD has formed an ascending triangle pattern on the 24-hour chart, which indicates that the buyers have taken control of the market and are likely to push the coin toward higher levels. The short-term outlook for Optimism remains bullish as the coin is trading above its crucial support level of $2.09. The buyers should continue to remain cautious and keep an eye on the $2.27 resistance level as any failure to break it could lead to a sell-off in the near term.

OP/USD 1-day price chart, Source: TradingView

The Relative Strength Index (RSI) score is increasing at a faster pace and has reached an index of 47.48, which indicates that the market is currently in a bullish state. The exponential moving averages (EMA) in the higher time frames, such as the 4-hour chart, suggest that the price action is highly bullish and is likely to sustain gains above $3.00 in the near term.

What to Expect From Optimism Price Analysis Next?

Optimism price analysis is well-positioned for further gains in the near term, and investors may use this as an opportunity to enter the market at current levels. Bulls need to break above the $2.27 level of resistance to sustain their momentum and reach new highs. On the downside, a breach below $2.09 could indicate a bearish trend and push prices lower in the near term. Investors need to keep an eye on these critical levels for further price movements in the OP coin.

Is optimism a good investment?

Optimism (OP) has shown a notable performance over the past week, appreciating by 4.05% in value, triggered by strategic partnerships and a significant airdrop. The collaboration with Velodrome and Chaos Labs to promote the adoption of Circle’s USDC stablecoin on the Optimism mainnet initiated a surge in OP’s price. This momentum was further boosted by an airdrop of over 10 million OP tokens to more than 22,000 unique addresses, leading to a peak price of $4.15.

Despite this positive trend, experts anticipate a correction in OP’s price towards the end of February, predicting a stabilization around $3.92 as the excitement from the recent airdrop fades. This short-term prediction suggests a cautious approach to investing in OP at this moment, highlighting the volatility and speculative nature of the crypto market.

Recent News

C Labs, a prominent developer within the blockchain space and the driving force behind the Celo blockchain, has recently revealed its plans to shift its network infrastructure to an Ethereum Layer 2 solution using the OP Stack. This strategic decision stems from a community-driven endorsement in a governance vote last July and an exhaustive eight-month evaluation of various scaling solutions, including Arbitrum Orbit, zkSync’s ZK Stack, and Polygon CDK.

The OP Stack, a pivotal development platform within the Optimism ecosystem, is provided by OP Labs, which actively contributes to Optimism’s growth. This stack aids developers in crafting customized Layer 2 blockchains, enhancing the versatility and scalability of blockchain applications.

Celo’s move to integrate with the Optimism ecosystem is aimed at joining the Superchain network, which encompasses chains like OP Mainnet and Base. This integration is anticipated to bolster scalability and overall network performance significantly. By embracing optimistic rollups, Celo aims to streamline Ethereum transaction processing on a secondary layer, addressing critical scalability concerns.

The proposed enhancements for Celo’s network are substantial, with plans to reduce block times from five seconds to two and boost throughput by an impressive 50%. A testnet for the Celo Layer 2 is slated for a summer 2024 launch, contingent upon further community approval.

This transition signifies a pivotal moment for Celo (CELO), initially conceived as a Layer 1 blockchain compatible with the Ethereum Virtual Machine (EVM). Notably, the network secured substantial funding, with $30 million from major investors like a16z and Polychain Capital in 2019, followed by an additional $20 million in 2021. Celo’s ecosystem supports a diverse range of applications, spanning from established Ethereum decentralized applications (dApps) like Uniswap and Sushiswap to Celo-native projects such as Valora and UbeSwap.

The integration of Celo into the Optimism ecosystem marks a significant step forward in blockchain interoperability and scalability. It underscores the industry’s ongoing efforts to address the challenges of blockchain throughput and transaction processing, paving the way for a more efficient and accessible decentralized financial landscape.

Optimism Price Predictions 2024-2033

Price Predictions By Cryptopolitan

| Year | Minimum | Average | Maximum |

| 2024 | $4.52 | $4.67 | $5.50 |

| 2025 | $6.53 | $6.71 | $7.90 |

| 2026 | $9.71 | $10.04 | $11.37 |

| 2027 | $14.37 | $14.88 | $16.90 |

| 2028 | $20.25 | $20.99 | $24.49 |

| 2029 | $27.45 | $28.50 | $34.66 |

| 2030 | $39.18 | $40.61 | $47.16 |

| 2031 | $59.30 | $61.33 | $68.10 |

| 2032 | $86.05 | $89.11 | $104.20 |

| 2033 | $128.45 | $132.01 | $155.09 |

Optimism Price Prediction 2024

According to the technical analysis of Optimism prices expected in 2024, the minimum cost of OP will be $4.52. The maximum level that the OP price can reach is $5.50. The average trading price is expected around $4.67.

Optimism Price Prediction 2025

After the analysis of the prices of Optimism is assumed that in 2025, the minimum price of OP will be around $6.53. The maximum expected Optimism price may be around $7.90. On average, the trading price might be $6.71 in 2025.

Optimism(OP) Price Prediction 2026

As per the forecast price and technical analysis, In 2026 the price of Optimism is predicted to reach at a minimum level of $9.71. The OP price can reach a maximum level of $11.37 with the average trading price of $11.37.

Optimism Price Prediction 2027

Based on the technical analysis by cryptocurrency experts regarding the prices of Optimism, in 2027, OP is expected to have the following minimum and maximum prices: about $14.37 and $16.90, respectively. The average expected trading cost is $14.88.

Optimism Price Prediction 2028

According to our deep technical analysis on past price data of OP, In 2028 the price of Optimism is predicted to reach at a minimum level of $20.25. The OP price can reach a maximum level of $24.49 with the average trading price of $20.99.

Optimism Price Prediction 2029

Based on the analysis of the costs of Optimism by crypto experts, the following maximum and minimum OP prices are expected in 2029: $34.66 and $27.45. On average, it will be traded at $28.50.

Optimism (OP) Price Prediction 2030

According to our deep technical analysis on past price data of OP, In 2030 the price of Optimism is forecasted to be at around a minimum value of $39.18. The Optimism price value can reach a maximum of $47.16 with the average trading value of $40.61.

Optimism Price Forecast 2031

The price of Optimism is predicted to reach at a minimum value of $59.30 in 2031. The Optimism price could reach a maximum value of $68.10 with the average trading price of $61.33 throughout 2031.

Optimism Price Forecast 2032

According to the technical analysis of Optimism prices expected in 2032, the minimum cost of OP will be $86.05. The maximum level that the OP price can reach is $104.20. The average trading price is expected around $89.11.

Optimism Price Prediction 2033

According to our deep technical analysis on past price data of OP, In 2033 the price of Optimism is predicted to reach at a minimum level of $128.45. The OP price can reach a maximum level of $155.09 with the average trading price of $132.01.

Optimism Price Prediction By Coincodex

Optimism had its peak price on 2024, when it traded at its all-time high of $3.26, while it reached its lowest price on June 18, 2022, when it traded at its all-time low of $ 0.401121. Since its ATH, the lowest price was $0.896377(a (cycle low). Since the last cycle low, the highest OP price was $ 1.500900 (cycle high). The current price prediction sentiment is bearish, with the Fear & Greed Index reading 56 (Greed).

Optimism has had 13 out of 30 green days in the last 30 days,

Optimism Price Forecast By Digital Coin Price

Digital Coin Price’s OP price forecast expects a gradual increase in the token’s value in the upcoming years. According to the website, Optimism’s price is anticipated to surpass the $3.36 mark in 2024. By the year’s end, it is projected that Optimism will attain a minimum value of $3.11. Furthermore, the price of OP has the potential to achieve a peak level of $3.57.

In 2033, it is anticipated that the price of Optimism (OP) will exceed $27.25. As we approach the end of the year, the minimum value of Optimism is projected to be $27.16. Moreover, the price of OP has the potential to reach a high of $27.29.

Optimism Price Prediction By CryptoPredictions.com

According to CryptoPredictions.com’s Optimism price prediction, the OP token’s price may surge further following its current hype. Optimism is predicted to start in March 2024 at $4.52 and finish the month at $5.50. During March, the maximum forecasted OP price is $4.025 and the minimum price is $2.737.

By the end of 2027, the OP token’s price may attain an average trading price of $14.88, with a minimum price of $14.37 and a maximum price of $16.90.

Optimism Overview

Optimism Price History

Let’s delve into the price history of the OP token. While it’s important to remember that past performance doesn’t guarantee future results, understanding the token’s trading history can provide a useful context for interpreting or making an Optimism price prediction.

When the OP token was first introduced to the open market via the initial airdrop on May 31, 2022, it was valued at $4.57, as per CoinMarketCap. However, this price seemed overly optimistic as the market quickly deemed it overvalued, causing it to drop to a low of $0.7973 before ending the day at $1.44 – a 68.5% decrease from the opening price.

Despite the initial price being the all-time high for Optimism, the OP token price has seen some fluctuations.

In June 2022, the market was still recovering from the depegging of the UST stablecoin and the subsequent collapse of the associated LUNA cryptocurrency. This was quickly followed by the Celsius crypto lending platform freezing withdrawals, further confirming the bear market. This series of events negatively impacted the newly launched Optimism, causing it to drop to its all-time low of $0.4005 on June 18, 2022 – less than a tenth of its launch price.

However, the token made a slow recovery, ending the month at $0.5434. But by July 13, 2022, the token fell to $0.4147, continuing its bearish trend.

Following Ethereum’s Merge – the transition to a proof-of-stake (PoS) consensus mechanism aimed at making the blockchain faster and more eco-friendly – on September 15, 2022, the crypto markets didn’t react as positively as many investors had hoped. Despite launching on OpenSea, Optimism was trading at $0.8917 on September 28. The OP token continued to fall, reaching $0.649 by October 21. However, by November 4, 2022, the token had regained over 108% and surged to $1.3512 following the launch of Pragmatism, a library design system created by Figma for the Optimism Collective.

This bullish run was short-lived, though, as the token fell to $0.7952 by November 10, 2022, triggered by the collapse of the FTX (FTT) exchange. Throughout the rest of November, the token fluctuated between $1 and $0.8 before starting a steady rise in December, spurred by Optimism’s announcement of the deployment of the AttestationStation, an attestation smart contract providing “a permissionless, accessible data source for builders creating reputation-based applications”.

On December 15, 2022, the platform also announced that an Optimism non-fungible token (NFT) would be “coming soon” on the AttestationStation, serving as a “customisable profile picture that can represent user identity across the Optimism Ecosystem”.

Earlier, the platform had announced Retroactive Public Goods Funding Round 2, set to launch in February 2023, aimed at giving back to those “powering the public goods that make Optimism possible”.

The first half of December saw OP rising, reaching a high of $1.19 before dropping to close the year at $0.9172. OP then experienced a rally at the start of the New Year, reaching $3.21 on February 3. A drop was followed by a recovery to $3.26 on February 24, but then it decreased to trade at about $2.52 on March 7, 2023. Optimism further declined and touched the $1.5 mark in early June.

More about the Optimism Network

What Is Optimism?

Optimism operates as a second layer chain, functioning atop the Ethereum mainnet, which is the first layer. Transactions are conducted on Optimism, but the transaction data is relayed to the mainnet for validation. This is akin to driving on a less congested side road while still enjoying the security of a major highway.

Lastly, we put proxies in front of our public endpoints in order to dynamically distribute load and eliminate downtime.

— Optimism (@Optimism) January 31, 2022

You can now check the network's status from the new status page: https://t.co/mtXoiaoTDe.

As per the current data from Defi Llama, Optimism is the second largest Ethereum layer 2, having $313 million locked in its smart contracts. Arbitrum leads the pack with $1.32 billion.

Wow, what a day.

— Optimism (@Optimism) June 1, 2022

OP Drop #1 had a turbulent launch which we finally stabilized after more than five hours of non-stop work.

We’ll be publishing a full, detailed retrospective on the lessons learned next week. Let’s quickly talk about what happened.

Synthetix, a protocol providing liquidity for derivatives, holds the position of the largest protocol on Optimism, with a total value locked (TVL) of $125 million. Uniswap, a decentralized exchange (DEX), is the second most utilized protocol on this chain. As of the current data, there are 35 protocols on Optimism, each having at least $1,000 locked in their smart contracts.

Optimistic rollups operate on the principle of ‘optimistic’ validation, where all transactions within the rollup are presumed to be valid. This approach saves time as individual transactions aren’t required to provide direct proof of their validity. Validators within the rollup are given a week to scrutinize the entire rollup for any fraudulent data.

According to a Dune Analytics dashboard, Optimism remarkably reduces Ethereum transaction fees, also known as gas fees, by an impressive 129 times. It is backed by DeFi platforms such as Synthetix and Uniswap. As of March 2022, Dune Analytics reports that Optimism safeguards approximately $740 million of on-chain value, a decrease from just over $1 billion in January.

Optimism was first introduced in June 2019, with a testnet launched in October of the same year. However, it wasn’t until January 2021 that an alpha mainnet was launched. It took until October 2021 for Optimism to release a version of the Alpha mainnet that was compatible with the Ethereum Virtual Machine. Finally, an open mainnet was launched in December 2021.

How Does Optimism Work?

Optimism essentially functions as a large, append-only record of transactions. All of its consolidated blocks are stored in an Ethereum smart contract known as the Canonical Transaction Chain.

Unless a user directly submits their transaction to the Canonical Transaction Chain, new blocks are generated by an entity known as a sequencer. This sequencer promptly validates transactions, then constructs and executes blocks on Optimism’s layer 2, a blockchain that resides on top of the layer 1 blockchain, in this case, Ethereum.

These blocks, referred to as ‘rollups’, are batches of Ethereum transactions. The sequencer further compresses this data to minimize the transaction size (thereby saving money) and then submits the transaction data back to Ethereum.

The layer 2 software of Optimism is engineered to closely resemble Ethereum’s code. For example, it utilizes the same virtual machine as Ethereum and calculates gas charges in a similar manner (though at a reduced rate, courtesy of its optimistic rollup solution).

Due to the underlying similarities between Ethereum and Optimism, any ERC-20 asset, which is a cryptocurrency that complies with the generic Ethereum token standard, can be transferred between the two networks.

How Do You Use Optimism?

For users, the experience of using Optimism closely mirrors that of the Ethereum mainnet. Your Optimism address is identical to your Ethereum mainnet address, starting with 0x. The blockchain explorer of Optimism is also the same as Etherscan, which is the blockchain explorer for the Ethereum mainnet. Optimism is compatible with a variety of decentralized finance (DeFi) wallets, including MetaMask, which is the most commonly used option.

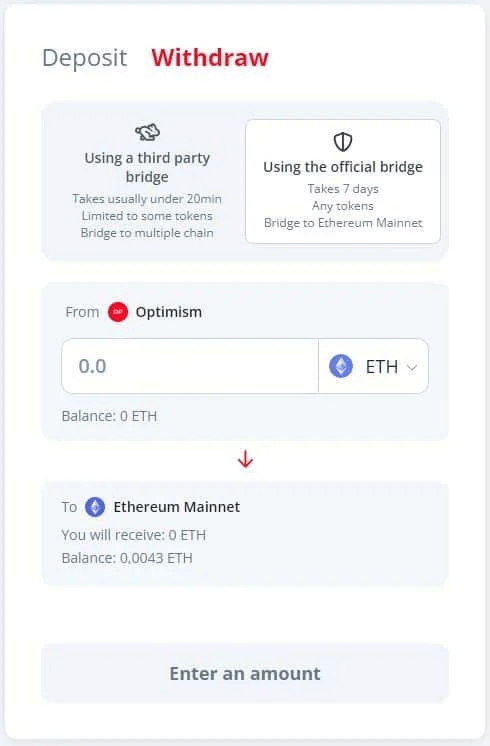

To utilize Optimism, you need to deposit your ETH or ERC-20 tokens into the Optimism token bridge. This enables you to carry out transactions on Ethereum via Optimism. Once done, you can convert your tokens back to the Ethereum mainnet.

To deposit your tokens, you must do so through the Optimism Gateway. This can be accessed via a Web3 wallet, such as MetaMask. Deposits typically take around twenty minutes, and for transferring 1 ETH, MetaMask estimated a fee of $18.

Optimism indicated that withdrawing the funds would take a week and cost $52.72. This delay is a characteristic of the week-long challenge period incorporated into Optimism’s optimistic rollup.

After depositing funds on Optimism, you can utilize them within supported decentralized applications. For example, Uniswap allows you to execute trades via Optimism to save on fees. Simply select Optimism from the network menu, and you can proceed with trading as usual.

You also have the option to use a centralized cryptocurrency exchange to deposit ETH into your Optimism address. However, before attempting to transfer funds to a layer 2 from your centralized exchange, always ensure that the exchange supports withdrawals to that particular chain. If you transfer funds to an unsupported address, you risk losing your funds irretrievably. As of the time of this writing, exchanges such as Binance, Bybit, and Huobi permit withdrawals to Optimism.

What is Optimism’s token (OP)?

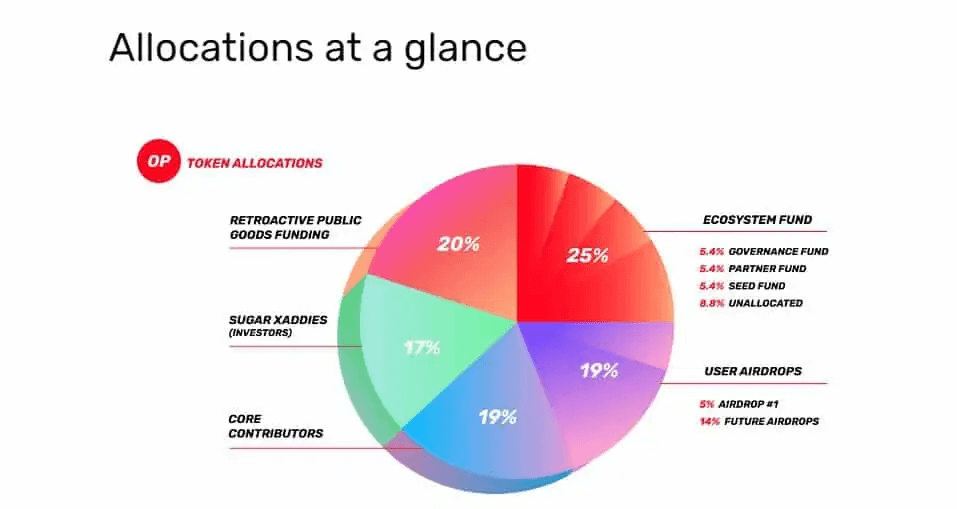

Optimism introduced its OP token on May 31. A total of 231,000 addresses were eligible to claim 214 million OP tokens for free, a process known as an “airdrop”. This represents 5% of the total supply of 4.29 billion, implying that 95% of the supply is yet to be released into the market. The number of users who claimed the first airdrop can be tracked on this Dune Analytics dashboard.

Hey folks–in the interest of transparency, we'd like to share some details about an ongoing situation:https://t.co/915vIgRIJG

— Optimism (@Optimism) June 8, 2022

Summary below 🧵👇

The airdrop encountered significant issues. Optimism confessed that they “grossly underestimated the traffic surge that the airdrop would generate,” resulting in many eligible token holders being left without tokens.

However, Optimism faced further negative publicity on June 8, when an exploit led to the theft of 20 million OP tokens intended for the liquidity provider Wintermute. According to Optimism, the exploit happened when Wintermute provided an Ethereum L1 address that had not yet been deployed on Optimism. Before the problem could be resolved, an attacker managed to seize the funds.

Wintermute accepted full responsibility. Since the hacker only liquidated one million OP tokens, Wintermute speculated that the attack was carried out by a whitehat (ethical) hacker. In a message to the hacker, Wintermute stated: “You have one week to consider being a whitehat. If this doesn’t happen, we are 100% committed to recovering all the funds, identifying the person(s) responsible for the exploit, fully exposing them and handing them over to the appropriate legal system.” Despite the assignment of blame, Optimism received a significant amount of criticism on Twitter.

The OP token grants holders the right to participate in The Optimism Collective, a two-tier governance system consisting of the Token House and the Citizens’ House. The Citizens’ House, set to be operational later in 2022, will govern decisions related to public-goods funding. The Token House, which is already active, sees technical decisions related to Optimism, such as software upgrades. In its early stages, Optimism raised funds on Gitcoin, a prominent public-goods funding platform.

Arbitrum Vs. Optimism

Arbitrum and Optimism, both classified as Optimistic rollups, have notable differences. One key distinction is their dispute-resolution processes for transaction validation. Optimism employs single-round fraud proofs executed on layer-1, while Arbitrum uses multi-round fraud proofs executed off-chain. Arbitrum’s multi-round fraud proofing is more advanced, offering greater cost-effectiveness and efficiency compared to Optimism’s single-round proofing.

Additionally, although both platforms are EVM compatible, they differ in their underlying virtual machines. Optimism uses Ethereum’s EVM, whereas Arbitrum operates on its own Arbitrum Virtual Machine (AVM). Consequently, Optimism supports only the Solidity compiler, while Arbitrum is compatible with all EVM-compiled languages, such as Vyper and Yul.

Optimism and Arbitrum diverge in terms of their development roadmaps. Optimism has a clearly outlined roadmap extending until 2024, which includes objectives like introducing advanced interactive fraud proofs, sharded rollups, and a decentralized sequencer.

On the other hand, Arbitrum does not publicly disclose its future plans on its website or Github.

Conclusion

Optimism has rapidly ascended as a favored Ethereum scaling solution. The Optimism Foundation recently put forth a proposal for transitioning the Optimism mainnet to Bedrock, a novel decentralized Rollup architecture devised by Optimism Labs.

The team expressed their confidence in the positive impact of the post-Bedrock experience for developers within the Optimism ecosystem and shared the consistent enthusiasm they’ve received from their partners regarding the upgrade. They affirmed their dedication to ensuring the success of this upgrade and are looking forward to observing the outcomes in the forthcoming months and years.

The evolving competition between optimistic rollups and ZK-rollups in the upcoming years, as they vie for dominance in layer-two solutions, also presents an intriguing aspect to keep an eye on.