TL;DR Breakdown

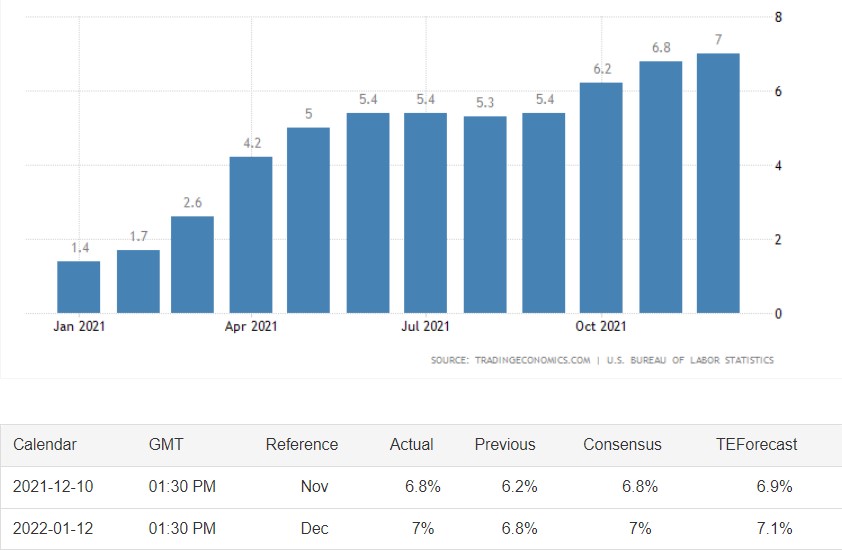

- US inflation has hit a 40-year record high of 7%

- CPI has increased 0.5% since December.

- The global crypto market has spiked 3.4% since yesterday.

- Stricter policies from the Fed can continue the bearish market for crypto.

The daily cost of living in the world’s biggest economy is increasing every day. US inflation has reached 7% as recorded on January 12th. It’s the largest increase in 40 years. To understand this inflation from a practical perspective, used car prices are up by almost 37%, and the average rental cost is up by almost 10%. Other daily necessity items such as food and fuel are also experiencing a sharp spike in prices.

In October last year, the US inflation rate was recorded at 6.8%, which was already inflicting tremendous pressure on the global economy. However, with 7%, the US economy is going into a very scary zone, as politicians are struggling to manage the consumer price index (CPI).

The US President Joe Bidon himself admitted that “there’s more work to do”, as political pressure piles up on the Democratic leader. The US is already struggling with its financial markets since the beginning of this year, with massive turbulence in the stock markets.

CPI data shows that consumer prices have actually increased 0.5% since December, the highest increase in a month since the pandemic had started. However, it’s not just limited to the US market. Consumer prices in the UK have also increased by 5.1%, a record-high in 10 years. The Bank of England predicts that increasing energy prices could take inflation over 6% in the country.

How will inflation impact the crypto market?

The crypto market experienced a short rally when the inflation data was published yesterday. This is because historically traders rush to buy riskier assets when inflation goes up. As a reason, we saw a subtle spike in Bitcion and the leading altcoins. The global crypto market cap has increased 3.4% in the 24 hours.

However, it’s not necessarily a good thing for crypto. We might just be experiencing a ‘dead cat bounce’, as the market is still very bearish. The rising inflation could force the Federal Reserves to aggressively raise interest rates and reduce its balance sheet. If that happens, treasury yields will go higher and all risky assets including crypto will be bearish.

Just months ago, many financial experts and investors praised Bitcion and claimed that it’ll replace gold as an inflation hedge in the future. However, the leading coin’s volatility suggests that there’s still a long way to go.

The current market is not trading crypto as a hedge against inflation, rather crypto is being seen as an effective alternative to stock because of the low-interest rates.