Inflation is gradually kicking in around the world, and some people believe it’s the outcome of the lax monetary policy of Federal Reserves and the significant increase in money supply during the outbreak of the coronavirus pandemic. To beat inflation, many experts and investors have advised investing in real assets such as precious metals (e.g., gold, silver, etc.), including digital assets like Bitcoin, which is considered a better inflation hedging asset.

Inflation is ticking

In January 2021, the United States inflation rate was around 1.4%, but currently staggering around 5.4%. As of October 21, the Inflation Expectations in the country were also seen at the highest levels since 2006, according to the founder of Compound Capital Advisors, Charlie Bilello.

Inflation Expectations in the US rise to their highest levels since 2006: 2.77% (5-year breakeven).

— Charlie Bilello (@charliebilello) October 21, 2021

The Fed Funds rate back in 2006 was over 5%. Today it's at 0%.https://t.co/m3dfKMl1zV pic.twitter.com/aXooypBWHr

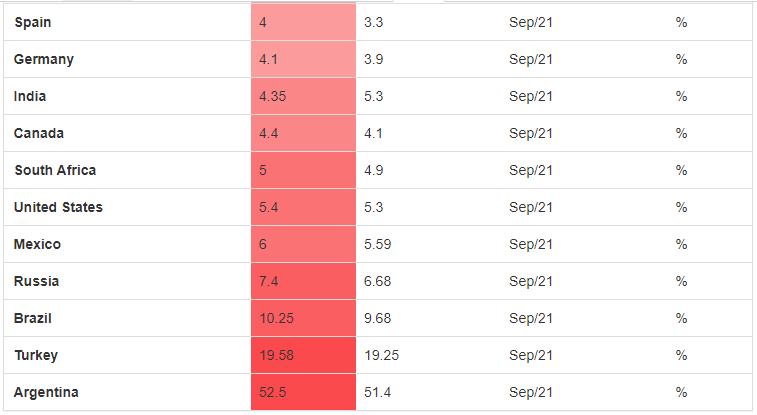

Not just the United States. Data from Trading Economics reveals that other G20 countries are also seeing a spike in inflation points, including Argentina, Canada, Germany, Spain, and many others. This will be a frightening development if the trend goes on for long.

It may be too early to predict hyperinflation, but many people are seemingly not going to take chances. Jack Dorsey, the CEO of Twitter, believes hyperinflation is going to change a lot of things. It’s unclear how severe this can affect the livelihood of people, but it’s speculated that real assets holders are going to benefit in such a situation, or at least preserve their money from devaluation.

Hyperinflation is going to change everything. It’s happening.

— jack (@jack) October 23, 2021

Bitcoin is hope

Amidst the uncertainty, many people are betting on the leading cryptocurrency asset to hedge against inflation. Peter Thiel, the founder of Paypal, is one of the people who are hopeful on Bitcoin, to the extent he wished to have purchased more BTC. “I feel like I’ve been underinvested in it,” Thiel said during an event hosted by non-profit Lincoln Network.

[Bitcoin is] the canary in the coal mine. It’s the most honest market we have in the country, and it’s telling us that this decrepit … regime is just about to blow up.

Peter Thiel

The fear of dollar devaluation via inflation has gotten more investors and institutions into Bitcoin. For instance, the largest Bitcoin corporate investor MicroStrategy began investing in the cryptocurrency to hedge inflation, amongst other reasons. Since its first purchase in August last year, the company hasn’t stopped buying Bitcoin. At the moment, it reportedly holds 114,042 BTC, which is worth nearly $7 billion, per Coingecko.

There may be more inflows in Bitcoin and the cryptocurrency market in the future as people continue to seek inflation-hedging assets. Recently, JPMorgan strategists said they are more convinced that the recent rally in Bitcoin to a new all-time high of $67,000 was driven by the fear of inflation than the optimism around Bitcoin ETFs.

We believe the perception of bitcoin as a better inflation hedge than gold is the main reason for the current upswing, triggering a shift away from gold ETFs into bitcoin funds since September.

JPMorgan strategists