Coinbase staking is essentially an investment opportunity for Coinbase clients. Staking simply means letting the blockchain use your crypto to validate transactions. If you’re into Coinbase, you should be looking for an easy way of staking, which may not be the best but is it safe? And if safety is guaranteed, how profitable is Coinbase staking? You can’t take a shortcut when financial matters are involved, so please review the general merits of crypto staking here.

Also Read:

• How To Transfer From Coinbase To Kraken?

• How To Transfer From Coinbase To Coinbase Pro?

• How To Claim Spark Tokens On Coinbase

• How To Close A Coinbase Account: All You Need To Know

• How To Transfer Crypto From Coinbase To Robinhood

What is Staking?

Staking is a blockchain terminology that refers to the active involvement in validating transactions within a blockchain network. These blockchain networks need to operate on a Proof-of-Stake consensus algorithm. Validating transactions within a blockchain network is a vital security feature that ensures transactions are legitimate and no fraudulent transactions are made within the blockchain network.

Therefore, as a result, if you hold, for instance, ETH, you can stake your ETH and participate in validating transactions within the Ethereum blockchain. Therefore, as an investor, you get rewarded for participating in the blockchain transactions, and these rewards are considered interest earned.

Since crypto holders on the Coinbase platform must meet specific requirements to begin earning rewards, the platform rewards those who stake particular cryptocurrencies. Staking is a financial product that allows crypto hodlers to take out interest from their crypto holdings without losing their crypto portfolio balance.

Basic requirements for Coinbase users only

Coinbase staking allows crypto holders to utilize their crypto holdings to earn more crypto by committing them to the platform. The entire staking process involves having a certain minimum amount of cryptocurrency coins to participate in transaction validations.

As a primary rule of blockchain transactions, all transactions need to be verified by credible participants within the blockchain network. Today, Coinbase has provided its users with an opportunity to be part of the robust network, participate in crypto staking and earn staking rewards using their cryptocurrencies.

As an investment strategy, it is important to understand deeply how crypto staking works on the Coinbase platform and how it compares to other staking platforms in the market today to make an informed investment choice.

To begin staking, you’ll need to meet all the requirements set by your platform of choice, in this case, the Coinbase platform. Before you are allowed to stake, there is a minimum balance that you need to have to validate other transactions within the blockchain.

How to stake cryptocurrency on Coinbase

To stake your preferred cryptocurrency on Coinbase, you should follow the following steps.

- Create an Account on Coinbase.

- Connect a bank card to your account for purchasing cryptocurrency.

- Purchase the relevant proof-of-stake cryptocurrency you intend to stake on Coinbase.

- Stake the purchased cryptocurrency by depositing the tokens purchased on Coinbase.

Things to keep in mind

- You may be required to accept User Terms specific to the asset you’d like to stake. Please read them carefully.

- You will retain full ownership of your staked crypto. In the event of a slashing incident involving staked ETH2, Coinbase may or may not replace your assets—depending on the cause of the slashing. Learn more about the slashing policy for ETH2.

- For some assets with lockups at the protocol level, Coinbase may withhold a small amount of that crypto to assure that all Coinbase customers have liquidity and can cash out their crypto as needed.

- Coinbase takes a commission on all rewards received, and the return rate for its customers reflects this commission and the actual amount of your crypto that was staked. You can find their current commission in Section 5.4 of the User Agreement.

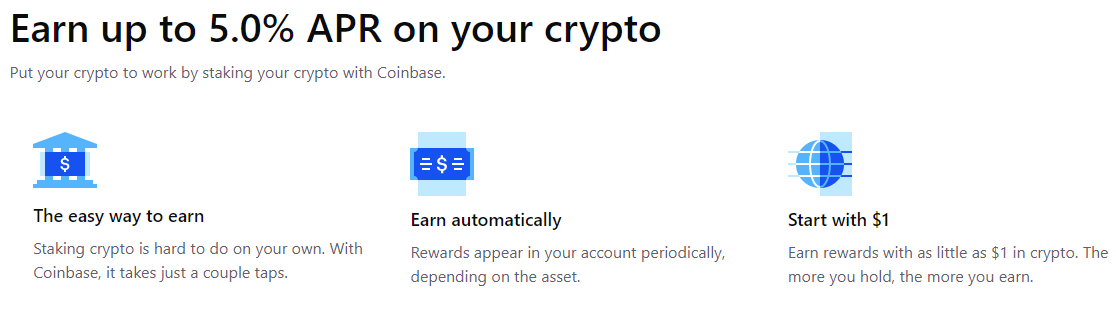

A few taps get you the yield

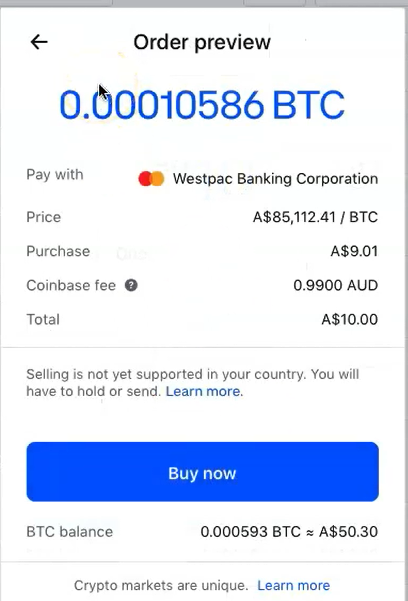

After purchasing a cryptocurrency like Bitcoin, click “Trade” on your Coinbase account.

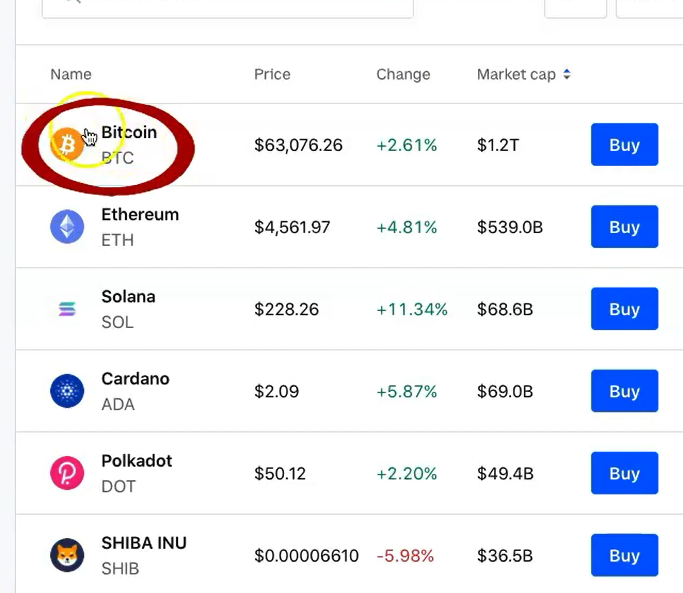

Proceed to buy the amount of cryptocurrency you want to stake. Let’s start with BTC, which you can easily convert to the other coins available for Coinbase staking. Everything about the choice of a cryptocurrency will be shown after.

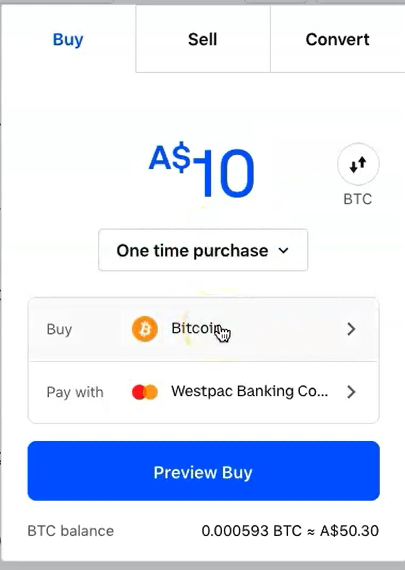

Decide the amount and preview the order.

Click buy now only if you’re satisfied with the details.

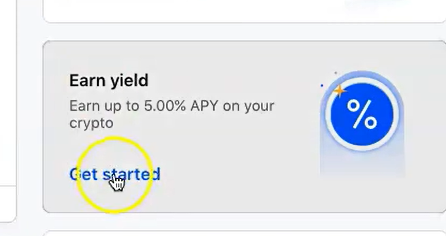

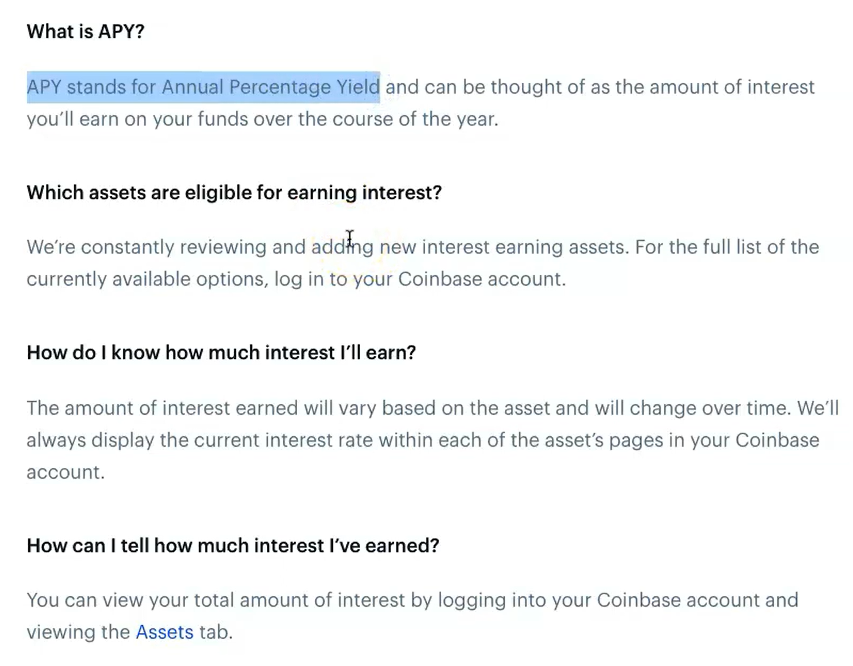

We don’t want BTC lying in your BTC wallet on Coinbase, so we go on to STAKING by clicking on “Get started” on the Earn yield section. You may want to read all the information available there to make an informed decision.

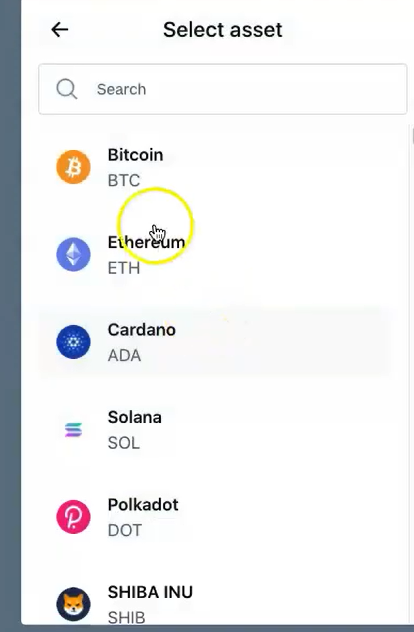

After reading this brief information on terms that will guide you in deciding, “Discover new assets” to know which cryptocurrency to stake on.

Click on the Bitcoin in your asset portfolio, and make an order to convert a specific amount of it to the chosen crypto for staking.

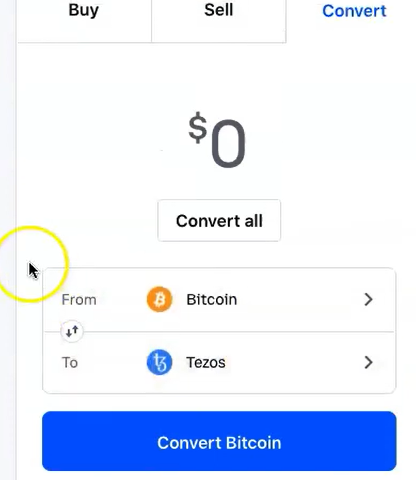

Click on convert from Bitcoin to your preferred coin. If you want to convert your Bitcoin to some more available assets, repeat the same process.

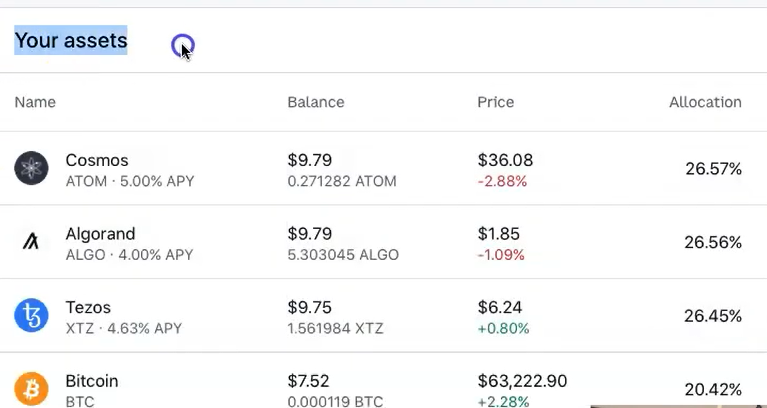

After making selections and conversions from Bitcoin to the selected cryptocurrency stepwise, this is now how your portfolio should look when you click “Your Assets.” In those quick selections and taps, you will be earning every year (yield depending on the crypto network) without having to do anything else.

How to Stake ETH on Coinbase

Staking ETH means tying up your coins until Ethereum completes its upgrade. When you stake your ETH, it converts to ETH2 on Coinbase.

- Make a Coinbase account or log in if you already have one.

- Purchase Ethereum tokens.

- Join the waitlist.

- Stake your Ethereum tokens.

Go to the Ethereum asset page under your Portfolio on the web or mobile and follow the respective prompts. If you’re signed in and eligible (see eligibility requirements above), you may be able to convert your ETH to ETH2 and start staking. If you’re experiencing issues with staking on the Coinbase mobile app, please make sure you use the latest version.

Your staked ETH will appear in your ETH2 wallet. This is because your ETH becomes ETH2 when you decide to stake. Please note that staked ETH (ETH2) cannot currently be traded or sent off-platform.

ETH2 staking rewards will be reflected in your account under Lifetime Rewards and updated regularly. At this time, staking rewards will not be added to your overall staking balance, and you will not be able to access them.

You’ll need 32 ETH to become a total validator or some ETH to join a staking pool. You’ll also need to run an execution client (formerly ‘Eth1 client’). Staking ETH is the act of depositing 32 ETH to activate validator software. More on the Beacon Chain.

Requirements for staking ETH

- Hold ETH in your Coinbase account.

- Live in a jurisdiction eligible for ETH staking.

- Complete identity verification.

- Complete ID document verification.

- Read and understand the terms and conditions associated with ETH staking.

Important: Only individual accounts are eligible for staking—not business accounts.

What are some benefits of Coinbase staking?

Many seasoned cryptocurrency holders do not like to sell their tokens since they anticipate future capital gains on their digital assets. The fundamental reason behind HODLing is to allow investors to gain more value as they wait for the crypto coins to gain market value over time as the demand grows.

Although holding cryptos for a prolonged time provides the chance to earn more, combining this investment strategy with staking can lead to even better returns on investment in the long run.

Some benefits of staking cryptocurrencies for rewards

- Ability to earn more assets; when you stake, for instance, 1 ETH, you’ll receive staking rewards in ETH; therefore, your earn more ETH coins. After a certain period, depending on your yield rates, you’ll have, for instance, 1.01ETH, which will undoubtedly have a higher value than 1ETH at any given moment.

- The opportunity to earn rewards without selling off your crypto holdings helps preserve your crypto portfolio.

- Staking offers incredible crypt investment opportunities to earn passive income for Coinbase users.

Crypto rewards through staking

| Cryptocurrency for Staking | Minimum Balance Required | Rewards Payout Rate |

| Algorand (ALGO) | 0.01 ALGO | Daily |

| Cosmos (ATOM) | 0.0001 ATOM | Seven days |

| Ethereum (ETH) | No minimum balance | Daily |

| Tezos (XTZ) | 0.0001 XTZ | Three days |

For an individual to stake crypto for rewards on Coinbase, the customer has to meet the minimum balance required. After that, a node will deposit some cryptocurrency to the staking network, which can be viewed as a security deposit. So, the staking game is essentially a game of numbers in that the more you stake, the higher the chances of your node being selected to create the subsequent block on the blockchain.

When the block is completed successfully, the validator is rewarded. These terms are used on a Proof of Stake consensus mechanism that Ethereum and several other blockchains use. The staking mechanism is similar to how miners are rewarded in blockchains that utilize the Proof of Work consensus algorithms like Bitcoin.

Coinbase staking rewards

Coinbase offers lucrative crypto staking rates for all the eligible cryptocurrencies. However, Coinbase restricts its customers to specific geo-locations and prohibits several global users accept US customers.

Several Coinbase customers prefer staking with the Coinbase exchange platform due to its ability to offer optimal services to its users. The algorithm on the platform allows users to stack up more coins to benefit from the Coinbase staking system.

As discussed earlier, the Coinbase staking reward system for eligible cryptocurrency will enable users to accumulate more coins as the Coinbase algorithm optimizes staking opportunities.

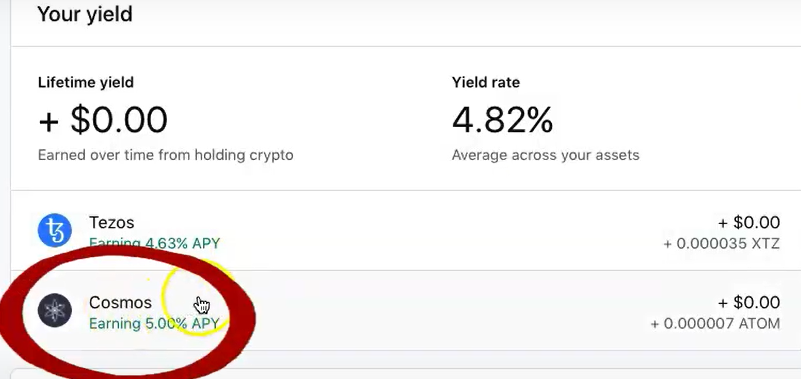

If you have more coins, Coinbase can stake more coins on your behalf, and therefore, your staking rewards will undoubtedly increase significantly. To earn rewards, you have to participate in staking, and the staking rewards on Coinbase also depend on the particular coin’s blockchain network. Make your choices on APY and other information available when clicking your selection.

Essentially, blockchain networks with higher frequencies of block creation have the potential for more rewards than networks with low block creation frequencies.

Why should I stake some of my cryptos on a Coinbase account?

Since the introduction of smart contracts, the adoption of Ethereum-based blockchains has undoubtedly increased. The ability to incorporate smart contracts has revolutionized crypto finance, and today, crypto holders can benefit from several functionalities of smarter blockchains.

Coinbase has taken a keen interest in such information and has provided its customers with a lucrative staking platform that allows users to earn interest by holding a particular amount of crypto.

Instant rewards can be achieved by staking several cryptocurrencies on the platform. According to the data from Coinbase, ETH is one of the most staked cryptocurrencies on their platform. Subsequently, ETH-based tokens are significantly popular for staking rewards within several other crypto platforms.

Financial products such as staking cryptocurrencies are viewed as passive income opportunities. The rewards are often earned without the crypto investor putting in actual work. However, staking programs ensure that blockchain transactions are validated, and new blocks are created much faster due to the availability of tokens on the network.

However, on Coinbase, several digital assets are eligible for staking; therefore, depending on the staking terms for each digital asset, an investor may be required to accept some predefined terms and conditions to stake some cryptocurrencies on the platform.

Coinbase account earnings eligibility requirements

Image source: Coinbase

To be able to stake your cryptocurrencies on Coinbase, you need to meet specific requirements:

- Your Coinbase account must be fully verified, meaning you must provide identity verification.

- After the identity verification process, the Coinbase account holder must deposit or purchase cryptocurrency on Coinbase and maintain a certain minimum balance to be eligible to receive rewards.

- Additionally, not all cryptocurrencies are eligible for rewards. To receive rewards, you need to hold suitable cryptocurrencies.

- Remember that Coinbase staking program is only available on the Coinbase.com platform. Therefore, users must hold their cryptocurrencies on this platform since the crypto rewards are not available on Coinbase Pro.

- However, not all cryptocurrencies are eligible for Coinbase rewards on the Coinbase.com staking platform.

What cryptocurrencies can I stake on the Coinbase account?

Based on the data retrieved from the Coinbase help page, there are four major options for Coinbase staking on the platform. The option involve either Staking Tezoz (XTZ), Ethereum (ETH), Algorand (ALGO), Dai, USD Coin, and Cosmos (ATOM).

Essentially, Coinbase offers the following yield rates for the cryptocurrencies mentioned above.

- ETH -4.5% daily rate

- ALGO- 4% daily rate

- ATOM- 5% every week

- XTZ-4.63% every three days

- DAI- 2% per day

- USD coin – 0.15% per month

The above cryptocurrencies are eligible for staking; however, their rewards are settled differently depending on the blockchain network.

- For instance, for Algorand, the earned rewards are often credited within 24 hours after the transactions are made. Essentially, all rewards are recorded as transactions to your Coinbase crypto wallet. However, the ALGO team is poised to make changes to their platform this year, which will affect staking terms. After successful migration, staking rewards for ALGO will be credited to users every three months (Quarterly).

- Due to the nature of Cosmos, the initial rewards are reflected after a week to a fortnight, while all subsequent reward settlements are reflected after one week.

- ETH rewards take approximately one week to reflect the first reward transaction, while subsequent rewards are earned daily, and screenshots are sent to you daily.

- Notably, the Ethereum blockchain network is complete; previously, the network does not automatically credit ETH2 staking rewards to the total balance.

- The Tezos rewards are known to take the longest on the Coinbase staking platform. Initial credits approximately take about a month to a month and a half. However, the network reflects and pays approximately three days after.

The Coinbase staking program also allows earning rewards for DAI and USD coin digital assets.

How does Coinbase account reward work?

On the Coinbase.com platform, investors gain crypto rewards through staking their crypto money. As described earlier, staking is committing to contributing your cryptocurrencies in blockchain validations and transaction verifications within the proof of stake consensus mechanism.

When crypto investors stake their crypto, they volunteer to use their verified crypto holdings to validate new transactions within the network, leading to new blocks. So, when your cryptocurrency is involved in the validation process, the system automatically rewards you for your participation within the network. The phenomenon is similar to how the Bitcoin blockchain network rewards miners for solving complex algorithms and creating new blocks.

Similarly, on Coinbase, users must meet the predefined requirements discussed above to start staking. However, the platform handles the details, and Coinbase often chooses what percentage to stake at any given time. Generally, the more crypto coins you stake, the more rewards you’ll receive.

Coinbase staking compared to other exchanges.

When making any investment decision, it is often common to compare your options to determine the best course of action. The Coinbase staking example allows clients to increase their crypto funds by committing them for a particular period.

However, more often than not, investment vehicles are subject to fees that investors may not be aware of before investing. Other exchanges such as Kraken and Binance also offer stake programs to their users. However, there are disparities in the overall returns, fees, and the cryptocurrencies eligible for Staking and the geographical availability of the staking program.

Generally, Coinbase charges 0% staking fees and has a running promotion that rewards users with $5 worth of Bitcoin upon signing up. However, cryptocurrency exchange platforms like Kraken allow a broader range of crypto coins for staking than Coinbase. However, the ease of use of the Coinbase.com platform makes it suitable for beginners and intermediate crypto investors.

How safe is Coinbase?

Coinbase is a publicly-traded company, and most users attest that you’re not going to find a safer exchange to use. That’s why they can get away with having comparably high fees. The US-accredited crypto exchange is the gold standard in safety, and some trust it more than managing private keys on my own. So that accounts for the higher fees charged on security, but Coinbase is notorious for poor support for many coins.

Worth noting that due to the above, Coinbase has one of the highest staking fees in the space, where 25% of your rewards are given to the Company. So, a massive cut on your profits for staking. They’re also FDIC backed, so you’re insured against losses, but not all of it.

Two Firefox 0-day vulnerabilities were referred to in a Coinbase blog post back in May and June 2019. For a layman, Firefox 0-day vulnerability is a jargon used for a loophole in the computer software which, if it goes untreated, allows hackers to get the system penetrated. This correspondence made way for the cyberpunk to connect with the staff members that they were aiming at. After getting in touch with the “high-payoff targets,” the hacker then sent another email embedded with a cryptic element.

2/ We walked back the entire attack, recovered and reported the 0-day to firefox, pulled apart the malware and infra used in the attack and are working with various orgs to continue burning down attacker infrastructure and digging into the attacker involved.

— Philip Martin (@SecurityGuyPhil) June 19, 2019

While it is never 100% safe to keep your money on any online exchange, Coinbase has one of the safest web wallets you can use since it holds 98% of its assets in offline cold storage that cybercriminals cannot access.

Coinbase complies with the Bank Secrecy Act, the USA Patriot Act, and local state laws and regulations in the US. Aside from security protocols, cryptocurrency exchanges in the US and the UK must abide by anti-money laundering (AML) and know your customer (KYC) policies. This requires financial service providers to try and verify the identity of users.

Coinbase is not insured by the Securities Investor Protection Corporation (SIPC), like other cryptocurrency brokerages. It does carry insurance, but users who lose their holdings due to a third party accessing their account as a result of a breach or losing their credentials are NOT covered.

The best and easiest thing to do to keep your account safe is to create a new email address — one that you don’t use for anything else — and a password you’ve never used before, anywhere.

Final Thoughts

Staking provides a comparatively reliable source of passive income that ranges, on average, from 5-12%, in return for simply locking up your funds. It can’t be transferred during your crypto lockup or “vesting” period if you’ve changed your mind and want to trade. This can be a drawback as prices could favorably shift. Or you can try to be a validator.

Volatility and prices could plunge for a particular asset, and you suffer the same fate. For example, if you’re earning 20% in rewards for staking an asset, but it drops 50% in value throughout the year, you will still make a loss. If you decide to stake, make sure you choose the asset carefully

The 25% cut on your reward saves you the trouble of learning Linux to set a validator or having to monitor that thing for power, internet connection, and storage. Most people consider that worth the compromise of letting Coinbase take a cut.

Staking may be a good choice for your cryptocurrency if you’re risk-averse, but there are many other ways of generating passive income. It may be worth looking into some of those options, as well. Here’s the process if you want to try the ETH staking.

FAQs about Coinbase Staking

Are my coins safe on Coinbase earn?

Yes, Coinbase is one of the most popular crypto exchange platforms in the current market, with an impeccable cyber security team. The platform secures crypto deposits in cold wallets with constant monitoring to ensure the security of clients’ deposits. Therefore, investing your crypto funds in Coinbase, learn about lucrative investments with good Annual Percentage Yield (APY).

It is difficult to lose money when staking unless the hackers decide to hack your staking service. However, to lose a digital asset or money is usually a sign of a security breach which is unlikely on Coinbase.

How long should I stake my coins on Coinbase earn?

The period of staking is entirely dependent on your financial goals. However, it is essential to mention that the longer you stake your coins, the more rewards you’ll receive. However, it is advisable to stake your coins with reputable partners like Coinbase.

Is staking profitable?

Yes, staking your crypto coins is a profitable investment strategy. Instead of leaving your coins idle in cold wallets for safety, it may be more beneficial to stake your coins and have a chance to earn rewards as your investment grows.

Why should I stake with Coinbase earn?

Coinbase offers several benefits to its users; for instance, with Coinbase’s impressive track record, most investors feel safe staking their tokens on the platform. The platform also provides mobile app access for users to easily monitor their investment progress.

Is Coinbase staking available worldwide?

At the moment, Coinbase services are not available globally, and full access is often primarily open to US residents, presumably due to tax implications and compliance for account holders before they start staking.

However, selected features are available to users in over 100 countries worldwide. Notably, other exchange platforms like Binance and Kraken offer a broader geographical reach than Coinbase.

[the_ad_placement id=”writers”]