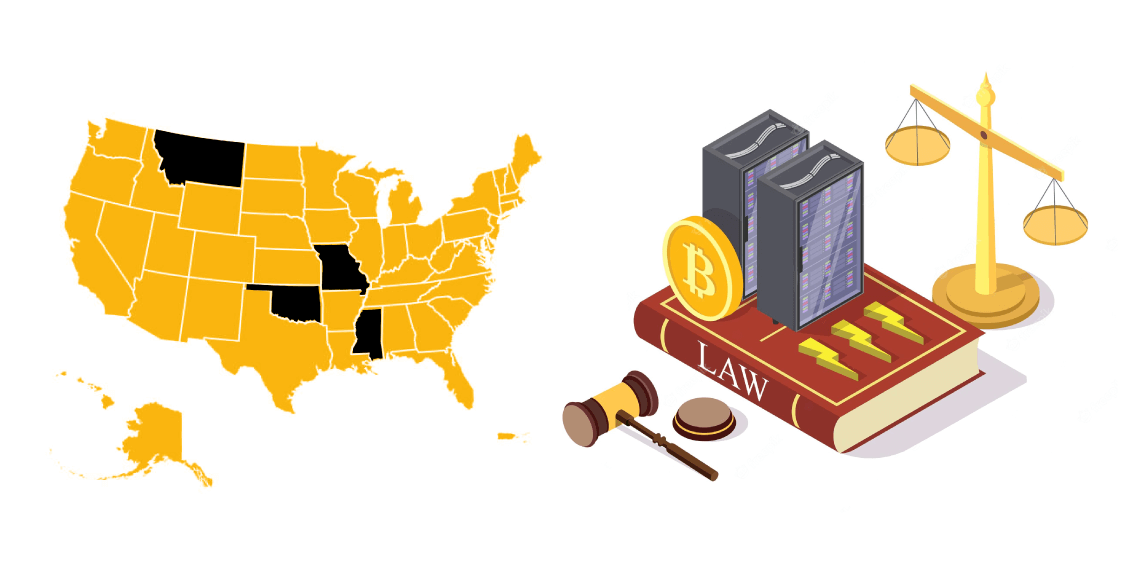

States around the United States are adopting legislation that defines, licenses, and regulates digital assets as the cryptocurrency market drama continues to develop, typified by falling asset prices and a series of scandals involving crypto banks, investment companies, and exchanges. The states are Mississippi, Missouri, Montana, and Oklahoma.

What the states’ regulations entail

The measures would make it possible to mine Bitcoin on a small scale in private dwellings and on a larger scale in places that are designated for industrial use.

In addition, the proposed rules would make it illegal for local government units to impose constraints on mining via zoning or noise regulations. They would also make it illegal for utilities to create discriminatory power prices that target mining businesses.

The measure proposed in Montana, known as SB 178, goes one step further. When digital assets are used as payment, the state and local governments would be prohibited from imposing any extra tax, withholding, assessment, or fee as a result of this legislation.

Groups who are worried about the possible loss of local authority over mining sites, which are routinely condemned for creating excessive carbon emissions and noise pollution, have voiced their opposition to the measures.

The Montana Environmental Information Center contends that the state Public Service Commission and local governments should not have their regulation authority curtailed in any way.

A few states are looking at offering tax breaks to commercial mining companies, which have proliferated rapidly throughout the United States since China’s government announced in 2021 that it would no longer allow its citizens to mine Bitcoin.

SB 1600, which would grant a significant tax credit against big capital expenditures in new mining operations, is now up for consideration in the state of Oklahoma.

Legislators will also discuss Senate Bill 443 (SB 443), which proposes instructing the state to collaborate with mining corporations in order to decommission abandoned oil and gas wells and use the resulting energy to power mining facilities.

New Jersey and New York’s regulations

New Jersey is poised to enact perhaps the most comprehensive regulatory regime in the country, with bills quickly making their way through the state Legislature.

The most prominent of these bills is the Digital Asset and Blockchain Technology Act, which creates an expansive licensing process for businesses that accept, store, trade, lend, or issue digital assets.

If enacted, the bill would also impose record-keeping and disclosure duties on brokers, exchanges, and investment firms and grant the state new enforcement authority.

The bill would shift primary authority for regulation from the Department of Banking and Insurance to the New Jersey Bureau of Securities, acknowledging the growing complexity of fitting quickly evolving cryptocurrency businesses within the outdated money transmission framework.

As for New York, lawmakers in the state could expand its already substantial BitLicense rules and the recent ban on Bitcoin mining, according to John Olsen, New York state lead for the Blockchain Association.

The 2015 BitLicense rules granted the N.Y. Department of Financial Services authority to license, regulate, and discipline cryptocurrency businesses and were a trailblazer for state crypto regulators.

The state further irritated the industry in November 2022 when Governor Kathy Hochul approved a two-year moratorium on new permits for mining operations powered by fossil fuels and proof-of-work algorithms.