NFTs are digital assets that represent real-world objects like music, art, digital avatars or images, videos, or any other collectible items but cannot be duplicated. They are backed by blockchain technology. The NFTs are sold online, frequently for crypto coins, and are encoded. Although NFTs use the same blockchain technology that powers cryptocurrencies, they’re not a currency.

In the digital and crypto world, NFTs are seen as the digital answer to collectibles, or are “one-of-a-kind” digital assets that have no tangible form, but can be bought and sold like any other asset. Or they can also represent real-world objects but fractional ownership can be shared by many using the Ethereum network and smart contracts.

Also Read:

• Best NFT Marketplace: Guide To Top Choices

• NFT Art Finance Token: Nftart Liberates Digital Art

• NFT Crypto Art: Disrupting The Art World

• NFT Marketplace: $2.5Bn Sales And Rising

• NFT Stocks: All You Need To Know

Even though said files are accessible to anyone and not restricted to the buyer, they still get big money for their investment. The market has raised a whopping $250 million in the year 2020 alone. All the big players of various enterprises are looking for their way into the NFT market. A recent report by nonfungible.com states that more than $2 billion was spent on NFTs during the first three months of 2021—marking a 2,100 percent increase from the fourth quarter of 2020.

Blockchain Technology and NFT

Blockchain has helped develop NFT through its proof-of-stake blockchain that enables NFTs and video gaming. This helps create never before seen realms of the internet-enabled virtual world with avatars and interactions based on digital assets and objects of augmented reality.

The continuing evolution of blockchain will make this an everyday reality on multiple fronts. Like cryptocurrency, blockchain is the enabling basis for NFT; however, the two don’t work the same way.

Difference between NFT and other tokens

The most essential and fundamental difference is that cryptocurrencies and other currencies are fungible, which means they can be traded or exchanged for one another. However, when it comes to NFT (non-fungible), they have a digital signature that cannot be sold or exchanged for one another due to their uniqueness.

NFT is simply another feather in the hat for the vast capabilities of blockchain technology. Much like cryptocurrency, it enables users to own assets and exchange them through a safe and reliable channel.

How does NFT work?

An NFT is created with a digital file that can either be tangible or intangible materials. The Ethereum blockchain records all the transactions over the public ledger and ensures the user’s safety, privacy, and assets.

At a very high level, most NFTs are part of the Ethereum blockchain. Ethereum is a cryptocurrency, like Bitcoin or Dogecoin, but its blockchain also supports these NFTs, which store extra information that makes them work differently from an ETH coin.

NFTs are bought and sold digitally in exchange for cryptocurrencies. When an NFT is sold, the creator gets some amount of commission in the form of cryptocurrency. Each marketplace has specific crypto wallet requirements. At present, no one wallet is usable on all the sites.

Each user has their exclusive ownership rights and unique data, making for a solid verification-based transfer of tokens between users. Like all digital entertainment-related assets, owners can leave their mark by signatures on their work through the metadata document. Artistic works have so far benefitted most from NFT since its birth. But you can almost sell NFTs in any form.

The file size or type makes no difference since it will always be a separate entity from the blockchain. When it comes to copyright or licensing, they might not automatically be applied. Most of the time, it is not a guarantee, like it wouldn’t be a certainty to gain rights to limited-edition nonfungible tokens.

In the digital content realm and applying NFT technology, anyone with the creativity and the audience for such creativity can use the underlying technology to create nonfungible tokens. The same blockchain technology for cryptocurrencies is now utilized by NFT creators as proof of ownership when you purchase NFTs. Here is a sample of how you can create NFT Crypto. The steps are:

- Create some art

- Get a crypto wallet

- Get some ETH (or don’t)

- Choose a marketplace

- Mint your first NFT

If you plan on selling NFTs or owning NFTs, you need to know more about the blockchain network, how to execute smart contracts, and be knowledgeable about the value of increasingly popular goods sold online.

How can NFTs be bought?

You will need a digital wallet that enables you to keep NFTs and cryptocurrencies stored. You may have to buy cryptocurrency in exchange for fiat money, like Ether, if you receive payments via NFT.

You can buy crypto from a credit card on platforms like Coinbase, Kraken, eToro, and even Paypal and Robinhood. You will therefore be able to transfer this currency into the wallet chosen from several digital wallets.

Most exchanges charge a percentage of your transaction when you buy cryptocurrencies, so remember these fees when researching various ways to navigate the market.

Examples of NFTs

NFTs have changed the perceptions and limitations of ownership rights. Based on the security of the blockchain, you can have solid ownership and authenticity in assets. Once NFTs started getting used to the auction of digital artwork, the unprecedented profits caught the eye of the masses to sell more and more digital art.

We have gathered many of the most famous examples of digital art being sold and many other physical objects. Here they are:

1. ‘Everydays: the first 5000 days’ by Beeple

A large collage of various bright photos was sold at an NFT auction for a whopping $69 million, significant development and event for digital artists and visual artists as the first digital artwork ever sold.

This set the foundation for more and more art world members to sell digital art and buy NFT art.

2. WarNymph by Grimes

Grimes is a famous artist who sold her digital assets known as “WarNymph” a broad collection of data. This collection of 10 digital assets, a collaboration with her brother, was sold for a stellar price of $5.8 million within the first few minutes alone.

3. NBA Top Shot

Sports collectibles are all high selling goods, primarily if related to the NBA. Top Shot is an NFT marketplace to buy, share or sell NBA franchise goods. LeBron James’ dunk against the Houston Rockets has been the most expensive collectible on the market thus far.

4.Cryptovoxels

Social networking, gaming, and commerce all join hands in this metaverse over blockchain technology. This user-based and owned virtual world is enabled on the Ethereum blockchain; it allows the exchange of parcels of land, art galleries, and interaction with other users.

Crytpovoxel is declared the Minecraft of cryptocurrency and has generated millions and millions for its users.

5. Jack Dorseys First Tweet

You might have noticed that all the above examples had popularity as a common factor. If endorsed or owned by a famous personality or celebrity, an NFT or any asset has twice the profits.

Similarly, Jack Dorsey, the CEO of Twitter, sold his first tweet for about $3 million as an NFT. Backed by a good cause, he aimed to invest the money into bitcoin and convert it to make donations to a charity named G.

Everyday uses of NFTs

The owner of an NFT typically refers to a license to use the digital asset but usually does not confer copyright or other rights to the buyer. Some licenses permit sole personal usage as well as commercial usage of NFT.

The identity and ownership can be confirmed at the blockchain Ledger. The NFT ownership is often associated with a digital signature/wallet. But is an NFT a cryptocurrency? Not really. When you buy an NFT, you are essentially buying a digital recording of ownership of a token, which can then be transferred to a digital wallet. Here are some ways you can apply for NFT ownership:

1. Music

Blockchain technology and the technology of the networks have opened the door for musicians to tokenize works and publish them as nonfungible tokens. The list of options was extended both for musicians and artists to monetize and profit from the music and other content in terms of music and artistic public image.

NFTs were applied to artists to increased revenues during the COVID-19pandemic that resulted in gain falling nearly 85%. The company reported around $57 million of annual revenue among the music industry in 2018 when it was the leading singer of the NFT XL.

2. Digital Art

A digital installation by the artist Beep called Everyday’s – The First 5000 Days sells in 2021 for US 69.3 million. A 3D-generated model titled “Mars’house” from the artist Krista Kim has sold on NFT as digital land for over US500,000.

In August 2021, Erwin Wurm released NFT among the first internationally renowned artists. The work Breathe In Breathe Out was published by German artist Knig for exhibition in MISA 20 years after Wurm’s first Fat Car.

3. Sports

NFTs have also been used for sport. In September 2019, basketball player Spencer Dinwiddie tokenized his contract so others who have invested in it. The Dapper Labs Blockchain platform was recently founded by dapper labs as an online platform integrated into any NB app.

Several digital video highlights can be bought through NFT marketplaces for sports-related goods and services.

4. Games

The NFT allows assets for trading without authorization from a game developer. NFT assets will often be represented in Game Asset, such as Digital Land Plats controlled by the user rather than the game developer.

5. Ticketing

Tickets are suggested as a user case for NFTs for any event. For instance, artists can be compensated to get royalties when they are allowed to resell. Another would be more intimate relationships between fan and artist.

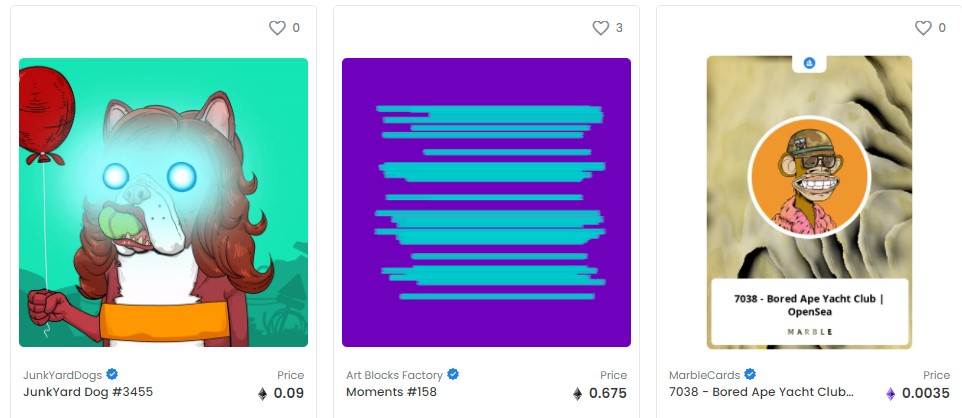

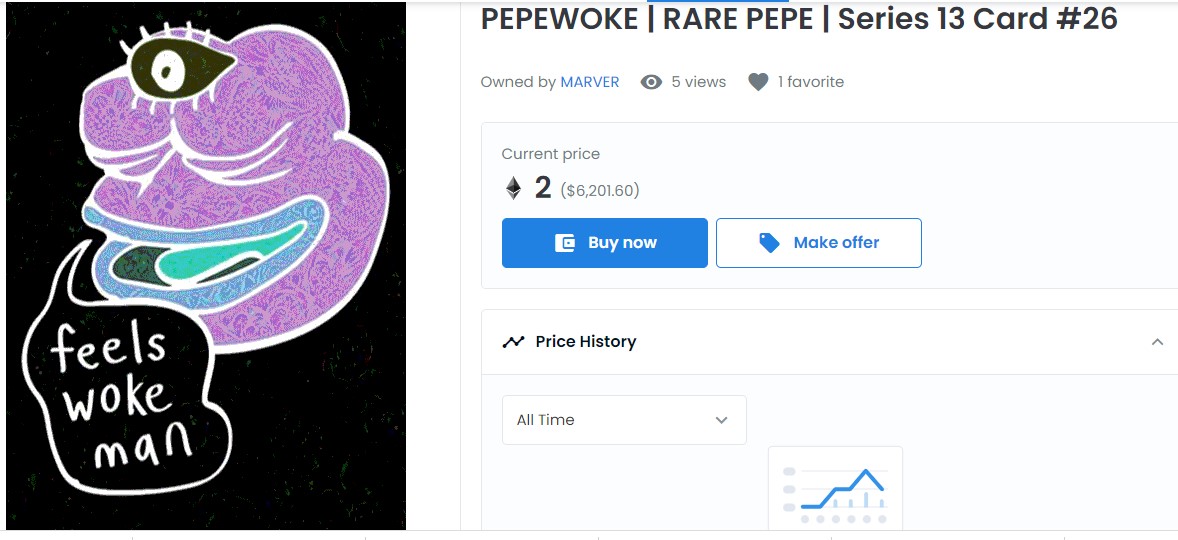

Popular NFT Marketplaces

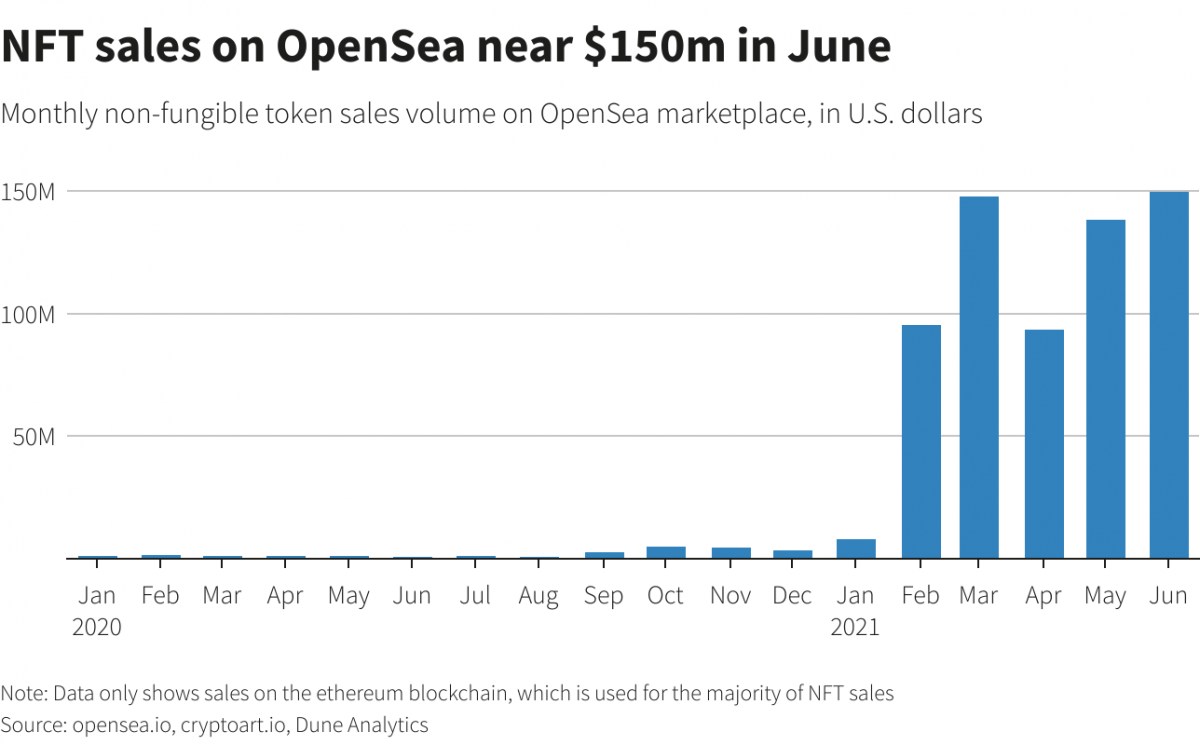

Presently the largest NFT marketplaces are OpenSea.io and Foundation.io. The community’s exclusiveness and price of entry are meant to afford it the potential to feature better-looking artwork. These NFT marketplace platforms aim to offer particular digital assets, i.e., assets belonging to a niche.

Certain artists suffered at the hands of Impersonators who listed and sold their work without permission. Buyer protections seem at best sparse, so when buying NFTs, it might be best to keep the adage “caveat emptor” (the customer beware). It may even mean a more significant price — not necessarily a bad thing to collectors seeking to capitalize. In Universal NFT Platforms, one can sell any kind of crypto assets. It can be anything from digital art to a domain. Some of the top Universal NFT platforms, Rarible, OpenSea, and Mintable.

1. Opensea.io

Once you create your account over their webpage, you’re free to browse their wide-ranged catalog. It is a peer-to-peer platform that offers rare digital and collectible items. Good browsing of the sales volumes will help you discover numerous new artists and objects.

2. Rarible

This open market is much more linked to artists and creators selling or issue their NFTs. RORI tokens are an excellent attractive incentive that helps with fees and community rules. It operates much like Opensea but has a more specified and targeted audience of creative types.

3. Foundation

It is a community-based marketplace that enables existing creators to invite other creators to sell their digital assets. This entire market comes with a cost entry; even if you’ve been upvoted by a current member, the minted prices add to the value of the artwork. Artists and investors will find the Foundation the ideal marketplace to truly capitalize on their artwork.

An excellent example of a peer-to-peer NFT marketplace is Valuables. It is a platform where one can essentially buy and sell tweets. Consider also Glass Factory, where users can purchase digital holograms. Other lesser-known marketplaces are Nifty Getaway and SuperRare.

Nifty Gateway is much like the previous marketplaces but art-focused for big creative brands, athletes, and creators. The goal is to generate the maximum profits on your digital art or other digital assets.

SuperRare is one of the marketplaces focused on curating and selling digital art. Most people spend millions on a worthless asset or buy another for a nominal price than they expected. Again, all that matters is that the original artist and owner profits off of the digital collectibles.

Why should you invest in NFTs?

Even though NFTs may seem risky in some instances, the question is, if you have the money to invest, why shouldn’t you? It might be worth starting with small investments to see where it goes for you. Whatever you decide is a personal decision since there is little to no way to determine the actual value of a digital asset with NFT.

Sometimes a particular asset may hold exceptional value or sentiments for the buyer; this shows that most digital assets have values that are dependent on what others are willing to pay. Like an auction, everyone is bidding for the highest price till the owner wants to sell. Technical or economic indicators play little to no role in the value of the asset.

This uncertainty may also mean that you might end up with less to nothing on your original price if you decide to resell your asset over NFT. If it loses demand, no one might buy it at all. One thing you must understand about NFTs is that you essentially purchased a token that gave you the right to own the original artwork. However, the actual copyright remains with the original artist or owner.

Since they’re not profitable stocks rather only collectibles, they’re taxed accordingly as well. The collectible tax rates may fluctuate too high and low rates for your digital assets, and it also depends on the increase in their demand over time.

Conclusion

NFTs have become the hottest crypto trend by 2020, and sales have increased 55% since 2020 from $250 million to $389 million in March 2021. The correct approach by most users has to been to do their research and understand the risks of investing in this marketplace.

From another perspective, after the first pandemic-induced lockdown, the real economy (comprised of the non-financial sectors) wrestled with an economic downturn. It seemed that the euphoria in the NFT markets was comfort food to escape from the depressing downturn.

It is not advisable to spend money you might otherwise need; start with a few dollars you have kept around extra. All blockchain-based avenues are highly volatile and uncertain; therefore, it is crucial to assess your options smartly. This warning does not seem to work for big spenders even as a shock in the form of slowing global trade has had negative effects on both the ‘real’ economy and financial markets.

NFTs have become a haven for creators and artists to get value for their work and effort. In such a competitive market that gives little space to digital art, NFT is a great avenue to earn and even get paid commission for their number of sales. The explosive NFT market growth is symptomatic of a deeper malaise: the process of financialization that has characterized the global economy for some time now.

All in all, if you’re looking forward to buying or selling an NFT, there is little history to judge to know for sure whether it’s the safest way. There is no way to know for sure if the value of an asset will increase or decrease or whether it will sell at all to begin with. It is a trade of making the best possible judgment and hoping for the best.

FAQs

What is a good NFT to buy?

10 Best NFT Stocks to Buy Now

- DLPN

- NET

- MAT

- ZKIN

- TKAT

- TWTR

- CIDM

Are NFTs likely to last?

The main reason why NFTs are likely to stick around and grow in popularity centers around the idea of uniqueness — having access to something that no one, in theory, could ever have access to without the owner’s active decision to replicate.

How many NFT buyers are there?

Buyers have mostly totaled 10,000 to 20,000 per week since March, outnumbering sellers, according to NonFungible.com, which aggregates NFT transactions on the Ethereum blockchain.

Are NFTs a form of cryptocurrency?

NFTs are, in a sense, just another asset class supporting the currency asset and blockchain exchange growth. They cannot be exchanged one-for-one which is what cryptocurrencies can be.