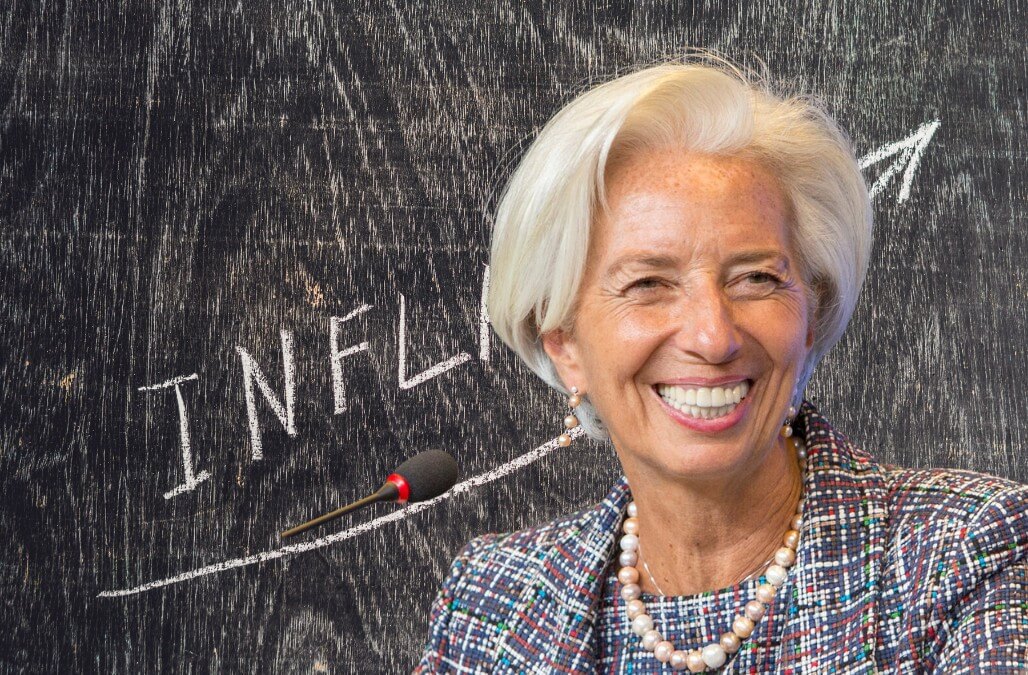

Christine Lagarde, the leader of the European Central Bank, has cautioned about the potential enduring consequences of the recent global economic upheaval, addressing the US Federal Reserve annual conference in Jackson Hole, Wyoming. She emphasized that this turbulence could result in a prolonged elevation of inflationary pressures beyond the typical levels, thus intricately complicating the responsibilities of monetary policymakers.

Lagarde also emphasized the necessity for central bankers to exercise prudence, guarding against heightened instability in relative prices and the cyclic pursuit of wages after prices, which could ultimately result in medium-term inflation.

Lagarde backs Powell’s caution on uncontrolled inflation

In her speech, Christine Lagarde elaborated on the potential consequences of a less flexible global supply, including the labor market and diminishing global competition. She highlighted the likelihood of prices playing a more prominent role in the adjustment process, especially when considering larger and more widespread shocks such as energy and geopolitical disruptions. This perspective was in line with earlier statements from Jay Powell, the chairman of the US central bank, who cautioned that the Fed still grapples with uncontrolled inflation and might need to implement additional rate hikes cautiously.

Central bankers in advanced economies find themselves at a critical juncture in their battle against inflation. Despite decreasing consumer price growth from the post-pandemic peak, inflation remains significantly higher than the longstanding target of 2 percent. Balancing monetary policy to curb inflation without inflicting undue strain on businesses and consumers has become increasingly divisive, particularly amid concerns about an impending economic downturn and tighter financial conditions.

The European Central Bank (ECB) has raised its benchmark deposit rate nine consecutive times, from zero to 0.5 percent to 3.75 percent. However, it has signaled a potential pause in policy tightening, possibly postponing further actions at its upcoming meeting on September 14. Recent business surveys indicating a potential recession in the eurozone have led investors to hedge their expectations regarding another rate increase by the ECB. This uncertainty hinges on the trajectory of inflation, excluding the volatile impact of energy and food prices.

Lagarde refrained from revealing her inclination, instead emphasizing maintaining rates at sufficiently restrictive levels for an appropriate duration to steer inflation back to the target gradually.

Germany’s economy is not in despair

Meanwhile, the German economy has faced consecutive quarters of contraction or stagnation, primarily due to a decline in its extensive manufacturing sector and disruptions in global trade. This economic weakness in the largest European economy has raised doubts about the ECB’s capacity to raise interest rates.

During a question-and-answer session following her remarks, Lagarde countered concerns about the German economy by stating that it was not in disrepair, affirming that efforts were being made to address its issues. She provided an example of how the country swiftly transitioned from Russian gas to liquefied gas within six months by constructing natural gas facilities.

Lagarde emphasized that those responsible for setting interest rates required a combination of clarity, adaptability, and humility to navigate the uncertainty stemming from various global shocks, including the coronavirus pandemic and Russia’s full-scale invasion of Ukraine.

While Eurozone inflation has decreased by half from its peak of 10.6 percent the previous year, economists projected a further decline from 5.3 percent in July to 5 percent in August, pending the release of new price data the following week. However, the rise in European tourism this summer is anticipated to sustain elevated service inflation. This complex situation presents a challenge for the ECB, which has indicated that it would need a gradual decline in underlying inflation, wherein services play a significant role, before ceasing its rate hikes.

In response to inquiries about the disparity in progress between Europe and the US in curbing inflation, Lagarde attributed the lag in the ECB’s rate hike last year to the Federal Reserve’s actions. She also pointed out the distinctive hurdles Europe faces due to its reliance on Russian oil and the proximity of the conflict in Ukraine, which present unique difficulties for the central bank in managing price pressures.

Finishing off, Lagarde expressed confidence that the inflation figures at the year’s end would exhibit significant differences from their current status.