The primary purpose of Crypto.com is to drive and accelerate the mass adoption of cryptocurrencies by providing a smooth cryptocurrency experience. With the establishment of CRO token on the Crypto.com platform, CRO became more accessible to the general population. CRO holders can suddenly stake CRO at a 20% APY on the Exchange.

Crypto.com has layered various advantages for purchasing, staking, and spending CRO since the Exchange’s start in 2020. Their comprehensive offering is composed of buying and selling with government money, trading, a VISA debit card, lending and borrowing, automated trading, and a non-custodial wallet.

Let’s focus on CRO and its potential as a cryptocurrency, but most importantly, how to stake it.

Also Read:

• CRO Price Prediction: Is CRO A Good Investment?

What is CRO?

Crypto.com was established in 2016 and held a successful initial coin offering (ICO) in 2017 to debut its now-defunct MCO currency. Crypto.com now looks to have a larger purpose of boosting cryptocurrency acceptance.

They’re concentrating on making bitcoin transactions possible all around the globe. The benefits vary from access to their syndicate events to exchange savings through CRO staking and earning staking rewards.

What is Cronos?

Cronos is an EVM-compliant sidechain that runs alongside the Crypto.com Chain. The Crypto.com network includes the Crypto.com chain and the Crypto.com centralized platform before the debut of Cronos.

Cronos is powered by Ethermint, a Proof of Stake (PoS) chain compatible with Ethereum and runs on a Proof of Authority (PoA) consensus method. It seeks to dramatically grow the Chain DeFi infrastructure by letting developers quickly move apps and smart contracts from Ethereum and other EVM-compatible chains to the Chain DeFi environment.

Cronos replaces MCO

Crypto.com phased out the MCO token on August 2nd, 2020, in favor of the CRO token. MCO token holders were eligible to exchange their MCO assets for CRO assets at a 1:33 ratio.

Although the change sparked some resentment among Crypto.com members, many think it was the best business option.

Any capability that used to be associated with the MCO currency has now been transferred to the CRO unit.

The Crypto.com platform has been considerably improved, and all services and advantages may now be obtained by just holding the Crypto.com token: CRO.

The CRO symbol kept the same; Crypto.org decided to rename the currency “Cronos” in 2022.

Staking CRO

Clients may rely on a reliable Validator with their local CRO tokens.

Validators operate nodes on the Crypto.org Chain network to verify transactions and generate CRO, which is then delivered to Delegators after a Validator charge is subtracted.

Stake CRO on the Crypto.org Chain Mainnet, like ERC20 on the Ethereum network, CRO is necessary for Crypto.org Chain Staking.

Although you may stake your CRO through the Crypto.com DeFi wallet app and Exchange, you should be aware that this is a centralized option.

Taking a decentralized approach is suggested so that you can stake with a decentralized wallet like Crypto.com’s DeFi Wallet.

Staking from Crypto.com DeFi Wallet App

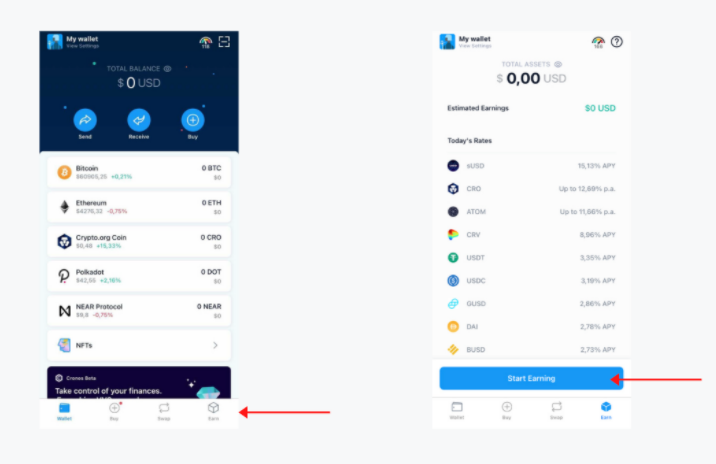

- To begin staking your CRO, go to the DeFi Wallet app dashboard’s bottom right menu and click “Earn.”

- The number of resources on the earn menu should be zero dollars if you’ve never employed this option.

- To begin, click “Start Earning.”

- Select CRO by pressing the little arrow on the asset’s right side of the exchange wallet app interface.

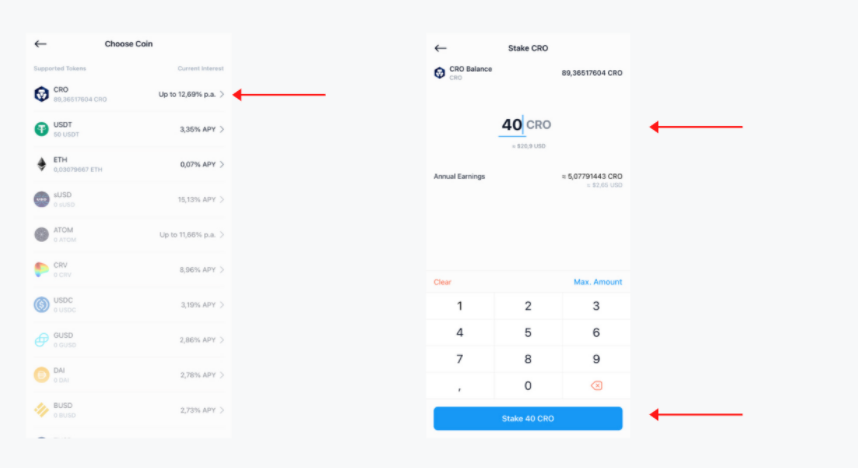

- Then, choose the “Stake CRO” button at the bottom of your screen and specify the number of resources you want to stake.

- A minimum stake of 5,000 CRO is needed while conducting payments of trading fees in CRO.

- The validator list will emerge after that.

- Scroll down to locate the validator you desire, or use the search box above to search the description of your validator on the crypto wallet.

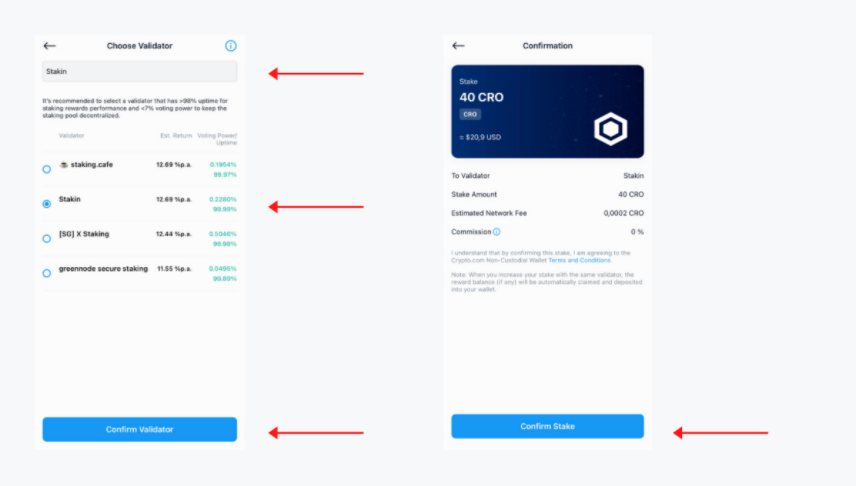

- Then, right-click on the validator’s name and choose “Confirm Validator.”

- Once you’ve done this, confirm stake and ‘view details.

- You’ll now see a summary of all the information. Look over the details and choose “confirm stake” to double-check your selection on the crypto.com app.

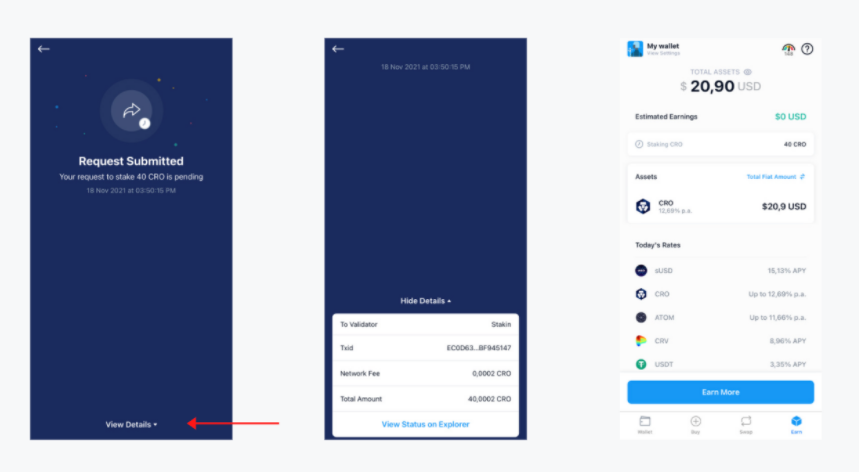

- After you’ve published your request, you should see the details if you select “View Details” to see additional information about your transaction, such as the amount of CRO-staked currency CRO balance in your exchange account.

Your CRO assets have now been staked. If your assets are not staked, please close the program and reopen it. It may take a few moments to reflect any changes in the app.

Advantages of Staking

- The first benefit is the 10-14 percent annual percentage yield (APY) that consumers may earn by staking the CRO cryptocurrency on the Crypto.com Exchange.

- The second benefit is obtaining access to the Crypto.com syndicate activities by staking your CRO (and generating 10-14 percent APY).

- The third benefit is the Exchange’s graded reductions in transaction costs. You save money by staking more CRO.

What is Syndication?

The Syndicate is a platform that allows the most promising crypto projects to raise funds by launching their coins or currencies on the Crypto.com Exchange. CRO holders, or those who have staked CRO on the Exchange, will receive preferential token allocation at a discount for specific events.

A syndicate is a weekly event during which Crypto.com enables consumers to shop cryptocurrencies at a lower price, generally 50% off.

Pros and Cons of Staking CRO

Pros

There are many advantages of CRO, many of which include:

- While staking on the Exchange, there is a high APY rate of interest.

- Exchange fee reductions.

- Sign up for a syndicate event where you may get a 50% discount on various coins.

- Staking a particular number of CROs earns you benefits like better interest rates.

Cons

The drawbacks of CRO stem entirely from the project’s immaturity.

- New ventures are characterized by a lack of liquidity, a restricted use case, and insufficient technology.

- CRO is a company that falls within these categories. It’s too early to say if CRO will carve out a niche in the cryptocurrency industry.

- The most significant drawback of CRO is that just a fifth of the total supply is now in use. This causes a lot of ambiguity about the entire project’s direction and CRO cost.

- People are criticizing the business concept because of the high APY for staking. Outside of the Crypto.com environment, Coin has limited utility.

FAQs about CRO staking

How much CRO do you need to stake?

To obtain a CRO refund on trading costs, you must stake at least 5,000 CRO while paying CRO expenses.

When can I withdraw my staked CRO?

If you have staked CRO, you may only withdraw the entire amount after 180 days. The precise day and time will be revealed while checking the staking specifics.

The number of days left in the staked period will also be displayed on the Stake & Earn main page.

Can I increase my staked CRO amount on the Exchange?

Yes, you may increase your staked CRO amount to earn more interest at any stage.

Once a fresh amount of CRO is contributed, each top-up will reset the staking term to 180 days.

[the_ad_placement id=”writers”]