TL;DR Breakdown:

- Trading volume for Russian Ruble and Bitcoin spiked to a nine-month high

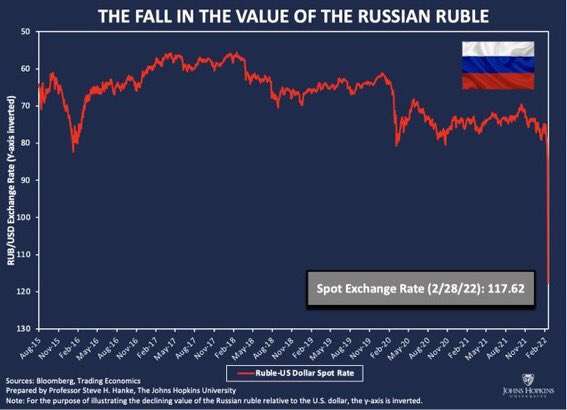

- The value of the Ruble recently hit an all-time low.

Russians are increasingly converting their Ruble (the nation’s currency) holdings to Bitcoin (BTC) following the ongoing crisis with Ukraine, a Paris-based cryptocurrency research platform, Kaiko, confirms.

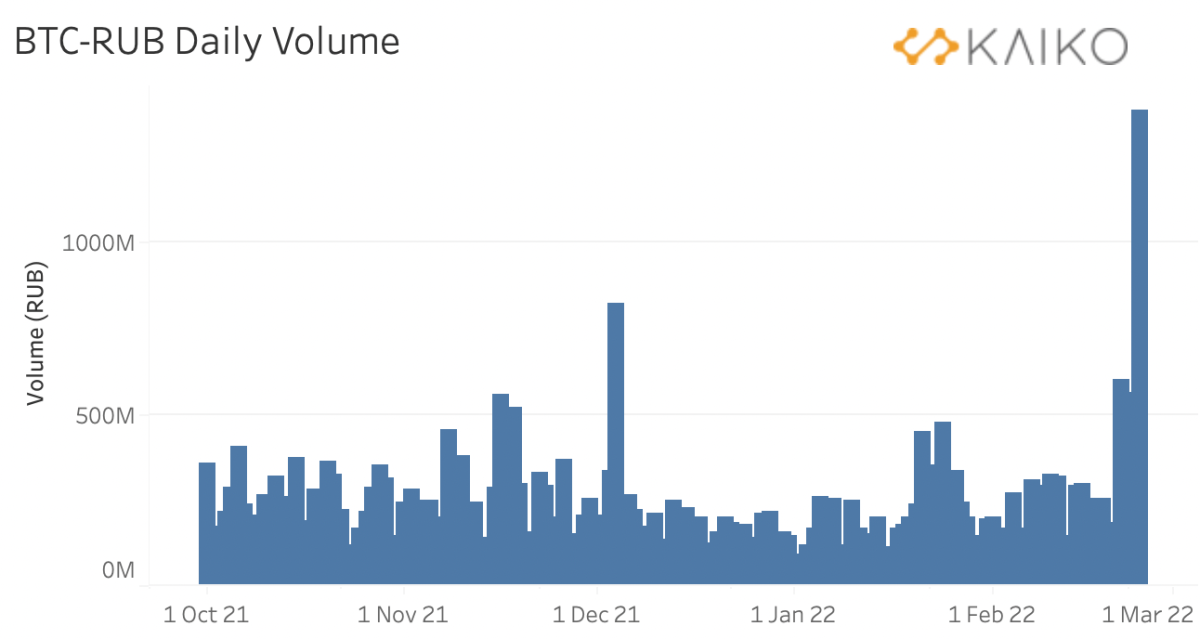

BTC/RUB trading volume spikes

Since Thursday, the Russian Ruble and Bitcoin trading volume has been on the increase as the Russian military pressed further into Ukraine. According to Kaiko, the BTCRUB trading volume spiked to a nine-month high, reaching nearly 1.5 billion RUB (or $13,157,894) at the time. Most of the trades were conducted on Binance, says Kaiko’s research analyst Clara Medalie.

Kaiko also reported that the trading volume for Tether and the Russian Ruble (USDT/RUB) increased an eight-month high of 1.3 billion RUB (or $11,764,705) when Russia attacked Ukraine. Meanwhile, the trading volume for Bitcoin and Ukrainian Hryvnia (UAH), including USDT/UAH, also spiked but not “but not as high as October levels,” Medalie added.

On 25th February, Ukrainian crypto exchanges reported over 200% increase in trading volume as users scrambled to convert to crypto, Cryptopolitan reported.

Why is Russia’s crypto volume increasing?

Investors in Russia are increasingly switching to Bitcoin and US dollar stablecoins to preserve their money from the Ruble collapse. The Russian economy has been severely hit following the tougher sanctions imposed on the country by the United States and other major nations of the world. The sanctions have placed a huge stress on Ruble, which led to a massive drop in Ruble value.

Ruble tanked to a new all-time high, particularly dropping by over 40% after the SWIFT sanctions were announced. The RUB/USD pair was trading at 117.62 some hours ago.

Thus, the locals are converting their RUB holding to Bitcoin and other cryptocurrencies in a bid to preserve their money. In the wake of the crisis, the crypto and traditional markets were affected. However, Bitcoin and Gold began later recorded a short-lived increase, indicating their dominance as hedge assets.