TL;DR Breakdown

- Russian market runs shortage of mining equipment amid government alarm on crypto bans

- Supply fails to meet the demand for mining cryptocurrency chips

- Crypto miners forced to pay higher bills on electricity due to the shortage amid ban fears

The Russian market has run into a shortage of mining equipment to its lowest level in 14 months. This news, corroborated by a report from NSD-Info, says that orders have dropped nearly 50% over the past year. A senior analyst commented, “The demand for mining equipment in the largest country on earth is falling. The trend of declining demand has become more pronounced during the last couple of weeks.”

However, there have been claims of the crypto ban in Russia recently as reported on 21st January this year. Meanwhile, the government has set regulations instead of banning cryptocurrencies completely.

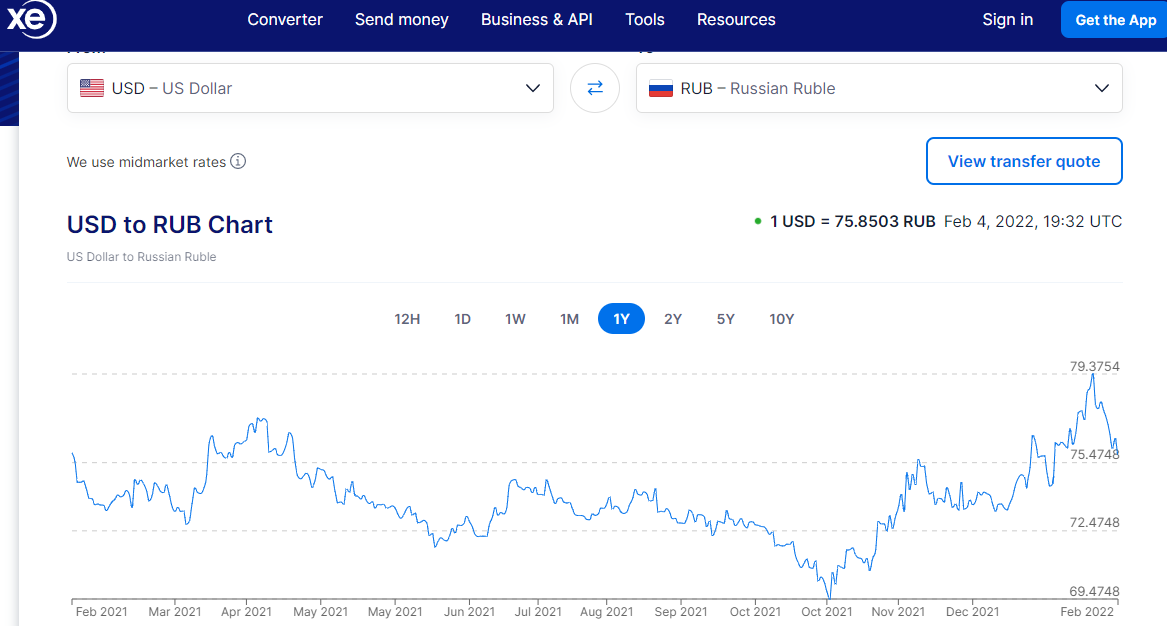

The exact cause of the shortage of mining equipment has not been confirmed, though it is assumed that the decline in the value of the Russian ruble (RUB) against the dollar (USD) and other currencies is playing a major part. A mining equipment retailer has reported a drop in sales of 50% over the past three months alone.

Russian market shortage causes high electricity bills

A senior analyst at NSD-info has said, “The situation is not catastrophic – we have still seen some demand,” said a senior analyst from NSD-Info, which monitors the downstream mining equipment market. “However, there has been a noticeable decline this year.”

As one would expect, the decline in demand for mining equipment has hit both large and small producers hard. According to RBC, “The smaller companies are suffering more because they cannot react as quickly to market changes.”

Smaller retailers are facing difficulties acquiring new shipments of ASICs, mainly due to distributors holding back shipments until the GPU demand has been met. Additionally, some major players have reportedly begun refusing to sell mining-related hardware to crypto mining clients, according to local news reports.

“There is simply not enough equipment on the market”, “We cannot offer our customers any certain prices or delivery times”, claims Dmitry Litvinenko, owner of Mining Device company. He added that some distributors are not even willing to sell him GPUs (Graphics Processing Units), which

A senior analyst commented, “The demand for mining equipment in the largest country on earth is falling. The trend of declining demand has become more pronounced during the last couple of weeks.”

Contracts with major Russian mining operations that were signed before the ruble’s decline are helping some companies stay afloat.”The projects on which we work now use finished products, and their prices are pegged to the dollar,” said Andrey Kuznetsov, director of engineering at Atommash. “We are not working with exports right now,”Olshansky stated that his company was seeing strong demand from Russian companies which were engaged in extractive activities, as well as mining exploration companies.

“The latter work even during a crisis,” Olshansky explained. “At least this area has not been hit as badly as the production of drilling equipment.

This is because many exploration companies have a mandate to engage in exploration work and can afford to fund it even when demand for revenues is low. When considering the effects of the ruble’s decline on mining equipment demand, it can be helpful to look at the prices of mining equipment in rubles.

According to xe. com-Info data, they have been largely stable during the last few years, with some fluctuations related directly to US dollar/RUB price changes.

This means that while a decline in demand is likely to put pressure on smaller companies, the larger companies are able to move into new markets, including developing countries that are more susceptible to currency fluctuations. overall, RBC reports that mining equipment producers have seen roughly a 20% drop in orders this year, with demand likely to continue falling throughout 2016.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decisions.