Tokenized real estate PayPal ban imposed on a U.S. based real estate firm RealT has turned out to be a boost to the platform sales. The permanent ban has come as a blessing in disguise for accompany that is fast disrupting the real estate sector.

The platform which runs on the Ethereum ecosystem has recorded a high number of users since it got banned in April. Since the ban, the platform has been accepting crypto as the only mode of payment. With only $50 U.S. users can own a percentage of tokenized real estate.

Who wins in tokenized real estate PayPal ban?

Although the tokenized real estate PayPal ban might be justified, it comes at a time when investors are turning to blockchain for solutions in the property industry. Tokenization opens up real estate tokenization to the ordinary investor and a boost to the unbanked populations.

RealT on their twitter account says before the bam PayPal controlled 62 percent of all sales and since launch, the firm has recorded transactions worth $800,000 through the payment processor. Out of this volume, four disputes worth $600 accounting for less than one percent were recorded.

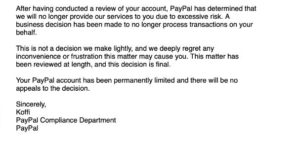

In April users reported issues with the transaction on the PayPal system. This saw the payment processor write to the tokenized real estate service provider banning citing “excessive risks” and no option to “appeal the decision”.

Ushering in a new era through tokenized real estate

Tokenized real estate PayPal ban is an eye-opener not only for RealT but any crypto adopter and user. It is clear that businesses can smoothly run on crypto. This seems to be the message to real estate digitalization firm appears to send to the globe through their official twitter handle:

Fortunately for RealT, we operate in an industry that centers on permissionless money and permissionless payments.

This has been a humbling reminder about some of the core principles of the ethos of the DeFi revolution: permissionless and censorship resistant finance.

The tokenized real estate firm goes on to tweet:

This unfortunate event actually resulted in an extremely value-able experiment for us that really changed the moral of the company, during what would otherwise be a critical event.

We were forced into the experiment of “Can a business survive on crypto alone?”

Could the tokenized real estate PayPal ban be a crypto chance to shine?

Just one week into the tokenized real estate PayPal ban, RealT saw a growth of 240 percent growth in sales through Coinbase. All the sales are crypto-only making the firm one of the “most popular tokenized real estate marketplace” based on the Ethereum ecosystem as the firms’ blog confirms:

While more payment merchants are always better, the fact that RealT was able to hit ATH in both sales and new user signups, with ONLY crypto as a payment mechanism, is insanely bullish for the crypto-space at large.

RealT is not the first firm to be banned from the PayPal platform. PornHub was axed in 2019 citing the payment processors’ user policy. However, PornHub turned to crypto has not turned back. PayPal recently partnered with Facebook’s Libra project only to pull out the last minute mysteriously.