“When it rains, it pours” is an adage that has been true in the crypto world. For a few months now, the cryptocurrency sector has had a bad run of luck. Voyager Digital Ltd., a broker, filed for Chapter 11 bankruptcy protection on Wednesday, aggravating the industry’s problems. Voyager Digital has joined the growing list of CeFi businesses harmed by Three Arrows Capital’s crash and declining cryptocurrency asset values.

Voyager Digital files for bankruptcy

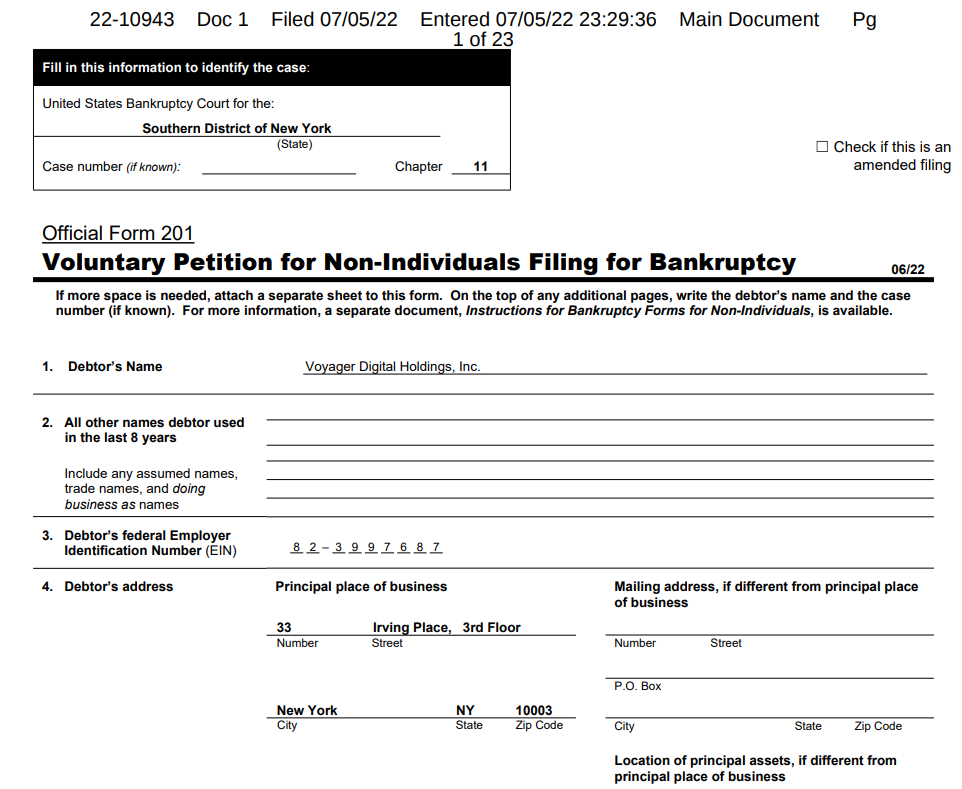

Voyager Digital, a cryptocurrency exchange that halted trading, withdrawals, and deposits the day after Halloween, has filed for Chapter 11 bankruptcy in the Southern District Court of New York. According to Voyager’s Chapter 11 bankruptcy filing, it is liable for anywhere from $1 billion to $10 billion in assets to more than 100,000 creditors.

Since last year’s peak, the crypto market has lost almost $2 trillion in value. This occurred amid a worldwide financial tightening that resulted in liquidity loss and leveraged bets that blew up.

Voyager Digital LLC and Voyager Digital Holdings are the two parts of the business. The ill-fated crypto exchange wasted little time after the United States’ 4th of July holiday filing for bankruptcy on July 5. On Wednesday, Voyager clarified that the maneuver is part of a “Plan of Reorganization.”

As part of this process, the proposed Plan of Reorganization would resume account access and return value to customers. Under this Plan, which is subject to change given ongoing discussions with other parties, and requires Court approval:

— Stephen Ehrlich (@Ehrls15) July 6, 2022

The strategy would enable consumers to reaccess their accounts, and Voyager Digital would return value to customers. The bankruptcy procedures of Chapter 11 put a halt on all civil litigation activities while allowing businesses to develop turnaround plans.

We strongly believe in the future of the industry but the prolonged volatility in the crypto markets, and the default of Three Arrows Capital, require us to take this decisive action.

CEO Stephen Ehrlich

Voyager Digital, a New York-based financial, is the most recent member of the sector to hit difficulties. Last month, hedge fund Three Arrows Capital was liquidated after failing to repay creditors; it had received hundreds of millions of dollars from Voyager.

Voyager Digital offered crypto trading, staking, and yield products. Withdrawals from firms offering high-yield services such as Celsius Network, Babel Finance, and Vauld have been halted as liquidity dried up. Voyager Digital declared a default on loan worth around $675 million issued to Three Arrows Capital last month.

Many of the crypto industry’s recent problems can be traced back to the collapse of TerraUSD in May. This stablecoin lost almost all its value, along with its paired token.

What is the way forward?

On Wednesday, Voyager Digital announced it had over $110 million in cash and held crypto assets on hand. It intends to pay staff using normal means and maintain their primary benefits and certain customer programs without interruption.

The firm is working to recover from the embattled crypto hedge fund, which includes the judicial liquidation process in the British Virgin Islands. Crypto markets dropped slightly after today’s filing. Bitcoin suffered a loss of 2.4% to $19,950 at 1:31 p.m. in Singapore as a result.

During the reorganization, we'll maintain operations. We intend to certain customer programs without disruption. Trading, deposits, withdrawals and loyalty rewards on the Voyager platform remain temporarily suspended.

— Stephen Ehrlich (@Ehrls15) July 6, 2022

The filing comes as industry experts increase their scrutiny of Voyager’s business practices, notably how the Canadian-listed firm stated in marketing materials that investors’ deposits were protected by Federal Deposit Insurance Corporation (FDIC) insurance.

FDIC insurance would protect bank-held cash deposits up to $250,000. However, it would not cover cash that is converted to stablecoins. Some people, including Coppola, have said that Voyager’s marketing around its handling of deposits is misleading.

Furthermore, the FDIC insurance kicks in if a bank goes bankrupt – this time, Voyager was insured by Metropolitan Commercial Bank. There is no assurance of survival in the event of a Voyager collapse. According to the filing, Voyager owes Google about $1 million.

For additional questions about the Chapter 11 process, you can call 1 (855) 473-8665 (toll-free in the U.S.) or +1 (949) 271-6507 (for parties outside the U.S.), or visit https://t.co/pJwk9cP8By. As always, thank you for your continued support.

— Stephen Ehrlich (@Ehrls15) July 6, 2022

According to the company, it has $100 million in cash, $350 million in cash at Metropolitan, and $1.3 billion in cryptocurrency. It also stated that it was owed $650 million from Three Arrows.

Stephen Ehrlich, the CEO of Voyager, stated in a July 6 tweet that customers with crypto in their accounts would get a mix of crypto, recovered Three Arrows Capital (3AC) funds, and common shares under the company’s proposed plan.

He also added that customers who have U.S. dollars in their accounts will be able to access those funds after a “reconciliation and fraud prevention process is completed with Metropolitan Commercial Bank.” Voyager Digital stated that part of the re-organization process would be for the firm to file “First Day” motions, which will allow it to continue operations.

In the same Twitter thread, Ehrlich stated he felt Chapter 11 was the best road for his clients, taking all variables into account, and assured that the platform’s assets would be protected and that Voyager would continue functioning.