Maker wrapped Bitcoin tokens, wBTC, have doubled ever since they were launched as collateral on the Maker protocol. wBTC represents Bitcoin value equivalent in the form of an ERC20 token. Bitcoin halving and the rising value of Bitcoin are said to be behind this trend.

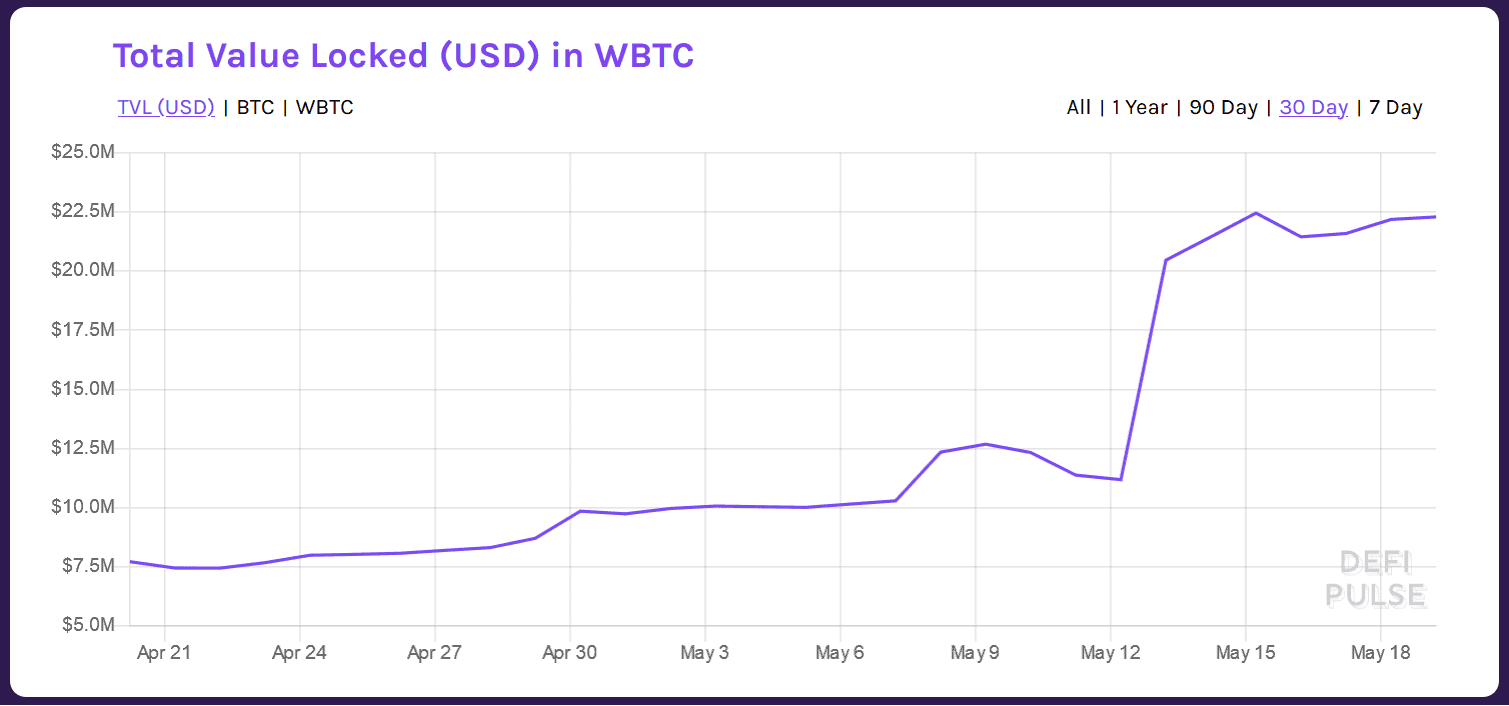

Total value locked in Bitcoin from DeFi Pulse

Recently, Maker protocol voted for the addition of Bitcoin as collateral in the form of ERC20 token or wBTC. The move has increased the liquidity in the Maker protocol and also bought BTC to the Ethereum realm. The move benefitted the overall DeFi community as well. The cross-chain currency increasingly found acceptance among the DeFi fans as the digital storehouse proved to be a high-quality collateral asset.

Maker wrapped Bitcoin tokens are witnessing rush post BTC halving

The Maker wrapped Bitcoin has doubled, increasing from 1,000 to the current 2,300 levels. The doubling, though, has happened rapidly in the past two weeks signifying that the Bitcoin collateral tokens have found more fans after the recent BTC halving event. At present, the total value locked in ERC20 tokens has touched $22.45 million.

The rising interest in Maker wrapped Bitcoin tokens is also primarily due to the liquidity storehouse trapped in the BTC chain. DeFi community is right in tapping into the substantial liquidity to fuel the protocol’s operations. Smart contracts are employed by Maker protocol for its loan-related operations that involve DAI tokens pegged to the U.S. dollar. The collateral in these loans is usually a cryptocurrency.

Diversity fueling rising interest in wBTC tokens

Over the years, the Maker Protocol has introduced new currencies to the fold. In its bid to revive the lagging liquidity, Maker wrapped Bitcoin tokens were launched in May through a decentralized governance voting model.

Maker wrapped Bitcoin is more than just collateral assets for DeFi loans. They represent the combination of Bitcoin and Ethereum chain in a way where both blockchains can interact safely. Not only can users transfer BTC onto ETH blockchain, but they can also achieve this transfer through trusted third parties. The initiative is a joint effort by Maker, Kyber, Compound, and other DeFi players.

The Maker loans in ETH fell by a significant margin meaning that users are drifting towards Maker wrapped Bitcoin in order to add more diversity to their collateral portfolio. Diversity in collateral ensures that risk in DeFi loans is minimized.