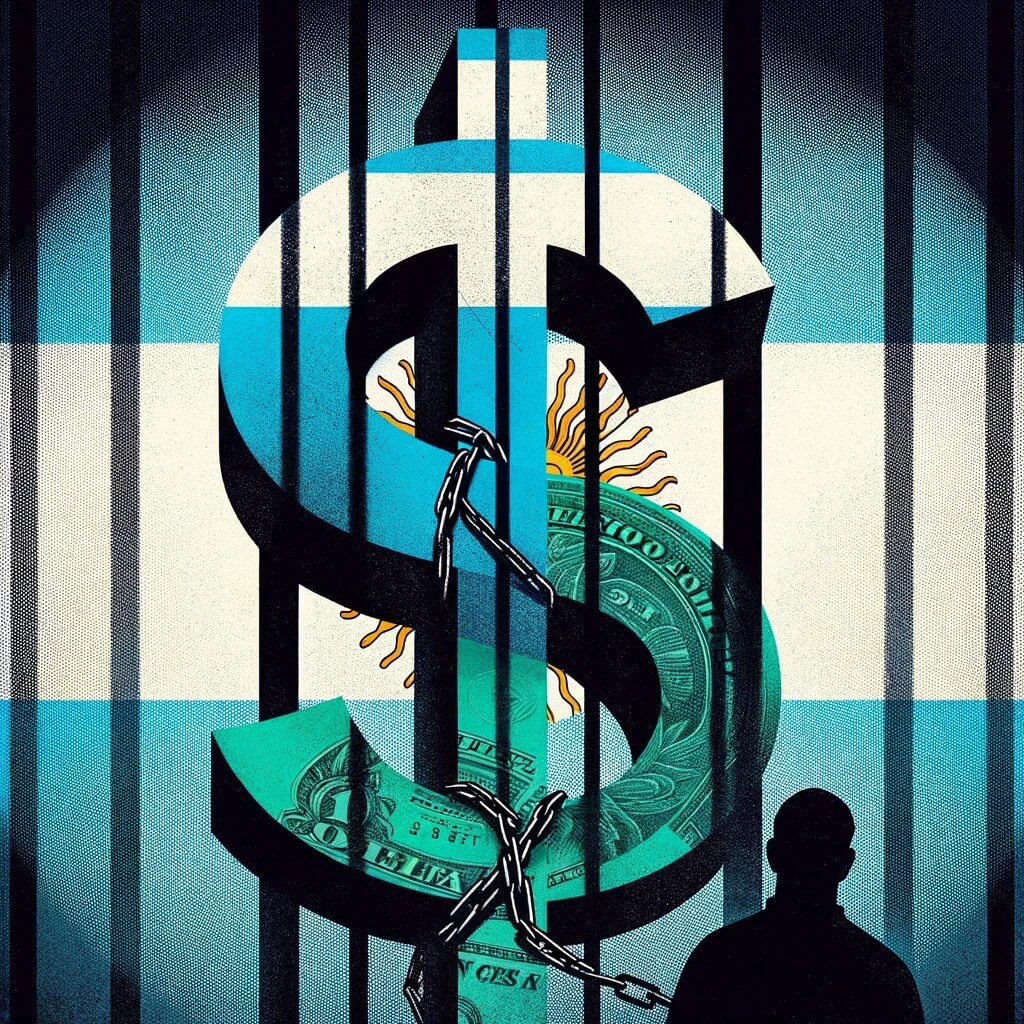

Argentina, in a bold move under the new government of President Javier Milei, is gearing up for a major economic overhaul. Economy Minister Luis Caputo is set to announce the first in a series of measures aimed at tackling the country’s soaring inflation, which has eclipsed 140% annually.

These decisive actions are part of Milei’s shock-therapy approach to economic policy, signaling a departure from traditional practices and a pivot away from reliance on the US dollar.

Argentina Embarks on a Challenging Economic Path

Milei’s administration, poised for transformative changes, acknowledges the tough road ahead. The President, in his inaugural speech, did not mince words about the gravity of Argentina’s economic situation.

He emphasized the necessity of stringent fiscal adjustments, highlighting the dire need to curb public spending and address the large fiscal deficit. This deficit, previously financed by the central bank’s money printing, has been a significant contributor to the rampant inflation plaguing the country.

Argentina’s move to reevaluate its reliance on the US dollar comes against the backdrop of these economic challenges. With banks set to open amid speculations of devaluing the peso’s official exchange rate, the country braces for a period of economic recalibration.

The government’s decision to reduce dependence on the US dollar is not just a financial maneuver but a strategic step towards self-reliance and economic stability.

A Shift in Economic Policy

The forthcoming policies from Caputo, scheduled for announcement, are expected to mark a pivotal shift in Argentina’s economic trajectory. These measures, while unspecified, are anticipated to address the core issues of inflation and fiscal imbalance.

Manuel Adorni, Milei’s chief spokesman, indicated that these announcements would be part of a regular series of press briefings, reflecting the government’s commitment to transparency and proactive communication during this period of economic transition.

This shift in policy signifies Argentina’s endeavor to navigate its economic challenges independently, moving away from traditional reliance on external monetary systems like the US dollar.

The emphasis on fiscal responsibility, curtailing public spending, and addressing the fiscal deficit underlines the Milei administration’s resolve to steer Argentina towards a more sustainable and self-sufficient economic future.

In essence, Argentina’s move to distance itself from the US dollar is a strategic decision in the face of overwhelming economic challenges. Under President Milei’s leadership, the country is embarking on a path of rigorous fiscal adjustments and economic reforms.

These changes, while challenging, are crucial for Argentina to regain financial stability and chart a course towards long-term economic resilience. As the world watches, Argentina stands at the crossroads of a significant economic transformation, one that could redefine its position in the global financial landscape.