Our Bitcoin price analysis reveals the BTC has entered a bearish zone after failing to remain above the $24,000 support. Bitcoin is trading at $23,943.09 after trading in a sideways direction for a few hours. Bitcoin’s trading volume has remained above $35 billion, illustrating strong bearish momentum.

A break below the $23,800 support is likely to trigger further losses in the BTC price. The next major support levels are $22,400 and $21,200. On the upside, immediate resistance is at $24,000 followed by a key hurdle near the $25,000 level. If there is a strong break above the $25,000 resistance area, the BTC price could start a fresh rally.

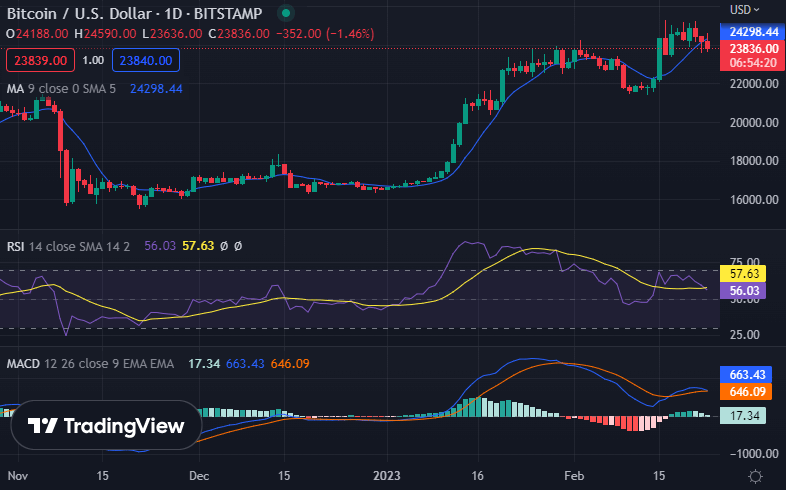

Bitcoin price analysis on a daily chart: Consolidation Pattern

The daily chart Bitcoin price analysis shows that BTC is trading in a range below the $24,000 resistance. The price action is painting a consolidation pattern and a break of either the upward or downward trendline could happen soon. A successful break above the upper trend line could open doors for more gains toward $25,000. However, if there is a break below the lower trend line, Bitcoin could test the $22,400 and $21,200 support levels.

The Relative Strength Index is residing near the 56.03 levels, but it is facing strong resistance near the $55 and $60 levels. The MACD is slowly losing momentum in the bearish zone, which suggests that there could be more losses in the BTC price.

The Moving Average lines are also highlighting a bearish zone. Bitcoin bulls need to defend the $22,400 and $21,200 support levels in order to start a strong rally in the near term. The EMA50 is providing solid support at the $22,400 level.

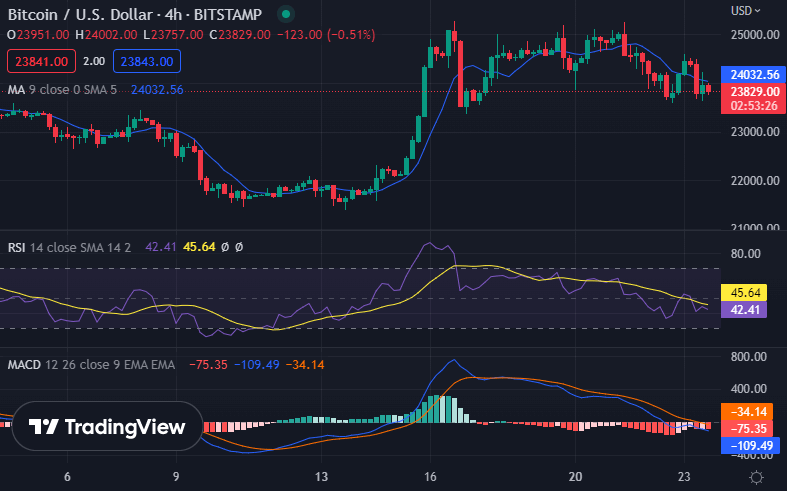

Bitcoin Price analysis on a 4-hour: Support and Resistance Levels

The 4-hour Bitcoin price analysis shows that BTC is struggling to hold the $23,800 support. A break below this level could push the price lower toward the next major support at $22,400. On the upside, an initial resistance is near the $24,000 level (recent breakdown zone). Above this, the BTC price is likely to face resistance near the $24,400 and $25,000 levels.

The RSI for BTC/USD is still below the 50 level, which suggests that the bears remain in control. If there is a break below the $23,800 support, the BTC price could soon test the 50-SMA at $22,400. The price of Bitcoin is trading above the psychological level of $23,000 and if it dives below this level then we could see a further decline into the $21,200 area. The Stochastic RSI for BTC/USD is declining and it might test the oversold area soon. This indicates that there could be a bearish trend in the near term.

Bitcoin price analysis conclusion

Bitcoin price analysis for today shows BTC is trading in a bearish zone below the $24,000 level. The next major support levels are $22,400 and $21,200. A break above the $25,000 resistance area is needed for a trend reversal. Bulls are still keeping a close eye on the $23,800 support to protect against further losses. If the BTC price fails to stay above this level, it could extend its decline toward $22,400 and $21,200.

While waiting for Bitcoin to move further, see our Price Predictions on XDC, Cardano, and Curve