- DeFi market plunge

- UNI & YFI tokens price drops by approximately 50 percent

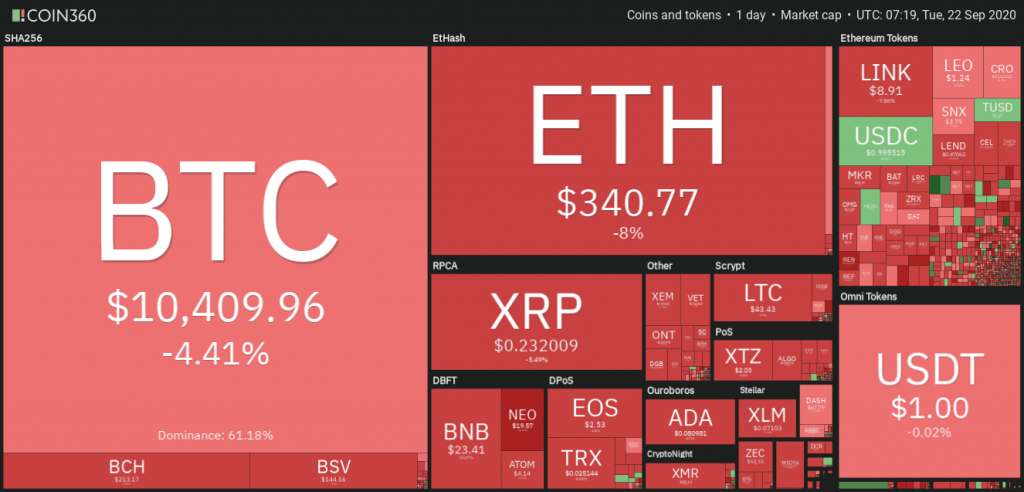

- Bitcoin and Altcoins in a bloodbath

- BTC initiated DeFi market plunge

Yesterday’s Ethereum price decline caused a DeFi market plunge with UNI, DEX and Yield Farm token losing more than 40 percent of their value. Ethereum has declined by over 30 percent since its 2020 peak of $482 on September 1 to reach $340 in less than a week.

The resurgence of the U.S. dollar has hugely triggered the recent decline in the price of bitcoin and altcoins like ethereum by U.S. dollar, and fears of a prolonged economic recession due to increased number of COVID-19 cases. The ETH/USD pair is still sedentary near $340 after an unsuccessful attempt to recoup its August price adventures.

Moreover, some essential factors on the ethereum network have been modified since ethereum initiated a bearish break early in September. These factors include the progress of significant stakeholders in the system like miners, whales, users, traders and the network’s activity, particularly regarding the DeFi ecosystem. Notably, ERC-20 tokens have surpassed Ether’s total market cap.

DeFi market plunge

Taking into account that the DeFi ecosystem is the heartbeat of the Ethereum network, it will massively affect Ethereum’s price action. An apprehension of Ethereum’s price movements provides traders with a hint of the direction finances are moving. Having this technical knowledge of the activities of the network offers a perception of how prevalent the network is compared to trading.

DeFi tokens massively outperformed both bitcoin and ethereum back in August, but it appears they are now losing their momentum. The majority of the DeFi tokens in the market have lost more than 50 percent of their value during the latest bear market.

YFI/USD 4-hour chart

Currently, the two DeFi tokens that have caused profound hype are Uniswap’s UNI tokens and Yield Finance’s YFI tokens. Since the two tokens peaked their monthly highs, they have dumped about 46 and 48 percent of their value. The DeFi market plunge appears to have been triggered by three factors: Ethereum’s price correction, bulls pulling out of BTC’s recent bull-run, and the massive sale of DeFi tokens.

Most of the tokens in the DeFi market dropped by 15-20 percent during the dump. Furthermore, governance tokens such as ChainLink which are indirectly considered as DeFi tokens plummeted by about 15 percent.

Even though the DeFi market plunge has co-occurred with the ethereum price correction, most analysts were anticipating a price correction. For instance, Yearn Finance has grown into a critical player in the DeFi ecosystem within three months. YFI tokens exploded by more than 1200 percent on major exchange Binance to hit its all-time high of $43,966. Uniswap’s UNI token burst onto the scene in a similar fiery charge in a considerably brief span.

UNI/USD 4-hour chart

Last weekend Uniswap airdropped 400 UNI tokens to all its liquidity providers before September 1. Within a few hours after the eagerly anticipated token was launched, several major exchanges such as Binance, Huobi, Okex and even Coinbase added support for UNI. The listing drove the token’s price from zero to hero in just a few days. UNI’s price rose from lows of $0.30 to hit a record $8.8 in less than a week.

As a result of the enormous gains by DeFi tokens, analysts were extensively expecting a price correction. However, the severity of the price correction has many analysts and traders alike in shock.

BTC/USD price decline initiated the DeFi dump

The opinions surrounding bitcoin’s bitcoin’s price movements between September 9-19 are still mixed. Strange enough, bitcoin underwent a firm bullish break while ethereum, the altcoins, as well as DeFi, remained quiet. Such a market trend is relatively unusual as normally when king crypto makes a move, the altcoins follow. The near-term reversed relationship between bitcoin and the altcoins indicates that BTC bulls exited the market as investors stirred DeFi gains to BTC.

One of the more interesting market dynamics I've seen in a while:

— Nick C. (@n2ckchong) September 18, 2020

Profit-taking dump on $UNI is causing BTC, ETH, YFI, and top DeFi alts to rally.$YFI is up 8% since UNI topped. pic.twitter.com/raTVXNcIQt

[the_ad id=”48512″]