Shiba Inu Price Prediction 2024-2033

- Shiba Inu Price Prediction 2024 – up to $0.000041

- Shiba Inu Price Prediction 2027 – up to $0.000123

- Shiba Inu Price Prediction 2030- up to $0.000348

- Shiba Inu Price Prediction 2033 – up to $0.0011

Let’s walk through Shiba Inu’s tracks through time to help decide whether SHIB is an excellent addition to your crypto portfolio. Let’s see what Elon Musk will do to help push the meme coin. After our walkthrough of the Shiba Inu price predictions, we will hopefully be more aware of SHIB value,

How Much Is SHIBA Worth?

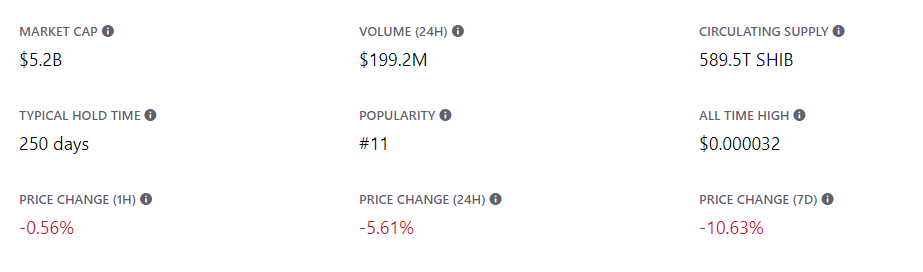

Today’s Shiba Inu price is $0.00002613 with a 24-hour trading volume of $822,233,535. Shiba Inu is down 4.06% in the last 24 hours. The current CoinMarketCap ranking is 11, with a live market cap of $15,455,417,766. It has a circulating supply of 589,289,410,812,691 SHIB coins and the max. supply is not available.

Shiba Inu Price Analysis: Sellers In Control As SHIBA Fails To Break Past $0.00002700

- Shiba Inu price analysis shows a bearish trend

- SHIB faces strong resistance at $0.00002751

- SHIB is trading at $0.00002613, down by 4.06%

The Shiba Inu price analysis on 24th April 2024 shows a bearish trend, with SHIB unable to break past the $0.00002700 level again. The meme coin has consistently faced strong resistance at this level and has failed to break through despite several attempts in the last few days. At press time, SHIB is trading at $0.00002613, down by 4.06% in the last 24 hours. The selling pressure has been relatively high as traders and investors are cautious.

Shiba Inu Price Analysis Daily Chart: SHIB Plunges To $0.00002613 as Bears Remain in Control

The 1-day chart for SHIB shows a clear bearish trend, with the coin failing to break past the resistance level. The bulls have not been able to make any significant gains and remain under pressure from the sellers.

SHIB has seen some encouraging gains in the last few weeks, with prices jumping from around $0.00002553 to over $0.00002751; however, the resistance at this level seems too strong for it to go beyond. This could mean that sellers are currently in control of the market, and SHIB may be unable to make any major gains in the short term.

SHIB/USD 1-day price chart By; TradingView

The Relative Strength Index shows SHIB is in the neutral region with a value of 51.01, and the Moving Average Convergence Divergence is in the negative zone, with the MACD line still above the signal line. This indicates that bearish momentum is still in play, and SHIB may trend further downward in the coming days.

Shiba Inu Price Analysis 4-hour Chart: Will SHIB Correct Lower if The Bearish Momentum Persists.

The Shiba Inu hourly chart shows that SHIB trades between $0.00002553 and $0.00002751 levels. The bearish momentum is visible with the 50-day Moving Average still below the 200-day MA, indicating further downside for SHIB if the current trend persists.

SHIB/USD 4-hour price chart By; TradingView

Technical indicators hint at more downside with the Relative Strength Index in the neutral region at 49.34 and might still drop further if the bearish momentum continues. The MACD line has dropped below the signal line, indicating a bearish trend, and the Know Sure Thing indicator is in the negative zone with a value of 0.000000446, suggesting further downside for SHIB.

What To Expect From Shiba Inu Price Analysis

Shiba Inu price analysis suggests that sellers are in control as SHIB fails to surpass the $0.00002600 level. Even though there had been some gains in the last few weeks, they have not been significant enough for SHIB to surmount the resistance at this level and could mean further downside if bearish momentum persists. If the selling pressure persists, SHIB could correct lower in the short term.

Is SHIB A Good Investment?

Shiba Inu (SHIB) has surged by 15% in the past week, driven by news of its team raising $12 million for a privacy-focused layer-three blockchain, Dogeverse. With a 163% increase over the past year, SHIB demonstrates medium- and long-term momentum. The recent bullish market sentiment, coupled with anticipation surrounding Dogeverse, is likely to boost SHIB’s price further.

Technical indicators suggest SHIB is amid a growth phase, with its 30-day average surpassing its 200-day average and robust buying pressure evident. The announcement of Dogeverse, operating across multiple chains, enhances SHIB’s utility and potential for broader adoption. Additionally, its deflationary tokenomics and staking opportunities are expected to increase demand and reduce circulating supply, potentially propelling SHIB’s price toward $10. As SHIB enthusiasts await its listing, investing in meme coins like SHIB could offer lucrative opportunities, especially considering its evolving ecosystem and utility within decentralized applications.

SHIB Recent News

Recently, the official Shiba Inu X account has provided a comprehensive guide on transferring BONE tokens seamlessly from the Ethereum mainnet to the Shibarium layer-2 network. The step-by-step demonstration, conveyed through an instructional video, highlights the importance of Web3 wallets like MetaMask for users holding BONE tokens.

How to bridge Bone from Ethereum Mainnet to Shibarium: a quick and simple guide! pic.twitter.com/vT7CDjswUO

— Shib (@Shibtoken) January 30, 2024

To initiate the process, users are directed to the secure Shiba Inu bridge portal at https://shibarium.shib.io/bridge. Connecting their wallets to the Shibarium bridge site, users can then input the desired amount of BONE tokens for transfer. The video emphasizes that certain functionalities, such as delegation and staking, are exclusive to the Ethereum Mainnet.

Upon confirming the transfer, users are prompted to authorize the transaction through their wallet, involving a two-step process with an estimated completion time of 20 minutes. The Shiba Inu community, known as the Shib Army, has shown appreciation for the transparent and user-friendly approach demonstrated by the Shiba Inu team.

Shiba Inu Price Predictions 2024 – 2033

| Year | Minimum | Average | Maximum |

| 2024 | $0.000034 | $0.000035 | $0.000041 |

| 2025 | $0.000049 | $0.000050 | $0.000060 |

| 2026 | $0.000071 | $0.000073 | $0.000086 |

| 2027 | $0.000101 | $0.000105 | $0.000123 |

| 2028 | $0.000145 | $0.000150 | $0.000171 |

| 2029 | $0.000199 | $0.000206 | $0.000252 |

| 2030 | $0.000294 | $0.000302 | $0.000348 |

| 2031 | $0.000433 | $0.000448 | $0.000516 |

| 2032 | $0.000620 | $0.000638 | $0.000744 |

| 2033 | $0.000884 | $0.000909 | $0.0011 |

Shiba Inu Price Prediction 2024

The price of Shiba Inu is predicted to reach a minimum value of $0.000034 in 2024. The Shiba Inu price could reach a maximum value of $0.000041 with an average trading price of $0.000035 throughout 2024.

Shiba Inu Price Prediction 2025

According to the technical analysis of Shiba Inu prices expected in 2025, the minimum cost of SHIB will be $0.000049. The maximum level that the SHIB price can reach is $0.000041. The average trading price is expected around $0.000050.

Shiba Inu Price Prediction 2026

After the analysis of the prices of Shiba Inu in previous years, it is assumed that in 2026, the minimum price of SHIB will be around $0.000071. The maximum expected SHIB price may be around $0.000086. On average, the trading price might be $0.000073 in 2026.

Shiba Inu Price Prediction 2027

Based on the technical analysis by cryptocurrency experts regarding the prices of Shiba Inu, in 2027, SHIB is expected to have the following minimum and maximum prices: about $0.000101 and $0.000123, respectively. The average expected trading cost is $0.000105.

Shiba Inu Price Prediction 2028

As per the forecast and technical analysis, In 2028 the price of Shiba Inu is expected to reach at a minimum price value of $0.000145. The SHIB price can reach a maximum price value of $0.000171 with an average value of $0.000150.

Shiba Inu Price Prediction 2029

Shiba Inu’s price is forecast to reach the lowest possible level of $0.000199 in 2029. As per our findings, the SHIB price could reach the maximum possible level of $0.000252 with an average forecast price of $0.000206.

Shiba Inu Price Prediction 2030

According to our deep technical analysis of past price data of SHIB, In 2030 the price of Shiba Inu is forecasted to be at around a minimum value of $0.000294. The Shiba Inu price value can reach a maximum of $0.000348 with the average trading value of $0.000302.

Shiba Inu Price Prediction 2031

The price of Shiba Inu is predicted to reach at a minimum value of $0.000433 in 2031. The Shiba Inu price could reach a maximum value of $0.000516 with the average trading price of $0.000448 throughout 2031.

Shiba Inu Price Prediction 2032

The price of Shiba Inu is predicted to reach at a minimum value of $0.000620 in 2032. The Shiba Inu price could reach a maximum value of $0.000744 with the average trading price of $0.000638 throughout 2032.

Shiba Inu Price Prediction 2033

Shiba Inu price is forecast to reach a lowest possible level of $0.000884 in 2033. As per our findings, the SHIB price could reach a maximum possible level of $0.0011 with the average forecast price of $0.000909.

Shiba Inu Price Prediction by DigitalCoinPrice

DigitalCoinPrice has expressed a bullish outlook on SHIB’s price performance in the future. Their Shiba Inu price prediction for 2024 indicates that the token could have an average trading price of $0.0000544 during that year. The website further forecasts a continued bullish momentum for the next decade, with the token’s price reaching an average of $0.000145 by 2029. Additionally, they predict that SHIB could attain its all-time high of $0.000397 by 2032, and its average price is expected to be around $0.000393.

Price Prediction by Technewsleader

According to Technewsleader, the price of SHIB is expected to rise over the next year, with a predicted value of $0.00002075 based on current market trends and factors such as supply, demand, and news events. The website also forecasts that in the next 5 years, the price of SHIB could potentially reach a high of $0.00006618, contingent upon specific conditions.

Looking further ahead, Technewsleader projects that by 2029, the price range of SHIB could be between $0.00013855 and $0.00016588. By 2032, the website anticipates that the price of SHIB could increase to $0.00052422.

Price Prediction by Wallet Investor

According to Wallet Investor, Shib is expected to experience a significant decrease in market price in the coming months, potentially falling to as low as 0.000001086 USD by December 2024. As a result, Wallet Investor does not consider Shiba Inu to be a favorable long-term investment opportunity for investors based on this prediction.

Price Prediction by Market Experts

Price Opinion from Wealthy Coin on YouTube

- Shiba Inu has had a good year so far in 2023 and the start of 2024, and the environment is growing and gaining attention from the general public and investment banks worth a trillion dollars.

- Whales have been buying a significant amount of Shiba Inu tokens, and one whale recently bought 311 billion tokens in two big payments.

- The latest additions of a Shiba/USD trading pair on cryptocurrency platforms and changes to the Shiba Inu game and metaverse have contributed to the increased interest in Shiba Inu.

- Finder’s panel of experts predicts a potential 350% increase in the price of Shiba Inu in about 30 months.

- BlackRock Inc. and Fidelity Investments have both shown interest in the cryptocurrency market, which could be good for the Shiba Inu market financially.

Shiba Inu Overview

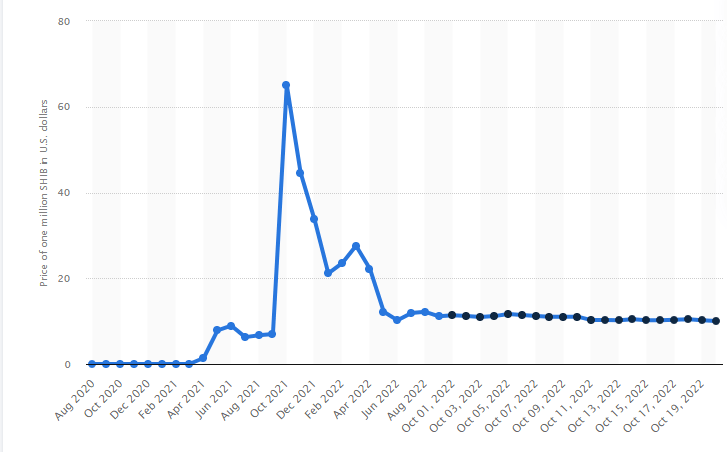

Shiba Inu Price History 2020 – 2024

Memecoin Shiba Inu saw its price grow by over 300 percent within the same month, marking a trading fury reminiscent of Dogecoin in early 2021. Indeed, the SHIB coin ranked as one of the biggest cryptos in the world based on 24h trading volume in October 2021 – with trading activity being almost as high as Ethereum’s. Originally starting out as a fun token based on the famous Japanese dog breed, the digital currency grabbed mainstream attention in 2021 probably because of its low barrier of entry: Even after its price spikes, Shiba Inu was one of the cheapest coins available, especially when compared to the price of 99 other cryptocurrencies. Combine this with survey information that most consumers in the U.S. and the UK invest in crypto either for growth or fun. Shiba Inu is probably seen by many as a relatively simple, “quick win” investment.

More on Shiba Inu

What is Shiba Inu (SHIB)?

Shiba Inu (SHIB) was developed to answer a simple question: What would happen if a cryptocurrency project was 100 percent run by its community?

SHIB is a token designed to be an Ethereum-compatible alternative to Dogecoin (DOGE). Like DOGE, SHIB is intentionally abundant — with an initial circulating supply of one quadrillion coins. The Shiba Inu ecosystem also supports projects such as an NFT art incubator and a decentralized exchange called Shibaswap.

Who created Shiba Inu?

An anonymous developer named Ryoshi launched SHIB in August 2020. The project began with a total supply of one quadrillion tokens — a truly vast number.

Shiba Inu has realized significant gains following its recent listings on popular crypto exchanges like Binance. However, there are bold critics of this ranking by market cap. However, on 6 April 2022, the price of several of the most popular cryptocurrencies fell today as investors evaluated moves by the Federal Reserve, which is desperately trying to rein in surging inflation.

Shiba Inu was initially listed on ShibaSwap, a decentralized exchange platform for Shiba Inu. The token, however, was created anonymously, just like Bitcoin, with the founder calling himself, Ryoshi.

Shiba has since grown over time, and now the token is listed as one of the most popular cryptocurrencies in the world, with a stable ranking consistently above #20 on CoinMarket1cap.

Shiba Inu has an inherent relationship with other tokens such as LEASH and BONE, used as governance tokens on Shiba Inu’s Decentralized Autonomous Organization.

One famed investor bought $5,000 Shiba Inu in late 2020, which was worth over $5 billion at its peak. This being said, that same investor is now barely a billionaire –– Shiba Inu has depreciated nearly 75% from its all-time high.

Shiba Inu (SHIB) has existed for quite some time now, and it has repeatedly been known as one of the cryptocurrencies with vibrant community backing. The token is inspired by the Dogecoin crypto and has since become one of its major rivals. Let’s see if our Shiba Inu Price Prediction can help shine a light thru the crypto winter in 2023.

SHIB Milestones

Since its launch, the cryptocurrency has grown immensely, and today, it is one of the top 20 cryptocurrencies ranked by its market capitalization. Going with the current news of what is happening in the crypto world, it is likely that this token’s price will continue going up, giving an even better reason to invest in SHIB.

The Shiba Inu burning has surpassed a significant milestone of 4.4 billion tokens and gained more bullishness from highly interested crypto investors. This ongoing Shiba Inu burning strategy can increase the cryptocurrency price in the near future with a constant value in the top cryptocurrency list. It has been speculated that ShibaSwap 2.0 is set to support a new burning mechanism for this Shiba Inu burning strategy. This can skyrocket SHIB to the next level, as expected by its community.

Introducing the NEW https://shib.io website, new @shib_iothemv branding, and the WAGMI Temple Alpha preview! Now you can purchase #shibthemetaverse lands easy as 1-2-3. Let us know what you think #shibarmy!

Shiba Inu Applications

There are several broad aspects to consider when determining the application of a cryptocurrency. The meme coin, for instance, borrows several qualities from different cryptocurrencies, making it relatively similar to other meme coins.

Although these tokens are often referred to as meme coins, it is evident that they sometimes offer value that can’t be found achieved when using mainstream tokens like Bitcoin and Ethereum.

So, what are some of the merits of Shiba Inu that warrant its usage?

SHIBA INU is built on the Ethereum blockchain and borrows several security features from its parent blockchain. Therefore, the Shiba Inu prediction analyzes the technology used behind a particular cryptocurrency to determine its longevity in the crypto space. Since the Ethereum blockchain is quite stable, the Shiba coin has a promising future.

Due to its relatively low transaction fees, the SHIB can essentially be used as an online currency – one of the main goals of developing Bitcoin, according to Satoshi’s Bitcoin Whitepaper.

PROS of investing in Shiba Inu

Shiba Inu has a large and vibrant following on social media, including crypto celebrities like Elon Musk and Vitalik Buterin.

The Shiba Inu ecosystem is rapidly expanding with a dedicated team of developers. Shiba Inu intends to grow into more than just a meme coin and provide real utility to the community.

SHIB has impressive cryptocurrency market listings and is accepted as a means of payment by many merchants.

CONS of investing in Shiba Inu

- Shroud of Mystery. The lead developer Shytoshi Kusama uses a pseudonym, and investors only learn of developments through sporadic articles on social media. There’s no centralized hub keeping track of announcements and developments – meaning we’re almost relying on the words of an anonymous source.

- Unclear tokenomics. The BONE token expected to be used for governance and gas fees on Shibarium has a limited supply of 250 million tokens. How the tokens will be migrated to Shibarium and used for gas and governance is unclear.

- There is stiff competition in the layer-2 blockchain, metaverse, and collectible play-to-earn gaming space. It is unclear how it will compete against these cryptocurrencies with a decentralized base and general anonymity among lead developers.

- There’s little information on how the Shi decentralized stablecoin will be backed up. Decentralized stablecoins face a lot of criticism.

But what’s this about Shiba Inu Whale Moves 25 Trillion $SHIB From Crypto Exchange To Cold Storage?

An unknown Ethereum address has transferred almost 25 trillion Shiba Inu tokens worth over $250 million from a top crypto exchange to a self-custody wallet, according to on-chain data reported by crypto analytics firm Santiment. The SHIB tokens were moved from an Ethereum address categorized by Etherscan as belonging to US crypto exchange Crypto.com to a new wallet.

The movement of tokens could adversely affect the market price (a trading strategy). So, please watch out before you decide about coin selection. Are SHIB whales cautioning SHIB’s retail traders and investors? Taking up the 3rd spot as one of the most held cryptos is Shiba Inu, with the whales holding about $653,600,200 SHIB at the moment.

A Metaverse project named “SHIB: The Metaverse” was launched as detailed in an official post on its website. The developers of the famous meme coin described the virtual reality space as the creation of an enabling environment for growth and sharing.

Where to buy Shiba Inu

Shiba Inu’s fast growth to fame and rise in crypto has helped it secure listings on cryptocurrency exchanges. Binance, KU coin, Gate.io, Kraken, FTX, Poloniex, MEXC, OKX, Lbank, and Crypto.com. According to Coinmarketcap, these exchanges offer deep Shiba liquidity. Factors to consider include security, liquidity, fees, regulation, and insurance.

You can also buy ShibaInu Coin on Shiba Swap. Simply create a Metamask wallet, send ETH to the wallet, connect the wallet to Shibaswap, and then swap ETH for Shib.

Shib Update 5.10

This update concerns the latest developments in the Shib Ecosystem, aligned with Ryoshi’s vision of decentralizing all industries using Shib platforms and financial products. The update is about Shibarium, Shi, and Shibaswap.

Shibaswap

Shibarium is an L2 Blockchain for Ethereum (utilizing $BONE ). It is the backbone of all the Shib projects in development and will offer a scaling and low-cost solution for many projects. The Shib team is planning a Shibarium Hackathon to help educate the community on Shibarium and reward teams with funds to build on Shibarium.

The decentralized exchange is completed and continually evolving. Shiba Swap is a token exchange feature on the Shiba ecosystem. The platform is anticipated to provide low transaction fees and fast token swaps. It will offer a more accessible entry into a plethora of tokens in the crypto space.

Shi

The Shi project is also nearing completion following experimental research on the previous and current stablecoins. The Shib army will have an excellent stablecoin solution. The developer did not provide timelines but hinted at test runs beginning soon.

Conclusion

Big developments are coming for the Shiba Inu network. The community is lively and shares the news. These will affect the value of Shiba Inu. The crypto market has been downward this year, and Shiba Inu has not been spared.

SHIB’s low price, limited utility, and rocketing prices- that go either direction, stand to be the biggest challenge facing SHIB. Technically speaking, Shiba Inu could reach a penny if enough capital is invested in dog-themed cryptocurrencies. Shiba Inu would need trillions in capital to reach $0.01, and institutions would need to purchase SHIB, which seems highly unlikely.

Shiba Inu has had a wild run since its inception following its meme and humble beginnings. Shiba Inu and Doge currently dominate the meme coin market. In an attempt to take the mantle, the Shiba Inu ecosystem is rapidly developing to create utility for its huge following. The developments are expected to raise Shiba Inu’s valuation in the future. In the long term, the value of SHIB will grow as the utility of the coin grows; speculators are likely to drop out of the project in favor of other promising undervalued cryptocurrencies.

The Shiba Inu community is hopeful about the future of their coin. Many signs suggest that this token’s popularity will only grow as it gains adoption over the next two decades. According to the current price fluctuations and past performance, it looks likely that Shiba Inu will reach new highs in the coming years as crypto adoption continues to increase worldwide.

However, it is important to note that nothing is guaranteed regarding cryptocurrency predictions, and short-term market fluctuations can cause massive shifts in price projections for any coin. Ultimately, the best way to determine if SHIB will be worth investing in is by keeping up with the latest news and trends within the crypto sphere.

The price predictions are not investment recommendations and should not be taken as such. The future value of Shiba Inu depends on many factors, including global acceptance, market cap, token demand and supply, technical infrastructure, development, and the number of other coins in circulation.

The creators of this cryptocurrency are focused on making the burn rate grow with the utilization rate of the platform. Crypto investors can access around 550 trillion coins in the cryptocurrency market.

Despite its high volatility, the Shiba Inu ecosystem is snowballing with high adoption from the crypto community. While it has been declared a meme coin, there are a lot of developments in the pipeline for Shiba Inu. These include the new Shi stablecoin scheduled for release before the end of the year. Such upgrades will maintain Shiba’s viability into the future.

According to the long-term price projection, the SHIB digital assets are anticipated to be profitable with a bullish trend despite all the price changes of the SHIB tokens and significant risk. Remember that information about the Shiba Inu coin is only for informational purposes. Knowing an approximate SHIB price is helpful, but as with any coin, you need to analyze the price action. Before making any investment decisions, always do your research beyond.