Due to its high return potential and innovative technological features, the crypto market has maintained its popularity among investors and enthusiasts. Thanks to the many changes made to the crypto scene, there is a sense of excitement and anticipation as we enter June 2023.

Here, we’ll look at some of the most talked-about crypto forecasts for June 2023, including the market movements and top coins that might be predicted this month.

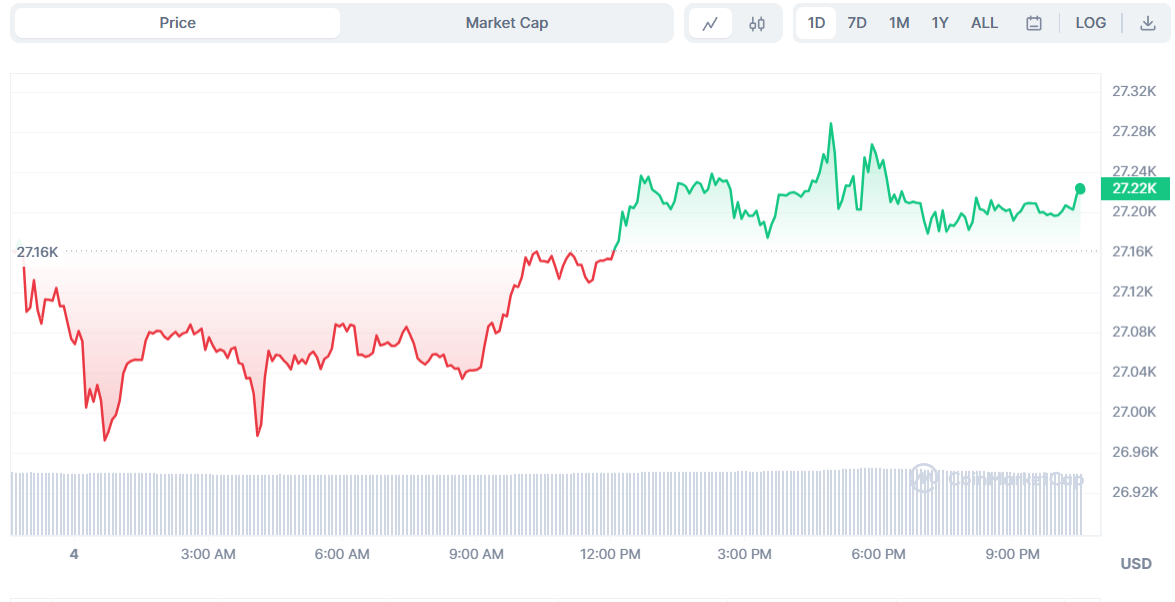

Will Bitcoin’s price keep falling?

On May 11, the Bitcoin price fell after a head and shoulders pattern had been broken (red icon). Bears should keep an eye out for the head and shoulders motif. Therefore, the breakdown was to be anticipated.

The price action following the breakout, however, has been quite irregular. Instead of falling drastically, Bitcoin’s price rose twice on May 30 and briefly traded above the pattern’s midline. But it began falling again not long after that.

The head and shoulders pattern might have been invalid as a result.

Therefore, a descending parallel channel is the next most probable arrangement. If this theory is correct, the downward trend began on May 31 when the price was met with resistance at the line depicted by the red icon.

It might test the $25,000 support line drawn along the channel as the price falls. This is the 0.382 Fibonacci retracement support level, based on the size of the entire uptrend. That makes it a potentially significant support level.

The RSI phenomenon supports this theory. When deciding whether to buy or sell an asset, traders can use the Relative Strength Index (RSI) as a momentum indicator to see if the market is overbought or oversold.

Bears have the upper hand if the RSI is below 50 and the trend is downward, and vice versa if the RSI is over 50 and upward. A bearish trend is indicated by the indicator’s position below 50 and subsequent decline.

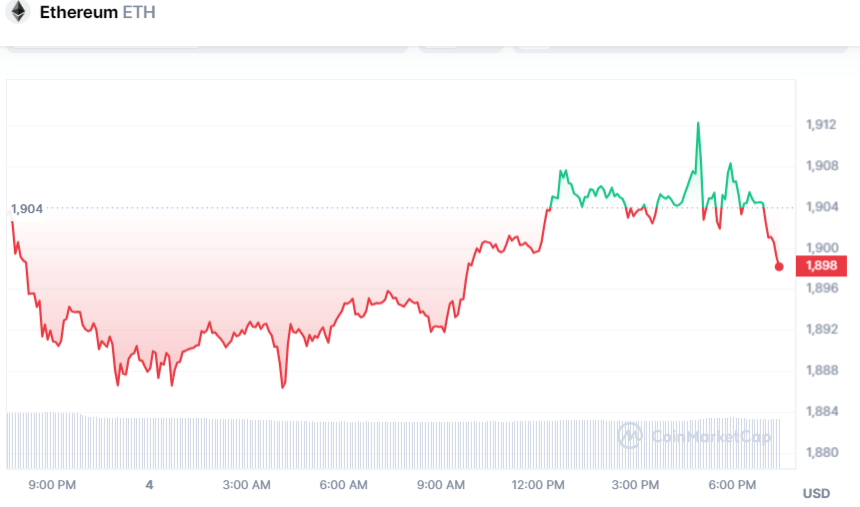

Altcoins coin seeing growth

Although Bitcoin is still the most well-known crypto, experts anticipate that other coins will grow considerably in June 2023. The shift to Ethereum 2.0 is projected to continue Ethereum’s growth trend, making it the second-largest crypto. Cardano, Polkadot, and Solana are just a few examples of cryptos that are expected to grow significantly as their use cases develop and they acquire tremendous popularity.

Throughout May, the price of Ethereum surged more than Bitcoin’s. In all likelihood, it will continue doing so in June.

Since 2022 began, the ETH/BTC exchange rate has been trading within a parallel declining channel. It reverberated at the exact center of the channel in April of 2023. This was the second time it had bounced at this particular line. Price action in the upper part of the channel indicates a possible channel breakout.

Additionally, PEPE which was the most talked about alternative crypto in May, became one of the top gainers of all time. On May 5, though, the price hit an all-time high before rapidly declining.

Despite this decline, a rebound appears expected in June. This is due to several factors. A sinking parallel channel has controlled the decline since May 13.

Since the channel is a corrective pattern, a break out of it is the most likely outcome.

On May 31, the market rebounded off the green support line of the channel. The lowest recorded RSI reading (green circle) coincided with the rebound. The indicator has gone up since then.

Central bank digital currencies (CBDC)

Governments and central banks worldwide have investigated the possibility of Central Bank Digital Currencies (CBDCs). By June, several governments might have launched CBDC pilot programs or even fully functional digital currencies, signaling further progress in creating and implementing CBDCs. Digital currencies supported by governments have the potential to alter the current financial system for the better by increasing productivity, openness, and access.

Crypto development of regulatory frameworks

The crypto business has significantly struggled due to the need for clear regulations. Global regulatory frameworks, however, are expected to continue maturing by June 2023. More apparent norms and regulations will provide a more stable environment for the growth of cryptos as governments aim to find a balance between innovation and investor protection.

The crypto market might see an influx of institutional investors and traditional financial institutions if regulations become more transparent.