The hottest name in cryptocurrency today has to be DeFi or decentralized finance. DeFi has to be the one innovation that has had the most impact on traditional finance in recent times. It combines new-age banking solutions with conventional practices to deliver an innovative approach to finance.

Technically, DeFi employs automatically enforceable agreements or smart contracts built on blockchain technology to provide banking services without involving intermediaries such as banks or lawyers.

But exactly what is Defi? When people ask, “what is DeFi?” it can be roughly defined as an ecosystem of permissionless financial applications built using public distributed ledgers. It is a way to offer traditional financial services, including lending, payment, asset management, in a decentralized setup.

What’s important about DeFi

Decentralized economics merges traditional banking with next-gen technologies, including blockchain. It is often called ‘Open Finance’ since it incorporates inclusive arrangements to build decentralized solutions aimed at the financial segment. The projects serve the consumer’s traditional economic needs, including lending, savings or checking accounts, trading, and many more.

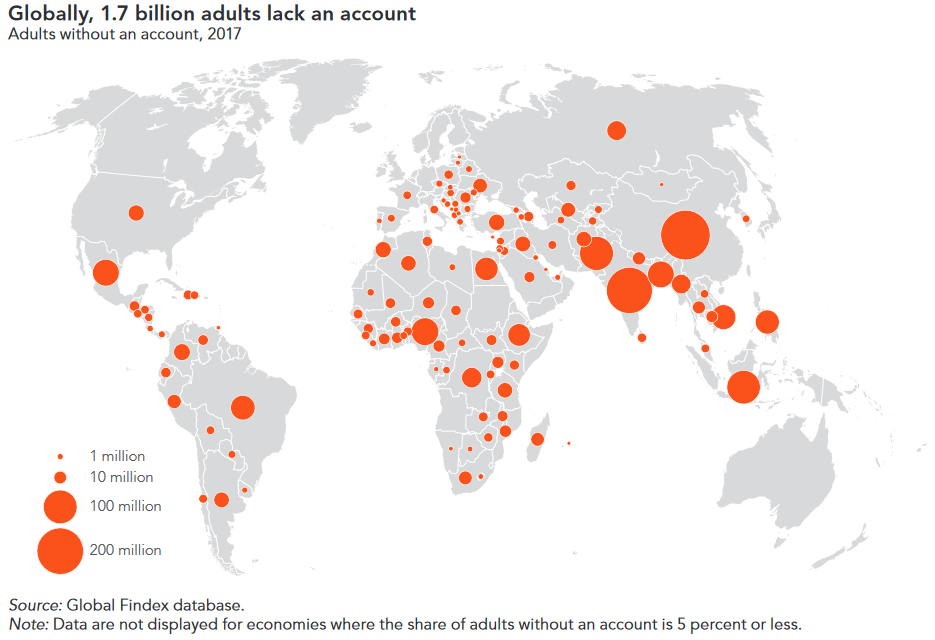

DeFi is evolving quickly, and it now includes every facet prevalent in the traditional industry. First, the DeFi revolution is helping people in remote areas get access to money through safe channels. It has opened a huge portal of opportunities that traditional finance missed to date.

Second, the functionality, safety, and accessibility on offer by Defi applications are far ahead of conventional financial solutions. All you need is a smartphone with a decent connection. The global expansion potential is practically endless. Most crypto analysts regard DeFi as the most vibrant and innovative sector in the entire crypto and blockchain realm today.

DeFi tokens are outperforming their crypto counterparts by a huge margin. Most of the DeFi projects have huge potential to leave an indelible mark on the financial sector for years to come. At present, the projects are at a nascent stage, yet they have achieved a huge following. As the industry blossoms, DeFi is sure to develop into a credible alternative to the traditional banking system.

One thing that has drawn people to cryptocurrency is its decentralization. Aside from other factors, decentralized finance is an essential area that has made people interested in crypto affairs. The decentralized system involves making financial transactions using a smart contract.

With this method, you do not need to have a third party involved in your affairs before making a financial transaction. DeFi rules out the role of intermediaries like a lawyer or the bank. The agreement is automated and makes use of online blockchain technology.

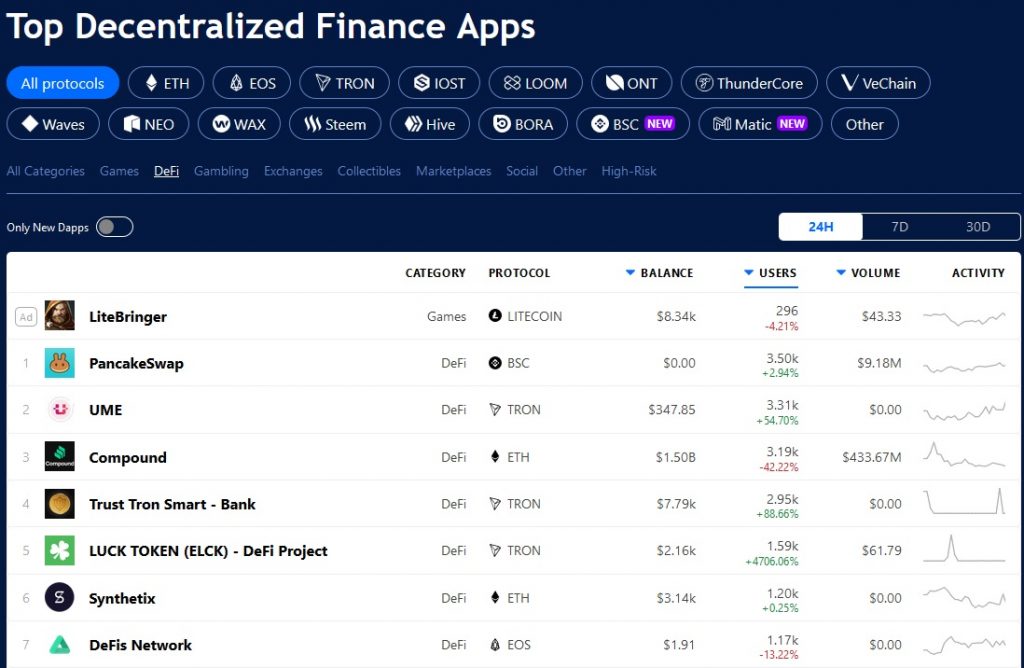

The use of DeFi DApp has been impressive. People are buying into the smart contract option rather than traditional financial systems with intermediaries. Since September 2017, over $15 billion has gone through DeFi and been locked up.

In a nutshell, DeFi is a system that uses the traditional financial system but uses smart contracts in place of intermediaries. The open finance system does not have any central authority. So, it is safe to say that the decentralized DeFi project annexes the traditional financial system and blockchain technology.

What can you do with DeFi?

Since introducing cryptocurrency like Bitcoin into the financial system, the centralized finance industry has not remained the same. With the rise of digital assets, the financial market experienced an exponential movement that overturned some traditional financial ways.

When the DeFi apps came on board, it proved itself as the game-changer. Decentralized finance has been a huge curve in the narrative of things financial-related. This change is possible with the impressive DeFi application.

An autonomous approach to handling your financial business

The decentralized applications (DApps) have impacted financial services, especially cryptocurrency trading. Doing crypto trading on decentralized exchanges (dexs), like Uniswap, is the evidence of this change that does not seem to consider a reverse.

In a decentralized exchange that supports decentralized applications, trading is entirely P2P. Your privacy and smooth transaction are the goal. You can trade with fellow traders and investors without having a third eye on your affairs like in a centralized exchange.

With this method, you can rule out other companies and financial institutions prying into your financial affairs. You do not need another platform to carry out your transactions. This exception affords you an autonomous approach to handling your financial business. Unlike a centralized exchange, you do not need to hold your assets in third-party wallets.

An option to trade currencies that are matched with other currencies

Using the DeFi ecosystem, you can buy digital currencies referred to as stable coins pegged to another particular currency in value. For instance, USDC and DAI have been pegged to the US Dollars.

An option to operate in an open system lending platform

With the DeFi lending protocol, the system is open. It provides decentralized lending platforms. Lenders and borrowers can operate with smart contracts, thereby ruling out the need for intermediaries and papers to be signed. It is a welcome change to the regular lending protocol.

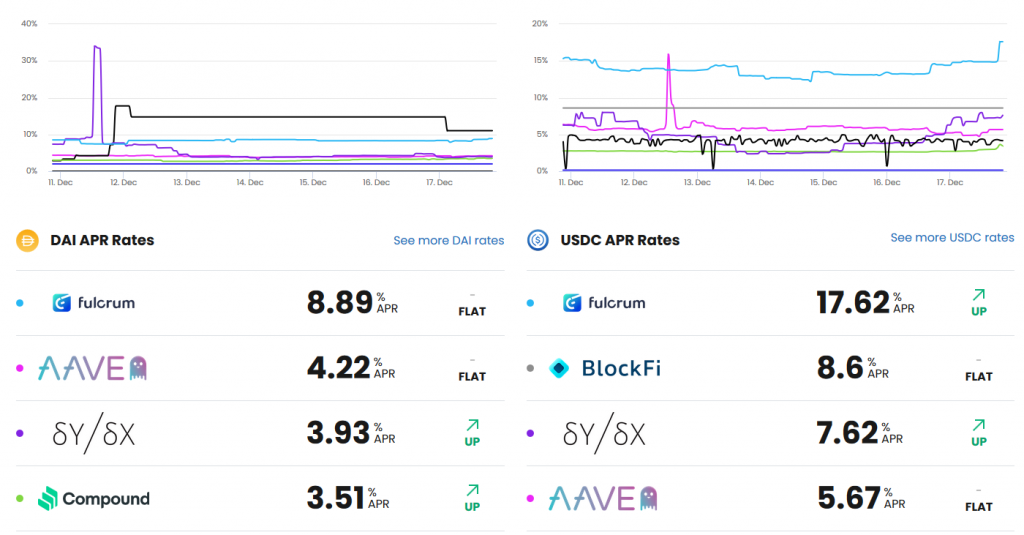

As a lender, DeFi gives you the chance to make extra bucks while transacting. While you are lending synthetic assets, you can earn interest. As a borrower, you are prepared to access liquidity without you having to sell off your assets. This feature means an increase in your liquidity pool. It is made available to users on such platforms as Aave and Compound.

Like the traditional system that requires you to have collateral for borrowing from the bank, you also need collateral in this system. One reason why the Defi system has been seen as a merger of both the traditional banking system and blockchain tech.

However, in this case, it is a smart and more efficient way of doing things. The borrower has to offer a more valuable underlying asset than the loan they want to access. The liquidity provider also enjoys some safety.

An option to trade beyond the cryptal space

With the Defi platform, you can trade in real-world assets like precious metals or currencies. Then, you can create and exchange their derivatives on such platforms as Synthetix.

A platform to make predictions

Another service you can enjoy with the decentralized application is a platform where you can bet on future events and get some positive results. Some platforms where you can do this are Gnosis, FTX, and Augur.

It is much like the traditional prediction market but with technological innovation occasioned by blockchain. There are no intermediaries involved. As a DeFi developer, you can partake of these predictions. For example, during the US presidential elections in 2020, these prediction markets flourished, with Augur recording over $8 million.

A platform to participate in a lottery

Another reason why some people use and recommend the Defi financial applications is in the areas of the lottery. You can participate in a no-loss lottery where everyone puts in their money and plays the lottery. This kind of lottery is different because no one loses.

When a winner emerges, the winner takes the accrued interest while everyone takes their money back. You can participate in this DeFi sector using the PoolTogether platform.

The good side of this lottery is that there is no loss for anyone involved. If you do not win, you can get your initial amount back. If you win, you will get the whole interest from everyone’s money.

A platform for yield farming

One new term that is making the rounds in the DeFi sphere is yield farming. It involves locking up cryptocurrencies for rewards. Yield farmers use coins like Tether, Dai, Ether, and so on. Two money markets where yield farming blossoms are Aave and Compound.

Yearn. Finance, and Uniswap

Yearn.Finance and Uniswap are platforms that serve to improve users’ experience within the DeFi system.

Uniswap is a Defi protocol that is meant to provide a solution to the issue of liquidity in decentralized exchanges. Built on Ethereum, it is meant for swapping tokens. Of course, you can swap your Defi tokens there too.

Yearn.Finance is created to maximize yields using the yearn protocol. It allocates liquidity to other DeFi solutions. With these two platforms, users’ experience within the Defi space is enhanced.

Why is DeFi making massive progress?

Since its introduction into financial transactions, the DeFi product has been recording upward mobility with great strides. One would wonder why DeFi is making such massive progress in the financial space. Why the craze for DeFi, you would want to ask. Here are some of the reasons why DeFi is the go-to option for most people.

Regulators are buying into it

Regulators have been the agent of change in the financial world. Most of the progress or retardation recorded by some financial trends and applications introduced into the financial institution has been because of regulators.

Regulators wield power to either allow a novel system to thrive or quench its fires even before it begins to spread. As a result, they are saddled with making some important decisions that will affect the state of society and everyone involved.

Whether or not they buy into a financial product will determine if it will thrive or not. The situation is a delicate one. If they allow these novel approaches to handling financial affairs to thrive, they may be putting financial institutions like companies and banks at risk of not making a living as intermediaries.

Also, they have to make decisions that will protect society from the financial risks involved in making financial transactions and saving money in unregulated spaces. But, a large number of people already buy into this innovative asset. Moreover, with the trend in technological innovations affecting every aspect of human lives, there will only be more innovations and not fewer.

Holding onto the archaic approaches to handling financial affairs has been the bane of novel approaches. It has created a hostile environment that has nipped some innovation. However, it seems that the era of stifled creativity is rolling by.

From the look of things, these regulators accept these changes because they are making some decisions supporting DeFi. The United States Securities and Exchange Commission (SEC) approved Arca in July 2020. Arca is an Ethereum-based fund. Its approval is a positive sign towards the acceptance of DeFi.

This is a far cry from the 2018 incident when New Jersey-based Basis returned US$133 million because the SEC regulations stifled its operative spirit. Nevertheless, with the current trend of things, there is hope of a better environment for technological innovations in the financial space.

Financial institutions are buying into it

DeFi has also garnered interest from mainstream players. Some big figures and institutions are beginning to accept DeFi and incorporate it into their system. For instance, 75 of the world’s authoritative banks incorporate blockchain tech into their operations to make payments faster and more efficient. This financial instrument is part of the Interbank Information Network headed by The Royal Bank of Canada, ANZ, JP Morgan.

People want to take advantage of the value

One reason why DeFi records so many savers is that people have seen that there is value in saving with DeFi. DeFi has higher returns. Many tokens were worth very little when they made their entrance into the financial space. However, with people putting interest in DeFi, the resultant effect is obvious in the rapid growth of the tradable asset.

Today’s financial institutions have a lot to learn from the multi-dimensional approach of decentralized economics. The Polymesh blockchain seeks to resolve some of these challenges for businesses and financial institutions with regulated assets.

The Covid-19 restrictions have favored the system

The Covid-19 pandemic has created an environment for DeFi to thrive. With the Covid, some territories are under restrictions. Also, the interest rate in global settings is lower than usual.

However, with DeFi, investors have a higher interest rate. Compound offers an interest rate of 6.75% annually for people who use decentralized stablecoin Tether. In addition to this impressive interest, savers also get Comp tokens. People who do not have bank accounts can make use of DeFi.

Advantages of decentralized finance

This decentralized system has given crypto asset an edge over fiat currency and other valuables. Here are some of the advantages of this technological innovation in the crypto world:

DeFi has affected market trend in favor of all tradable tokens

With DeFi coming into the market, people have found a better, easier, and more effective way of doing financial transactions, and of course, they have given it some serious thought. The result of that thought is the rise in the reputation of DeFi.

For example, in the traditional finance system, lenders and borrowers are legally required to know themselves before any transaction occurs. That is, both parties will have to make known their identities. Also, the lender will have to evaluate the borrower and ascertain their ability to repay the loan before the transaction can occur.

With DeFi, there is no need for such scrutiny and consideration. The system allows for trust and privacy. The smart contract has an enforceable agreement, and the process is automated. It uses online blockchain tech. With an option such as this, most people are making a U-turn on their way to the usual traditional financial system and are locating the way to DeFi.

DeFi has occasioned a rise in the value of digital assets

The market capitalization of tradable tokens has risen massively as a result of this system. Tokens that traders use for DeFi smart contracts are higher in value presently. Within the space of a year, some tokens have tripled their value and even more than that.

The Aave token, for instance, has increased almost 200 times its value. Another token, the Synthetix Network Token, has risen 20 times more than its value. The erc20 tokens are also doing well. All of these are made possible by the DeFi system.

DeFi grants people access where the traditional system restricted them

With the stringent requirements of the traditional system, most people cannot access financial services within that space. There are several restrictions on loan issuance platforms.

However, with a DeFi tool, anyone can access financial services. Factor like age, wealth, or geographical location is no barrier to anyone. With a mobile phone and internet connection, anyone can access the internet and access financial services.

DeFi offers more transparency

DeFi offers a more transparent financial platform than the traditional system can offer. Most DeFi protocols are created on the blockchain and are accessible to everyone involved. The transactions recorded on the system are open for public scrutiny. You can also get to use governance tokens to shape the protocol’s future. The accounts have numerical addresses, only making them privacy-sensitive.

With the transactions open to everyone, there is no room for suspicion. It is a platform where trust and privacy thrive. This kind of operation promotes accountability. Where transactions are accounted for, there is a higher chance of improved operations.

Drawbacks and risks of DeFi

With the juicy tales of Defi services also come some risks that cannot be neglected. Some of them are:

Third-party audit

DeFi is built on a smart contract. Somehow, the Defi protocols may be susceptible to manipulations. A DeFi protocol that contract its smart contract audition to firms may be putting the system at the mercy of exploiters, whether now or in the future.

Centralization of data feed

DeFi uses blockchain protocols. However, they cannot access off-chain data. This point is where oracles come in. These third parties close the gap between the blockchain and offline information.

The point of worry in this setup is the possibility of the oracle making a mistake. If it ever happens that the oracle relays wrong information, the resultant effect will be disastrous.

Risk of hackers

There are chances of hackers taking advantage of the system since it operates a decentralized app. Without a central body, hackers could do havoc on the KuCoin exchange platform in September 2020.

While centralized exchanges could freeze the hackers’ accounts, thereby halting their activities, those with a decentralized system could not freeze their funds.

What are Decentralized Applications?

Decentralized applications are a huge part of the entire DeFi spectrum. Apps are central to understanding the DeFi’s capabilities and how it operates. The dApps are applications built on blockchain that functions to serve financial operations through a decentralized network. Whether it is blockchain or other DLT-based foundation, the idea is to build a decentralized framework. Thus, DeFi applications are not under any central organization or monitoring authority.

How dApps are Taking Over Traditional Finance

The dApps are fully automatic and are driven by smart contracts that define the various financial functions. These pre-programmed contracts work flawlessly as per the initial fed values and protocols. Most importantly, smart contracts can handle a diverse range of functions, including client approval and payment processing. Think of them as money legos that can be expanded as per the developer’s choice.

DeFi progress currently depends on Ethereum evolution. Most value is locked in Ethereum based projects. The programmatic flexibility and scalability of Ethereum will define how fast Defi financial products progress.

Vital DeFi components

The realm of DeFi apps is growing at a tremendous speed. The applications serve myriad purposes, helping save time and money. Today, almost every sector has a relevant DeFi application. As the sector undergoes expansion, the dApps also expand their outreach to serve more clientele. Here are some common DeFi applications characteristics:

Open-Source

Most DeFi apps follow open-source protocols to remain decentralized and serve a wide range of audiences. The public coding helps get multiple programming inputs. The auditing remains transparent besides offering superior security and functionality. Open-source codes are known for their security and stability.

Transparency

When it comes to DeFi, the concept of transparency acquires a whole new meaning. Transparency is inherently ingrained within the decentralized realm, and DeFi is no different. Since most dApps are built on Ethereum blockchain, which inherently offers superior transparency in terms of transactions, payment processing, functionality, and smart contract mechanisms. Unlike traditional banking, the entire blockchain-related interaction remains in the public domain.

Another key difference is that individuals are not connected directly with a bank’s specific account per se. Instead, the system employs a numerical address, and the underlying account itself remains pseudo-anonymous. Information about crypto assets remains secure at all times. The accounts do have owners and can be traced back if need be.

Global Outreach

There is a dearth of banking channels in developing nations. Decentralized Finance is helping empower the downtrodden with safe banking solutions. DeFi developers are building next-gen financial platforms that can be used in remote areas with minimal internet connection.

Besides developing nations, Defi services also serve developed regions where traditional banking flaws have disrupted financial channels. Age-old banking and currency systems are now being upgraded with new technologies. The unbanked masses and the traditional clientele are both getting on the DeFi bandwagon. Whether it is a village in Hawaii or a New York City, numerous types of Defi services are available at the tap of a button.

Permissionless

There are no gatekeepers in DeFi, and the power is available for anyone. Anyone can access or develop a DeFi application with minimal limitations and permissions. Unlike licensed players, DeFi is open-source and therefore far better accessible.

The conventional bank account does not give much freedom, and approvals are a huge concern. Interest rate related hassles are kept at a minimum. The decentralized world skips unnecessary regulatory mechanisms and thereby deliver the best open finance products.

Interoperability

Interoperability is at the heart of the DeFi revolution since it is meant to bridge new-age and age-old banking channels. Interoperability ensures that seamless functionality is maintained across diverse blockchain platforms. DeFi solutions or money legos must operate across myriad networks and platforms to serve its diverse clientele.

Decentralized solutions are designed to remain accessible to developers, users, critics, and everyone. Also, users must be able to deploy stablecoins, trade at an exchange, use wallets, and do so simultaneously. Therefore, interoperability is crucial to the Defi applications since these money legos require deployment in diverse blockchain environments.

Flexible

Flexibility is one characteristic that is at the core of DeFi apps. A flexible environment, especially Ethereum blockchain, allows the developers to remain in sync with changing financial scenarios. Platforms must remain flexible to offer newer functionality and integrate with other platforms/networks. Users should be given independence in designing their interface and interaction protocols for a smart investment.

DeFi redefines lending solutions

Lending is one area where DeFi shines. Over the past two years, DeFi lending solutions have really taken off big time. The traditional loan approval process is cumbersome, time-consuming, and confusing. Large banking giants rule the lending realm and have a monopoly in their respective regions. Negotiating with lending companies for a suitable loan is nothing short of harassment.

DeFi has redefined lending by designing innovative consumer-centric products. The new-age DeFi powered financial system delivers flexibility, better rates, faster processing, more money lender options, and so much more. Ethereum is also gaining a foothold in the lending arena. There has been a sea change in the lending sector ever since the introduction of decentralized apps.

Compound – Redefining lending

Compound dApp is where DeFi really shines the brightest. It has shown the world how lending can be an interesting concept by empowering both the consumer and the lender. Compound gives users the ability to lend their cryptocurrency out to other users without any intermediaries. In return, the lenders earn interest, which is also in crypto assets form. From an investment perspective, lenders and borrowers are matched as per smart contracts making it a far safer process than today’s lending scene.

Additionally, smart contracts also manage the payment of interest rates as per the changing market conditions. There is no third party or intermediaries involved in the process. Compound has been so successful that many similar dApps have been built on the same interest rates pattern.

Decentralized Exchanges – bringing together tomorrow’s traders

A Decentralized exchange represents the coming of age of the crypto realm. This DeFi use case offers more security and safety features to crypto users with minimal human intervention. Peer-to-peer lending is ideal for serving the unbanked and those looking for more flexibility. The streamlined user interface and enhanced security are perfect in today’s cyber scenario.

Unlike the centralized, traditional money market or Coinbase, decentralized exchanges are more transparent, secure, and efficient. Conventional products are vulnerable to thefts, security breaches, and hacking scandals. A quick Google search reveals a history of exchange crashes causing huge losses to users.

Decentralized exchanges don’t suffer from such issues. Smart contracts ensure money or digital assets are not held directly, and blockchain hides the user data. Wallet-to-wallet interaction promises more security for your digital assets. There is no centralized point to attack in a decentralized exchange.

Uniswap – Next Step in Lending Ecosystem

With the introduction of ‘Automated Market Making,’ the Uniswap platform changed the way users trade. The innovative smart contract mechanism allows instantaneous settlement between parties. The live rates offered to the traders help execute trades with confidence unlike other traditional types of trades. The ‘Pooling’ feature further allows the users to earn interest via lending without any third-party involvement.

Next-Gen Savings Powered by DeFi

Savings are the life-blood of the financial industry. Be it small-term saving accounts or pension funds, savings are crucial to a working professional’s life. DeFi products are helping redefine the way savings are done in today’s age. Collective interest-earning apps are helping users save money and earn more interest on their collective kitty.

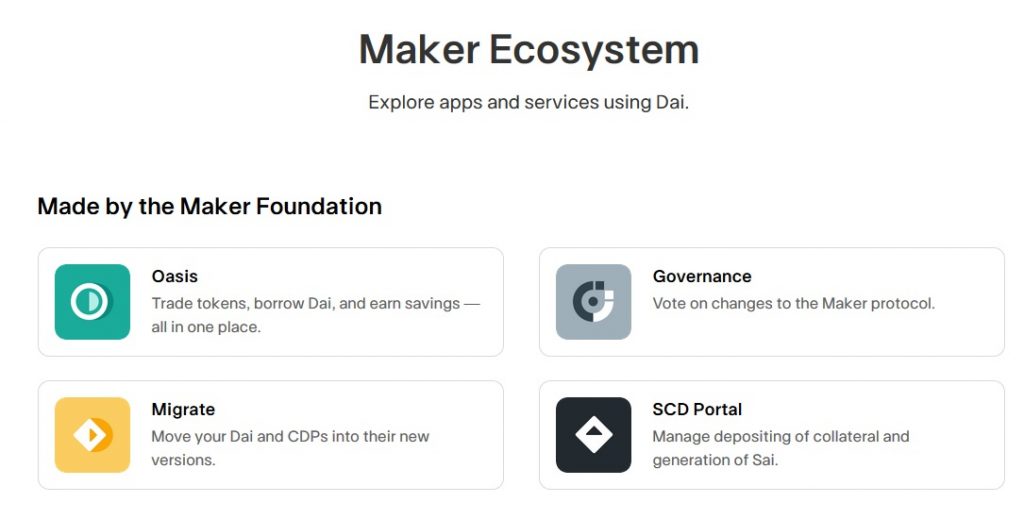

MakerDAO – The King of Decentralization King

Maker stablecoin allows pegging of other stablecoins with the US Dollar by backing it up by crypto collateral. In other words, users can now deploy crypto without worrying about the volatility that plagues cryptocurrencies such as Bitcoin and ETH.

Users can build their very own DAI stablecoin using the Maker Oasis dApp. Furthermore, dai stablecoin can then be used for various purposes, including trading, transactions, and much more. In a way, Maker can be termed a decentralized reserve bank offering dai as a panacea.

What the future holds in store for DeFi

Today, DeFi products are dependent on a collateral model to safeguard investor interest. As DeFi evolves, borrowers will build their credit history, allowing them to borrow sans collateral. Such an identity-based mechanism would require a universal decentralized identity mechanism built upon solid financial and economic credentials.

Vulnerabilities in the smart contract must be plugged to further secure the dApps from hacking attacks. Over-collateralization must be avoided to develop lending credentials at par with today’s lending institutions.

Evolutionary DeFi to Power Next-Gen Finance

Improvements in the user experience will help bring more users to its fold. The First-generation DeFi ecosystem lacked an interactive user interface and website browsing experience. Latest dApps focus on user interaction to appeal to a wider audience. Just like crypto assets, Ease-of-use remains a key design criterion.

Crypto wallets will also undergo evolution to offer more features and functionality to the consumers. In the future, all-inclusive crypto wallets will be the flavor as consumers seek a one-size-fits-all solution for all their crypto investments interaction. One crypto wallet must serve as a universal gateway for comprehensive digital asset management. Imagine a home page that shows all your holdings with a single click, including loans, collateral, holdings, trading activity, and more.

Merging traditional finance with DeFi concept

Decentralized governance is another interesting area emerging out of the DeFi ecosystem. Initially, many DeFi solutions have centralized characteristics, including ‘master keys’ to control certain functions. For example, an emergency shut off valve in the hands of the developer team can help secure the dApp in the event of a hack.

However, the evolution of DeFi demands that governance protocols be shared with the stakeholders. Decentralized Autonomous Organizations are fast emerging as decision-makers helping stakeholders exercise more control instead of banks. Today’s financial institutions have a lot to learn from the multi-dimensional approach of decentralized economics.

Is DeFi here to stay?

Monetary issues have always been central to human civilization. Money, in one form or another, has been driving human endeavors for millennia. For decades, the U.S dollar ruled the scene. Today, crypto is doing the same thing, albeit on the cyber front. We might see a complete overhaul of the financial realm and the abolition of fiat currency in the future.

Future trajectory of DeFi

Cryptocurrency and blockchain are emerging as next-gen technologies with the potential to script enormous social change. As societies evolve, new technologies power human needs. Today, decentralized technologies powered by Ethereum are doing just that. Various type of Dapps deliver financial services using smart contracts and a technological twist to disrupt the traditional system.

DeFi solutions are setting benchmarks in both the financial and economic sectors. The old fiat currency ways are being challenged. Fast-moving economies are adopting the latest decentralization technologies to serve their citizens with the best banking solutions available. DeFi solutions represent the cusp of democratic ideals by offering a highly transparent financial system that is truly decentralized. In a way, DeFi means more power to the people.

Conclusion

Decentralized finance is a technologically innovative approach to financial trading that disrupts the status quo in the financial space. With the advent of DeFi into financial discourse, the system has experienced massive growth. Given the market trend and the continuous technological breakthroughs the sector has experienced, we are looking at a more decentralized and liberal financial system.

Something truly remarkable is happening in the financial system – cryptocurrencies are empowering the unbanked. The concept of money is changing as people accept the new normal, i.e., digital assets. Large financial institutions are looking at crypto in a new light. The world is witnessing a quantum leap in banking channel development. It is rare to see an entire sector transforming so fast in such a short time and that too from scratch.

DeFi will soon catch up with conventional fiat financial services. Evolutionary patterns always include ups and downs, which help bring improvement phases. DeFi will also undergo suitable corrections in the future before it establishes itself as the ‘De Facto’ financial mechanism to serve the masses. Till then, there’s ample scope for technological improvements.

The responsibility bestowed on everyone concerned minimizes the risks involved with the system to protect savers and interested bodies. It also calls for a responsible system of maximizing its potential and enhancing its benefits to everyone concerned.