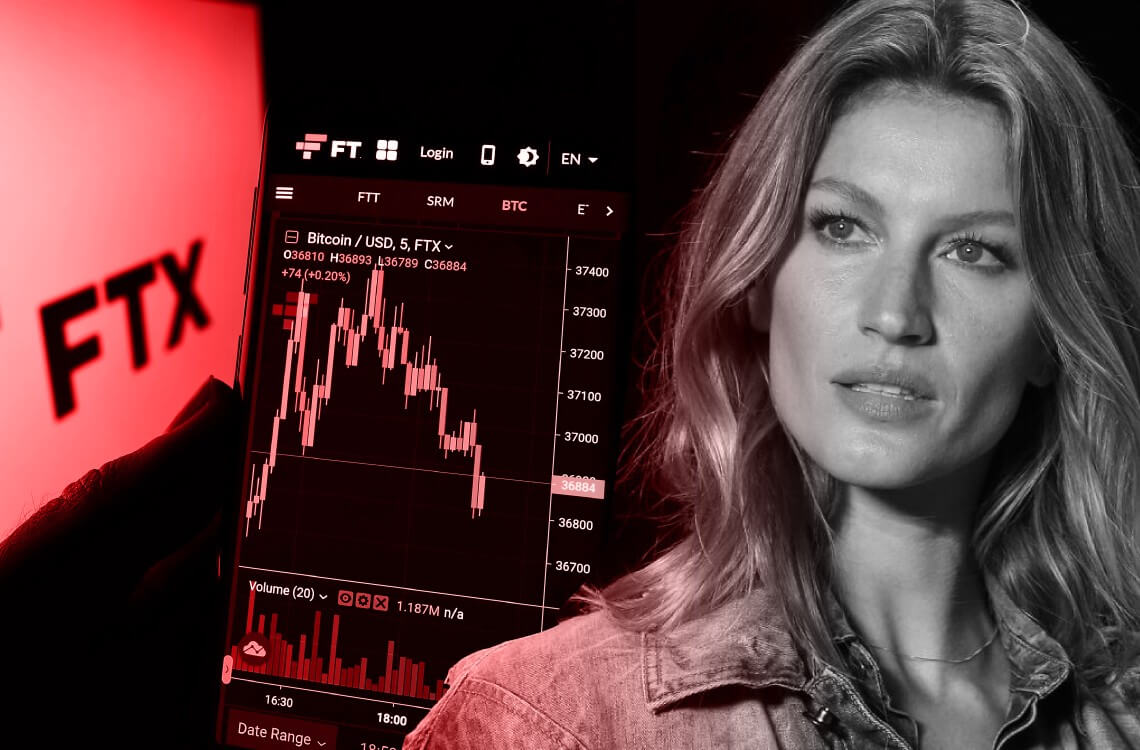

Gisele Bundchen, the Brazilian supermodel and actress who is also the estranged wife of NFL superstar Tom Brady, has finally broken her silence on the shocking collapse of crypto giant FTX, which she and Brady both heavily invested in and promoted.

In a recent interview with Vanity Fair, Bundchen revealed that she was ‘blindsided’ by the collapse of the crypto company, which filed for bankruptcy in November last year, leaving hundreds of investors, including the former couple, out of pocket.

FTX’s collapse and the fallout for Bundchen and Brady

As a result of the astonishing failure of FTX, Bundchen and Brady were among the investors who sustained possible losses amounting to substantial amounts of money. The pair had also been FTX brand ambassadors and appeared in a commercial for the firm that aired during the Super Bowl.

Bundchen has more than 680,000 shares in FTX Trading, which were once valued at $57 million, while Brady has more than 1.1 million common shares of the same entity, which at their peak were worth $93 million. It is unclear how much the former couple lost, as it is not known when they bought the shares or if they were gifted to them in return for their promotional work.

Gisele’s reaction to FTX’s collapse

In the Vanity Fair interview, Bundchen spoke candidly about her reaction to the collapse of FTX, stating that she was ‘no different than everyone else’ who trusted the hype around Sam Bankman-Fried and FTX. Bundchen said that she was ‘blindsided’ by the collapse, which had a significant impact on her finances.

She declined to go into specifics but did explain that her financial advisors had described FTX as ‘a sound and great’ investment. She added that she was ‘so sorry for all of us that this happened, and I just pray that justice gets made.’

Investors who also lost money following FTX’s collapse

Bundchen and Brady are not the only ones who lost money following FTX’s collapse. Robert Kraft, the billionaire owner of the New England Patriots, holds more than 110,000 Series B preferred shares in FTX Trading, the entity that owns its main crypto exchange.

His firm also owns 479,000 Class A common shares and 43,545 Series A preferred shares in West Realm Shires, the unit that owns the company’s US-based exchange.

Altogether, the roughly 630,000 shares would have been worth $53 million. Other large institutional investors who lost money include Tiger Global Management, the Ontario Teachers’ Pension Plan, and Sequoia Capital.

The failure of FTX has sent shockwaves to be felt across the cryptocurrency sector and brought attention to the potential dangers of investing in developing technology.

The collapse has also led to an increase in the regulatory monitoring of the cryptocurrency business, with some experts anticipating that additional firms will face similar inquiries in the future. This spike in regulatory scrutiny of the cryptocurrency industry was another consequence of the collapse.

Meanwhile, the legal battle over FTX continues, with the company’s founder and CEO, Sam Bankman-Fried, currently awaiting trial in New York City on fraud charges, to which he has pleaded not guilty.