NEO Price Prediction 2024-2033

- NEO Price Prediction 2024 – up to $26.05

- NEO Price Prediction 2027 – up to $82.45

- NEO Price Prediction 2030 – up to $265.98

- NEO Price Prediction 2033 – up to $848.34

In the crypto market, new projects appear every day. On average, only one project out of ten becomes a complete working ecosystem, and only a few of those have an application to the problems of the modern world. One successful start-up is NEO, open-source crypto with the extended functionality to develop smart contracts and decentralized applications (dApps).

Neo (NEO) might not be one of the biggest names in the business, but it’s reputedly China’s first open-source blockchain — and is often referred to as ‘the Chinese Ethereum’. Erik Zhang, one of the co-founders, is the inventor of the ‘Delegated Byzantine Fault Tolerance‘ consensus mechanism, making NEO the first crypto to use this algorithm.

With supporting details on the coin’s potential in this NEO price prediction, you might want to add the coin to your portfolio.

How much is Neo worth?

Today’s Neo price is $16.32 with a 24-hour trading volume of $45,024,093. Neo is down 1.49% in the last 24 hours. The current CoinMarketCap ranking is #93, with a live market cap of $1,153,321,653. It has a circulating supply of 70,538,831 NEO coins and a max. supply of 100,000,000 NEO coins.

Neo Price Analysis: NEO Eyes Major Breakout, Targets $18.21

TL;DR Breakdown

- NEO/USDT resistance is present at $16.61

- NEO breaches support at $14.90

- NEO breaks above 20-day MA

Neo Price Analysis 4-hour chart: Bullish Signs for NEO as it Breaks Above 20-day MA

The NEO/USDT 4-hour price chart shows a narrowing bollinger band, indicating decreased crypto market volatility. However, with the price trading above the upper band, NEO could be set for a potential breakout to $18.21 if the current trend is accompanied by increased trading volume. Additionally, the RSI is at 62.70, and aligns with the current market trend, indicating that NEO is overbought. Typically, investors would expect a reversal towards the moving average (MA) or support at $15.63, but a strong bullish could drive the token even further up.

NEO/USD Price Analysis 1-day chart: Bullish MACD Signals Potential Rally Beyond $16.61

As seen on the 1-day chart, NEO is trading within $14.90 to $16.61 range, and could be set to break above the immediate resistance. A reversal from the $16.61 resistance could pull NEO to $14.24. However, a break out of the resistance level could see NEO recapture its early March highs. The MACD corroborates the recent price trend, with a bullish crossover indicating potential buying opportunities.

Is NEO a Good Investment?

NEO enables a smart economy through its unique consensus mechanism and advanced blockchain technology. Although it stands out in the competitive industry, external variables like market conditions and regulations (especially in China) can affect it greatly. Because of this dynamic regulatory landscape, investing in NEO is intricate; investors must carefully assess factors such as its current market position, technological innovations, and relevant legal framework before making any investments.

Neo Recent News/Opinions

After Neo N3 comes the Neo X sidechain, a solid shield against MEV bots

Neo Price Predictions 2024 – 2033

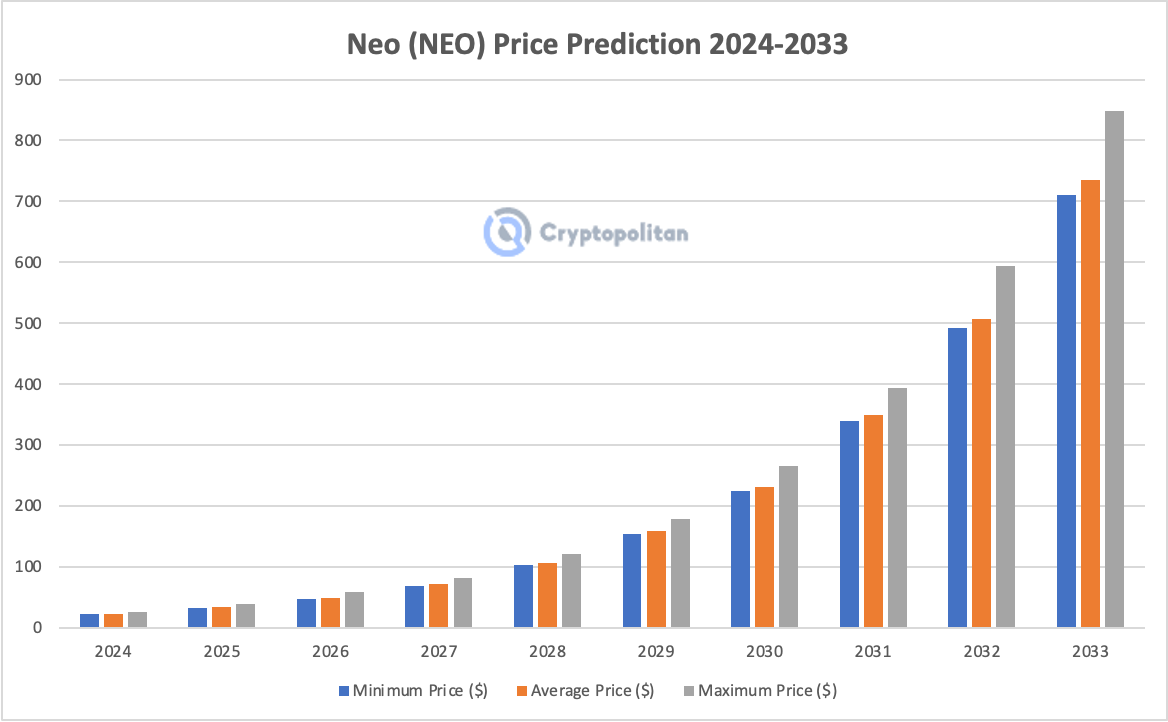

NEO, classified as an altcoin, has demonstrated substantial gains for investors over time. However, its trajectory has mirrored that of Bitcoin and other prominent digital assets above, tracking through the fluctuations of the crypto market. Currently at 91.7% below its ATH, the question of whether Neo coin can stage a recovery in the foreseeable future is a pertinent one. Let’s delve into our NEO price prediction spanning the years 2024 to 2033.

| Year | Minimum Price ($) | Average Price ($) | Maximum Price ($) |

| 2024 | 22.49 | 23.14 | 26.05 |

| 2025 | 33.13 | 34.29 | 38.44 |

| 2026 | 47.14 | 48.86 | 58.44 |

| 2027 | 69.24 | 71.68 | 82.45 |

| 2028 | 103.32 | 106.19 | 121.78 |

| 2029 | 153.54 | 158.85 | 179.06 |

| 2030 | 224.42 | 230.77 | 265.98 |

| 2031 | 339.34 | 348.57 | 394.34 |

| 2032 | 492.44 | 506.39 | 594.23 |

| 2033 | 710.41 | 735.73 | 848.34 |

NEO Price Prediction 2024

Based on technical analysis and on our NEO price projection for the year 2024, investors should anticipate a potential maximum value of $26.05 and an average value of $23.14 for the cryptocurrency. Furthermore, the forecast indicates that the token’s market price is expected to remain above a minimum threshold of $22.49.

NEO Price Prediction 2025

In our NEO price forecast for 2025, a dominant bullish sentiment is anticipated to persist in the NEO market. This is projected to drive the token’s value to attain a maximum price of $38.44. Furthermore, the projected average price is set at $34.29, while the predicted minimum price is expected to stay around $33.13.

NEO Price Prediction 2026

As per our NEO price forecast for 2026, the market is poised to witness NEO’s value surging to a peak of $58.44. Meanwhile, the projected range indicates a minimum value of $47.14, with the average price projected to settle at $48.86.

NEO Price Prediction 2027

Looking ahead to 2027, our NEO price projection suggests an exciting possibility of the token reaching a peak market price of $82.45. In terms of the average market price, our forecast indicates a figure of $71.68. On the more conservative side, the projected minimum price for NEO is expected to be around $69.24.

NEO Price Prediction 2028

According to our NEO prediction for 2028, there’s a possibility that NEO could reach a maximum price of $121.78. Additionally, our forecast indicates an average trading price of $106.19, and a minimum price of $103.32.

NEO Price Prediction 2029

Our NEO price prediction for 2029 projects a maximum price of $179.06, a minimum price of $153.54, and an average price of $158.85.

NEO Price Prediction 2030

Our NEO price prediction for 2030 indicates that the NEO cryptocurrency could reach a maximum trading price of $265.98. Additionally, the projected average price is anticipated to be around $230.77, while the expected minimum price is likely to hover around $224.42.

NEO Price Prediction 2031

Based on our NEO price prediction for 2031, it is anticipated that NEO could witness substantial price gains, potentially reaching a maximum price of $394.34. Furthermore, the forecast indicates a projected minimum price of $339.34 and an average price of $348.57.

NEO Price Prediction 2032

As per our NEO price prediction for 2032, the market is anticipated to witness NEO’s value potentially reaching a peak value of $594.23. Our forecast suggests a minimum price of $492.44 and an average price of $506.39.

NEO Price Prediction 2033

As per our forecast for NEO’s price in 2033, the cryptocurrency is anticipated to achieve a peak value of $848.34. Notably, the projected price range indicates that NEO’s lowest predicted price is $710.41, while the average estimate stands at $735.73.

NEO Price Forecast by Wallet Investor

Wallet Investor predicts that there could be a significant decline in the price of NEO, potentially causing it to plummet from its present value of $16.15 to around $3.284 by 2025.

NEO Price Predictions by Changelly

According to the NEO price predictions by Changelly, the coin’s value could reach a maximum value of $17.29, a minimum value of $10.65 and an average price of $13.97. The year 2026 could see NEO’s value potentially surge by around 262.5%, reaching a maximum price of $58.76. For 2029, Changelly predicts a maximum value of $179.04, a minimum value of $107.49 and an average price of $158.83. Finally, for 2033, NEO is expected to attain a peak market value of $848.26, a minimum value of $510.55 and an average price of $678.33.

Digitialcoinprice NEO Price Predictions

Digitalcoinprice’s NEO price prediction outlines a progressive and positive trajectory for the cryptocurrency over the upcoming years. In 2024, they anticipate NEO’s value to range between $14.69 and $35.84, with an average price of $33.45. The forecast for 2028 envisions a potential increase, with NEO’s value projected to fluctuate between $62.85 and $75.09, averaging around $69.75. As the years advance, the forecast suggests a consistent upward trend, with NEO’s anticipated prices gradually climbing. By 2033, the prediction envisions NEO’s value potentially reaching between $306.32 and $317.39, showcasing substantial growth from its current value.

Neo Overview

| Popularity | #93 | Market Cap | $1,153,321,653 |

| Price Change (24 hours) | +1.49% | Trading Volume (24 hours) | $45,024,093 |

| Price Change (30 days) | +16.22% | Circulating Supply | 70,538,831 NEO |

| All-time low (Oct 2016) | $0.07229 | All-time high (Jan, 2018) | $196.85 |

| Price from ATL | 22515.69% | Price from ATH | -91.7% |

Neo Price History

From 2017 to 2018, NEO, formerly known as AntShares, emerged as a significant player in the crypto market, peaking at $198.38 in January 2018 after a rebranding and a series of bull runs. However, by the end of 2018, its price had plummeted to around $7 amid a broad market correction. Between 2019 and 2020, NEO’s price saw minor fluctuations, primarily hovering between $7 and $25, reflecting a period of relative stability within the volatile cryptocurrency market.

The years 2021 and 2022 were characterized by volatility and market downturns, with NEO reaching over $100 in early 2021 before falling to a range of $6 to $10 by the end of 2022 due to bearish sentiment and regulatory pressures. In 2023, NEO exhibited signs of stabilization, briefly touching $14 in April, but soon fell to a price range of $7-10$ and closed the year at $13.51. In the first quarter of 2024, NEO touched $18 for the first time since April 2022, and at the time of writing, the token is trading at $16.4.

More on Neo Token (NEO)

What Is NEO?

NEO, in short, is a blockchain project from China founded in 2014. It used to be called Antshares, but this changed later. NEO cryptocurrency is also called the Chinese Ethereum because they are strongly committed to creating a smart economy and receiving huge Chinese government support. This means that the project developers want to make it easy to use smart contracts on the NEO network.

For investors to use the NEO platform, the second crypto is used – namely, GAS. This can be considered the fuel of NEO. One share of the NEO token is also seen as one share in the network, and the GAS crypto is used to make transactions on this network.

It is possible to earn GAS with your NEO coin by saving your NEO coin in official wallets. This is due to the proof of stake principle. You deposit your NEO coin in your wallet and receive a portion of the GAS spent on the network in proportion to the amount of NEO coin you own. It is thus possible to generate some passive income for yourself.

You can imagine that when the NEO price or the GAS price rises, you will benefit from the price difference on your NEO but also that of your obtained extra GAS. This is one of the reasons investors invest or have invested a lot in NEO crypto in the past. Over the years, as with any project, a lot has happened with the NEO price action. We should add that it’s impossible to mine this virtual currency because they were all distributed during the ICO.

NEO 3.0

The NEO team was working on the project for three years. The Cryptocurrency market has been waiting for the NEO 3.0 release since the end of 2020. The launch was postponed several times. However, in March 2021, Neo started rolling out an N3 version of its public blockchain technology.

NEO tries to create its own digital identity by attracting developers to create decentralized applications on the blockchain platform. The improved consensus protocol can be used worldwide. The upgrade of the system occurs when the Ethereum network (a major competitor of NEO) is suffering capacity problems. Moreover, China, famous for its strict crypto regulation, claimed blockchain as a strategically leading technology.

NEO 3.0 will raise transaction speed from 1,000/second to 5,000/second and cut “gas fees” 100 times. The fee reduction is a core point in competition with ETH, which has too high fees.

The upgrade will include a decentralized file storage solution and a new governance mechanism. Under the new governance, NEO holders will vote in a NEO Council, which includes 21 members. The Council will control the management of fees, network upgrades, and other operation-based cases.

Poly Network, a consortium interoperability protocol, is used to facilitate NEO token migration to the new network. The migration with Poly Network will show whether the network works well to create a blockchain from scratch and transfer all the data from the existing chain without errors.

Here are some of the major elements of the NEO 3.0 network that are supposed to attract developers to the system: multi-language support, native oracles that secure access to any off-chain data, advanced interoperability, decentralized storage, and self-sovereign identity, best-in-class tooling, and a dual-token model.

Sometimes people include NEO in the list of Ethereum Killers. Both systems provide similar features for the market, but NEO has more advanced technology and surpasses ETH in various aspects. The platform uses its own virtual machine NeoVM, allowing you to run even the most complex contracts quickly. The theoretical network capacity is 10,000 transactions per second.

At the moment, the speed does not exceed 1000 tps. NEO implements an advanced dBFT protocol that effectively protects the system from most known cyberattack methods. Unlike Ethereum, which uses the extremely sophisticated programming language, Solidity, NEO supports Java, C#, Kotlin, GO, and Python.

In the middle of April 2021, after NEO 3.0 started rolling out, the NEO/USD pair managed to hit $130. It’s a significant rise from 0.0320 USD during the ICO in August 2017. Analysts and crypto enthusiasts believe that it’s not the limit and that further development will lead to higher prices.

Conclusion

Even though the NEO project hasn’t had enough publicity that it should have, the project behind it is a futuristic one. There are many NEO price predictions, but we are bullish on the coin and hope that it performs well in the future. Our expected maximum price for this coin by 2023 is $10.67.

According to algorithmic averages and expert predictions, the predicted price of NEO by 2032 is $339.43. Despite the optimistic price predictions, you must do your research before making any investments, as cryptocurrencies, like NEO, are volatile. With a quick market recovery, a massive 51.7% push to the upside is anticipated by the end of 2023.