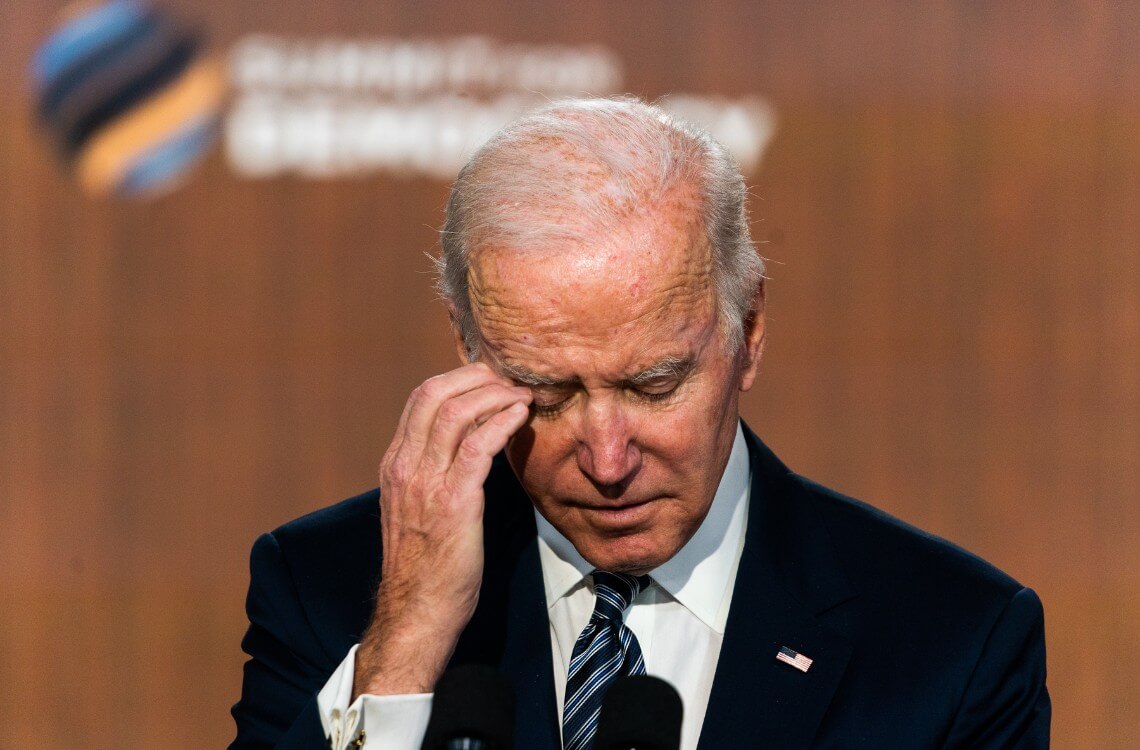

As President Joe Biden aims his attention on bolstering the U.S. economy and battling inflation in his pursuit of re-election, he finds himself facing an emerging, problematic situation: a Saudi-imposed oil price surge. With Saudi Arabia and Russia joining forces to push oil prices closer to the alarming $100 mark, Biden’s economic strategies are in jeopardy.

Navigating Troubling Oil Waters

This recent development sees Brent crude, an oil benchmark, surpassing the $90 a barrel mark for the first time in 2023. This surge is mainly attributed to Riyadh and Moscow’s strategic choice to maintain their supply cuts until the end of the year. It’s an audacious move, especially considering the 25% rise in oil prices since June, driven by unparalleled global demand. But what’s even more concerning for Biden is the timing.

The efforts by Saudi Arabia to inflate oil prices come at a crucial moment. The U.S., on one hand, is working to solidify an historic agreement to bridge relations between Israel and the kingdom. On the other, it’s seeking to fortify an alliance against Russia at the imminent G20 meeting in India. As a result, tensions between Washington and Saudi Arabia are threatening to boil over, especially if the U.S. decides to point fingers for the escalating pump prices and potential economic downturn.

Despite the gravity of this situation, Biden’s touted “Bidenomics” is being tested. Pump prices have historically held considerable sway over voter sentiments regarding the economy. With oil market experts predicting crude prices to touch the $100 a barrel milestone before year-end, fuel costs are set to skyrocket. This rise could very well undo all the optimism surrounding the receding inflation in western nations.

A Political Conundrum Amid Rising Prices

While the U.S. Federal Reserve grapples with the potential need to increase already sky-high interest rates to stabilize the economy, Biden’s strategies are under a microscope. A continuous rise in fuel prices not only threatens to counteract the positive public sentiment about the economic situation but also the credibility of Biden’s administration in its ability to control inflation.

Fuel price inflation is glaringly evident. U.S. gas stations have reported a price hike of nearly a quarter this year, with the cost per gallon now at $3.80. Although this hasn’t yet reached the record peak of over $5 last summer, it’s a staggering 60% hike from the prices when Biden assumed office. Such statistics are golden opportunities for Republican critiques. They’re vocally attributing the escalating prices to the White House’s more environmentally-focused stance at the expense of domestic oil production.

The White House’s previous strategies, like urging shale drillers to increase oil production and releasing crude from federal reserves, seem to be losing their efficacy. With the Strategic Petroleum Reserve dwindling to its lowest since 1983 and the slow growth in the shale sector, Saudi Arabia now wields even more influence over global oil prices.

The evolving relationship between Biden and Riyadh is becoming a focal point for critics. Some argue that the strained rapport has paved the way for Saudi Arabia to tighten ties with Russia and manipulate the oil market. Meanwhile, speculations are rife about Saudi Arabia’s objectives, particularly with the kingdom’s ambitious Vision 2030 reform project requiring stable and high oil prices.

As the White House strives to mend its relationship with Riyadh, it’s clear that Biden’s administration is viewing the U.S.-Saudi association beyond just the oil dynamics. However, with the possibility of oil prices hitting $120 a barrel, priorities could swiftly change. Saudi Arabia, knowing its leverage over oil prices and the pending U.S. elections, might just hold the ace in this high-stakes geopolitical poker game.