- Bitcoin’s realized cap increased by over $43 million

- Ethereum had a new realized cap low of $22.4 billion in April 2020

- This data is more accurate for the long-term investors

Data from Glassnode shows Bitcoin’s realized cap is $43 million over its highs in 2017 when traded at $20.000.

Bitcoin’s current market capitalization is $190 billion. This new high implies that the BTC holders are profiting 65 percent.

Bitcoin’s realized cap shows the last price traded and multiplied by the total supply. For example, if the trader has BTC 100 coins and sells just one for $2, the market cap, in this case, is $200.

The realized cap is measured by taking all coins at the price they last transacted on-chain. In essence, that’s the price the traders paid for Bitcoin.

That allows analysts to determine the amount of an asset’s original price for market partakers’ tax purposes. The exchanges where all orders, no matter if they are “buy” or “sell” orders, are directed through a central exchange. In other words, centralized exchanges are out of this estimation. So this data is more accurate when we speak about with a longer horizon.

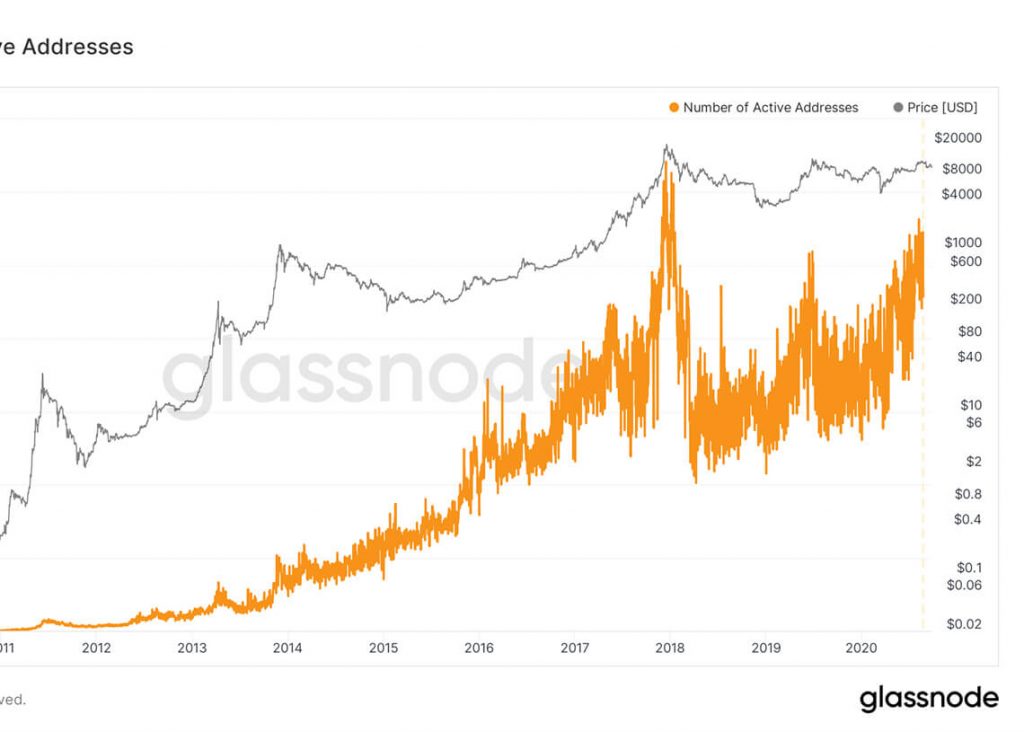

What do the metrics chart show?

It’s easy to see that the realized cap remained to increased higher in the first quarter of 2018. Also, it is clearly shown the testing $90 billion in the period from January to May. It happened three times, notwithstanding prices having dropped back level lower than $10,000.

Also, the chart shows the Bitcoin’s realized cap was in a steady trend of growth.

How many crypto-addresses are successful?

Another research shows that over 72 percent of them are in profit at this moment. Most investments were made in the price scale from $1,040 to $5,285, and from $8,450 to $9,560.Ethereum tried to recover its previous.s highs.

It was a real struggle. ETH’s realized cap revealed the longer downtrends. In April 2020, it had a new low of $22.4 billion. Also, a smaller number of ETH addresses are profitable, according to available data, it is 62 percent. The most significant number of ETH was sold at $160.