The storm clouds hanging over Binance.US, the renowned American subsidiary of the global crypto behemoth, have darkened. The company has recently culled about a third of its workforce, equating to a staggering 100 jobs.

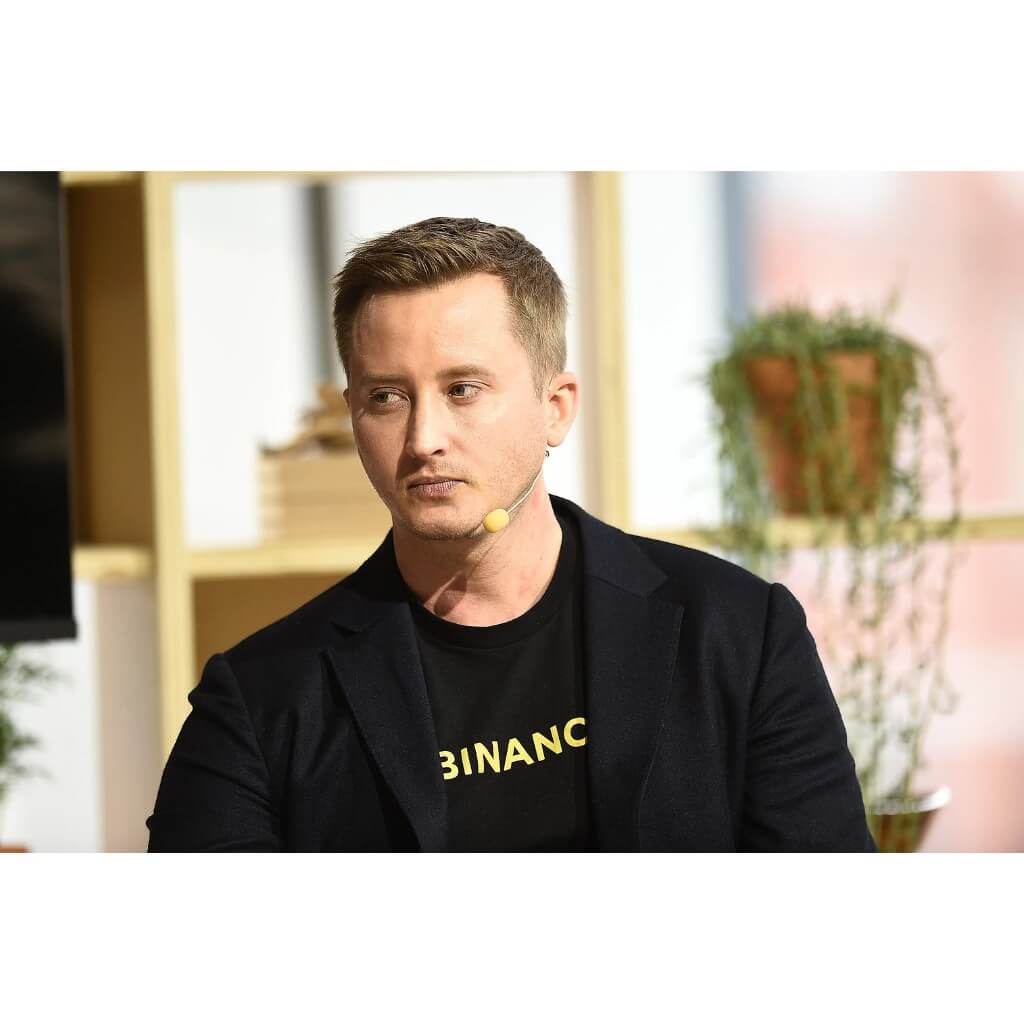

Adding to this grim tally is the surprising exit of its President and CEO, Brian Shroder. Now, let’s pull back the curtain on what led to this corporate upheaval and the challenges facing Binance.US.

Regulatory Onslaught: A Catalyst for Change

Under the scrutinizing eyes of financial regulators, Binance.US has found itself grappling with a relentless barrage of challenges. The Securities and Exchange Commission (SEC) has displayed an assertive approach towards the crypto realm, and Binance.US has felt the weight of this scrutiny.

The domino effect created by the SEC’s actions against the crypto sector was cited by a company representative as a significant factor in their recent layoffs. In their words, these challenges imposed by the SEC bear “real-world consequences for American jobs and innovation.” It’s hard to dismiss the biting irony that a platform, which stands for decentralized financial freedom, is cornered by centralized financial watchdogs.

The consequences for Binance.US haven’t stopped at job cuts. The leadership seesaw now has Norman Reed, the Chief Legal Officer, stepping in as the interim leader, filling the void left by Shroder.

Binance.US: The Turbulent Months

Brian Shroder’s tenure at the helm of Binance.US, albeit brief, was anything but smooth. Since boarding the ship in September 2021, he found himself navigating the company through some stormy regulatory waters. A substantial part of the turbulence arose from the lawsuits filed by both the SEC and the Commodity Futures Trading Commission (CFTC).

The accusations hurled at Binance, its U.S. arm, and co-founder Changpeng “CZ” Zhao, were far from trivial. These entities faced allegations of running illicit exchanges, selling unauthorized securities, flouting commodities regulations, and mishandling users’ funds.

The legal battles took a toll on the company’s operations. In a bold move on June 9, Binance.US suspended USD deposits and froze fiat withdrawal avenues for its clientele, signaling its ongoing tussle with the SEC.

But the plot thickens. For two tumultuous months, Binance.US rebranded itself as a purely crypto-based exchange. The return to USD transactions in August was only made possible by forging a strategic alliance with MoonPay.

To further illuminate the impact of these regulatory clampdowns, we need to crunch some numbers. A Reuters report, referencing data from Kaiko, painted a bleak picture for Binance.US’s market traction. A decline as dramatic as plummeting from a 22% market share in April to a meager 0.9% by June 26 underlines the scale of their setbacks.

To say Binance.US is at a crossroads would be an understatement. With an interim CEO at the wheel and a significant reduction in manpower, the crypto giant’s American arm must chart a course that satisfies regulatory demands while regaining user trust. The world of cryptocurrency, renowned for its volatility, has served Binance.US a reminder that this volatility isn’t limited to just market charts.

The coming months will be crucial in determining whether Binance.US can weather the storm and reclaim its position as a major player in the U.S. crypto space. Only time will tell, but one thing’s for certain – they’ve got a mountain to climb.