There’s no doubt that both Bitcoin and Ethereum have had a great year so far. Bitcoin survived the pandemic and displayed its safe-haven characteristics as it moved from its March lows of $5,000 to touch a high of $15,968 last week. Similarly, Ethereum also moved from $190 to reach $490 high. All this happened within a few months’ time and placed these digital assets in the top investment baskets across the globe.

However, long-term perspectives define an asset as per its macro fundamentals. The birth and rise of DeFi or ‘Decentralized Finance’ bought a new lease of life into a dwindling ETH. The surge in the DeFi realm also bought prosperity to Ethereum. Now, DeFi is struggling, and many say it was like a bubble from the very beginning. The point is – why is Ethereum looking stable despite a fading DeFi scene. Well, it all comes down to ETH 2.0 upgrade and the role it will play in Ethereum’s lifetime journey.

Bitcoin, Ethereum, DeFi, and ETH 2.0 – Yes, all are connected

Binance, in its trading report for October, notices that Bitcoin is now well involved in DeFi and that ETH 2.0 is much awaited even from a trader’s perspective. The report features insights deciphered from extensive trading data, including the futures markets.

October saw Bitcoin price rise to touch the $14,900 mark, marking more than 27 percent. However, the realm of DeFi has reported losses, and Binance’s DeFi index has charted a downward trajectory for the past few months. Most of the DeFi tokens have lost close to 90 percent of their value.

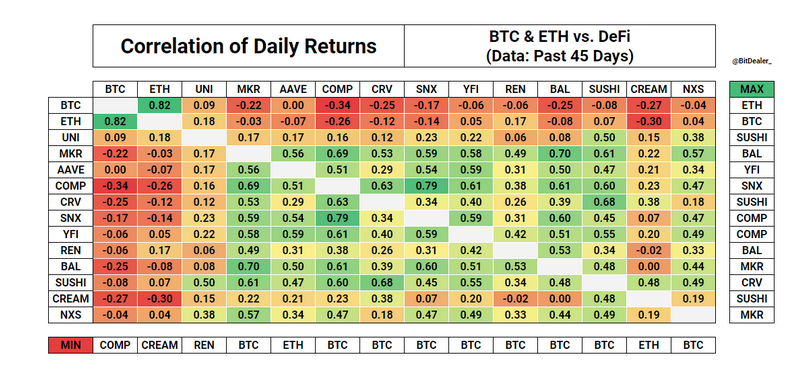

There’s nothing but carnage across the board when it comes to DeFi. What was initially dubbed as correction turned out to be a massive bear run where investors lost a significant part of their investments. Interestingly, Binance notes how DeFi and Bitcoin are now closely related to each other. The introduction of ‘wrapped BTC’ meant that most of the DeFi money moved into Bitcoin to avoid risk, which was supported well by the rising Bitcoin price.

What’s even more surprising is how ETH is now decoupled from DeFi despite sharing technology. DeFi is powered on the back of ETH, and the whole realm depends on ETH stability to function. Analysts believe that DeFi fundamentals are safe, and the decline is only related to risky assets. Long term investors need not worry as ETH 2.0 will bring a breath of fresh air.

How ETH 2.0 will save Ethereum

ETH 2.0 investors are banking on a slew of updates that aim to reform many of the ETH ills. From enhancing transactions to improving the ETH ecosystem’s efficiency, ETH 2.0 is hailed as an elixir. The ‘Proof-of-Stake’ model will help maintain supply while reducing the token supply. ETH 2.0 Phase 0 is set to launch near December 1, subject to minor conditions. The road looks clear, and the next ETH upgrade won’t face any hurdles.

The successful projects of DeFi still enjoy funding. That’s because investors believe that ETH 2.0 improvements will also trickle down to DeFi. The Binance report highlights how a dwindling DeFi won’t take down ETH with it. The upgrade will help DeFi survive and push ETH price to new highs as it bolsters Ethereum’s sentiment.