TL;DR Breakdown:

- The Indian government will introduce a new crypto regulation bill in the upcoming parliament session.

- The bill aims to ban all private cryptocurrencies in the country.

- The Reserve Bank of India will develop its own digital currency according to the bill.

- There might be major crypto sell-offs in the region if the bill is passed.

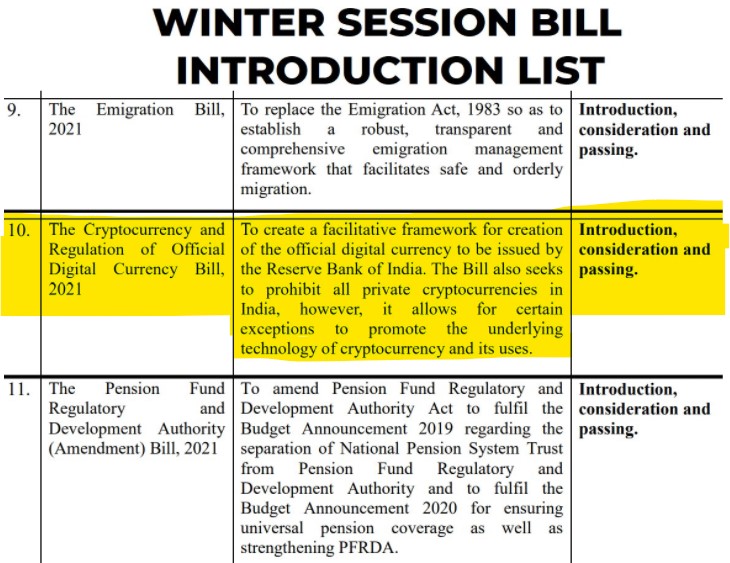

The Indian government is set to introduce a cryptocurrency regulation bill in the winter session of the parliament, which will start on 29th November. According to the official government document, the bill will seek to ban the usage and investment of all private cryptocurrencies, excluding ‘a few exceptions’.

According to the agenda of the bill, the government will seek to only promote the official digital currency to be issued by the Reserve Bank of India. The document doesn’t provide any further clarity to the bill.

However, it’s clear that if this bill is passed, all private cryptocurrencies such as Bitcoin, Ethereum, Cardano, and others will be banned in the country. The government will look to develop and promote its own cryptocurrency through the Reserve Bank of India.

In terms of the ‘few exceptions’, the agenda states that the bill will allow the promotion of certain cryptocurrency technologies. Although no further clarification is given, this could be indicating the usage of major blockchain technologies and features such as smart contracts.

How will the new bill impact the crypto market?

If the new bill is passed in the upcoming parliament session, it will discourage the usage and marketing of cryptocurrencies in the country. It will also mean that local and international retailers in the country won’t be able to use or invest in any crypto assets.

India is the largest economic power in South Asia. Its strong regulatory stance against crypto can lead other countries in the region to follow the same path. Earlier this month, we saw that President Biden’s new crypto regulations in the US caused a significant downturn in the market. As the market is starting to climb up again, Indian’s potential crypto ban can trigger massive sell-offs in the market, causing major crypto prices to go down significantly.

The global crypto market faces a tense end of the year, as regulatory decisions around the world can decide the direction of major coins heading into 2022.

India continues to resist crypto adoption

The Indian Prime Minister Narendra Modi has been a constant sceptical of cryptocurrency. Earlier this month, the PM called upon other nations to introduce crypto regulations. PM Modi also shared concerns that the increased adoption of crypto might allow the digital currencies to end up in the wrong hands and spoil the youth.

Earlier this year, the Indian government also attempted to criminalise any form of crypto possessions, trading, or mining. However, the plan didn’t end up in the parliament for a hearing. Reports suggest that PM Modi chaired a cabinet meeting recently to share concerns about the unregulated crypto markets. His government believes that the widespread usage of crypto in India can lead to increased money laundering and terror funding.