Ethereum Classic Price Prediction 2024-2032

- ETC Price Prediction 2026 – up to $75.52

- ETC Price Prediction 2029 – up to $222.67

- ETC Price Prediction 2032 – up to $705.99

Ethereum Classic (ETC) is one of the oldest cryptocurrencies that still has maintained its place among the top altcoins as it has reached a market cap of over $6 billion and trades on all major exchanges. The coin’s popularity has piqued investors’ interest; therefore, many people look for the accurate Ethereum Classic price prediction. However, some associate Ethereum Classic with risks.

Ethereum Classic’s price once skyrocketed as Ethereum miners throw their weight behind the old ways. So, what’s the verdict here? Should you buy ETC and use the Ethereum Classic price prediction to find your way?

How much is ETC worth?

Today’s Ethereum Classic priceis $15.35 with a 24-hour trading volume of $65,370,586. Ethereum Classic is up 0.05% in the last 24 hours. The current CoinMarketCap ranking is #23, with a live market cap of $2,192,938,669. It has a circulating supply of 142,827,413 ETC coins and a max. supply of 210,700,000 ETC coins. Ethereum Classic is 91.29% below the all-time high of $176.16.

Here’s a note: Market cap just doesn’t show actual money. So much Dogecoin has been lost forever that the market cap is a fraction of what is shown. Bitcoin also has quite some losses too, with an estimated 3.6 million dead coins. If exchanges would reveal how many coins are actually bought and sold at which prices, that would be more useful. Or qualify them by TRUST scores.

Scroll below to see why there’s never a dull day in crypto!

Also Read:

- Why is Cardano founder Charles Hoskinson making fun of Ethereum Classic?

- Ethereum vs. Ethereum Classic: How will the Merge affect them?

- Ethereum vs. Ethereum Classic: What’s their difference and relation to the Merge?

Ethereum Classic Price Analysis: ETC/USD Price Targets $17 Breakout as Support Holds at $14.85

TL;DR Breakdown

- ETC/USD Market sentiment suggests a potential drop to $15.02

- Price target of $17 if ETC breaks resistance at $15.64 and $16.24

- ETC holding above support at $14.85

Ethereum Classic Price Analysis 4-hour chart: ETC/USD Market Sentiment Hints at $15.02 Drop

The 4-hour Ethereum Classic chart reveals a bearish trend as the SuperTrend line is positioned above the price. This suggests that traders may want to consider short-selling or exercising caution in long positions, as the market sentiment leans towards a downward movement that could see ETC dropping to $15.02. Furthermore, the Relative Strength Index (RSI) is at 41.69. The Relative Strength Index (RSI) currently registers at 41.69, indicating a neutral sentiment with room for potential downside.

ETC/USD Price Analysis 1-day chart: $14.85 Support Holds Strong Amidst Market Turbulence

Upon examining the 1-day chart, it is evident that the ETC-USD trading pair is currently situated beneath its crucial Simple Moving Averages (SMAs). Noteworthy is ETC’s ability to sustain its support level at $14.85. If ETC manages to weather the ongoing market decline, there could be a growing likelihood of an upside. The potential price objective, in the event of ETC breaking out from its current range and surpassing resistance levels at $15.64 and $16.24, is $17.

ETC Recent News

“ETCPOW Store Launches: Get Ready to Power Up with $ETCPOW Tokens!”

Exciting news! 🔥🥳🚀

— ETCMC (@ETCMC777) September 4, 2023

The #ETCPOW Store is now live!

You can now acquire the Digital software using $ETCPOW tokens.

Stay tuned for an array of upcoming products and special offers, including the highly anticipated #ETCMC plug-and-play nodes and much more. 💚🫡

Store in our… pic.twitter.com/m1j8DfOQ4P

Ethereum Classic Price Predictions by Cryptopolitan

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2023 | 20.51 | 21.22 | 22.75 |

| 2024 | 29.17 | 30.23 | 35.82 |

| 2025 | 42.84 | 44.35 | 50.94 |

| 2026 | 61.00 | 63.22 | 75.52 |

| 2027 | 88.68 | 91.85 | 105.05 |

| 2028 | 127.21 | 130.89 | 154.12 |

| 2029 | 185.49 | 192.03 | 222.67 |

| 2030 | 268.61 | 276.29 | 317.96 |

| 2031 | 406.27 | 417.32 | 467.85 |

| 2032 | 597.41 | 618.27 | 705.99 |

Ethereum Classic Price Prediction 2024

Ethereum Classic price prediction for 2024 is that the ETC price is expected to reach a minimum price of $29.17 and an average trading price of $30.23. The Ethereum Classic token is expected to reach a maximum price of $35.82 by the end of the year.

Ethereum Classic Price Prediction 2025

Ethereum Classic price prediction for 2025 suggests ETC could trade at a minimum price of $42.84 and an average forecast price of $44.35 with a maximum value of $50.94.

Ethereum Classic Price Prediction 2026

Ethereum Classic’s price prediction for 2026 suggests that the ETC token could reach a minimum of $61.00 and an average forecast price of $63.22. The maximum value is expected to be around $75.52 by the end of 2026.

Ethereum Classic Price Prediction 2027

The Ethereum Classic ETC price prediction for 2027 suggests ETC’s price could potentially attain a minimum price of $88.68 and an average forecast price of $91.85, with a maximum trading price of $105.05.

Ethereum Classic Price Prediction 2028

Ethereum Classic price forecast for 2028 forecast ETC to reach the lowest possible level of $166.39 in 2028. As per our findings, the ETC price could reach a maximum level of $154.12 with an average forecast price of $172.62.

Ethereum Classic Price Prediction 2029

The Ethereum Classic forecast for 2029 suggests the ETC token could reach a minimum price of $185.49 and an average forecast price of $192.03, with a maximum trading price of $222.67 throughout 2029.

Ethereum Classic Price Prediction 2030

Ethereum Classic ETC price forecast for 2030 is ETC could potentially attain a minimum price of $268.61 and an average trading price of $276.29, with a maximum price of $317.96 by the end of 2030.

Ethereum Classic Price Prediction 2031

Our Ethereum Classic coin price prediction for 2031 expects the ETC token to reach a minimum of $406.27, an average forecast price of $417.32, and a maximum trading price of $467.85.

Ethereum Classic Price Prediction 2032

The Ethereum Classic ETC price prediction for 2032 suggests ETC could reach a minimum market price of $597.41. Ethereum Classic ETC price could surge towards a maximum of $705.99, with an average price of $618.27 by the end of 2032.

Ethereum Classic Price Prediction by Digitalcoinprice

Digitalcoinprice offers a bullish Ethereum Classic price forecast, envisioning ETC’s value reaching $33.69 by the close of 2023. This represents a substantial 119.19% surge from its present valuation. Their prediction relies on a comprehensive examination of market dynamics and technical metrics, all pointing to robust bullish tendencies for ETC. Digitalcoinprice further indicates that this bullish trajectory could persist over the long term, projecting maximum price targets of $69.93 in 2026, $115.05 in 2029, and an impressive $208.60 in 2032.

Ethereum Classic Price Prediction by Coincodex

Coincodex presents an optimistic outlook for Ethereum Classic’s price in the short term, forecasting a rise to $16.29 by September 9, 2023, marking a potential increase of 6.48% from its current market value. Their analysis relies on technical indicators, which currently indicate a bearish sentiment, along with a Fear & Greed index standing at 40 (Fear). Coincodex’s projections suggest a substantial price surge to $36.25 in 2024. However, the subsequent years are expected to bring corrections, resulting in a market price of $23.99 in 2025, followed by $16.83 in 2030, and a long-term estimate of $13.69 by 2040.

Ethereum Classic Price Prediction by Wallet Investor

Wallet Investor holds a pessimistic view on Ethereum Classic (ETC) as a long-term investment. According to their projections, ETC’s price may potentially plummet to $1.430 USD by 2024, signifying a substantial price decrease of approximately 90.69%.

Ethereum Classic Price Prediction by Market Experts

Forex Trading on YouTube highlights a critical weekly support area for Ethereum Classic, with a lower band around $11.50 and a higher band around $14.50. The trader suggests that if this support area is broken, it could lead to a significant drop, possibly down to $8.

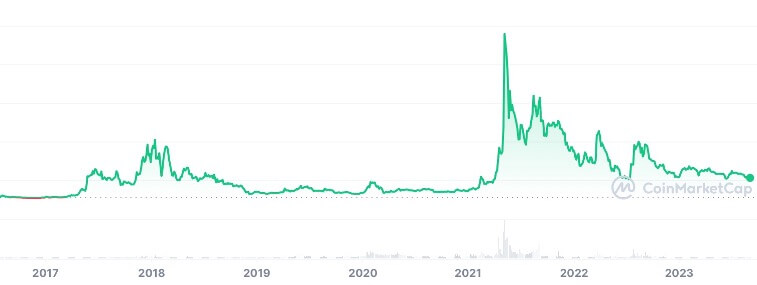

ETC Price History

Reviewing its recent performance over the past months reveals Ethereum Classic’s price oscillating between $25 and lower values. This volatility can be attributed to the persisting market instability. Ethereum Classic has experienced a notable drop of over $1.6 in just one week, illustrating the challenging conditions it has faced. With the market maintaining a bearish outlook, there is uncertainty regarding whether Ethereum Classic can attain the desired gains.

More on Ethereum Classic

What is Ethereum Classic?

Ethereum Classic coin was created in July of 2016 due to a split in the Ethereum community after the original blockchain got hacked. Fundamentally, the two blockchains – Ethereum and Ethereum Classic were similar at first. The history of this crypto is definitely valuable.

Ethereum Classic is a hard fork of the source platform Ethereum which occurred in 2016 after the hack of the Ethereum-based Decentralized Autonomous Organization (DAO). The community got split into two opposing camps, and the same happened to the project as well.

Over time, differences arose as the Ethereum classic network community wanted to keep the blockchain running on a Proof-of-Stake consensus algorithm and secure blockchain immutability. The Ethereum community wanted to develop it into a much advanced, proof-of-stake-based digital currency.

Few people understood the concept of division in the initial stages, and the Ethereum Classic prediction remained at a lower level. The hard fork coin is more of a protocol rather than a store of value like gold. Ethereum Classic’s current market status is being compared to gold, despite the overall crypto market facing a broad sell-off in the past week.

For those investors who wanted to exit the DAO, the so-called “Split function” exposed an enormous loophole in the whole system. Instead of simply requesting a refund, the hacker launched a recursive function that repeated the request before the initial transaction was registered on the blockchain.

Ethereum Classic Price Trends

Ethereum Classic (ETC) has faced challenges in terms of price growth compared to other Layer 1 blockchain projects this year. Several factors have contributed to ETC’s underperformance:

- ETC has faced stiff competition from newer blockchains such as Solana and Avalanche, which boast faster transaction speeds and lower fees. This competition has diverted attention and investment away from ETC.

- The contentious hard fork of Ethereum Classic from Ethereum back in 2016 has left a lasting negative sentiment surrounding ETC. This event still influences the perception of the project and its potential.

- There are concerns about ETC’s long-term viability and adoption prospects, especially when compared to Ethereum (after the Merge upgrade). This upgrade has generated optimism around Ethereum and raised doubts about ETC’s ability to compete.

However, there are also potential catalysts that could trigger a price turnaround for Ethereum Classic:

- The implementation of network upgrades aimed at improving transaction capacity and efficiency, could enhance ETC’s appeal and competitiveness.

- ETC’s lower transaction fees make it more accessible for activities like NFT trading and participation in the metaverse. Continued adoption in these areas could drive demand for ETC.

- Ethereum Classic tends to follow the overall crypto market trends. If speculative assets in the crypto space experience a rally, ETC could benefit from increased investor interest.

Halving Events

Ethereum Classic’s total supply is hard-capped at 210,700,000 ETC as of December 2017. Similar to Bitcoin having reward halving, Ethereum classic reduces its block reward by 20 percent for every 5,000,000 blocks. At every halving event, updating the Ethereum Classic prediction is necessary. This is applicable to every cryptocurrency out there.

Ethereum Classic works on the Proof-of-Work protocol and has great potential owing to the Nakamoto Consensus mechanism. Recently, Ethereum Classic reduced the block reward for mining each block from 4 ETC to 3.2 ETC. The Ethereum Classic prediction became more optimistic due to the halving event as the coins left to mine lowered. Therefore, Ethereum Classic price has become more similar to Bitcoin’s price in some aspects than its original source – Ethereum. People have always compared Ethereum Classic’s price and functionality to that of Ethereum, the latter winning every time.

Today, we can see that the Ethereum Classic price rise has slowed down, and the coin even fell behind the original Ethereum, which the Ethereum Foundation runs. Ethereum trades with a much larger market capitalization and has gained much larger popularity. However, Ethereum Classic is still trendy and can be purchased on practically every cryptocurrency exchange. Therefore, let us have a look at the Ethereum Classic price prediction.

Should you invest in Ethereum Classic?

When comparing the Ethereum blockchain vs. Ethereum classic blockchain, the difference can’t be clearer. We can see that Ethereum has performed substantially better than the Ethereum Classic price over the past years. Price, as a well-performing factor, fuels its increased usage among users, pushing vendors and service providers to widen their accepted deposit methods and add Ethereum. For example, price predictions show that it will equate to and even overseed the usage of Bitcoin in iGaming deals. Should you sell Ethereum Classic and buy Ethereum instead?

Ethereum Classic has also been in shambles as the expectations regarding Bitcoin’s rise to $100K have turned to fears of stability at $40K. Previously, the growth of Bitcoin was expected to bring stability to other coins, including the Ethereum Classic, but it didn’t happen. As a result of this change, there has been a continuous decline seen in the case of many coins.

Despite the ongoing difficulties for the market, there are chances of a market revival. If you buy the dip, there are chances that you might feel fortunate to have bought Ethereum Classic. As Bitcoin makes further gains, there are chances that the Ethereum Classic might also cross $50. The rise of this currency depends on a rally and stability in its value.

What’s the Hoskinson Vendetta?

More drama unfolded two months ago as Charles Hoskinson fired the next salvo in his long-running vendetta against the Ethereum Classic community, who he still feels did him an injustice by refusing his proposal to create a treasury and pay his development team (IOHK) from the proceeds.

Since then Charles has been in control of the Ethereum Classic Twitter handle, which he has refused to return to its community, despite their requests. ETC proponents say that is because of personal spite and pettiness, while Charles says that it’s his property and he can do what he wants with it. He sees it as a personal memento of his time at ETC.

Charles’ response was to let everybody know that this was a deliberate and malicious act, not an accident. Unfortunate but reflects more poorly on Charles than it does Ergo. 😬

Conclusion

As big institutions increasingly threaten incoming blockchain tech, only truly decentralized cryptocurrencies will survive the wild ride. Ethereum Classic has proven its ability to resist censorship against all the odds and to deliver the original Ethereum vision of robust applications. By combining the Ethereum technology with the philosophy of BTC, ETC is uniquely positioned to be the Smart Contract Platform of the future, as other chains are captured by special interests and become compromised.

Ethereum Classic has a lot of potential and is considered one of the most profitable cryptocurrencies for long-term investments. Due to its unique technology and continuous development, ETC is expected to grow even more in the next few years and could reach new heights.

Ethereum Classic’s past performance is not a guarantee of future results. However, it has consistently grown in price and value over the years with an investment portfolio that is worth millions today. In addition, Ethereum Classic also has a very active community that actively supports the coin. Thanks to the loyal and tech-savvy community, the coin is expected to reach new heights in the next few years.

ETC is, however, set to face competition from Ethereum POW, which is verified by POW miners who were phased out by the Merge. Ethereum POW will steal part of ETC’s market share with a growing community. There’s also the other possibility of ETH miners migrating to ETC. Wear the shoes that fit, that’s a common principle shared by the community,

Our Ethereum Classic forecast shows that ETC will hit another ATH in 2029 with a minimum of $185.49. Negative news and market crashes could, however, derail Ethereum Classic’s performance in the cryptocurrency market. ETC price needs to rise 1106.83% to reach a new all-time high.

ETC crypto analysis and prediction are not investment advice; the cryptocurrency market prices are highly volatile.