Waves Price Prediction 2023-2031

- Waves Price Prediction 2023 – up to $3.42

- Waves Price Prediction 2026 – up to $10.1

- Waves Price Prediction 2029 – up to $30.67

- Waves Price Prediction 2032- up to $91.25

Recently, Sasha Ivanov, the founder of the Waves blockchain, promised to solve the shortcomings common to decentralized autonomous organizations (DAOs). The turnout of the DAO voting could affect WAVES prices and so, keep watch on what happens next. This Waves Price Prediction guide can help you navigate your way through good investment choices

Ivanov’s Power Protocol is designed to set and then measure key performance indicators (KPIs) and offer financial rewards and penalties to facilitate accountable, transparent, and efficient community collaboration. The first DAO to use the Power Protocol was Waves’ Power DAO, and without a doubt, increasing transparency will help increase TRUST for the crypto. Investors in the market have already found this platform extremely interactive and uncomplicated and price increases are not too far with increasing credibility.

The Waves blockchain was initially designed to facilitate the transfer of fiat currency and cryptocurrency and to optimize asset tokenization. Users could deposit numerous cryptocurrencies and fiat currencies using the Waves Platform through external “gateway” service providers. This Waves Price Prediction guide can help you navigate your way for good investment choices.

These assets could then be sent through the Waves platform as tokens and then withdrawn back into their original fiat or crypto form through a gateway. All of this can be accessed by downloading the Waves extension on your browser.

How much is WAVES worth?

Today’s Waves price today is $2.16 with a 24-hour trading volume of $47,356,050 USD. Waves is down 4.86% in the last 24 hours. The current CoinMarketCap ranking is #137, with a live market cap of $239,344,998. It has a circulating supply of 110,979,376 WAVES coins and the max. supply is not available.

The price of Waves has fallen by 1.20% in the past 7 days. The price declined by 6.38% in the last 24 hours. In just the past hour, the price shrunk by 0.21%. Waves is 96.27% below the all-time high of $62.36. Prices may vary in different exchanges.

Also Read:

- Waves price analysis: Bearish swing results in a massive fall up to $3.15 edge

- Bitcoin, Ethereum, Waves, and Loopring Daily Price Analyses – 18 September Roundup

What is Waves Crypto?

Some months ago, WAVES is back in one of the top positions in the crypto market after overcoming losses in the previous weeks. The native cryptocurrency registered an increase in its value that exceeds 11.72 percent in the last 24 hours. Bruited as the embodiment of tech freedom for blockchain-based finance, Waves technology might as well be the tool for massive adoption. Let’s see why that’s possible.

The Waves crypto blockchain is a source for users to create and then launch their custom crypto tokens. What makes Waves stand apart from other such platforms is that it doesn’t require lengthy smart contract programming. Users can easily and freely trade the tokens they create over the blockchain. Each user has scripts that manage and create each user’s tokens and keep them safe from cyber hacks.

The main aim of the Waves team was to create a platform that develops new tokens, as well as the mechanism to regulate them, in a way that is as simple as launching any other web application. Crypto jargon and understanding its mechanics can be quite a complicated feat for some but the Waves team has made it a point to simplify the process as much as possible.

The assets that are created and designed over the Waves blockchain are then subject to the built-in Waves Exchange. The Waves Exchange helps set the path for the tokens created over the Waves blockchain itself as well as other tokens of WAVES.

Waves Crypto Overview

[mcrypto id=”141362″]

How was Waves developed?

The Waves blockchain was developed back in 2016 by a Russian entrepreneur by the name of Sasha Ivanov. The founder wanted to develop a platform that simplified the crypto token process for users and gave them the autonomy to create their tokens with ease.

At the same time as developing Waves, Sasha developed the Waves Platform AG which is a non-profit company to drive and fund the blockchain. Operating from Moscow Russia, the Waves Platform has been the backbone of its domain blockchain network.

Back in 2016, right after the creation of the Waves cryptocurrency, the initial coin offering for WAVES was initiated. The process raised around $22 million in a short span of time. After the success of the coin offering, by the last quarter of 2016, WAVES cryptocurrency became fully functional.

How Waves blockchain operates

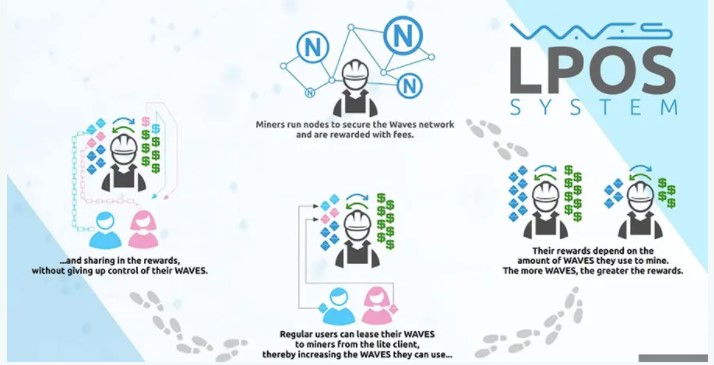

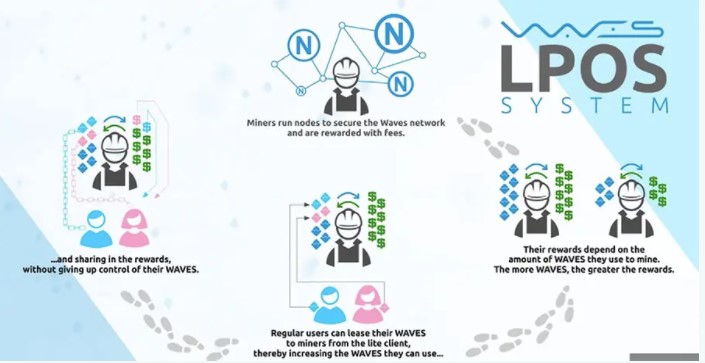

The background mechanics of the Waves blockchain aren’t too dramatic or complex. The software essentially uses two different types of nodes to run the system. The two nodes are full nodes and lightweight nodes.

The full nodes of the software are responsible for putting together and saving the history of the transactions. The lightweight nodes on the other hand are dependent on the full nodes for each transaction confirmation. The lightweight nodes also keep track of the one-on-one interactions between users across the network.

Alongside the system of nodes, Waves operates on the basis of a combination of POS and LPoS. Proof of Stake (POS) and Leased Proof of Stake (LPoS) work in sync to keep the network stable and to make it run smoothly.

Where to buy WAVES

The WavesDEX has proven itself to be a reliable exchange for trading cryptocurrencies. Traders’ funds are considered to be safer than on regular cryptocurrency exchanges because the funds are held in personal cryptocurrency wallets, rather than on a centralized exchange database.

The top cryptocurrency exchanges for trading in Waves stock are currently Binance, BTCEX, Bitrue, MEXC, and OKX.

How much is 1 WAVES?

How Staking Waves Work

Waves’ Exchange disclosed the inauguration of a decentralized Forex market (DeFo) on 29 September 2021. The new market will operate using stablecoins hooked to the rate of assorted fiat currencies. The market currently has seven different stablecoins.

As per the announcement, the initial seven stablecoins added to the platform include USDN, EURN, JPYN, CNYN, RUBN, UAHN, and NGNN. Furthermore, the firm revealed that the pairs added to the decentralized FOREX platform were created using the Neutrino protocol decided upon by ecosystem members.

If you wish to unstake USDN (Neutrino USD), sign in to your account on Waves. Exchange, hover over the Investments item, and click on USDN in the Neutrino staking section. Click on Unstake USDN. In the popup that appears, enter the amount you wish to withdraw and again click on Unstake USDN to confirm.

- Waves Price Prediction 2023 – up to $3.42

- Waves Price Prediction 2026 – up to $10.1

- Waves Price Prediction 2029 – up to $30.67

- Waves Price Prediction 2032 – up to $91.25

Waves Token Technical Analysis

Waves token has faced challenges lately as it got stuck in a bearish consolidation range amid the broader crypto market’s bearish trend. The concerns over regulatory scrutiny from the SEC, the loss of USDC’s dollar peg, and the collapse of SVB have added to the bleak outlook for WAVES’ price. Nevertheless, our advanced technical analysis can provide a comprehensive outlook on the risks and opportunities associated with investing in Waves. Despite the challenges, there may still be potential for growth in WAVES, and our analysis can help investors make informed decisions in this volatile market.

CoinMarketCap reports that the current price of the WAVES token is trading at $2.2, showing a downtrend of nearly 1.55% from yesterday’s price. Our technical analysis of the WAVES token suggests that this cryptocurrency could soon display bullish signals, surging to new highs as it experiences a significant recovery rally in line with the overall bullish trend led by Bitcoin following the Fed’s efforts to aid banks’ collapses. Looking at the daily price chart, Waves is struggling to trade above its EMA-20 trend line at $2.25, facing rejection near its immediate resistance level of $2.2. However, after forming a low near $2, the WAVES token has taken support and is making an effort to surge above the 23.6% Fib level. As the EMA-50 trend line has dropped significantly from its previous resistance level to $2.5, WAVES tokens are trading within a consolidation level dominated by bears. WAVES is currently in an extreme fear zone due to the SEC’s crackdown on crypto, creating a FUD situation for investors. The Balance of Power (BoP) indicator is trading in a highly bearish region of 0.92, suggesting that the bearish rally may extend if the WAVES token breaks below its consolidated pattern.

The popular RSI-14 indicator is trading on the verge of a bullish region at the level of 45, just near the midline, which may cause the WAVES token to test its resistance near the 31.6% Fib levels. Moreover, the MACD line has formed a bullish pattern in the chart, showing green candles above the signal line and indicating buying pressure in the WAVES price chart. However, the SMA-14 is not promising, as it is slowly dropping below the midline at 40, which may trigger a short-term bearish retracement for the WAVES token to bottom levels. If the Waves coin breaks above its resistance of $2.4, it may pave its upward road to its Bollinger band’s upper limit of $3.1, and if it manages to break its strong resistance of EMA-200 at $3.5, it may attempt to go higher. Conversely, if WAVES drops below the crucial support level of $2.1, a further bearish rally is expected, which may cause it to accelerate a sharp collapse and trade near its Bollinger band’s lower limit of $1.8. If Waves’ price fails to hold above $1.6, it may gear up for a more bearish bloodbath and trade near $1.2.

Waves Price Prediction By Cryptopolitan

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2023 | 2.81 | 2.9 | 3.42 |

| 2024 | 4.07 | 4.22 | 4.92 |

| 2025 | 5.78 | 5.95 | 7.15 |

| 2026 | 8.6 | 8.9 | 10.1 |

| 2027 | 12.7 | 13.06 | 14.99 |

| 2028 | 18.09 | 18.61 | 22.16 |

| 2029 | 25.07 | 26.01 | 30.67 |

| 2030 | 35.4 | 36.7 | 42.89 |

| 2031 | 53.43 | 54.89 | 62.2 |

| 2032 | 79.12 | 81.32 | 91.25 |

Waves Price Prediction 2023

Our Waves price prediction for 2023 is a maximum Waves price of $3.42. We can expect Waves’ price to be around an average of $2.9 and a minimum value of $2.81 for the same year. The prices will grow steadily in 2023, and the upward trend is expected to continue steadily as the bullish signals continue to develop.

Waves Price Prediction 2024

The Waves price prediction for 2024 is a maximum price of $4.92. We can expect the Waves price to be around an average trading price of $4.22 and a low price of $4.07 for the same year. The price increase of Waves here is steady, and the token’s price action is building solid momentum. The prices are projected to continue rising as vigorous support is created in 2024.

Waves Price Prediction 2025

Our Waves price predictions for 2025 are a maximum of $7.15. We can expect Waves’ price to be around an average of $5.95 and a minimum price of $5.78 for the same year. Here, we witness a turbulent year with increased price volatility. The Waves coin price fluctuates vigorously, as evidenced by the increasing gap between the minimum and maximum value according to the Waves price analysis.

Waves Price Prediction 2026

Our Waves price prediction for 2026 is a maximum of $10.10. We can expect Waves’ price to be around an average of $8.9 and a low of $8.6 for the same year. The price of Waves is forecasted to continue the established upward trend. Again, significant price fluctuation is witnessed, with wider price ranges. The projected volatility could result from increased adoption of the Platform, which increases demand for Waves coins.

Waves Price Prediction 2027

Our Waves price prediction for 2027 is a maximum of $14.99. We can expect Waves price to be around an average of $13.06 and a low of $12.7 for the same year. By 2027, the Waves forecast the price will begin to increase exponentially due to increased demand. The prices here are recorded alongside high trading volumes, indicating a solid trend that could continue upward according to the Waves price forecast.

Waves Price Prediction 2028

Our Waves price prediction for 2028 is a maximum of $22.16. We can expect Waves price to be around an average of $18.61 and a low of $18.09 for the same year. As predicted, the Waves price could break the ATH, as shown by the forecasted maximum price. The statistical analysis shows a strong bullish trend that will continue in subsequent years according to the current Waves price prediction.

Waves Price Prediction 2029

Our Waves price prediction for 2029 is a maximum of $30.67. We can expect Waves price to be around an average of $26.01 and a low of $25.07 for the same year. The gap widens between the projected low and highest price, indicating more volatility despite the increase in the token price. Trading volume continues to increase according to the predictions, cementing the upward trend according to the Waves coin forecast.

Waves Price Prediction 2030

Our Waves price prediction for 2030 is a maximum of $42.89. We can expect Waves price to be around an average of $36.7 and a low of $35.4 for the same year. The prices will continue to increase exponentially in 2029 as the Waves token continues to record new highs. By 2030, the token trading volume will begin to decline, indicating a possible reversal.

Waves Price Prediction 2031

Our Waves price prediction for 2031 is a maximum of $62.2. We can expect Waves price to be around an average price of $54.89 and a low of $53.43 for the same year. The projected prices continue to maintain the uptrend despite the decline in trading volume. Ideally, the price increase is fueled mainly by the increasing demand for the token due to the massive adoption of the Waves Platform.

Waves Price Prediction 2032

In 2032, our Waves price prediction expects the token to attain an average trading price of $81.32. The minimum projected price for the Waves cryptocurrency is $79.12, with a maximum trading price of $91.25.

Waves Price Prediction By Digital Coin Price

According to analysts at Digital Coin Price, WAVES is anticipated to surpass the $4.79 threshold in 2024 and may even reach a maximum level of $4.95 by the year-end. However, the cryptocurrency is also projected to experience a minimum dip of $4.70.

Digital Coin Price’s Waves price forecasts the anticipated projection for WAVES will surpass the $41.95 threshold in 2032. It is also anticipated that by year-end, WAVES will have a minimum value of $41.79. Moreover, there is a possibility that the price of WAVES may attain a peak of $42.50.

Waves Price Prediction By CryptoPredictions.com

CryptoPredictions.com’s Waves price predictions are optimistic for the upcoming years as the website expects a slow increase in the token’s value. In April 2023, it is forecasted that WAVES will begin trading at $2.609 and end the month at $2.759. The highest anticipated price for WAVES during the month is $3.397, while the lowest price is expected to be $2.310.

In 2027, the price of the Waves token is predicted to reach an average trading price of $5.75, with a minimum price of $4.89 and a maximum trading price of $7.19.

Waves Price Prediction By Wallet Investor

Wallet Investor gives a bearish outlook for the Waves token’s future price points as the token may devalue in the future. The website expects the Waves token to reach an average forecast price of $0.347, with a minimum price of $0.174 and a maximum trading price of $0.521.

Waves Price Prediction By Market Sentiment

Waves crypto has been gaining traction in the cryptocurrency market due to its unique features and potential for growth. Market sentiments and crypto experts suggest that Waves market has a bright future ahead.

One of the key features of Waves is its user-friendly platform, which enables anyone to create their own custom digital assets or tokens quickly and easily. This has made it popular among startups and small businesses looking to raise funds through Initial Coin Offerings (ICOs) or Security Token Offerings (STOs).

Conclusion

According to a recent blog post by Sasha Ivanov, the founder of Waves, the platform has some exciting future plans in store. These include enhancing the DeFi capabilities of its Ride programming language, introducing lending pools on Swop.fi – the Waves-powered liquidity pool, and launching DeFi protocol-based synthetic assets linked to stocks and Bitcoin.

Waves crypto has shown great potential in the crypto market, and it continues to garner positive attention from experts and investors alike. Despite the volatility of the crypto market, Waves has proven to be a resilient and promising investment option for those looking to enter the space. Market analysts advise you to do your own research before investing in the volatile crypto asset.

Waves cryptocurrency has seen tremendous growth recently as it partnered with some big names in the crypto markets. The coin is expected to continue growing in the years to come as more and more people adopt it. The Waves team is also working on upgrading to Waves 2.0 in the coming year. The new protocol is expected to improve the Waves outlook and performance.

The price of the Waves token is projected to have a general upward trend in the future. Despite the current bearish trend experienced in the overall crypto space, price forecasts show a promising future result for the Waves token. The projected increase in the token’s price is attributed to several factors.

Fundamental analysis shows that the Waves’ price will record healthy trading volumes that ensure the price of Waves continues to rise. Finally, the market research shows the overall acceptance of the Waves platform and it could also translate to an increase in the price of the Waves coin.

Prices may be volatile in the near term, but they could rise over time as the cryptocurrency market matures. If you buy WAVES now at $2.16, the possible ROI after nine years (end of year 2032) is 97.6% of the total investment.

Investors are advised to do their own research before investing in any digital asset.

Disclaimer. The information provided is not trading advice. Cryptopolitan.com holds no liability for any investments made based on the information provided on this page. We strongly recommend independent research and/or consultation with a qualified professional before making any investment decision.