Participants in the crypto ecosystem are on high alert as Multichain’s silence fuels worries about the platform’s safety. According to reports, key participants in the crypto industry are fortifying their defenses as worries about Multichain, a major platform for transferring assets between different blockchains, mount.

Multichain protocol delay causes token price crash

Following a bullish April, May was yet another month of hacks, rug pulls, and exploits, bringing uncertainty back to DeFi. The protocol in question has garnered the most media attention recently. The delayed node upgrade for the cross-chain DeFi protocol had a domino effect and caused a 30% token price crash.

While most of the cross-chain routes of Multichain protocol are functioning well, some of the cross-chain routes are unavailable due to force majeure, and the time for service to resume is unknown. After service is restored, pending transactions will be credited automatically.…

— Multichain (Previously Anyswap) (@MultichainOrg) May 24, 2023

Binance was forced to suspend deposits for eleven bridging tokens on May 25. This was after days of blocked transactions due to the protocol’s fiasco.

Aside from multichain, hacks, exploits, and rug pulls ruled the week. A crypto project allegedly stole $32 million from customers’ cash; the DeFi protocol WDZD Swap was used to make $1.1 million; and an Aave v2 flaw on Polygon caused certain contract assets to be frozen.

We'll be temporarily suspending deposits for the following bridged tokens-network while we await clarity from the Multichain team.

— Binance (@binance) May 25, 2023

POLS-BSC

ACH-BSC

BIFI-FTM

SUPER-BSC

AVA-ETH

SPELL-AVAXC

ALPACA-FTM

FTM-ETH

FARM-BSC

DEXE-BSC

Deposits of the above assets on other networks are…

Another gloomy week for the top 100 DeFi coins, with little movement from the prior week, with the majority of DeFi tokens trading in the red on weekly charts.

Multichain emerges as a popular bridge protocol despite the current dilemma

Wild rumors over Multichain’s safety and the whereabouts of its team are filling the hole left by the platform’s silence four days after it appeared that technical concerns were slowing down some users’ ability to withdraw tokens from the network. One tweet that attributed some cross-chain interruptions to “force majeure” has only served to amplify the prevailing suspicion that something is wrong.

Regardless of Multichain’s actual situation, the light-on-facts environment is pressuring many companies to reduce risk immediately. Their comments demonstrate how the potential harm crypto bridges can cause goes far beyond the most obvious and well-known risk to bridges (being hacked by North Korea).

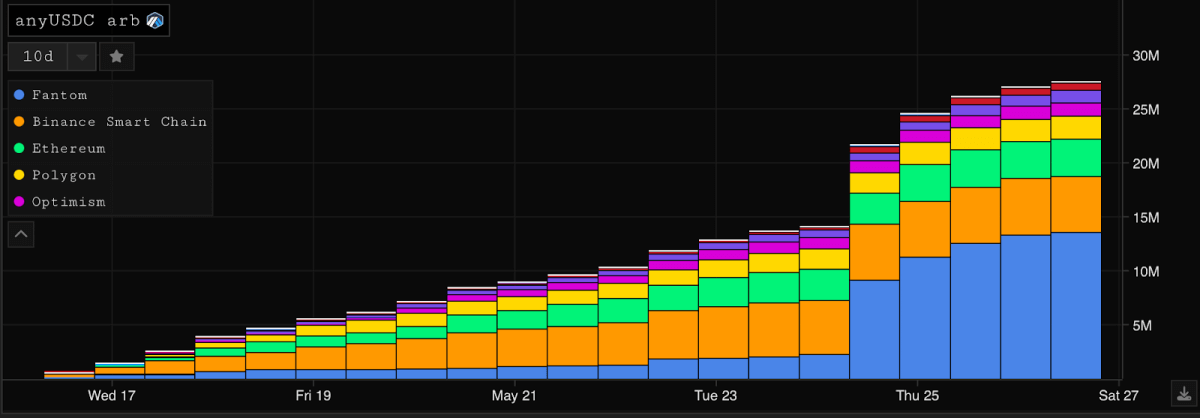

The dilemma is made worse by the popularity of the protocol among bridges. According to information from Messari and DeFiLlama, it is the third-largest bridge protocol by transfer volume and total value locked.

Like most bridges, Multichain uses a mint-and-lock technique to transfer assets among the 92 blockchains it interacts with. For instance, if a USDC stablecoin holder uses the protocol to transfer the asset from Ethereum to Fantom, the token is first locked up in a smart contract on Ethereum before being reissued on Fantom as a “wrapped” token with the name anyUSDC.

According to DeFiLlama, Multichain’s anyUSDC and other wrapped USDC tokens as it accounts for 50% of the market for stablecoins on Fantom. Although none of the USDC assets on Fantom are “native” assets that Circle issues directly onto the chain, they are all “bridged” assets. As a result, the value of all USDC tokens on Fantom depends on bridges.

As long as the bridge functions, this arrangement is functional. Wrapped USDC tokens on Fantom lost their dollar peg at the height of the protocol’s difficulties this week while it didn’t. Some arbitrage traders told news outlets that during the controversy around Multichain, which is in charge of producing 80% of the stablecoins on Fantom, they purchased wrapped USDC tokens at a 30% discount.

Binance warns of risks with non-native assets

Binance, a major crypto exchange, highlights the dangers of using non-native assets. In a tweet sent on May 27, traders were urged to remember to check their trust in the issuer behind the stablecoins they hold.”

Remember to check you trust the issuer behind stablecoins you hold.

— Binance (@binance) May 26, 2023

To increase user safety, #Binance has reached out to other industry players, including @Tether_to and @circle, with hopes to expand support for native versions of stablecoins on our platform.

Updates soon.

The strong reliance of the Fantom ecosystem on Multichain has yet to alarm market participants into a mass exodus. According to data from terminal-builder Parsec, despite small outflows to other chains, overall statistics like total value locked remain largely stable.

During the Multichain madness, Squid Router, an Axelar-based bridging protocol that uses swaps rather than wrapped tokens to transport value across chains, also saw a spike in activity.

But parties outside the stablecoin markets have been alarmed by Multichain’s approach to wrapping assets to bridge them. On May 25, Binance announced that it would temporarily halt deposits in 10 Multichain-bridged assets while they await clarity from the Multichain team.”

Service for aggregating bridges Li.Fi also closed access to Multichain on May 26 as a precautionary measure.