Chainlink Price Predictions 2024-2033

- Chainlink Price Prediction 2024 – up to $26.85

- Chainlink Price Prediction 2027 – up to $81.47

- Chainlink Price Prediction 2030 – up to $242.98

- Chainlink Price Prediction 2033 – up to $772.47

No one could say if — and when — the crypto winter is ending. We can regard some successful strategies as “green shoots” to create hope for the crypto industry. ETH witnessed three consecutive weeks of inflows after 11 straight weeks of sell-off, according to a CoinShares report. Fear not, and let’s explore Chainlink Price Prediction.

How Much is LINK Worth

Today’s Chainlink price is $17.53, with a 24-hour trading volume of $356,410,249. Chainlink is down 2.59% in the last 24 hours. The current CoinMarketCap ranking is 16, with a live market cap of $10,265,536,437. It has a circulating supply of 587,099,970 LINK coins and a max. Supply of 1,000,000,000 LINK coins.

Chainlink Price Analysis: LINK Retrace The $17.53 as Following The Downtrend

- Chainlink price analysis shows a negative trend today

- LINK has lost 2.59 percent in the past 24 hours

- The $18.00 level remains a key resistance for the bulls

Chainlink price analysis on 13th April 2024 displays a bearish outlook. The digital asset is trading near $17.53 after reaching a high of $18.00 several days ago. LINK opened today’s session at $17.53 and has since suffered a downtrend, losing 2.59 percent in value over the past 24 hours. LINK has been trading in negative territory as the bears have been in control in today’s session.

Chainlink Price Analysis Daily Chart: LINK Downtrend Progress Amid High Trading Volume

The 24-hour chart shows that LINK has found support near $17.12 and is trading above this level. The nearest resistance for the bulls lies at the $18.00 level, recently proving a tough barrier for cryptocurrency. The daily trading volume has significantly decreased today as the bears have been in control, with over $356 million worth of LINK changing hands during this period.

Chainlink price analysis shows that LINK is trading below its 20-day exponential moving average of $17.82 and the 50-day EMA of $17.05. The relative strength index (RSI) has dropped to 42.20, indicating neutral price momentum.

LINK/USD 24-hour chart, Source: TradingView

The MACD indicator lost its positive momentum and dropped to 0.352, suggesting that the bears remain in market control. The Average True Range (ATR) has also decreased to 0.228, indicating decreasing market volatility in the near term.

Chainlink Price Analysis Hourly Chart: Recent Developments and Further Indications

The hourly chart for LINK indicates that the bears have been in control and are attempting to lower the price. The nearest support for LINK lies at $17.12, below which the bears could target $17.10 or lower levels. If it fails to break above $17.00 in the near term, the sellers may attempt to push the price down.

LINK/USD 4-hour chart, Source: TradingView

The RSI indicator has decreased and is currently at 45.82, suggesting some bearish momentum in the past few hours. The MACD indicator also shows a bearish crossover and is currently at 0.020, indicating that sellers remain in control. The ATR indicator has decreased to 0.236, suggesting market volatility is decreasing.

What To Expect From Chainlink Price Analysis

Chainlink price analysis suggests that LINK may face selling pressure soon if it fails to break above $17.60. The bulls must sustain their gains above this level and climb higher for a potential rally in LINK. If LINK fails to close above $17.60, it could return to the $17.12 level soon.

Recent News

Chainlink Whales Amass $112M in LINK Tokens, Fueling Price Surge

Chainlink, one of the leading altcoins in the crypto market, has witnessed a notable resurgence in the wake of a significant drawdown. Currently trading at $20.18, the token has experienced a modest 0.6% price surge over the past 24 hours, signaling a positive shift in momentum.

The price of $LINK has increased by ~15% since $LINK was first accumulated by this mysterious whale.

— Lookonchain (@lookonchain) February 11, 2024

And the whale has accumulated 5,587,368 $LINK ($112M) from #Binance via 55 addresses in the past 6 days.https://t.co/ds8Ghx6eyu pic.twitter.com/rqKjfwk95V

This enigmatic figure has amassed a staggering 5,587,368 LINK tokens, valued at around $112 million, through 55 different addresses on Binance within just 6 days. Other substantial LINK accumulations have been observed, including one withdrawal of 495,057 LINK worth $7.5 million on multiple occasions at an average price of $15.12.

While these individual accumulations do not wholly represent broader trends within the Chainlink ecosystem, data from IntoTheBlock suggests a total whale accumulation of $176.98 million in the past 24 hours, marking a substantial increase of 13.44%.

Is LINK a Good Investment?

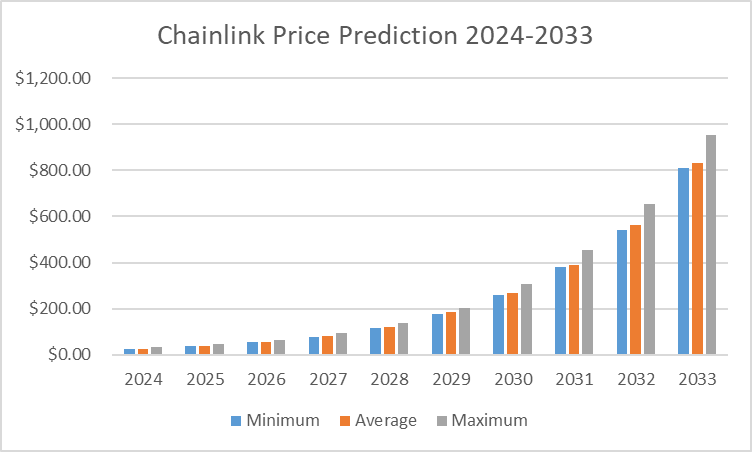

Chainlink Price Prediction 2024-2033

| Year | Minimum | Average | Maximum |

| 2024 | $23.05 | $23.77 | $26.85 |

| 2025 | $33.25 | $34.20 | $40.09 |

| 2026 | $46.90 | $48.26 | $56.85 |

| 2027 | $67.03 | $69.44 | $81.47 |

| 2028 | $98.42 | $101.89 | $116.13 |

| 2029 | $141.13 | $145.21 | $170.81 |

| 2030 | $209.93 | $217.20 | $242.98 |

| 2031 | $306.90 | $315.59 | $360.67 |

| 2032 | $447.24 | $463.02 | $534.33 |

| 2033 | $616.19 | $634.71 | $772.47 |

Chainlink Price Prediction 2024

According to the technical analysis of Chainlink prices expected in 2024, the minimum cost of LINK will be $23.05. The maximum level that the LINK price can reach is $26.85. The average trading price is expected around $23.77.

Chainlink Price Prediction 2025

After the analysis of the prices of Chainlink in previous years, it is assumed that in 2025, the minimum price of LINK will be around $33.25. The maximum expected LINK price may be around $40.09. On average, the trading price might be $34.20 in 2025.

Chainlink Price Prediction 2026

Chainlink price is forecast to reach a lowest possible level of $46.90 in 2026. As per our findings, the LINK price could reach a maximum possible level of $56.85 with the average forecast price of $48.26.

Chainlink Price Prediction 2027

Based on the technical analysis by cryptocurrency experts regarding the prices of Chainlink,in 2027, LINK is expected to have the following minimum and maximum prices: about $67.03 and $81.47, respectively. The average expected trading cost is $69.44.

Chainlink Price Prediction 2028

The experts in the field of cryptocurrency have analyzed the prices of Chainlink and their fluctuations during the previous years. It is assumed that in 2028, the minimum LINK price might drop to $98.42, while its maximum can reach $116.13. On average, the trading cost will be around $101.89.

Chainlink Price Prediction 2029

Chainlink price is forecast to reach a lowest possible level of $141.13 in 2029. As per our findings, the LINK price could reach a maximum possible level of $170.81 with the average forecast price of $145.21.

Chainlink Price Prediction 2030

Crypto experts are constantly analyzing the fluctuations of Chainlink. Based on their predictions, the estimated average LINK price will be around $217.20. It might drop to a minimum of $209.93, but it still might reach $242.98 throughout 2030.

Chainlink Price Prediction 2031

According to our deep technical analysis on past price data of LINK, In 2031 the price of Chainlink is forecasted to be at around a minimum value of $306.90. The Chainlink price value can reach a maximum of $360.67 with the average trading value of $315.59.

Chainlink Price Prediction 2032

The price of Chainlink is predicted to reach at a minimum level of $447.24 in 2032. The Chainlink price can reach a maximum level of $534.33 with the average price of $463.02 throughout 2032.

Chainlink Price Prediction 2033

Every year, cryptocurrency experts prepare forecasts for the price of Chainlink. It is estimated that LINK will be traded between $616.19 and $772.47 in 2033. Its average cost is expected at around $634.71 during the year.

Chainlink Price Prediction by Technewsleader

Chainlink price prediction by Technewsleader estimates the price of LINK to experience enormous growth. It could attain a yearly turnaround of a minimum of $37.96 and a maximum trading price of $95.36 by 2029. The market analyst states that LINK could attain a maximum price of $170.80 in the next ten years, with a minimum forecast price of $290.26 by the end of 2032.

Chainlink Price Prediction by Coincodex

According to Coincodex’s Chainlink price prediction, the outlook for the cryptocurrency is optimistic. By March 12, 2024, Chainlink is forecasted to rise by 6.45% and reach $21.46. The current sentiment is bullish, with the Fear & Greed Index indicating extreme greed at 82. Over the last 30 days, Chainlink has recorded 15 green days out of 30, with a price volatility of 4.17%. Based on these indicators, it’s deemed a good time to consider buying Chainlink.

Looking further ahead, the long-term Chainlink price predictions for 2025 through 2030 show a potential for substantial growth. By 2025, Chainlink’s yearly low is estimated at $20.15, with a high prediction of $77.71, offering a potential gain of 289.64% from today’s price if it reaches the upper target.

Similarly, for 2030, the price forecast ranges from $44.78 to $95.43, indicating a potential increase of 378.46% from the current price if Chainlink achieves the upper price target. These predictions highlight Chainlink’s potential as an investment option with significant growth opportunities in the coming years, particularly considering its role in the DeFi ecosystem and the increasing demand for reliable data oracles.

Chainlink Price Prediction by DigitalCoinprice

Coincodex is another website with a bullish outlook on LINK’s short-term and long-term prospects. The Chainlink price prediction suggests a bullish outlook with expectations of significant growth. By the end of 2025, Chainlink is forecasted to increase by approximately 254.91%, reaching a value of $27.67. However, the current Fear & Greed Index reflects extreme fear in the market. Over the next few years, gradual price rises are anticipated, with 2024 ending around $16.79, followed by $19.67 in 2024. By 2032, the price could reach $149.15, indicating long-term optimism.

Chainlink Price Prediction by Market Experts

Prominent crypto trader Michaël van de Poppe recently highlighted the potential for Chainlink (LINK) to enter a bullish cycle, noting its undervaluation compared to Bitcoin and strong weekly price action following a period of sideways movement. Poppe suggests that with Bitcoin showing signs of a macro reversal, altcoins like LINK, which have lagged in early 2023 trading, could see increased momentum. He believes there’s significant room for exponential growth as valuations remain below previous cycle highs. Specifically, Poppe envisions LINK breaking out from current levels convincingly within 2-3 months, with initial conservative upside targets set around $42.

Overall, the valuation of $LINK is very low compared to Bitcoin.

— Michaël van de Poppe (@CryptoMichNL) March 2, 2024

It's literally at the start of the bull cycle.

Great weekly candle, and I suggest we're breaking out of this range in the coming 2-3 months to 6700 sats. pic.twitter.com/Zc3ZGlxOrp

Chainlink has exhibited impressive performance, with a notable 17.2% increase in price over the past 30 days, despite being significantly below its previous all-time high of $52.70. This suggests a more achievable path towards double-digit values for the altcoin. Changelly’s cryptocurrency experts have provided their Chainlink price prediction, forecasting a minimum of $20.44 and a maximum of $24.56 for March, with an average price range of $20 to $21.83. Looking further ahead, the forecast suggests LINK could hit $42 by October 2025.

While the market outlook appears favorable for Chainlink and other altcoins, it’s important to note the unpredictability of the cryptocurrency market and its susceptibility to shifts in overall sentiment. With Bitcoin reaching $65,000, there’s anticipation for another potential bull run in the altcoin sector. Investors should remain vigilant and consider various factors when making investment decisions in this dynamic market environment.

Chainlink Price History

2018 began with a strong bullish rally, and most digital assets were at their summit. Chainlink token was not an exception. However, after that, a sharp freefall in the altcoins market resulted in billions of dollars being wiped out of the market.

We are currently witnessing a somewhat similar situation. Most altcoins are currently at one-half to one-fourth of their all-time high.

Not many altcoin projects managed to survive the famous crypto winter season. Some altcoins like Ethereum price and Chainlink price managed to endure the dark moment, and their price began rising.

2019 was a very significant year for Chainlink. Its token LINK was performing very impressively in the market. The performance is heavily associated with the pioneering DApps on the Chainlink network and listing by a few crypto exchanges, such as Bitbox, the previous year.

This drove the LINK price from $0.3 at the beginning of the year to a record $1.13 by May 2019. The oracle coin broke its ATH twice more that year, and on June 24, 2019, LINK’s price reached a record $4.540. The bullish rally was heavily driven by the release of the Chainlink network on the Ethereum main network.

In 2020, the Chainlink project emerged as the top performer of all cryptocurrencies beating significant cryptocurrencies like Bitcoin and Ethereum for the second year in a row. Bitcoin price The massive rally was heavily connected to the 2020 DeFi craze.

LINK began trading at around $1.70 and hiked toward $4.570 in February. LINK remained quiet until mid-July when the LINK price rallied towards a new ATH at $8.40. The rally continued, and Chainlink’s digital asset price almost hit $20 but faced rejection and pulled back to under $12.

In 2021, Chainlink’s price enjoyed a strong bull run as wave-like bullish activity caused the price to rise from the $12.00 mark to the recent highs of $36.00.

Chainlink’s price faced strong resistance at the $36 mark, which it could not break through and ended up being rejected from the level. The rejection caused the price to fall to the $23.50 mark before the price bounced back to the $30 support level.

Afterward, in May, the coin reached its all-time high of $52.88, and from thereon, it started to fall. The fall in the price of Bitcoin affected Chainlink until it was $30.

More on Chainlink

What is Chainlink?

Chainlink is known as a decentralized oracle network or blockchain abstraction layer. Chainlink uses blockchain technology to securely enable computations on and off chain, supporting what it calls hybrid smart contracts.3 Enterprises using Chainlink can access any major blockchain network, including Ethereum and Solana.

Chainlink Applications

Due to the way the smart contracts of Chainlink were developed, Chainlink has the prospect of fitting into every facet of our lives. Chainlink’s smart contracts were developed to solve the issue with Oracle. The Oracle problem is that blockchains were disconnected from the outside world.

The smart contracts for Ethereum and other crypto assets could only fetch data that was already stored on the blockchain. However, non-deterministic data (data outside the blockchain database) could not be fetched. However, the introduction of Chainlink introduced a middleware solution that could fetch data from outside a blockchain database.

It was done by creating decentralized networks of Oracles, and the fascinating thing here is that the blockchain is not in any way affected.

The ground-breaking development raises the prospect of Chainlink through the roof, and the technology is applicable in the following areas: using satellite imagery in the military for information gathering; triggering insurance payouts; global trade; direct transactions which cut out intermediaries for post-trade processing; paying your workers or getting paid in real-time for services rendered; can be used during elections to vote; can be used for trading on gaming platforms, etc.

Where to buy Chainlink (LINK)?

To use Chainlink’s Oracle system, you need to have Chainlink’s native token, LINK, as a payment means for the service. Chainlink network is built on the Ethereum network and utilizes ERC677, which obtained its efficacy from ERC 20 token standards and enables token transfer to comprise a data payload.

The ERC677 is also utilized for settlement with a Chainlink node operator who supplies and feeds data into the network, paid for by the buyers. The vendors decide the cost of the service after bidding.

Many investors are wondering where to buy the token Chainlink. Apart from earning Chainlink tokens by participating as an oracle or a node operator, they can also be acquired from a cryptocurrency exchange.

Top crypto exchange platforms such as Binance, Coinbase, and Gemini allow individuals to buy LINK using fiat currency via a credit card or debit card, bank transfer, etc. Use a hardware wallet to store LINK tokens securely.

When did Chainlink reach its all-time high?

The popularity and demand for smart contract technology surged in 2021 due to the heightened proliferation of blockchain tech and the Ethereum blockchain’s upgrade. On January 23, LINK’s price reached a new all-time high of $52.

The price of Chainlink continued the positive momentum, and a little later, it was trading at record levels above the $30 price level. On February 14, 2021, LINK peaked at $35.58, setting a new all-time high, but it has since retraced lower.

The coin surged after a small downward trend, reached another all-time high, and traded at $52.43 on May 10. This was the new all-time high set by Chainlink in May.

It couldn’t continue this price growth; shortly afterward, it fell nearly half this price. Chainlink’s price today is just above 25 USD.

What drives LINK price?

Certain prominent elements affect the market value of any cryptocurrency. Such factors include economic news, market sentiments, and government regulations. Apart from these popular asset price influencers, we have identified some more factors responsible for the price actions of LINK.

- Chainlink Future Developments

Chainlink continues to garner significant appeal among developers, and it has completed over 300 integrations with nodes, data providers, DeFi, and blockchain-based projects. To date, every single Chainlink integration has bolstered LINK’s market capitalization, and continued growth is expected.

The more projects linked to Chainlink, the higher the market price of LINK, especially if the projects boom with impressive scalability. In 2021 alone, Chainlink had over 700 partnerships, integrations, and collaborations; in the first quarter of 2022, the project added 140 more.

- Speculations and Interests

The surge in the price of LINK is often tied to rising interest in the coin and significant DeFi developments. It is no hidden secret in the crypto market that when institutional investors turn to an asset, its price goes up.

Similarly, speculations play a significant role in the price of any asset. The value of LINK will respond to rumors in the crypto space, news, and discussion in public columns among miners, investors, and devs.

More importantly, DeFi migration for centralized finance systems will undoubtedly generate massive speculative interest in blockchain projects like Chainlink.

- Oracle Services Functionalities

The output of a smart contract is only as good as its external data sources. Hence, if the data source is malicious, the smart contract outputs inaccurate outcomes.

Ensuring the validity and accuracy of data sources is one colossal concern that Chainlink solves via its Oracle services. The expansion of Chainlink’s functionality could significantly impact LINK’s market value, as seen in 2019 when Google announced a Chainlink integration that led to a giant leap in the coin’s value.

More future integrations and real-world applications will definitely affect LINK’s price.

Where to store LINK

You can use a software wallet (e.g., MetaMask, Trust Wallet) or a hardware wallet (e.g., Ledger, Trezor). When it comes to using a crypto wallet vs. an exchange to store your coin, crypto wallets are generally preferred. However, these options are a bit more cumbersome and do come with their own risks. For example, if you lose your wallet keys, nobody will unlock them for you. But crypto investors still recommend using these wallets because they give you full control over your coins and are less likely to get hacked.

Conclusion

Chainlink theoretically faces off against the entire cryptocurrency market as a cryptocurrency. However, there are only three major rivals to Chainlink as a project: Band Protocol, API3, and WINKlink. As connecting other projects is the primary function of Oracle networks like Chainlink and the three listed above. The most crucial parameter for them is the number of partners they have got, making them compatible with one another and the outside world. Chainlink has ten times more collaborations and integrations than those three combined, putting it far ahead of its rivals. It is unquestionably the best.

The long-term price projections indicate LINK will probably reach new all-time highs as crypto adoptions intensify in the coming years. However, these are our Chainlink price predictions based on deep analysis and the tracking of historical data, so they are not investment advice. Do your own research before taking an investment option.