Polkadot is a blockchain consisting of multiple sharded chains, meaning it can make many transactions on parallel chains (Parachains). Polkadot (DOT) is the native token for the Polkadot ecosystem.

Polkadot enables interoperability, meaning it allows communication and transfer of data between unrelated blockchains in a simple, secure, and energy-efficient manner. Why stake Polkadot? Staking Polkadot helps secure the Polkadot network.

Also Read:

• Polkadot Price Prediction: How High Can Dot Go?

What is Polkadot staking?

Polkadot staking is a good way of locking up your DOT on a platform for the purpose of earning interest or helping secure the ecosystem. Staked Polkadot is known as Bonded Dot tokens.

Validators help secure and scale the Polkadot ecosystem. With enough validators, the Polkadot network can process as many as 1000 transactions in a second. On exchanges staking Dot helps provide liquidity for traders and lenders who borrow at interest. Pooled staking positions help leverage lower transaction fees and higher payouts.

Polkadot is a decentralized user-driven community with all decisions made on-chain. This way Polkadot avoids forks on its network. Polkadot is ranked number 12 with a market cap of $18B and has a Twitter following of over 1.2M.

How does Polkadot staking work?

Polkadot uses a nominated proof of stake (POS) consensus to approve the accuracy of transactions in its sharded blockchain. There are two ways of staking Dot; as a validator and as a nominator. In a nominated POS, nominators elect Validators (Node operators) by committing their Dot to them. You should note that only 256 nominators ranked by their stake earn rewards from a validator, therefore staking as a nominator is an active process to ensure you don’t miss out on payouts.

Staking Dot as a validator is a hustle, making an error can affect your rating and likely lead to the slashing of your bonded Dot. There is a dynamic minimum amount of Dot required to become a validator, with the maximum number of node operators capped at 1000.

Both nominators and validators then get rewards for securing the Polkadot blockchain.

Staking as a validator is a highly demanding task, we are therefore going to look at how you can stake Dot tokens by being a nominator. Anyone with Dot tokens can act as a nominator.

Crypto exchanges also offer Dot staking. To stake on Binance you need to create an account and complete user verification before you can purchase Dot tokens. Binance offers Dot staking on a locked and flexible basis.

How to stake Polkadot with Polkadot-js Extension

Polkadot.js browser extension is an easy-to-use web extension Dot wallet. The wallet easily integrates and signs transactions on Polkadot dAPPS and web 3 services.

Polkadot wallet is a hot wallet meaning it directly interacts with the staking platform. As a security measure, it is advised to create two accounts on Polkadot-js. A stash account, to store your unbonded Dot balance and controller accounts to hold Dot that will actively interact with the staking platform. Always leave some Dot stored in the controller account for transacting fees when bonding or un-bonding Dot.

A person has the option of compounding interest or having the interest sent to an external wallet address for receiving staking rewards.

Step 1: In the Polkadot-js wallet create a controller and stash account.

Step 2: Visit Polkadot.js webpage

Step 3: Under the accounts tab, click ‘Accounts’ then add your Polkadot-js extension wallet account to connect.

Step 4: Select staking under ‘Network on the drop-down menu.

Step 5: Click the ‘+Nominator’ button at the top

Step 7: Next pick your controller and stash accounts. Enter the number of Dot to bond and choose how you want to get interest. This could be compounded or sent to an external or stash wallet. After this click ‘Next’

Step 8:On the next screen, choose and add the validators you want then click ‘Bond and nominate’.

Step 9: Input your password and sign the transaction to start staking Polkadot on your bonded account.

Polkadot staking through a pool

A Cryptocurrency exchange pools cryptocurrencies to leverage higher interest for its dot holders. Polkadot can be staked through a pool on Binance and Kraken digital coin exchanges.

To stake on Binance and Kraken you first need to create and verify accounts before you can stake. After creating the account, deposit Polkadot or purchase on the exchange. Both exchanges have high Polkadot liquidity.

Kraken rewards payout is biweekly and the dot funds are sent to their rewards destination in the exchange.

Binance offers Dot slot auctions. These are auctions that allow projects to compete for slots (Parachains) on the Polkadot network. The project with the highest staked Dot token (Bdot) wins the auction. Stakers are awarded by Binance a share of $30M in rewards during the auction period. Winning projects reward their stakers while losers have their Bdot refunded. Slots are leased to projects for a maximum of 96 days and during the period Bdot is locked into the project.

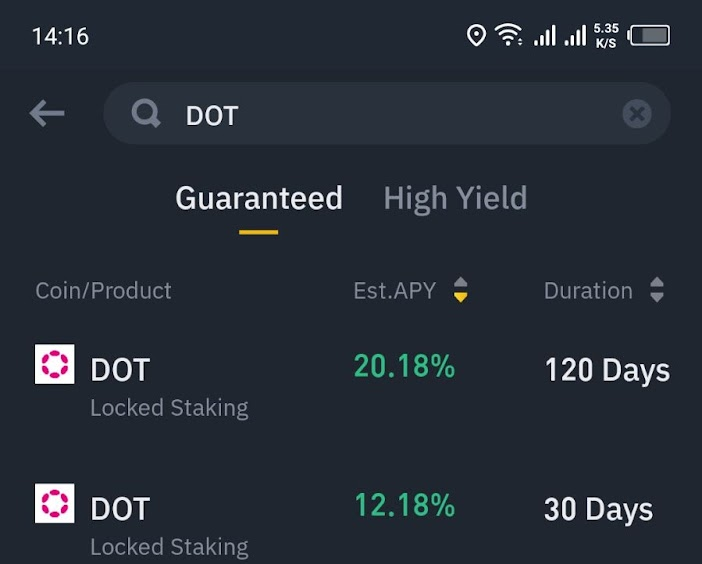

Binance offers both flexible and fixed staking for Polkadot. In fixed staking, DOT is locked up into Binance for a predetermined period with daily interest payouts while with flexible staking, DOT is locked up in a user-determined period but at lower Interest rates ranging between 20.18% and 0.5% Annual Percentage Yield.

By staking on Kraken you get to join their validator nodes with biweekly payouts, the more you stake the more you earn with no limit on when you can withdraw. Kraken has high Polkadot liquidity so you can always derive value from your coins. Unlike Binance, staking Polkadot on Kraken is on-chain. Passive return Interest rates hover at 12% APY.

Ledger hardware wallet ledger device can be used to set up a Polkadot account the same way with a Polkadot extension wallet to receive rewards.

How much can I earn with Polkadot staking?

Polkadot staking interest varies from platform to platform. Binance currently offers the best returns at 20.18% with a lock-up period of 120 days.

Staking on-chain with the Polkadot-js extension will earn you about 10% APY with an option of compounding interest. Unlike other staking products, staking on Polkadot-js is an active process, you have to keep checking to ensure you meet the reward requirements.

Binance locked staking will earn you 20.18% APY locked for 120 days with daily interest payouts. Locking DOT tokens for 30 days gets you 12.18% APY. After the lock-up period, the principal is sent to the spot wallet. Flexible staking has an APY of about 0.5%.

Kraken exchange offers 12% APY for staking Polkadot.

Is Polkadot staking profitable?

Staking Polkadot is profitable. In the long run, your DOT count will grow, however, its value is prone to volatility. Polkadot is a well-grounded project with projections of price growth in the future.

Dot slot staking on Binance is profitable taking into regard the staking and voting rewards. The value of winning projects also determines your profitability since the projects are not assured of listing on Binance.

Withdrawing your Bdot before maturity leads to a loss of interest on exchanges. On-chain bad validators can lead to the slashing of Bdot.

Polkadot staking vs mining

Polkadot uses a nominated Proof-of-Stake consensus algorithm, while Ethereum uses a Proof-of-Work consensus algorithm. This means Polkadot uses a staking mechanism to validate blocks while Ethereum validates transactions by solving hard mathematical computations in a process referred to as ‘mining blocks’. Ethereum is transitioning from Proof of Work to the environmentally friendly Proof-of-Stake consensus algorithm.

Next, we will compare staking Polkadot and Ethereum mining.

Other projects that use a Proof-of-Stake model include BNB, SOL, ADA, ATOM, ALGO, RUNE, EGLD, and NEAR protocols.

Benefits of staking Polkadot

- Staking helps secure the network, that way a whale cannot take the network hostage.

- You earn passive returns with the option of compounding your interest.

- Holding Dot gives you the chance to participate in community voting for coming messages.

- Staked Dot acts as a measure of the health of the ecosystem.

- Increasing the total value locked increases the value of the circulating Dot.

- If Polkadot value rises you get to earn higher interest.

- High and competitive annual interest rates.

Drawbacks/risks of staking Polkadot

- There is a risk of your bonded dot being slashed if your validator misbehaves.

- Only nominated validators earn staking dot rewards.

- If you lose your custodial wallet private key you can’t recover your Polkadot.

- Staking on non-custodial wallets means your stake is dependent on the security of the platform.

- Changes in total value can result in slippage resulting in interest volatility.

- A Polkadot price crash would result in losses.

- It is difficult to determine honest validators for nomination.

- Interest rates on exchanges are dictated and can vary.

- High commission fees set by validators mean less interest rates for stakers.

- You need at least 10 DOT to stake with a custodial wallet.

- Only nominators with DOT stake above the volatile amount can earn more dot on staking

- The maximum count of nominators is capped at 22,500 so you have to keep looking if you meet the cut.

- Only 256 nominators on a validator earn rewards.

Conclusion

Staking is an environmentally safe way to secure the blockchain network while earning interest. Staking as a nominator on a hot wallet is an active process due to several factors that could leave your bonded Dot not earning rewards. Staking as a validator is also a hustle that requires attention 24/7 to avoid going astray.

Pooling Polkadot on non-custodial wallets for staking is a more straightforward route with relatively higher long-term returns. The only risk is that your Bdot may get lost when the exchange is compromised.

Staking rewards at the end of the staking period will be affected by the prevailing value of DOT.

Staking is a great way to secure a blockchain and a good route to earning passive income.

[the_ad_placement id=”writers”]