Fantom Price Prediction 2024-2033

- Fantom Price Prediction 2024 – up to $1.49

- Fantom Price Prediction 2027 – up to $4.37

- Fantom Price Prediction 2030 – up to $13.67

- Fantom Price Prediction 2033 – up to $40.59

Fantom (FTM) was created to overcome Ethereum‘s limitations and create a new generation of blockchain, solving the trilemma of scalability, security, and decentralization. However, with Fantom’s outstanding 2,108% growth and additional 2,000% unique addresses, FTM continues to struggle, losing 93% of its value from its ATH in Jan 2022. A better revenue-earning strategy must be put in place.

For 2023, we can expect FTM to spike to previous highs with the recent passage of a governance proposal bringing gas monetization to successful dApps. Gas monetization will benefit #Fantom‘s ecosystem of builders by introducing a new revenue source: monetizing the volume of transactions generated by their dApps. This aims to attract quality developer talent to ensure a healthy, sustainable network.

Fantom continues to attract investors as the billionaire investor and founder of HyperChain Capital Stelian Balta add another $15 million. HyperChain has a considerable investment track record in the past few years, a practice that enables it to keep doing well as other funds implode in the crypto winter. How has the Fantom community managed to navigate the chaotic crypto weather?

How much is FTM worth

Today’s live Fantom price is $0.4769, with a 24-hour trading volume of $86 M. Fantom has increased by 5.92% in the last 24 hours. The current CoinMarketCap ranking is #62, with a live market cap of $1,336,861,328. It has a circulating supply of 2,803,634,836 FTM coins and a max. supply of 3,175,000,000 FTM coins.

Also Read:

- Bitcoin, Ethereum, Fantom, and Nexo Daily Price Analyses – 21 November Roundup

- The fall and rise of Fantom, thank you, Andre Cronje

- How to Stake Fantom

- Oryen (ORY), Fantom (FTM) And Pancakeswap (CAKE) Could Make You A Millionaire

- Cryptos With The Best DeFi Features: Gnox (GNOX), Cardano (ADA),& Fantom (FTM)

Fantom price analysis: FTM experiences bullish sentiment

TL;DR Breakdown

- Resistance for FTM is $0.4861

- Support for FTM is at $0.2996

Fantom price analysis 1-day chart: Price indicates major retracement

Using Bollinger Bands, it can be seen that prices had a significant jump up to the upper band which represents strong buy pressure. This was then succeeded by the consolidation period where the price moved within the bands. At the moment, the price is retracing back towards the middle band that indicates a possible cooling down from the previous bullish sentiment.

The Moving Average (marked by an orange line) indicates a sustained uptrend since the price has been above this indicator for the duration of the study. This moving average has acted as the dynamic level of support for the price.

The RSI hit overbought region above 70 coinciding with the price peak and has since pulled back below this level. The RSI remains in the mid-50s as of the most current data point, signifying a less overbought state, although a relatively strong market for FTM.

The chart displays the price support and resistance levels. The current value is attempting to test the support level at 0.9748 USDT. In case this support holds, it could become a stabilization point; though a break below would mean the bearish view. Also, resistance at 1.1981 USDT could be the next target if the price recovers.

To sum up, the FTM price analysis on the daily chart predicts a correction following a strong move up, with a possibility of consolidation or further retracement signaled by the proximity of a support level and the RSI’s return to more neutral levels. The future price moves will be affected by if these support levels will hold whether or the price will break below them and the current bullish trend will be changed.

FTM/USD technical analysis on a 4-hour chart: FTM looks to be in a consolidation pattern with the price action testing supports

The 4-hour chart of Fantom (FTM) versus Tether (USDT) provides a short-term perspective of the market movements.

Bollinger Bands analysis shows that the FTM price is currently close to the lower band, which usually works as a dynamic supportive level. This implies the market could be in a low volatility phase with a likelihood of price bounce if the support level is maintained.

The moving average convergence divergence (MACD) is just below the signal line, but the moving average convergence divergence seems to be converging toward the signal line, as the histogram shows momentum reduction. It could mean a short-term change or stability if the MACD crosses above the signal line.

Price action is horizontal as supported by the horizontal channel of support at the level of 0.9447 USDT and resistance at the middle Bollinger Band. The price doesn’t show a substantial breakout from this range so it consolidates.

To summarize, on the 4-hour chart, FTM looks to be in a consolidation pattern with the price action testing supports and indicators indicating a possible stop of bearish movement. But, traders would normally seek for other indications in order to state with certainty the change in trend.

What to expect from Fantom price analysis next?

The 1-hour chart analysis of Fantom (FTM) vs Tether (USDT) shows a microcosm of price action, which provides intraday trading clues.

The price of FTM is slightly below the middle Bollinger Band, which usually serves as an immediate gauge of the market’s sentiment. The current position indicates possibility of a downward pressure or a side-way consolidation in the shorter term.

Price action has broken below the orange moving average line, which is normally used as a short-term trend indicator, indicating bearish momentum. This may be viewed as a reinforcement of the ongoing negative market sentiment towards FTM.

The recent candlesticks are mostly small, consolidation-oriented, with no breakout, representing a market with low momentum and traders’ indecision.

In general, on the 1-hour chart, FTM is characterized by the bearish tendency signs with a narrow range, which means that the market is in a state of confusion.

Is Fantom a good investment?

Fantom’s value proposition lies in its utility as a decentralized storage network, which could see increased demand with the growth of data storage needs and decentralization trends. Its investment potential is subject to the usual risks of cryptocurrency volatility, market sentiment, and regulatory changes. Long-term viability would depend on adoption rates, technological robustness, and the competitive landscape.

Our CP price prediction section will showcase how the coin perform in the next few years.

Recent news on Fantom

The Fantom Foundation has announced that it has drastically reduced the validator self-staking requirement from 500,000 FTM to 50,000 FTM. This change is effective immediately. By reducing the self-staking requirement, the Fantom Foundation aims to make the process of becoming a validator on its network more accessible and democratic.

Fantom introduces Sonic: Andre Cronje, co-founder of Fantom, is introducing a significant upgrade called “Sonic” to modernize blockchain technology. Aimed at resolving speed and cost issues prevalent in networks like Ethereum and Bitcoin, Sonic promises a 65-fold speed increase for Fantom. The upgrade targets major financial institutions and requires a substantial stake in native FTM tokens

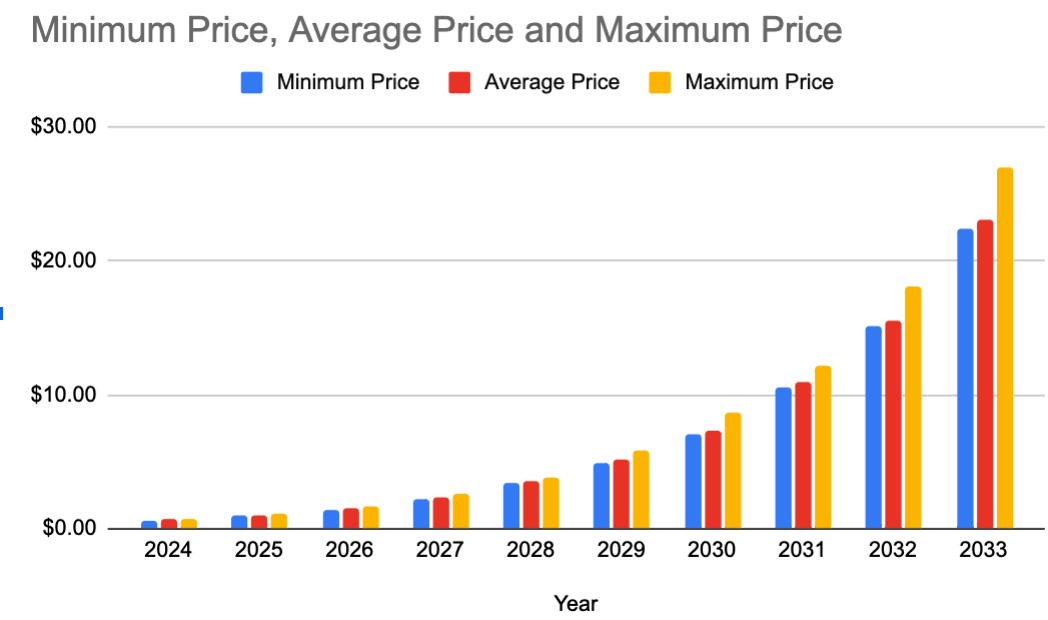

Fantom Price Prediction 2024-2033

Fantom FTM Price Prediction by Cryptopolitan

| Year | Minimum Price | Average Price | Maximum Price |

| 2024 | $1.21 | $1.26 | $1.49 |

| 2025 | $1.73 | $1.79 | $2.14 |

| 2026 | $2.51 | $2.60 | $3.08 |

| 2027 | $3.60 | $3.71 | $4.37 |

| 2028 | $5.40 | $5.55 | $6.35 |

| 2029 | $7.84 | $8.06 | $9.58 |

| 2030 | $11.62 | $11.94 | $13.67 |

| 2031 | $16.21 | $16.69 | $20.08 |

| 2032 | $23.41 | $24.25 | $27.67 |

| 2033 | $36.02 | $36.99 | $40.59 |

Fantom Price Prediction 2024-2033

Fantom price Predictions by Cryptopolitan

Fantom Price Prediction 2024

Our Fantom price prediction for 2024 suggests the cryptocurrency could reach a maximum price of $1.49. We anticipate a minimum price of $1.21 and an average trading price of $1.26.

Fantom Price Prediction 2025

For 2025, Fantom is expected to reach a maximum price of $2.14, with a potential minimum of $1.73 and an average value of $1.79.

Fantom Price Prediction 2026

Our prediction for 2026 indicates Fantom will achieve a maximum price of $3.08, with an average price of $2.60 and a minimum price of $2.51.

Fantom Price Prediction 2027

FTM is predicted to reach a maximum price of $4.37, an average price of $3.71, and a minimum expected price of $3.60 in 2027.

Fantom Price Prediction 2028

For 2028, Fantom might reach a maximum value of $6.35, alongside a minimum trading price of $5.40 and an average price of $5.55.

Fantom Price Prediction 2029

Our prediction for 2029 forecasts a maximum price of $9.58, with an average forecast price of $8.06 and a minimum price of $7.84.

Fantom Price Prediction 2030

For 2030, FTM may attain a maximum value of $13.67, an average trading price of $11.94, and a minimum price of $11.62.

Fantom Price Prediction 2031

FTM is projected to reach a maximum price of $20.08, an average of $16.69, and a minimum of $16.21 in 2031.

Fantom Price Prediction 2032

For 2032, FTM may reach a high of $27.67, an average price of $24.25, and the lowest possible price of $23.41.

Fantom Price Prediction 2033

In 2033, FTM is forecasted to potentially reach a maximum price of $40.59, with an average price expected to be around $36.99 and a minimum value of $36.02.

Fantom Price Prediction by Wallet Investor

According to Wallet Investor, Fantom could be a bad long-term investment. They expect the coin to be worth $0.0481 in one year and to devalue by 79.25% by 2029.

Fantom Price Prediction by Cryptopredictions

Cryptopredictions expects Fantom will have a maximum price of $1.693, with an average price of $1.345 by 2024. According to their Fantom Forecast, the coin’s lowest price by then is expected to be $1.151.

By 2025, Cryptopredictions FTM price prediction predicts that Fantom will have a maximum price of $1.424 with a minimum price of $0.968. The average trading price of the coin is expected to be $1.139.

Furthermore, Cryptopredictions expects FTM coins to have a maximum price of $1.04 with an average trading price of $1.663 by 2027. However, the coin’s lowest price by then is expected to be $1.413.

Cryptopredicts predicts that by 2028, FTM will have a maximum price of $2.399 and an average trading price of $1.919. The coin’s lowest price by the end of 2028 is expected to be $1.631.

Fantom Price Prediction by Digital Coin Price

According to Digital Coin Price, FTM is expected to have a maximum price of $1.31, with an average trading price of $1.26 by 2024. The lowest price of the coin is predicted to be $0.53.

By 2027, they also predict that FTM will reach a maximum price of $2.73. The average and minimum prices of the coin are $2.56 and $2.28, respectively.

By 2033, Digital Coin Price predicts that Fantom will have a maximum price of $11.62 and an average trading price of $11.54. The coin’s lowest price is expected to be $11.18

Fantom Price Prediction by Coincodex

According to Coincodex, FTM is expected to devalue and be worth $0.61 in 6 months. They predict that FTM will reach $1.47 in one year.

Coincodex also gave a long-term price fantom FTM price forecast. They expect the FTM price to reach a high of $0.85 by 2027, with a low of $0.58. They also expect the coin to be worth $5.02 by 2031, with a yearly low of $0.74.

Fantom Price Prediction by Industry Experts

Industry experts believe that Fantom will reach its all-time high in 2024. According to a recent analysis by the popular crypto trading YouTube channel “Successful Trading,” Fantom has a potential of 780% before the year closes at $3.4. The YouTube influencer gave reasons why the coin will do well this year, and one of their reasons is the fact that the Fantom blockchain has great fundamentals and projects that support it.

Fantom Price History

Looking at the price increase of FTM in recent weeks, the token looks like a good investment. FTM price was bearish during the initial phase; you could buy Fantom at $0.02 initially and then drop as low as $0.003 in the subsequent weeks. Even though some investors early lost money, prices soon turned bullish.

In May 2019, prices plunged to depths of $0.02 once again. After consolidating in this zone for a while, prices dropped further toward $0.003 and continued to dip.

The token maintained its bearish prices until the onset of the 2020 bull run. The bull run extended the price action even more.

The prices once again knocked $0.02, and it remained bullish. In 2021, the prices turned even more bullish as the Fantom price began its journey towards $1, maintaining its upward trajectory to the current price range of $1.98 and $2.2 in February 2022.

The bulls took prices even higher in 2021. The FTM token hit all-time high level of $0.916 in May 2021. At the time, its market cap was $476 million.

In July, prices dipped as low as $0.12. A bullish outburst followed this bearish momentum as FTM broke resistance levels, finally reaching another all-time high of $1.66.

In September, the token dropped again to $0.98 before rallying to another all-time high at $2.33. Prices turned bearish again, dropping to $2.02 in October before finally reaching their all-time high of $3.48.

The FTM market cap currently sits at $3.019 billion and continues to increase. The trading volume is 1,127,951,248 USD, while the prices are down by 1.36%. The current price of the token is around $1.25.

The price history of Fantom (FTM) from 2022 to 2023 showcases a dynamic market trend with significant fluctuations. On August 16, 2023, Fantom’s price opened at approximately $0.2285 and experienced a slight variation, reaching a high near $0.2286 and a low around $0.2106, before closing the day at about $0.2155. Moving into September, the opening price on the 1st was around $0.2007, peaking at $0.2045 and dipping to $0.1988, with the closing price settling at $0.2039.

In the latter part of 2023, the volatility of Fantom’s price became more evident. By October 20, the opening price had decreased to roughly $0.1770, with the high and low of the day being $0.1838 and $0.1765 respectively, concluding at $0.1825. A notable surge was observed on November 10, with the opening price at $0.2597, reaching a significant high of $0.2962 and a low of $0.2587, closing at $0.2939. This trend of fluctuation continued, as seen on November 16, where the opening price was $0.3293, soaring to a high of $0.3771 and a low of $0.3274, before closing at $0.3498.

More on Fantom (FTM)

What is Fantom (FTM)?

Fantom (FTM) is one of the best-performing tokens in the market. It is the governance token of a directed acyclic graph (DAG) smart contract platform, popular for eradicating the issues related to smart contract contracts.

The platform provides higher transaction speed, with a more reliable infrastructure backing up the platform. Fantom launched in 2018, but the mainnet OPERA of the platform came out in December 2018. The platform’s creator is Dr. Ahn Byung Ik, but Michael Kong is its current CEO.

The Fantom team provides increased scalability, decentralization, and security and specializes in full-stack blockchain development. Fantom is a fast, high-throughput open-source smart contract platform for digital assets and dApps using a new scratch-built consensus mechanism.

A unique feature of Fantom’s Mainnet is the Lachesis mechanism, which is responsible for 2-second transaction finalization and also brings several improvements to the existing proof-of-stake consensus.

The native token of the Fantom blockchain (FTM) aims to “grant compatibility between all transaction bodies around the world.”

$15M HyperChain Infusion

This latest eight-figure investment follows two previous investment rounds including an initial investment of $2.5 million made in 2018 when Fantom was founded and a $15 million investment in April of 2021.

The Fantom network is a high-performance, scalable, and secure smart-contract platform designed to facilitate decentralized, scalable, and secure applications.

According to data from the Fantom Foundation, there have been more than 178,000 smart contracts launched on the Fantom network to date, which process more than 850,000 transactions per day on average. There are currently more than 2.85 million unique wallets, with thousands more being added every day. As Fantom offers absolute finality, transactions can never be reversed and it offers institutional-grade security to distributed networks.

Fantom Price Perfomance

According to the official announcement shared by Fantasm Finance DeFi protocol, its mechanism was drained of $2,600,000 on 9 March 2022. Per the post-mortem, the exploiters utilized BNB Chain, Fantom, and Ethereum. The exploit was triggered by a previously unknown error in Fantasm’s pool contract.

The contracts’ devs missed the condition to check for the minimum amount of FTM injections required to mint XFTM, a synthetic asset of Fantasm. This flaw allowed the attacker to mint XFTM tokens with only FSM and exchange XFTM for FTM. The repayment campaign starts on 11 March 2022

They swapped FTM tokens to Ethers and moved the ETH from the protocol via Celer Bridge. The total amount lost amounted to approximately $2,622,097. On 10 March, the attackers started to wash their loot through the Tornado Cash mixer.

The Fantom community has submitted a new governance proposal to lower the self-staked amount required to run a validator node. When writing, the community needs to reach at least 5% of the total ADM supply to run a validator node on the network. If all stakeholders accept this new proposal, that percentage will reduce to about 20%.

With the tides constantly shifting between bearish and bullish conditions, it is almost impossible for any of the top contenders to maintain their ranks. Yet, some things happen that overturn the market. One example is when the Fantom project announced its integration with 123swap‘s uniquely designed framework: non-custodial, cross-chain, and decentralized.

Seamless integration with other legacy back-end systems

When applied to crypto ecosystems, Blockchain technology offers opportunities and benefits to businesses through greater transparency, increased security, and easier traceability. The network is open-source and fully permissionless and uses an Asynchronous Byzantine Fault Tolerance (aBFT }. Capitalizing on its full potential depends on seamless integrations with other legacy back-end systems to facilitate better outcomes.

Here’s how the blockchain process applies to almost every industry, and how it motivates interest and investment in blockchain technology integration over the past few years.

This event can help FTM gain mainstream acceptance among crypto stakeholders and inspire upward price movement. However, with Cronje gone at the end of March 2022, what is the outlook for FTM’s price and what direction can Fantom developers hope for in the future?

The goal at Fantom is to focus much more intensely on agile testing and the iteration of solutions. The overall aim is to experiment with many different possibilities and quickly isolate those that work best. A recent user survey brought out the ff results:

- 56% have been using crypto for more than two years; 64% for more than one year

- 62% of users who stake participate in liquid staking

- 69% of users have used a Fantom dApp at least twice a week in 2022

Conclusion

At the forefront of blockchain technology, Fantom is enabling faster and more secure DeFi transactions, paving the way for a decentralized future. Our price predictions are based on historical data, project use cases, collaborations, and fundamental analysis. With that in mind, we expect Fantom to increase in the future; thus making it a good investment. Our long-term Fantom price forecast is $40.59. We advise that you do your own research before investing in cryptocurrencies—including Fantom