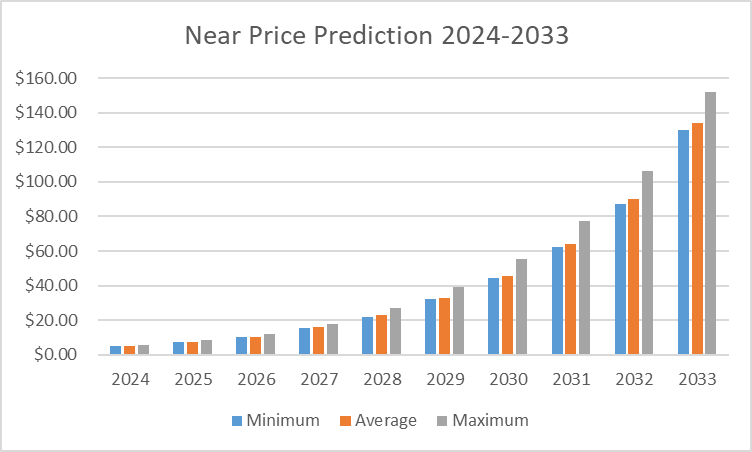

NEAR Price Prediction 2024-2033

- NEAR Protocol Price Prediction 2024 – up to $5.78

- NEAR Protocol Price Prediction 2027 – up to $18.02

- NEAR Protocol Price Prediction 2030 – up to $55.44

- NEAR Protocol Price Prediction 2033 – up to $151.92

Near Protocol (NEAR) is a blockchain platform with significant attention and partnerships within the cryptocurrency industry. Initially established by a small team in San Francisco, NEAR Protocol has rapidly expanded its influence and formed collaborations with industry giants. As a result, it has witnessed a consistent upward trajectory since its inception.

Cryptocurrencies continue to gain traction as a viable asset class, and investors are becoming more aware of the potential for long-term returns. In this NEAR Price Prediction, we will look at the current price state of the NEAR Protocol and its price predictions between 2024 – 2033 to determine if it is a good investment opportunity.

How much is NEAR Protocol worth today?

The live NEAR Protocol price today is $6.77 USD with a 24-hour trading volume of $472,317,394 USD. We update our NEAR to USD price in real-time. NEAR Protocol is down 0.28% in the last 24 hours. The current CoinMarketCap ranking is #18, with a live market cap of $7,184,323,652 USD. It has a circulating supply of 1,060,786,577 NEAR coins and the max. supply is not available.

NEAR Protocol price analysis: NEAR follows a bullish movement at $6.75

Near Protocol price analysis for today shows that the price has been steady above $7.750 for most of the day. The bull trend is present, with a surge of more than 5.34%. The bullish sentiment has been fuelled by buying activity from the traders. This has allowed the token to remain above the crucial $7.50 level for the day.

The support for NEAR/USD remains strong at $7.41, a key level for the bulls to hold on to. A break below this level could cause prices to fall back into a bearish trend. On the other hand, if traders can push prices above $7.90, they will be in an advantageous position and likely be able to push the token further.

NEAR price analysis: NEAR gains momentum after trading near the $6.50 mark

The MACD is currently bearish as expressed in the red colour of the histogram. However, the indicator only shows low momentum as observed in the short height of the histogram. Moreover, the darker shade suggests an increasing bearish pressure across the charts as the price action observes rising volatility across the short-term charts.

The EMAs are trading below the mean position as net price movement over the last ten days remains positive. Currently, the EMAs are trading close to each other showing low bearish momentum at press time. Moreover, the converging EMAs suggest a decreasing bearish momentum.

The RSI has returned to the bottom of the neutral region as the price action falls to the $4.250 level. At press time, the indicator trades close to the mean at the 39.68 index level as the price suggests low pressure from either side of the market while the neutral slope suggests low activity across the markets.

The Bollinger Bands are currently expanding as the price action increases volatility across the short-term charts. Moreover, the bands will continue converging as the price consolidates around the $4.250 mark. At press time, the bands’ lower limit provides support at the $4.000 mark while the upper limit presents a resistance level at the $4.500 mark.

Technical analysis: 4-hour NEAR/USDT analysis

Overall, the 4-hour NEAR price analysis issues a buy signal at press time with 13 indicators supporting the bulls. On the other hand, only three of the indicators support the bears showing a low bearish presence. At the same time, 10 indicators sit on the fence and support neither side of the market.

The 24-hour NEAR price analysis shares this sentiment and also issues a buy signal with 13 indicators supporting the bulls against only six supporting the bears. The analysis shows bullish dominance across the mid-term charts with a strong bullish presence at the current price level. Meanwhile, the remaining seven indicators remain neutral and do not issue any signals at press time.

What to expect from NEAR Protocol price analysis?

The NEAR Protocol price analysis shows that the NEAR market observes strong bearish momentum causing the price action to dwindle from the $8.500 mark towards the $6.50 mark. While the bulls found strong support level at the $6.50 and bounced back to the $7.75 price level.

Traders should expect NEAR to continue its strong bullish rally, however, the rally would require a brief rest at the current price level as the bulls appear to be exhausted and need time before continuing the charge. Moreover, the strong trade volume suggests an increasing trade activity for the asset suggesting a strong force behind the recent push. As such, the price can be expected to move between the $7.400-$8.300 price level across the short-term charts.

Currently, the closest support level lies at $7.750 while NEAR Protocol finds it difficult to move past the $8.00 level.

Is Near Protocol a good investment?

NEAR Protocol distinguishes itself in the cryptocurrency market with its emphasis on scalability, usability, and developer-friendliness. It aims to facilitate the creation of decentralized applications (dApps) and smart contracts, catering to both developers and end-users. NEAR’s innovative technology and user-centric approach make it attractive for mainstream adoption of blockchain applications. With a focus on user experience and developer tools, NEAR Protocol is positioned to drive significant growth in the decentralized application ecosystem. Its potential to disrupt traditional industries and capture market share in the blockchain space makes it an intriguing investment opportunity for those interested in innovative technology solutions.

Near Protocol Recent News/Opinions

Tomorrow the Protocol is conducting an AMA session to answer community questions and expand on their ideas regarding LiNEAR and its role in the future of Web3.

Tomorrow. 8am UTC. Spaces. DIY to convert the timezone.

— NEAR Protocol (@NEARProtocol) March 26, 2024

Don't miss it.

NEAR. Chain Abstraction. Ft @ilblackdragon, @MetaWebVC, and @LinearProtocol.

Learn about Chain Abstraction, the role of LiNEAR, and how the puzzle fits together in the future of Web3. https://t.co/XgoFSEjcWi

NEAR Price Prediction 2024-2033

NEAR Price Prediction by Cryptopolitan

| Year | Minimum | Average | Maximum |

| 2024 | $4.89 | $5.06 | $5.78 |

| 2025 | $7.22 | $7.42 | $8.53 |

| 2026 | $10.00 | $10.37 | $12.23 |

| 2027 | $15.56 | $15.97 | $18.02 |

| 2028 | $22.12 | $22.76 | $26.84 |

| 2029 | $32.16 | $33.07 | $39.12 |

| 2030 | $44.12 | $45.77 | $55.44 |

| 2031 | $62.14 | $45.77 | $55.44 |

| 2032 | $87.08 | $90.28 | $106.06 |

| 2033 | $130.13 | $133.74 | $151.92 |

NEAR Price Prediction 2024

Our NEAR protocol price forecast for 2024 is expected to trade at a minimum price of $4.89, with an average of $5.06, and a maximum price of $5.78 by the end of 2024.

NEAR Price Prediction 2025

The NEAR forecast for 2025 suggests a continuation of price rise with a minimum value of $7.22, an average price of $7.42, and a maximum value of nearly $8.53.

NEAR Price Prediction 2026

The NEAR Protocol technical analysis and projections for 2026 anticipate the minimum price to be around $10.00, with an average trading price of $10.37, and a maximum value of nearly $12.23 by the end of 2026.

NEAR Price Prediction 2027

In 2027, our NEAR price prediction for 2027 estimates Near protocol’s price to be trading at a minimum price of $15.56, with an average price of $15.97, and a maximum price value nearly reaching $18.02 by the end of 2027.

NEAR Price Prediction 2028

The NEAR Protocol price prediction for 2028 suggests the bullish sentiment will continue with a minimum price of $22.12, an average trading price of nearly $22.76, and a maximum value of $26.84 by the end of 2028.

NEAR Price Prediction 2029

In 2029, our NEAR protocol price prediction forecasts NEAR to be trading at a minimum of $32.16, with an average price of nearly $33.07, and a maximum value of $39.12 by the end of 2029.

NEAR Price Prediction 2030

The NEAR Protocol forecast for 2030 suggests a sustained bullish sentiment with a minimum value of $44.12, an average trading price of nearly $45.77, and a maximum value of $55.44 by the end of 2030.

NEAR Price Prediction 2031

The Near Protocol price forecast for 2031 suggests NEAR Protocol price is forecast to reach the lowest possible level of $62.14 in 2031. As per our findings, the NEAR price could reach the maximum level of $63.97 with an average forecast price of $77.17.

NEAR Price Prediction 2032

In 2032, our NEAR Protocol price prediction estimates that the NEAR Protocol price could reach a minimum of $87.08, with an average value of $90.28, and a maximum value of nearly $106.06 by the end of 2032.

NEAR Price Prediction 2033

For 2033, the NEAR Protocol price prediction indicates a minimum price of $130.13, an average price of $133.74, and a maximum price of $151.92.

NEAR Price Prediction by Coincodex

According to the current NEAR Protocol price prediction by Coincodex, there is a forecasted drop of -7.20% in the price of NEAR Protocol, with an estimated value of $1.792654 by November 26, 2024. Technical indicators suggest a neutral sentiment, while the Fear & Greed Index shows a level of 71, indicating greed among investors. Over the past 30 days, NEAR Protocol has experienced 21 green days out of 30, with a price volatility of 17.00%. Given these factors, Coincodex suggests that it may be a good time to consider buying NEAR Protocol.

Looking ahead to 2024, based on historical price movements and considering BTC halving cycles, the yearly low NEAR Protocol price prediction is estimated at $1.682558, while the potential high for NEAR Protocol in 2024 is predicted to reach $4.42. The forecast extends further, with a price prediction for 2025 ranging between $3.74 and $15.04, potentially yielding a 714.98% gain if NEAR reaches the upper price target. By 2030, the prediction ranges from $10.72 to $13.57, suggesting a potential gain of 635.12% if the upper price target is achieved.

NEAR Price Prediction by DigitalCoinPrice

DigitalCoinPrice has a bullish outlook on Near future prices and projects, and the market expert suggests all technical indicators, the 200-day SMA will drop soon, and the price will hit $1.90 by the end of January By July 2024, NEAR Protocol’s short-term 50-Day SMA shows a $1.68.

The long-term price forecast for Near is for Near Protocol to be worth trading at a minimum price of $4.63, an average price of $5.37, and a maximum price forecast of $5.49.DigitalCoinPrice estimates the price of Near to attain a maximum price of $9.00, while by 2032, they expect Near to attain a maximum price of $23.26.

NEAR Protocol Price Predictions by Technewsleader

Technewsleader has a relatively bullish Near-protocol price forecast, estimating a one-year price change of $2.13, with a trading range of $4.04 to $5.09 in 2026. The long-term price forecast by Technewsleader estimates Near to trade at a range of $12.31 to $14.77 in 2029, with a maximum possible value of $6.10 in five years. Technewsleader estimates Near Protocol to unlock its full potential in 2032, reaching a maximum price of $25.40.

NEAR Price Prediction by Market Experts

According to Altcoin Doctor, a popular cryptocurrency market analyst based on YouTube, Near has the highest price and potential to spike rapidly, and they believe it can reach $10.0 by mid-2024.

As per Altcoin Doctor, Protocol Near price prediction suggests Near could hit a low of $0.97 in 2021 but will gain momentum towards 2024 and beyond. He further suggests that the long-term price forecast for Near is bullish, with an expected trade value of $31.97 by the end of 2026. The Youtuber has given a technical analysis of future price points for the cryptocurrency and believes that Near has a lot of potential to move up in price.

NEAR Protocol Overview

| Popularity | Market Cap | $3,290,953,950 | |

| Price Change (24 hours) | -1.16% | Trading Volume (24 hours) | $174,366,360 |

| Price change (7 days) | -8.62% | Circulating Supply | 1.1B EOS |

| All-time low | (Nov 04, 2020)$0.5024 | All-time high | (Jan 17, 2022) $20.42 |

| From ATL | +522.79% | From ATH | -83.96% |

NEAR Protocol Price History

The Near Protocol (NEAR) began its journey in August with a vision of creating a scalable and permissionless blockchain. In October 2020, the first known trade value for NEAR was recorded at $1.072, and the price briefly spiked to $1.884 on the same day. However, the asset experienced a subsequent downturn, finding support at $0.538 by November 5th. NEAR then saw a recovery, closing the year with an annual trade price of $1.459.

The year 2021 Near Protocol price movements show an uptrend, as NEAR began trading at $1.305. By March 13th, it reached a new all-time high (ATH) of $7.572. However, a prolonged downward movement in the market pushed the price down to $1.537 by July 19th. An upward trend followed, driving the price to $11.776 on September 9th and further to $13.168 on October 26th.

On November 15th, NEAR Protocol launched its “Nightshade” sharding solution, coinciding with a price of $12.046. The year concluded with an annual trade price of $15.793. In early 2022, NEAR Protocol (NEAR) experienced significant growth. It reached its all-time high of $20.42 on January 16th. However, it underwent a correction in February and dipped below the $10 level. The price began to surge again in April, reaching a peak of $19.64 on April 8th.

However, like many other cryptocurrencies, the current value of NEAR was impacted by the broader market downturns during this year’s crypto crashes. On June 18th, its value plummeted below $5, dropping further to $2.90.

The downward trend continued throughout the end of October and into November, with NEAR falling even lower. Eventually, it dipped below its launch price, reaching a 52-week low of $1.44 on November 21st.

NEAR closed 2022 at $1.2747 and has been trading between $1.16 to $1.16 since then. The price of Near is down -15.76% in the last 30 days, while in the past week, NEAR has declined by -13.83%.

More about the NEAR Network

What is NEAR Protocol?

Near Protocol is a decentralized platform built on the proof-of-stake consensus model. It was created to enable developers to quickly and easily build, deploy, and scale applications with minimal overhead costs. Unlike other blockchain platforms, NEAR provides an intuitive user experience via its wallets and software development kits (SDKs).

NEAR Protocol, also known as NEAR, is a layer-one blockchain platform designed to address the limitations of existing blockchains and provide a community-run cloud computing infrastructure. It aims to offer improved transaction speeds, higher throughput, and enhanced interoperability, making it an ideal environment for decentralized applications (DApps).

One notable feature of NEAR Protocol is its use of human-readable account names, simplifying the user experience compared to the complex cryptographic wallet addresses commonly used on other blockchains like Ethereum. This user-friendly approach helps lower the entry barrier for developers and users alike.

To tackle scaling challenges, NEAR Protocol introduces innovative solutions. It has developed its consensus mechanism called “Doomslug,” which optimizes block production and reduces the time required for block confirmations. This enhances the overall performance and efficiency of the network.

NEAR Protocol is being developed by the NEAR Collective, a community-driven initiative responsible for updating the platform’s codebase and releasing regular updates to the ecosystem. The collective’s overarching goal is to build a platform that offers high security for managing valuable assets such as money, identity, and high performance to make blockchain applications practical and accessible for everyday users.

Numerous projects are being built on NEAR Protocol, showcasing its versatility and potential. For example, Flux is a protocol on NEAR that enables developers to create markets based on various assets, commodities, and real-world events. Mintbase, another project on NEAR, is an NFT (Non-Fungible Token) minting platform allowing users to create and trade unique digital assets.

With its focus on scalability, usability, and developer-friendly features, NEAR Protocol aims to contribute to the advancement of decentralized applications and foster the growth of Web 3.0, a vision of a more decentralized and user-centric internet.

Near Protocol Technology

NEAR Protocol tackles scalability challenges by implementing sharding, which involves dividing the network into smaller fragments called shards. Each shard is responsible for processing a specific portion of the network’s code, enabling parallel computation and enhancing the network’s capacity as the number of nodes increases. This approach reduces the computational load on individual nodes and improves transaction speeds and efficiency.

NEAR Protocol utilizes a Proof-of-Stake (PoS) consensus mechanism to achieve consensus among network nodes. Validators, who want to participate in transaction validation, must stake their NEAR tokens. Token holders who prefer not to operate a node can delegate their stake to validators of their choice. Validators are chosen through an auction system at regular intervals, with those holding larger stakes having more influence in the consensus process.

Validators in NEAR Protocol have distinct roles. Some validate chunks, which are aggregations of transactions from a specific shard, while others produce blocks containing chunks from all shards. Additionally, nodes called “fishermen” monitor the network, detect any malicious behavior, and report it. If a validator engages in improper behavior, their stake can be penalized. This system incentivizes validators to act honestly and ensures the security and integrity of the network.

Founders of Near Protocol

Erik Trautman, Illia Polosukhin, and Alexander Skidanov co-founded NEAR Protocol (NEAR). Erik Trautman is an entrepreneur with a background in finance and Wall Street. Before NEAR Protocol, he founded Viking Education, an organization focused on training software developers. Illia Polosukhin brings over a decade of industry experience to NEAR Protocol, including three years at Google, where he worked on machine learning projects. Alexander Skidanov is a computer scientist who previously worked at Microsoft and later joined memSQL as the director of engineering.

In addition to the co-founders, NEAR Protocol boasts a talented team of experienced developers. The team includes several individuals who have achieved recognition, such as International Collegiate Programming Contest (ICPC) gold medalists and winners. The NEAR Protocol team also emphasizes their expertise in building scalable, sharded systems, which aligns with the protocol’s focus on improving blockchain scalability.

NEAR Protocol Tokenomics

The NEAR token serves multiple purposes within the NEAR Protocol ecosystem. First and foremost, it is used to pay for transaction fees incurred when executing operations on the blockchain. Users need to hold and spend NEAR tokens to interact with decentralized applications (DApps) and perform transactions on the network.

In addition to transaction fees, NEAR tokens play a role in storing data on the blockchain. Users must provide collateral in the form of NEAR tokens to store their data securely and reliably on the network.

NEAR Protocol employs a token reward system to incentivize and reward various stakeholders within the ecosystem. Transaction validators, who play a crucial role in securing and validating the network, receive NEAR token rewards. These rewards are distributed every epoch and amount to approximately 4.5% of the total NEAR supply annually.

Furthermore, developers who create smart contracts on the NEAR platform receive a portion of the transaction fees generated by their contracts. This incentivizes developers to build and deploy innovative applications on the NEAR blockchain. The remaining portion of each transaction fee is burned, which reduces the supply of NEAR tokens and potentially increases their value over time.

NEAR Protocol is designed to support a variety of tokens, including those “wrapped” from other chains, as well as non-fungible tokens (NFTs). This versatility allows for interoperability and the seamless integration of different token standards within the NEAR ecosystem.

NEAR has established a bridge with Ethereum, enabling users to transfer ERC-20 tokens from the Ethereum network to NEAR. This bridge facilitates the movement of assets between the two blockchains, expanding the possibilities for users and developers within the NEAR ecosystem.

NEAR Platform Governance

Resources allocated to the protocol treasury are distributed by the NEAR Foundation, a Switzerland-based non-profit dedicated to protocol maintenance, the entire crypto ecosystem with funding, and guiding the protocol’s governance. Technical upgrades to the NEAR crypto network are carried out by the Reference Maintainer, selected by the NEAR Foundation board. However, all nodes in the network must consent to updates by upgrading their software. Eventually, oversight of the Reference Maintainer will be conducted by community-elected representatives.

NEAR Protocol aims to pull ahead in the crowded race to provide the infrastructure for Web 3.0 and has sought to distinguish itself through its unique developer and user-friendly features.

The governance of the NEAR Protocol involves multiple entities and mechanisms to ensure effective management and decision-making within the ecosystem. The NEAR Foundation, a non-profit organization based in Switzerland, is crucial in protocol maintenance, ecosystem funding, and guiding governance processes. The foundation is responsible for allocating resources from the protocol treasury, which supports the development and growth of the NEAR ecosystem.

The Reference Maintainer handles technical upgrades and maintenance of the NEAR crypto network. The NEAR Foundation board initially selects the Reference Maintainer, but consensus from all network nodes is required to implement updates. This ensures that the majority of the network participants agree upon changes to the protocol. In the future, the oversight of the Reference Maintainer will transition to community-elected representatives, allowing for a more decentralized and community-driven governance approach.

NEAR Protocol is positioning itself as a leading infrastructure provider for Web 3.0 and distinguishes itself through its developer and user-friendly features. By focusing on ease of use and providing robust tools and resources for developers, NEAR aims to attract and empower a vibrant developer community. The protocol strives to create an environment that fosters innovation and encourages the creation of user-friendly decentralized applications.

NEAR Protocol Unique features

NEAR Protocol (NEAR) stands out from other blockchain platforms due to its unique features and technologies. One notable innovation is the implementation of Nightshade, a variation of sharding. Nightshade enables parallel processing of transactions across multiple sharded chains, significantly improving the blockchain’s transaction throughput. With up to 100,000 transactions per second and near-instant transaction finality, NEAR Protocol achieves high performance while keeping transaction fees low.

NEAR Protocol also focuses on improving user experience and developer friendliness. It utilizes human-readable addresses, making the onboarding process simpler and more intuitive for users. Additionally, NEAR provides modular components that allow developers to quickly start projects like token contracts or non-fungible tokens (NFTs). By lowering entry barriers and offering developer-friendly tools, NEAR Protocol aims to attract a wide range of developers and facilitate the creation of innovative decentralized applications.

NEAR Protocol’s commitment to ecosystem growth is evident in its substantial ecosystem funding initiatives. With an $800 million fund, NEAR aims to support projects accelerating growth within the protocol ecosystem. The funding includes partnerships with Proximity Labs, and it encompasses scaling support for existing projects and startup grants for 20 selected startups. NEAR Protocol focuses on funding teams involved in decentralized finance (DeFi), NFTs, DAOs, and gaming, actively seeking to revolutionize how people interact with money and drive the adoption of Web3 technologies.

Moreover, NEAR Protocol aims to make blockchain technology accessible to a broader audience. The release of a JavaScript software development kit (JS SDK) allows over 20 million JavaScript programmers from the Web2 world to enter the blockchain and Web3 space easily. By leveraging JavaScript’s familiarity and widespread usage, NEAR Protocol empowers developers to build applications in a language they are proficient in, fostering broader adoption and expanding the developer community within the NEAR ecosystem.

NEAR Protocol has been experiencing significant expansion in its ecosystem, driven by its focus on user experience and ease of project deployment. The network recently launched the public beta version of Sender, a non-custodial mobile wallet app. The app, already connected to over 20 leading projects within the NEAR ecosystem, has garnered over 300,000 downloads of its web extension. Sender Labs, the wallet developer, received seed funding from Binance Labs and Metaweb Ventures, followed by a private funding round.

NEAR Protocol Ecosystem Expansion

Since the mainnet launch of NEAR Protocol in 2020, the ecosystem has witnessed the introduction of nine decentralized applications (dApps) with a total value locked (TVL) of approximately $285 million as of the time of writing. This demonstrates the growing activity and adoption within the NEAR ecosystem.

The Near Protocol Security

NEAR Protocol has also strongly emphasized security. The Rainbow NEAR-Ethereum bridge successfully defended against two attacks, with the second attempt resulting in the hacker losing 2.5 ETH. Additionally, NEAR announced successful mitigation of two vulnerabilities on Aurora, its Ethereum sidechain, through its bug bounty program. These security measures underline the protocol’s commitment to maintaining a robust and secure environment for users and developers.

The NEAR Protocol team remains confident in their dynamically sharded Proof-of-Stake blockchain’s scalability, security, and sustainability. By combining the power of Proof-of-Stake and sharding, NEAR aims to become one of the most scalable, secure, and environmentally friendly blockchain networks in the cryptocurrency space.

Where to buy Near Protocol

(NEAR) can be purchased from several reputable cryptocurrency exchanges. Here are some popular platforms where you can buy NEAR:

Binance: Binance is one of the largest and most well-known cryptocurrency exchanges globally. You can buy NEAR directly with popular cryptocurrencies like Bitcoin (BTC) or Ethereum (ETH) on the Binance platform.

Huobi Global: Huobi is another prominent cryptocurrency exchange that offers NEAR trading pairs. You can trade cryptocurrencies like Bitcoin, Ethereum, and Tether (USDT) for NEAR on Huobi Global.

Mandala Exchange: Mandala Exchange is a user-friendly cryptocurrency exchange that provides NEAR trading options. You can buy NEAR using various cryptocurrencies supported on the platform.

OKEx: OKEx is a reputable cryptocurrency exchange where you can buy and trade NEAR. It offers NEAR trading pairs with popular cryptocurrencies such as Bitcoin and Ethereum.

Near Protocol Fundamental analysis

NEAR Protocol (NEAR) stands out among platforms like Microsoft Azure or Amazon Web Services due to its unique selling points and fundamental features. One key aspect is the distributed network of validators, which ensures the security of the NEAR network without a single point of failure. This decentralized approach prevents hacking, tampering, and data loss, setting it apart from centrally-controlled cloud platforms. NEAR Protocol’s primary goal is to empower users by giving them control over their assets, data, and governance.

Scalability is a standout feature of NEAR Protocol. The network performs impressively through its Doomslug block production technique and Nightshade sharding system. NEAR can process up to 100,000 transactions per second, surpassing competitors like Solana. Additionally, transactions on the NEAR network finalize in less than a second, accompanied by extremely low transaction fees. The combination of Nightshade and Doomslug enhances throughput, efficiency, and network capacity, enabling lightning-fast transactions.

NEAR Protocol also prioritizes simplicity and convenience. Its use of human-readable account names makes cryptocurrency more accessible to users worldwide, reducing the complexity often associated with wallet addresses.

Interoperability is another strength of NEAR. The “Rainbow Bridge” allows users to bring tokens from Ethereum and easily build Ethereum projects using the Aurora Ethereum Virtual Machine. This seamless interoperability expands the possibilities for users and developers within the NEAR ecosystem.

NEAR Protocol’s commitment to sustainability is noteworthy. It became the world’s first climate and carbon-neutral blockchain in 2021, demonstrating its dedication to environmental responsibility.

Regarding cost-effectiveness, NEAR Protocol offers significantly lower transaction fees than other blockchain platforms. Developers are also empowered to earn 30% of transaction fees, giving them an additional incentive to contribute to the ecosystem.

Conclusion

Near Protocol (NEAR) is a blockchain platform with significant attention and partnerships within the cryptocurrency industry. It offers a developer-friendly environment for building decentralized applications (DApps) and addresses scalability challenges through its innovative sharding technology.

The protocol has made notable strides in expanding its ecosystem through partnerships with industry giants such as Binance and Mirae Asset Securities. These collaborations aim to enhance liquidity, foster growth, total market capitalization and drive innovation within the NEAR ecosystem.

From a technical perspective, NEAR Protocol’s use of Nightshade sharding and a Proof-of-Stake consensus mechanism enables high throughput, fast transaction finality, and low fees. The protocol’s commitment to user experience and developer-friendliness, exemplified by its human-readable account names and JavaScript SDK, further sets it apart in the blockchain space.

When considering NEAR Protocol as an investment opportunity, it’s essential to weigh multiple factors, including its partnerships, technological innovations promising growth, and market trends. Price predictions from various sources suggest a potential upward trajectory for NEAR, with projections ranging from $130 to $251 by 2033.

However, it’s important to note that cryptocurrency investments are inherently risky and subject to market volatility. Investors must conduct their research, assess risk tolerance, and seek professional advice before making investment decisions.

NEAR Protocol’s progress, ecosystem expansion, and partnerships indicate a promising future for the platform. With its focus on scalability, usability, and developer-friendly features, NEAR aims to contribute to the advancement of decentralized applications and the growth of Web 3.0.