Tron Price Prediction 2024-2033

- Tron Price Prediction 2024 – up to $0.22

- Tron Price Prediction 2027 – up to $0.58

- Tron Price Prediction 2030 – up to $1.74

- Tron Price Prediction 2033 – up to $4.97

TRX, or rather Tronix, is the native crypto asset of the TRON Network. TRON is a Blockchain-based decentralized network targeting an unchained, worldwide digital content entertainment structure using distributed ledger technology and enabling straightforward and cheap data sharing. How is Tron Price Prediction making out in this turbulent crypto weather as major crypto exchanges unravel?

One of the several cryptocurrencies that experienced an all-time high during the late 2017 and early 2018 cryptocurrency craze is TRX. It may be realistic to wonder whether and when it can return there, if at all, given that it hasn’t even come close to the heights it attained back then. As with other cryptos, it is always advised to do your own research and seek investment advice whenever investing.

Like many cryptocurrencies and blockchain assets, Tron enjoys a great deal of interest not only in its immediate utility in empowering the next form of the internet – but also in its potential to bring profit to those holding it. Rest assured that a lot of development is taking place to improve the Tron ecosystem. If you encounter any issue with the system, here is a good place to look.

How much is TRX worth?

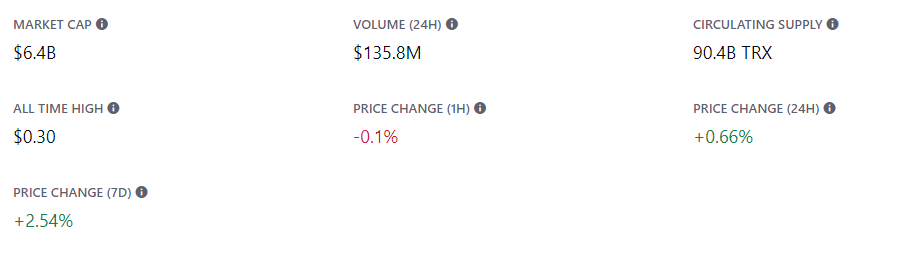

Today’s TRON price is $0.1134 with a 24-hour trading volume of $272,886,997 USD. TRON is up 1.31% in the last 24 hours. The current CoinMarketCap ranking is #10, with a live market cap of $9,933,356,279 USD. It has a circulating supply of 87,581,362,326 TRX coins and the max. supply is not available.

Tron price analysis: Upsweep continues as TRX surpasses $0.1131

TL; DR Breakdown

- Tron price analysis indicates an uptrend.

- Coin value has advanced up to $0.1131.

- Strong support is available at $0.1059 end.

The latest one-day and four-hour Tron price analysis for 23 April 2024 indicates signs of a growing upsweep. The bulls have been on the winning side since the past few weeks. In the past 24-hours a further spike in the bullish momentum was observed, as the coin value hiked up to $0.1131 high. As a result of the increasing movement, further rise in the coin value is expected soon.

TRX price analysis 1-day chart: Bullish tide extends as TRX hits $0.1131 target

The latest one-day Tron price analysis depicts a bullish scenario regarding the ongoing market events. The past week proved highly favorable for the bulls as a constant upward spike was observed. Because of the aggravating buying activity, the cryptocurrency value has advanced up to $0.1131 high today. Whereas, its Moving Average (MA) value has improved up to $0.1111 because of the continual upswing.

The volatility is increasing which is a bearish signal for the coming week. Because of the rising volatility, the upper extreme of the Bollinger bands indicator has switched to $0.1241 high. Whereby, the lower end of the Bollinger bands indicator is now situated at $0.1059. The Relative Strength Index (RSI) indicator confirms the bullish trend as its overall value has climbed up to index 43.76.

TRX/USD 4-hour price chart: Increasing trend continues as coin value ascends

The recent four-hour Tron price analysis gives out a highly bullish prediction regarding the current price movements. The bulls remained on the leading edge since the early hours of the day. Because of the intensifying buying pressure, TRX/USD value has sought bullish recovery beyond the $0.1131 horizon. Side by side, the Moving Average value has moved up to $0.1122 because of the persistent bullish side as well.

The volatility seems to be on the decreasing side which is a bullish signal for the coming hours. Because of the declining volatility, the upper extreme of the Bollinger bands indicator now shows its value at $0.1131. Whereby, the lower extreme of the Bollinger bands indicator suggests its value at $0.1101. The RSI indicator confirms the ongoing uptrend as its overall value has ascended to index 60.62.

What to expect from TRX price analysis?

The recent one-day and four-hour Tron price analysis gives out a favorable prediction for the cryptocurrency buyers. Because of the increasing trend recorded during the past week, the coin value has ascended to $0.1131. Side by side, the four-hour price analysis confirms a rising bullish momentum as well because of the latest upturn.

is Tron a good investment?

Tron (TRX) presents an intriguing investment prospect with notable advantages despite facing criticisms and challenges. Its enduring presence in the cryptocurrency market, consistently maintaining a top 50 position, underscores its resilience. Tron’s bold ambition to decentralize the web, exemplified by strategic acquisitions like BitTorrent, has drawn attention. The integration of the USDD stablecoin has bolstered Tron’s liquidity, appealing to investors seeking stability amidst market volatility. The recent introduction of an algorithmic stablecoin has catalyzed TRX’s price surge, showcasing its innovative potential.

However, detractors highlight concerns over founder Justin Sun’s controversial reputation, potential risks associated with the USDD stablecoin, and issues within Tron’s ecosystem, particularly concerning low-quality decentralized applications. Consequently, while some investors view Tron as a promising asset for portfolio diversification, others advise caution due to uncertainties surrounding its leadership and ecosystem. Ultimately, investing in Tron demands careful evaluation, thorough research, and an understanding of one’s risk tolerance to navigate its opportunities and challenges effectively. Our Tron price forecast section provides analysis on the profitability of the coin in the coming years.

Recent News on TRON

Crypto Market Outlook: TRON, and Optimism Gain Momentum. The cryptocurrency market is witnessing notable upticks in TRON (TRX) and Optimism (OP) driven by various factors. TRON’s resilience amidst market volatility, and Optimism’s rebound fueled by ecosystem growth and partnerships. TRX is expected to surpass $0.130, while OP expected to exceed $3.50 to generate substantial returns, these coins represent promising opportunities amid ongoing market fluctuations.

Tron Founder Justin Sun Counters UN Report on USDT Misuse. Tron founder Justin Sun has disputed a United Nations (UN) report that raised concerns about the misuse of Tether’s USDT in illicit activities, particularly in Southeast Asia. The report highlighted potential issues with online gambling and money laundering. Sun refuted specific details related to USDT transactions on the TRC-20 protocol within the Tron network, emphasizing the network’s commitment to transparency and legal compliance. Tether, the company behind USDT, responded by emphasizing its role in developing economies, commitment to transparency, and proactive efforts against misuse. The UN report acknowledged successful law enforcement operations against money laundering networks using Tether. Justin Sun advocated for increased blockchain education and proposed collaborations between Tron, HTX DAO, and the United Nations to expand global understanding of blockchain technology and foster legitimate financial transactions.

Solana Overtakes Tron in Stablecoin Volume. Tron, once a leader in stablecoin volumes, has lost its top spot to Solana, raising concerns about its market position and user confidence. Solana recorded a stablecoin transfer volume of $24.58 billion in December, surpassing Tron and Ethereum. Tron faces additional challenges with legal issues, as the SEC charges founder Justin Sun and affiliated entities. The legal uncertainties could impact Tron’s credibility and market sentiment. Despite these challenges, Tron is exploring partnerships, such as the one with ChainGPT for an AI-powered chatbot, and has implemented Stake 2.0 to enhance its staking model. TRX’s current price stands at $0.109931, showing resilience despite the stablecoin volume setback.

Tron Price Predictions 2024-2033

Price Predictions By Cryptopolitan

| Year | Minimum ($) | Average ($) | Maximum ($) |

| 2024 | 0.11 | 0.15 | 0.22 |

| 2025 | 0.22 | 0.23 | 0.27 |

| 2026 | 0.32 | 0.34 | 0.38 |

| 2027 | 0.48 | 0.50 | 0.58 |

| 2028 | 0.71 | 0.73 | 0.83 |

| 2029 | 1.01 | 1.04 | 1.24 |

| 2030 | 1.43 | 1.47 | 1.74 |

| 2031 | 2.00 | 2.07 | 2.47 |

| 2032 | 2.93 | 3.01 | 3.50 |

| 2033 | 4.05 | 4.17 | 4.97 |

TRON Price Prediction 2024

Our deep technical analysis of past TRX price data suggests that in 2024, TRON’s price is expected to hit a minimum of $0.1578. The TRX price may peak at $0.1935, with an average trading price of $0.1624.

TRON Price Prediction 2025

Based on forecasted prices and technical analysis, TRON’s price in 2025 is anticipated to reach a minimum of $0.2233. The TRX price might rise to a maximum of $0.2727, averaging around $0.2314.

TRX Price Forecast for 2026

The forecast for 2026 indicates that TRON’s price could drop to as low as $0.3247. However, the TRX price might climb to a peak of $0.3797, with an expected average of $0.3362.

TRON (TRX) Price Prediction 2027

In 2027, TRON’s price is projected to reach a minimum of $0.4813. The price may surge to a maximum of $0.5844, maintaining an average of about $0.4981 throughout the year.

TRON Price Prediction 2028

The 2028 forecast suggests that TRON’s price could reach a minimum of $0.7059. The TRX price might escalate to a high of $0.8332, with an average trading value of $0.7308.

TRON Price Prediction 2029

Our in-depth technical analysis indicates that in 2029, TRON’s price is expected to hover around a minimum of $1.01. The maximum price value could be $1.24, with an average value of $1.04.

TRON (TRX) Price Prediction 2030

TRON’s price in 2030 is predicted to reach at least $1.43. The price may peak at $1.74, with an average value of $1.47 throughout the year.

TRON Price Forecast 2031

The 2031 forecast for TRON suggests a minimum price of $2.00. The TRX price might achieve a maximum of $2.47, averaging around $2.07.

TRON (TRX) Price Prediction 2032

For 2032, TRON’s price is predicted to reach a minimum of $2.93. The price might climb to a high of $3.50, with an average price of $3.01.

TRON Price Prediction 2033

In 2033, the price of 1 TRON is expected to reach at least $4.05. The TRX price may escalate to a maximum of $4.97, averaging around $4.17 throughout the year.

TRON Price Prediction By Coincodex

According to the current TRON price prediction provided by Coincodex, the value of TRON is anticipated to decline by -8.69%, reaching $0.127464 by March 10, 2024. Coincodex’s technical indicators suggest a Bullish current sentiment, with the Fear & Greed Index indicating 90 (Extreme Greed). TRON has experienced 18/30 (60%) green days, with a price volatility of 5.97% over the past 30 days.

The forecast from Coincodex suggests that it is now an opportune time to purchase TRON. Considering the historical price trends of TRON and the BTC halving cycles, the lowest predicted price for TRON in 2025 stands at $0.121087. Meanwhile, TRON’s price is expected to climb to a high of $0.431121 in the following year.

TRON Coin Price Prediction By DigitalCoinPrice

Digital Coin Price suggests that there is potential for TRON to surpass the $0.36 mark and sustain its market position by the end of 2025. The lowest price for TRON is projected to be between $0.30 and $0.36, with the most probable price expected to stabilize at around $0.34 by the conclusion of 2025.

Despite the significant fluctuations in TRON’s value and the debates over its environmentally unfriendly energy consumption, billionaire venture capitalist Tim Draper remains firm in his forecast, anticipating that TRON will achieve $0.36 by the end of 2025 or early in the year.

In 2033, TRON is expected to aim for a minimum value of $2.62. It is projected to strive for a maximum and subsequent top-tier price of $2.72, with an average forecast price pegged at $2.71. TRON may surpass its previous highs and advance to new levels. Should conditions evolve favorably, it is anticipated that TRON will ascend to its next stage. However, there is also the possibility of a decline in its value.

TRON Price Prediction By CryptoPredictions.com

According to Cryptopredictions.com, TRON’s price is expected to begin at $0.15 in April 2024 and conclude the month at $0.17. Throughout April, the highest projected TRX price is $0.217, with the lowest price forecasted to be $0.147.

TRON Overview

TRON Price History

As seen on the Tron chart, the price of Tron cryptocurrency has seen a good amount of volatility over the past years.

After spending the second half of 2019 retracing from $0.04, TRX eventually found support around the exchange rate of $0.11.

This resulted in a push higher at the beginning of 2020 as the price set a new higher high, indicating that a new bull cycle has potentially begun.

However, after peaking at $0.026 in the middle of February 2020, the Tron price got heavily rejected to the downside, destroying any bullish price prediction at the time. What followed for the price of crypto was another dump lower.

The Tron price pushed through previous support and set a new several-year low at $0.07.

The price started to slowly recover from there on, creating a bullish Tron (TRX) price action structure by the end of the year.

In September, the Tron price moved and saw a very sharp spike to the upside, resulting in a brief breakout from the significant resistance of $0.04 as it hit a new several-year high of $0.05.

During the following weeks, the crypto retraced toward the previous resistance of $0.22-$0.025 and retested it as support.

As expected by analysis of several well-known traders at the time, Tron’s price reversed from thereon. After spending the end of 2020 in a consolidation, Tron pushed higher at the beginning of February in a solid bull run, resulting in a $0.065 level being reached, beating several predictions.

It is in a bearish momentum and has an RSI index of 39. In the 4-hour chart, we can make a short-term Tron price prediction using the above technical analysis. With the reversal in the trend, the coin price has changed its bearish outlook as it is trading above the 50-day and 100-day MA, breaking out of the upper end of the Bollinger Band.

Developments affecting the TRX Price

The price took a sudden hit of 7% when, on December 17, Justin Sun announced that he had been appointed as Ambassador, Permanent Representative of Grenada to the World Trade Organization, and would be stepping back from TRON. As a result, the TRON Foundation has said it has “settled to dissolve itself on July 25, 2022”.

Despite this, the Tron (TRX) price still keeps going up. Could it be that the strategic investment of an undisclosed amount in the DeFine social NFT platform is finally bearing fruits? The funding will be used to develop the first NFT marketplace in the TRON ecosystem and launch auctions soon. Or could it be that the network’s BTFS file storage system (was integrated with DeFine in September? Or TRON’s expansion into the NFT ecosystem with APENFT is operating successfully? Or was some other strategy hatched by Justin Sun?

Now, let’s look at the long-term Tron price prediction for the upcoming years and remember that these Tron price predictions are not investment advice.

More on the Tron Network

What Is Tron (TRX)?

Tron (TRX) was created by tech entrepreneur Justin Sun in 2017. The TRON project funds were raised through an Initial Coin Offering (ICO), with a subscription of funds reaching 70 million. This was one of the largest ICOs and increased cryptocurrency popularity even further.

Today, Tron has grown into one of the largest cryptocurrencies with over $5.4 billion in capitalization, while the 24-hour trading volume exceeds $250 million.

At first, TRX ran on Ethereum’s ERC-20 blockchain as it offered a quick and easy solution for running the peer-to-peer network. Later on, the developers of Tron switched the blockchain to their custom-made solution.

The blockchain used proof of stake mining and validation consensus algorithm and was one of the first cryptocurrency projects to implement this solution.

One of the primary use cases and benefits of the TRX platform is the support for content creators and artists by providing ownership over the content they create.

This is done by storing and tracking the information about created content and its use on the blockchain.

Therefore, content creators can directly track how their creations are used and their reward for producing them. The middleman is eliminated, and content creators get paid instantly.

TRON Ecosystem Applications

Some of the core applications that the TRON ecosystem aims to provide include:

- Wallet-Cli: Wallet-Cli is the official wallet client provided by the TRON foundation. Further, Wallet-Cli is a command-line version of the wallet that provides essential tools to communicate with the TRON public chain by RPC protocol. RPC protocol stands for remote procedure call, an inter-process communication technique used for point-to-point communication between software applications. Wallet-Cli supports all functions of the TRON public chain in real-time.

- TronLink: TronLink is a TRON wallet that provides users with a convenient experience, complete functions, and secure funding options.

- Blockchain Explorer: The first blockchain explorer based on TRON is tronscan.org, which offers essential functions like searching transactions, accounts, blocks, nodes, smart contracts, token creation, and more.

- DApp: TRON public chain aims to attract a vast community of developers to join in the development, deployment, and running of DApps on the blockchain because of their high performance, low cost, and safety.

Tron Foundation

The Tron foundation is the governing body of the Tron blockchain. They aim to popularise and further develop the blockchain. Based in Singapore, they ensure that the TRX blockchain is regulated and complies with laws. Tron, Justin Sun, is still the Tron foundation leader and is listed in the Forbes list of 30 under 30 in Asia.

In 2018, a popular peer-to-peer torrent-sharing network – BitTorrent, announced that the TRON Foundation had acquired them to use TRX tokens to incentivize and reward network users. This created massive interest for the token, and it soon exceeded a $1 billion cap.

Several other projects and development phases have since been launched, with the most notable ones being the Odyssey, which created a system for incentivizing content creators. Further development phases – Great Voyage and Apollo-enable content creators to build their brands and issue personalized initial coin offerings to raise funds for their projects.

Plans to develop the ecosystem align with Star-Trek and Eternity phases. Star-Trek is set to launch in mid-2023, and Eternity in late 2025.

Therefore, we will probably see interest in Tron and blockchain itself grow even further in the upcoming years and increase the price.

Let’s look at Tron’s previous price history to understand what the future price could look like. It is a good investment if you rapidly lose money in all others.

Tron has been compared with Ethereum due to its lower fees and fast payment. When ETH was at its all-time high, a considerable amount of fees was applicable for transfer, and for this reason, people started shifting to TRON.

What other factors affect the TRX price?

Tron celebrated the most significant milestones in its existence, surpassing a million active user accounts. But since then, a lot has changed because the total number of active user accounts surpassed 4 million, and it is flourishing.

Moving forward, in the first week of June 2021, there have been more than 10 million transactions recorded on the Tron blockchain. On June 14, it recorded a total of 1,049,206 transactions. That is almost triple the number of transactions recorded daily on the Bitcoin blockchain.

Factors affecting Tron’s price are the same as any other cryptocurrency – mainly, the supply and demand on cryptocurrency exchanges. More significant deals are often done off the exchanges, creating a negligible impact on the Tron price.

Supply and Demand

The coin supply naturally comes from the number of tokens released into the market every day. In the case of Tron, you can earn a mining reward by staking the coin.

As of now, staking TRX offers around a 7 percent annual yield. However, this yield will vary over time and based on market conditions.

On the other hand, the demand for Tron comes from investors who want to buy it with the expectation that its long-term value will grow. Another motivation for purchasing Tron is the ability to stake your coins, giving you an annual yield.

Staking TRX tokens also gives the power to vote on various issues that the network developers want to solve or features that they want to add. Therefore, by purchasing and staking TRX, you help ensure the TRX blockchain’s consensus mechanism.

Regulatory Compliance

Recently rumors of the United States and China investigating the TRON Foundation and the blockchain itself. In his Twitter account, the founder of Tron Network, Justin Sun, ensured no reasons to doubt the accusations of malpractice as the network is run as a decentralized network. Therefore, claims of centralized manipulation are of no sense since the TRON Foundation is only one of several thousands of participants.

Overall, TRX is compliant with various global regulations as any other major blockchain. This ensures the demand for TRX continues growing. Therefore, over time, the crypto market price should continue to rise over the next five years.

The Rise of DApps

Over the last months, the TRX network experienced an increased interest in decentralized applications (DApps). As of now, more than 100 DApps are running on the blockchain, offering various categories of functionality ranging from exchanges to gaming and gambling.

Websites such as DappRadar offer a quick overview of the most popular ones and how many users have each decentralized application attracted over time. User count ranges from several hundred to several thousand, and this number is expected to grow further over the next 5-year period.

This raised interest in the TRX blockchain functionality, which created an additional appeal to invest in Tron. Therefore, creating extra trading volume and market growth for the cryptocurrency market.

Where to buy Tron?

Tron is available for trading on practically every major exchange, just like Bitcoin or Ethereum. It is one of the best-known cryptocurrencies, with a high average trading volume of more than $2 billion per day. As seen during previous bull markets of cryptocurrencies, this number is likely to grow over the next five years. Therefore purchasing crypto shouldn’t be an issue for anyone interested in trading or investing.

How to store Tron?

Tron offers several options for storing crypto. The basic one is the so-called TRON paper wallet, which involves a primary method of printing out your private keys and keeping them on a piece of paper in a place to which only you have access. This basic solution comes from earlier cryptocurrencies such as Ethereum.

Other options include Tron Android wallet, Tron IOS wallet, Chrome wallet, Exodus desktop wallet, and the commonly used hardware wallets of Ledger Nano and Trezor. This means that the Tron coin can be stored in as many different wallet options as other well-established cryptos, such as Ethereum.

TRON DAO introduced a development fund to support blockchain projects focused on AI. With AI technology gaining increased attention and experiencing growth, especially within the cryptocurrency sector, TRON DAO seeks to expedite this trend through its latest $100 million fund.

It is anticipated that TRON will soon position itself at the top list of dominating the payment sector, significantly pushing TRX’s price to the North.

Not long ago, TRON’s stablecoin USDD depegged from $1 and traded at $0.97, which built up a strong negative sentiment in the TRON community with an extended bearish consolidation ahead in the TRX price graph. However, the development team seems promising as it looks for several ways to revive the ecosystem with great enhancements to the network. It is advised to do your own research and conduct good investment advice before investing in the highly volatile market.

TRON has evolved the blockchain space to a new era as it focuses on developing the foundation of a decentralized global ecosystem, which is a crucial sector of the crypto space. TRON coin is a highly-rated cryptocurrency with massive potential for widespread adoption in the future. Much of these expectations are due to the strategic partnerships continuously secured by the TRON ecosystem in a bid to promote awareness of the platform.

An example of such partnerships is the recent collaboration with the Republic of Dominica, in which the TRON platform will be used to create fan tokens known as Dominica Coins (DMC), which serve to promote the country’s national and cultural heritage.

The Tron ecosystem is rapidly growing with new users and dApps. This results from the robustness, scalability, and low cost of the blockchain. As we transition into WEB 3, we anticipate new industry players to plug into the Tron blockchain, like Samsung.

Furthermore, the TRON network continues to attract numerous developers and users with its high throughput and low transaction fees. On the first of September, Tron’s founder, Justin Sun, announced the network had hit a new milestone, recording a total transfer value of over $5 trillion since its launch in 2018.

Tron has weathered its investors from this year’s crypto winter, and due to its high utility, it will be highly profitable in the following market bull run. The shaky performance of Tron USDD stablecoin will adversely affect Tron’s performance in the case of a crash.

Many Tron opponents and Ethereum proponents have long believed that Tron is not legitimate crypto. They have speculated on the legitimacy of Tron as a company in general after Tron openly admitted that it is going after Ethereum. ETH is the second-largest crypto by market capitalization.

However, crypto enthusiasts think that the two projects cannot be compared. They are different since the ETH developers wrote their code from scratch, while Tron might have copied and improved the code. Nonetheless, Sun said that the Tron blockchain code was written from scratch and originally in Chinese, the main thing going for TRX.

TRON may soon make a bullish reversal as the developing team is actively looking for valuable opportunities to bring to the TRX platform. If the demand for TRX stays stable or increases, and supply remains constant, TRON crypto may see a price increase in the future. With the Tron Foundation out of the way, TRX will be one of the most decentralized cryptos and can shoot up to a high of $3.05 with an average forecast price of $2.56 by 2032. You have to trade and hold TRX for a long time before getting rich due to its volatility.

Most TRON price predictions consider TRX a favorable asset for long-term investment, capable of delivering steady profits over the years. The future prices of TRON will majorly depend on the crypto market’s favorability to make it a good investment option. That said, these price predictions are not guaranteed, as various factors can influence cryptocurrency market prices. Thus, investors are advised to consult with financial market experts before making investment decisions.

By reading your favorite coins’ price analysis and daily roundups, you may keep yourself updated and better able to make a decision.