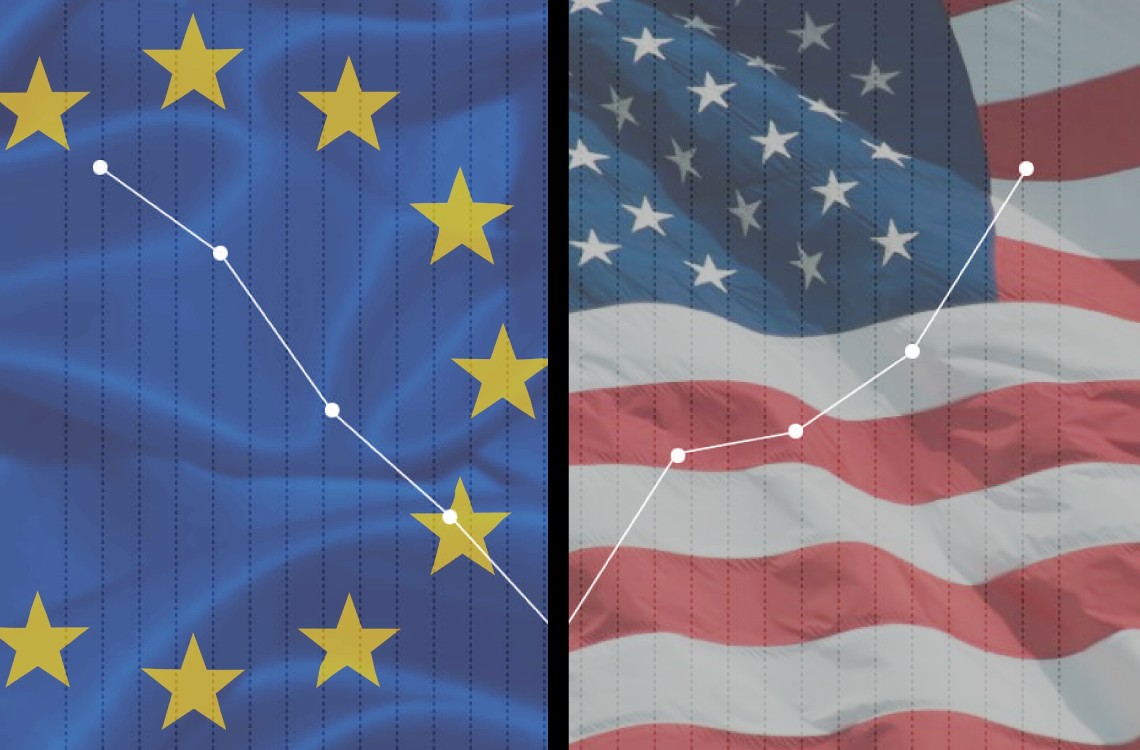

The striking disparity in economic growth between the U.S. and Europe is a spectacle worth dissecting. As the U.S. economy boasts an impressive 4.9% annual growth in the third quarter, leaving behind a trail of three consecutive quarters surpassing the 2% growth benchmark, Europe is caught in a quagmire of stagnation.

The U.S. is flourishing, evident in robust business results, while Europe remains in the shadows, creating a transatlantic economic chasm that demands attention.

Engaging in Discourse and Seeking Answers

Now, let’s not dilly-dally; Europe’s sluggishness isn’t a result of some long-term trend. Both regions, when stripped to the bare GDP per capita and adjusted for inflation, have danced the same economic tango since the dawn of the millennium.

But post-pandemic, the U.S. has left Europe in the dust, surpassing pre-pandemic peaks half a year prior to Europe and maintaining a steady growth momentum. Europe, however, has flatlined.

The U.S. is barely scratching below its 2015-19 growth trend, whereas Europe lags with a 5% shortfall. Analyzing the stark divergence, it’s clear that the U.S. is the victor in this round of economic battle.

But why? The search for answers steers us towards the households, the beating heart of the U.S. economy, fueled by robust consumption and investment.

Yet, this leaves us pondering: which policies catapulted the U.S. to these heights of economic exuberance compared to Europe?

Fiscal Policy: The Game Changer

The fiscal policies of the two regions are as different as night and day. The U.S. embraced a more substantial fiscal stimulus, allowing its deficit to balloon more than Europe’s.

This, coupled with progressive policies focusing on unemployment benefits and wage compression, resulted in a staggering accumulation of unspent money and a boost in consumer spending.

The U.S. also tackled the energy price shock with more resilience, thanks to its position as a net energy exporter, unlike Europe’s heavy reliance on imports.

While both regions have experienced similar inflationary pressures, the U.S. has managed to maintain its growth trajectory, leaving Europe grappling with its economic shortcomings.

Europe’s Road to Redemption: Learning from the U.S.

So, where does Europe go from here? It’s high time for a moment of introspection and learning from the U.S. playbook.

The American fiscal stimulus has proven its worth, upholding the economy without wreaking havoc on inflation — a stark contrast to the stringent European budgets. Is Europe’s sluggish growth a result of delayed effects or policy missteps? Only time will tell.

But one thing is for certain: the U.S.’s willingness to embrace bold fiscal moves and progressive policies has set it on a path of economic resilience, leaving Europe in dire need of a strategy overhaul.

Europe’s stagnation is not a badge of honor. It’s a wakeup call. The U.S. has demonstrated that strategic fiscal policies, coupled with a focus on domestic demand, can propel an economy to new heights.

Europe, it’s time to take notes and rethink your economic playbook. The world is watching, and the clock is ticking.