In the fast-paced, high-stakes world of cryptocurrencies, every advantage can make a significant difference. Understanding and implementing the principles of the Modern Portfolio Theory (MPT) can offer that edge. It offers a methodology for maximizing returns for a given level of risk, or alternatively, minimizing risk for a given level of expected return.

While MPT was not originally designed for cryptocurrencies, its core principles remain relevant and powerful tools for crypto investors. This Cryptopolitan guide aims to explore the application of Modern Portfolio Theory in cryptocurrencies, helping you to navigate through inherent risks and optimize your portfolio for maximum gains.

What Is the Modern Portfolio Theory?

The theory of finance and investment called Modern Portfolio Theory (MPT) is a significant and influential theory. It was created by Harry Markowitz and first appeared in the Journal of Finance in 1952 under the title “Portfolio Selection.”

Markowitz’s hypothesis suggests that investors can create an optimal portfolio by balancing the amount of risk taken with potential returns. This can be achieved through diversification using a quantitative approach. Basically, investors can minimize their risk while still maximizing their returns.

According to modern portfolio theory, it is insufficient to only consider the potential risk and return of an individual stock. Investing in multiple stocks allows for diversification, which results in lowered portfolio risk. It measures the advantages of diversification, emphasizing the importance of not investing all assets in one place.

When buying stocks, investors face the risk of receiving lower returns than they anticipated. This risk is referred to as the deviation from the average return and is unique for every stock, known as its standard deviation from the mean. Modern portfolio theory refers to this deviation as “risk.”

Investing in a variety of individual stocks can lower risk compared to investing in just one type of stock, as long as the stocks have different risk factors. For example, a portfolio that includes one stock that does well when the weather is sunny and another stock that does well when the sky is cloudy will be less risky than investing in one of the two stocks. This is because the portfolio will still make gains regardless of whether the sky is sunny or cloudy. Hence, adding diverse stocks to a portfolio can decrease its overall risk.

To clarify, Markowitz demonstrated that successful investing involves selecting the optimal assortment of stocks to allocate one’s savings, rather than solely choosing individual stocks.

Types of risks according to the modern portfolio theory

MPT was designed to reduce idiosyncratic risk, which is the risk associated with a specific investment’s unique characteristics. This theory suggests that individual stock returns have two risk components.

- Systematic Risk: Systematic risks are market risks that cannot be eliminated through diversification. Examples of such risks include interest rates, recessions, and wars.

- Unsystematic Risk: The risk that is particular to individual stocks, such as a change in management or a decline in operations, is called specific risk or unsystematic risk. To decrease this kind of risk, you can have a more extensive range of stocks in your portfolio, which is known as diversification. Specific risk is the part of a stock’s return that is not related to general market movements.

Using the Modern Portfolio Theory to Maximize Your Crypto Gains

Diversification With Proper Risk Management

Diversifying your portfolio is important because the risk of each individual stock doesn’t have a significant impact on the overall risk of the portfolio. What matters more is the differences between the levels of risk of each stock and how they interact with each other, also known as covariance.

For example, imagine investing all your funds in one oil and gas company. Such an investment can lead to various risks including:

- Competitiveness: How tough is the competition? Is the possibility of other companies surpassing ours a concern?

- Company Mismanagement: If the company is not managed efficiently and is unable to make a profit, it may result in bankruptcy.

- Political Risk: The supply and prices of oil are affected by global political issues such as the conflicts in the Middle East and the ongoing conflict between Russia and Ukraine.

- Technological Risk: As search for better energy sources and make progress in wind, solar, and nuclear energy, there is a possibility that oil might be substituted by these more effective alternatives and new technology.

- Social Risk: As more individuals become invested in ESG mandates and worry about carbon emissions, there is a growing trend of reducing reliance on oil and gas usage in our society. Many are also calling for government action on this issue.

- Environmental Risk: Changes in the environment can affect the demand for oil. Investors may face various problems, such as restricted supply, adverse weather conditions impacting oil extraction, and oil spills.

The pandemic provided a clear example of unsystematic/diversifiable risk. Specifically, airline stocks suffered greatly during this time period. Investors who diversified their holdings beyond just travel industry stocks were better equipped to mitigate idiosyncratic risk.

While some investors may believe that investing in various assets within a single asset class offers sufficient diversification, it’s not exactly true. For instance, investing in numerous meme coins or solely in cryptocurrencies may not reduce your risk.

Let’s consider the example of Ethereum, which can have one of two outcomes in the future: Ethereum may maintain its position as the leading smart contract platform, and other protocols such as Cardano, Avalanche, Solana, NEAR, or VeChain may gain a near-to-equal market dominance. Having diverse investments may yield greater returns in this case while reducing your risks.

At the same time, there is also a small chance that widespread adoption never happens and the crypto industry slowly bleeds to its demise. In that case, diversifying your investment in crypto alone will yield nothing but losses because technically, you still had your eggs in a single basket.

To understand the impact of investing in various asset classes, let’s consider the example of an investor who diversifies their portfolio by investing in multiple industries like cryptocurrency, oil, solar energy, nuclear energy, and property.

- Mismanagement risks are reduced: Even if the oil company fails, the nuclear energy and solar company could still succeed, and the property investment and cryptocurrency would be unlikely to be significantly impacted.

- Environmental risks are reduced: If environmental factors affect oil production, it may only impact certain companies and investors may start investing in alternative energy companies. Real estate and cryptocurrency prices are not likely to be affected by these environmental risks.

- Political risks are reduced: The political risk varies by industry. Although the ongoing conflicts in the middle east and Ukraine may harm investments in the oil industry, the solar and nuclear sectors may experience growth due to these events. And at the same time, Bitcoin and other cryptocurrencies remain relatively neutral.

Using Correlations to Properly Diversify Your Assets

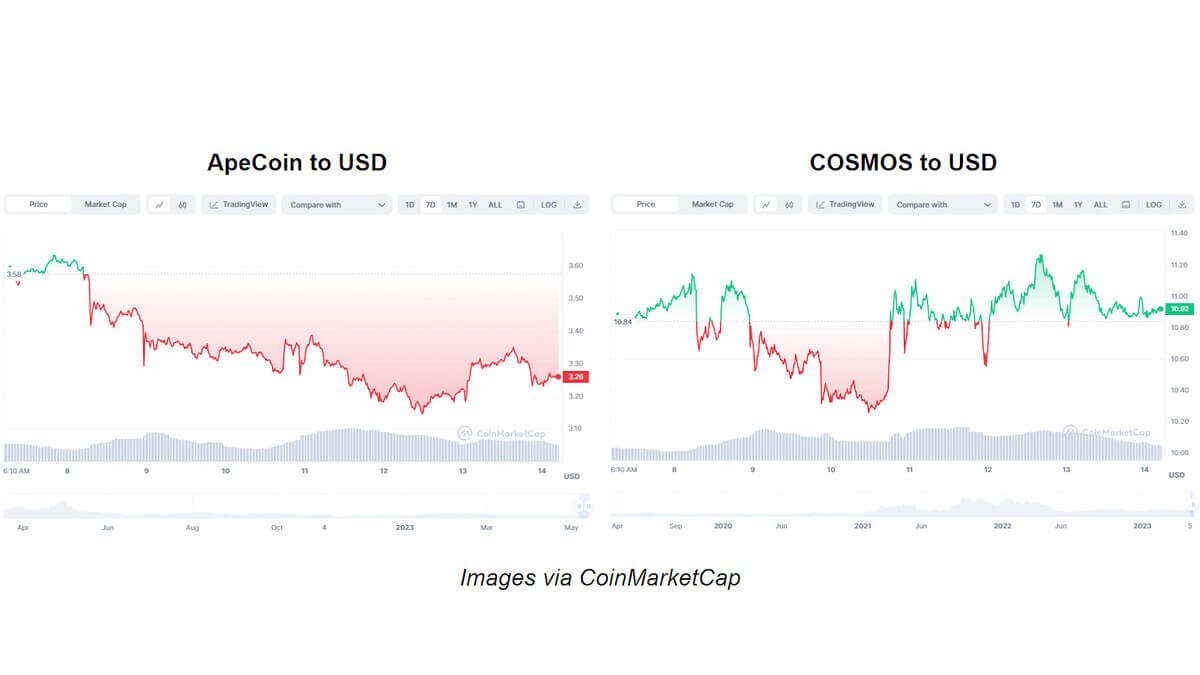

Let’s break this concept down in a way that you can understand it. Imagine you have invested in two coins that are performing in a different manner over a specific time frame, just like the ones shown below:

Our goal with MPT is to analyze the relationship between assets during the same timeframe. In this example, COSMOS has been performing relatively well on the 7-day time frame, but on the other hand, ApeCoin has a mostly negative price action in this period. It is obvious that both these coins have been quite uncorrelated based on their performance relative to one another. In this case, we say that the correlation between these two assets is negative.

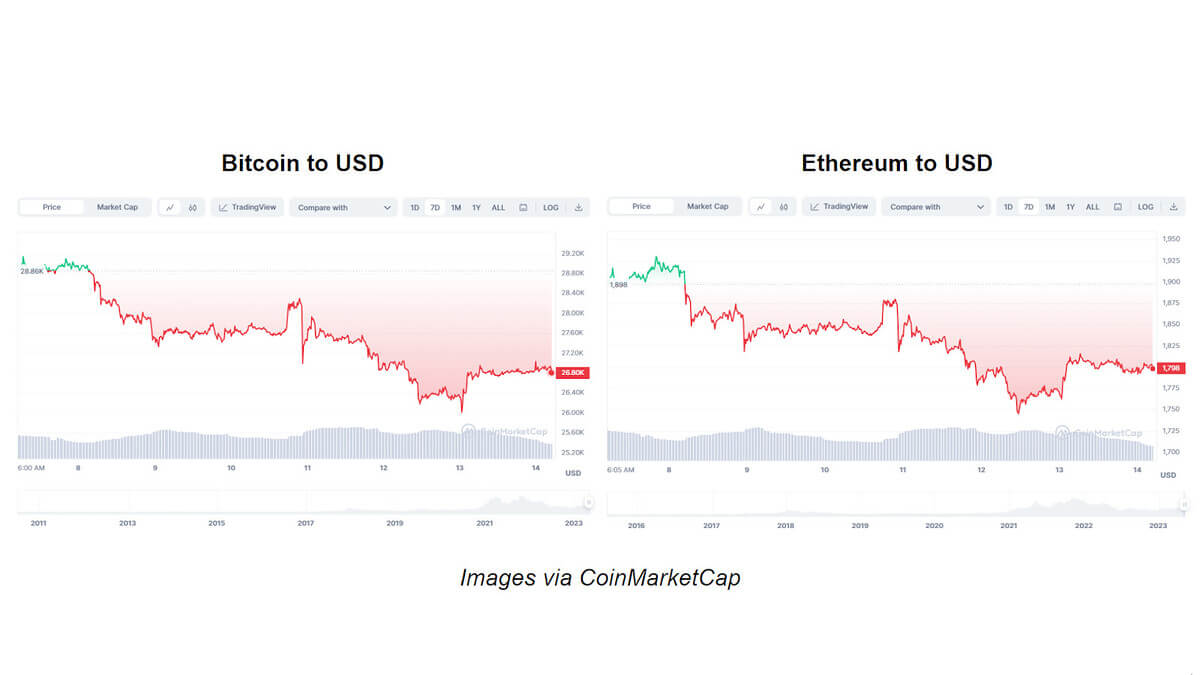

Now let us take a look at Bitcoin and Ethereum, two examples that are highly correlated.

We don’t complex formulas to look at the two charts above and realize that the level of correlation between them is higher. But of course, if you have a technical background in mathematics and finance, you can always look at Portfolio Selection by Harry Makowitz and read the paper.

To better understand correlation, it’s useful to explore assets beyond the realm of cryptocurrency. Finding uncorrelated projects, companies, commodities or assets within a single asset class is a challenge, and even when non-correlation is present, it is usually only temporary.

But exceptions do exist. Although the overall cryptocurrency market experienced a decline, NFT, Metaverse, and GameFi projects showed a high degree of independence from the rest of the market.

While pure cryptocurrency projects were declining, these sectors were performing well for a brief period before eventually following the general trend and collapsing alongside the rest of the market. That is because people still want to play games, regardless of the price fluctuations and macroeconomic conditions.

So to put the Modern Portfolio Theory into effect, you need to diversify in assets that are less correlated with each other. Does that mean you need to select both winning and losing crypto assets in order to achieve diversification and find assets that are not correlated?

Investors don’t aim to choose a losing asset intentionally. The decision is based on optimization. They have various assets with estimated returns, variances, and covariances, and they decide on the weightings of each asset in a portfolio to maximize returns and minimize variance.

An investor would allocate a certain percentage, such as 5%, to one asset and a different percentage, like 10%, to another asset. This is done with the intention of maximizing the expected return and minimizing the variance.

However, it is easier said than done manually unless you have a degree in mathematics or finance. That is because there are lots of complex mathematical formulas involved. But even the best financial firms don’t sit and manually do their calculations with a pen and paper. Instead, they rely on automated software and tools.

If you are a layman with no previous experience with math, you can use a free portfolio optimization Web API based on Markowitz’ Modern Portfolio Theory. It comes with comprehensive documentation to help you get started.

Conclusion

Modern Portfolio Theory (MPT) provides a robust framework for understanding and managing investment risks, and it is equally applicable to cryptocurrencies. It classifies risks into systematic and unsystematic, encouraging diversification to manage the latter.

The central tenet of MPT – diversification, can be effectively used to optimize crypto portfolios, mitigating risks while maximizing potential returns. While the crypto market is notoriously volatile, applying the principles of MPT can provide you with a strategic advantage, enabling you to make more informed decisions and potentially realize greater gains from your crypto investments.

We hope that this article helped you understand the core ideas behind the Modern Portfolio Theory and provided you a framework to start applying it to your crypto investments.