Polygon is a Layer 2 scaling solution that works with any blockchain. It’s the first platform to make it straightforward for Ethereum network scalability. Polygon’s Layer 2 scaling technology makes it easy for developers to build Ethereum network-compatible chains on the platform.

Also Read:

• Polygon Price Prediction: Is Matic A Good Investment?

• How To Buy Polygon Crypto?

Polygon reduces development costs and time for both companies and individuals while also making it simpler to build their Ethereum network-compatible blockchains. This will result in much rivalry within the sector, creating better projects and creating more creativity.

The Polygon team created the Plasma Chains scaling model and the Ethereum Matic PoS Chain sidechain based on Proof-of-Stake (PoS). Over time, this sidechain has become a popular scaling option for various applications.

Sandeep Nailwal, Jayanti Kanani, and Anurag Arjun, three Indian blockchain developers and consultants, formed the company Polygon Network. Polygon’s current chief executive officer is Jayanti Kanani.

Polygon has attracted a large number of customers due to its possible applications. It is currently ranked #17 on CoinMarketCap in terms of market capitalization. Let’s look at all you need to know about it before learning how to stake Polygon crypto.

Why choose Polygon?

There are several reasons why Polygon has gained such a high level of traction in the blockchain space in a short span.

1st Reason – Ethereum compatibility

Participants can leverage the network to help Ethereum scale in many ways: first, as a developer, one can use guides, documents, tutorials, or SDKs. Otherwise, one can also choose to become a validator or delegator for the Polygon PoS chain and secure the network.

2nd Reason – High Scalability

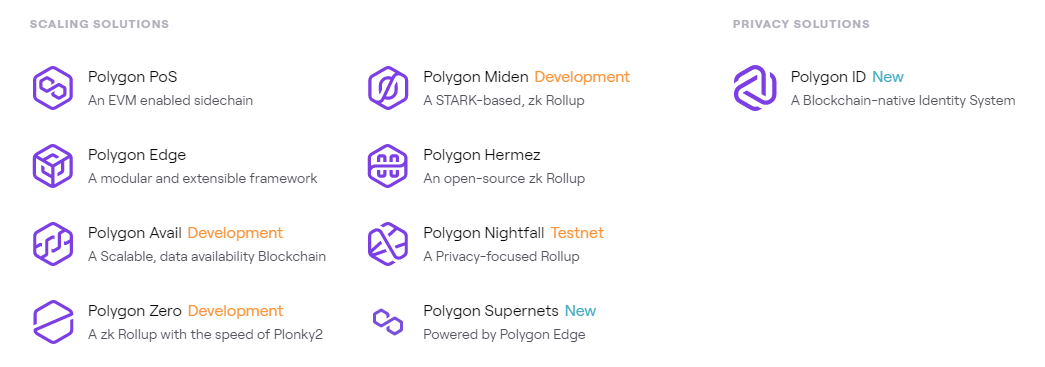

Polygon is ahead in the scalability race with its live or in-development solutions. Polygon also has the Nightfall solution on the Testnet. The Polygon Nightfall is a one-of-a-kind scaling solution that leverages optimistic roll-ups following Zero-Knowledge cryptography.

3rd Reason – High security

Polygon, built on top of Ethereum, endows it with the modular ‘security as a service’ solution and helps keep it secure. The ease of development qualities of the Polygon Network is reportedly equivalent to Ethereum. One does not need a protocol-level language to work around Polygon. Moreover, it is free from the entry barriers relating to token deposits, fees, or permissions.

4th Reason – Robust community

The network has 1.2 million followers on its official Twitter handle. Its crypto ecosystem is similarly expansive and quite all-encompassing. It has more than 440 DeFi protocols in its compatibility list. Moreover, it has nearly 50 DApps and over 300 NFTs. It also supports 150 gaming projects, almost 100 infrastructure projects, 35 Metaverse projects, and more than 50 DAOs in the supported list.

What is Polygon staking?

Polygon is a Proof-of-Stake blockchain, so your staked tokens secure the network. Staking is an excellent way to earn passive income on your crypto and compound your holdings. Plus, it supports your favorite networks and helps to decentralize the blockchains.

Polygon has its cryptocurrency, called MATIC, which is used to pay fees on the Polygon network for staking, and governance (which means that MATIC holders get to vote on changes to Polygon). You can also buy and sell MATIC via Coinbase and other exchanges. The name MATIC comes from an earlier stage in Polygon’s development.

How does Polygon staking work?

When you stake, you delegate Polygon to validators who run nodes on the Polygon Network. Staking, in essence, is a method of assisting in the network’s security, and you get compensated for it.

The PoS ecosystem of Polygon works by rewarding users with MATIC, the protocol’s native token. To earn MATIC, you can choose one of the following options:

Become a validator and commit to the network by running a full node to validate transactions on the blockchain. As a node validator, you receive a cut of fees and newly created MATIC. However, if you act maliciously, make a mistake, or even if your internet connection is slow, your MATIC rewards will be slashed as punishment.

Become a delegator, which is a type of public node. As a delegator, you receive other people’s MATIC and use it to help the network conduct PoS validation. The larger the delegated stake, the higher the delegator’s voting power. This is easier than being a node validator, but it also has challenges.

Polygon has introduced a Polygon Bridge, a trustless cross-chain transaction channel to deposit and withdraw assets between different networks. So, how do you bridge Ethereum assets to Polygon so you can enjoy its fastest speed and cheap fees?

First, you would need a crypto wallet like MetaMask to bridge tokens from Ethereum to Polygon. Then, log in to the Polygon Web Wallet by clicking Polygon Bridge, which will prompt you to connect your crypto wallet. Connecting your wallet requires you to sign a message. The signature won’t cost any fees. But always make sure the website you are using is legit, the same as your wallet.

As you click “Sign” to proceed, you will be redirected to the Polygon Bridge interface, and if not, you can select “Bridge” on the left menu bar.

To send your tokens from Ethereum to Polygon:

- Go to the “Deposit” tab.

- Once there, click on the token name to choose the token to bridge.

- Enter the amount and click “Transfer.”

Once you have read the important notes, click “Continue.” Now, you’ll also see the estimated gas fee and if you are ok with it, click “Continue” to proceed. Review your transaction details before clicking “Continue.”

You’ll then be prompted to sign and approve the transfer in your MetaMask wallet. Check the details and click “Confirm.”

Once confirmed, wait for the tokens to arrive in your Polygon wallet. You can also check on Etherscan to see your transaction status.

How to stake Polygon on Metamask

Staking a Polygon blockchain is very similar to staking an ERC-20 token. You need to complete just a few extra steps to stake your Polygon with MetaMask.

It is important to note that you can only stake your Polygon tokens from the Trust Metamask Wallet website and not from any other wallets or exchanges. The Trust Wallet website is directly integrated with the Polygon blockchain, allowing you the most secure and reliable way of staking tokens.

Step 1 – Download and install the MetaMask extension on your web browser. Once you have the extension installed, you will need to follow these steps:

Step 2 – Click on the MetaMask extension icon and click on the “Add Token” option.

Step 3 – Search for the Polygon (MATIC) tokens and select them from the list.

Step 4 – Click on the “Stake” button. Enter the number of Polygon tokens you want to stake, then click on the “Stake ” button.

Step 5 – Confirm your transaction by entering your selected password or using a secure authentication method such as U2F. Your staked Polygon tokens will be immediately locked up and begin earning rewards based on your staking amount.

You can also configure your staking preferences by clicking on the “Settings” icon within MetaMask and selecting the “Token Balances” option. You can specify how long you want to lock up your Polygon tokens, adjust your gas limit settings, and change other account options.

You can withdraw your staked tokens by clicking on the “Withdraw” button in MetaMask. Remember that you can only withdraw your Polygon tokens from the Trust Wallet website, not other wallets or exchanges.

Polygon staking: earn rewards through a pool

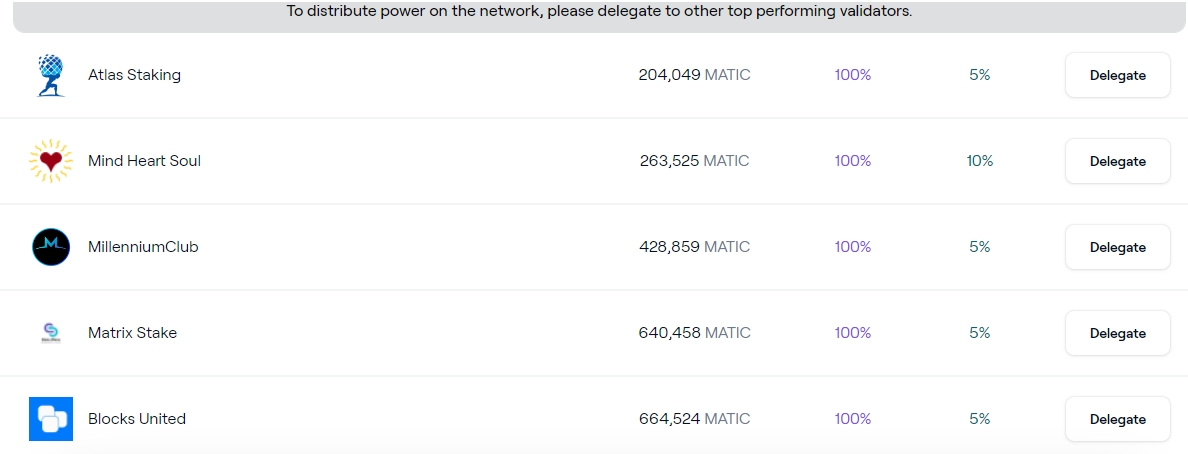

Staking pools enable cryptocurrency holders to pool their assets together to increase the chances of being chosen to verify the next block of transactions on a blockchain network. To distribute power on the network, you may delegate to other top-performing validators:

Staking-as-a-Service platforms enable crypto investors to stake their stakable PoS digital assets via a third-party service that takes care of the technical aspect of the staking process. For this service, platforms charge a fee – usually a percentage of the staking rewards.

In addition to pure staking-as-a-service platforms, several leading exchanges have also launched staking services dubbed “exchange staking.” Exchange staking enables investors to leave their PoS stakable assets in their trading account’s wallets to earn “interest” in fresh tokens. The exchange handles the technical side of the process and (usually) charges a small percentage fee for that service.

How is consensus achieved for staking in Polygon?

When Ethereum replaces Proof-of-Work with proof-of-stake, there will be the added complexity of shard chains. These are separate blockchains that will need validators to process transactions and create new blocks. The plan is to have 64 shard chains, with each having a shared understanding of the state of the network. As a result, extra coordination is necessary and will be done by the beacon chain.

The beacon chain receives state information from shards and makes it available for other shards, allowing the network to stay in sync. The beacon chain will also manage the validators, from registering their stake deposits to issuing rewards and penalties.

What role does Proof-of-Stake play in the Matic Network architecture? The threshold uses the weight in terms of the stake that comes with every vote. For instance, in Polygon, the consensus is achieved for committing checkpoints of Polygon blocks to the Ethereum network, when at least ⅔ +1 of the total staking power vote for this.

How much can I earn staking rewards with Polygon?

There are several different methods to profit through Polygon, so it’s ultimately a question of what you want. Some people like to sit back and let their Polygons appreciate by staking rewards in value over time, while others prefer to trade them on exchanges.

The best approach to increasing your staking Polygons’ value is to store them in a wallet that supports staking rewards – such as the Polygon Wallet. You’ll earn rewards interest on your polygons if you stake them in a connected wallet like this, which is based on the current market price.

If you want to trade your Polygon crypto on exchanges and be more active, you’ll need a staking pool with market information and trading tools. This will allow you to keep track of the market in real-time to make better trading decisions.

Finally, how much money you make using a staking Polygon is determined by how much time and effort you are willing to invest in a decentralized network. If you’re seeking to maintain and develop your Polygons, then the return on your investment should be modest. However, if you want to trade them frequently and make the most of your profits, it will require more.

So, how and where to stake Polygon?

Some centralized exchanges to stake MATIC are Coinbase, Kraken, Binance, FTX, Gemini, and Huobi. Which one you choose depends on your area of residence, of course. For example, people who live in the United States are likely to choose Coinbase over Binance because of the limitations Binance has on the US. Here is a table showing the different APY interest rates.

Other platforms also support Polygon staking. For example, you can stake your Polygon on validators such as Cryptonomicon, Mind Heart Soul, VK Labs, Matrix Stake, and Coinstash.

Is Polygon staking profitable?

Yes, it can be very profitable if you stake the Polygon network correctly.

According to the Polygon website, over 2.75 billion MATIC are currently being staked, and nearly $516 million have been paid in rewards. The maximum APR for Polygon (MATIC) is about 3.85% on 100 tokens for 365 days, as per the Polygon Rewards calculator.

The rates are affected by network volume, age of coins held in the wallet, the number of blocks generated, transaction fees, and other factors. The validator Witval, which is staking the most MATIC as per Polygon, is offering rewards of 17.7%, while Valis Labs offers 19.15% and MyCointainer 18.48%, according to StakingRewards.com. Meanwhile, Matic Foundation, Allnodes, Self Liquidity, SelfMoon, and Decentral Games offer 6.75%.

Binance meanwhile offers 21.54% APY for locking your MATIC for 90-days. You can earn 15%-17% on Bitfinex and 10% on KuCoin.

Staking Rewards Calculator

Polygon allocates 12% of its total supply of 10 billion tokens to fund its staking rewards program. Polygon has garnered a global validators base of 100, where more than 14,300 delegators have participated, with the total stake reaching a volume of US$4.5 billion. The importance of total rewards distributed has been nearly US$824 million.

The calculator only shows an estimated staking reward. You can find out the exact value on the website of the platform or exchange. For example: When staking 1,000 Polygon (MATIC) for 12 months at a staking reward of 17% APY, your passive income for 1 year can be about 184.95 MATIC or $201.59 with a current Polygon (MATIC) price equal to $1.09.*

Before starting investing, please carefully study the full terms and conditions of your chosen platform or exchange and be sure to consult with an investing expert. Remember that investing in Polygon (MATIC) or other cryptocurrencies is always a risk.

The Matic Bridge

The Matic Bridge helps link tokens from Ethereum to Polygon. It is also known as the PoS or Proof-of-Stake bridge. You need to log in to the Matic Web Wallet and connect to your Ethereum wallet to use this bridge. The suggested way is to use the Metamask extension for Chrome. Among other wallets, Matic holders can stake from their Coinbase wallet, Trust Wallet, and Fortmatic wallet through Frontierwallet via their mobile.

Polygon Yield Farming

Polygon farming incentivizes liquidity irrespective of the farm one chooses. All one needs to do is deposit funds in a liquidity pool. It implies that you will be submitting two currencies in one pool at a 50:50 ratio. There are several tools to check the list of farms available on Polygon.

Polygon NFT

Creating and selling NFTs on Polygon is a simple process of many subsequent steps. Powered by NFTically, the Polygon NFT marketplace keeps products catering to multiple categories, including art, virtual worlds, trading cards, collectibles, utility, and more.

Curve Polygon Dynamics

Acquiring Matic to pay for transaction fees on Curve Finance is a lucrative proposition as it is very cheap. Users may still need MATIC to pay for gas fees. One can also use the bridge to leverage Ethereum. Once done correctly, it is also possible to bridge USDC/DAI and deposit and swap on the Curve Polygon Website.

PolygonScan

PolygonScan is the main blockchain explorer for the Polygon blockchain. It allows anyone to explore and search the Polygon blockchain for transactions, addresses, tokens, prices, and other activities taking place on Polygon.

Latest Onboardings

Bloxroute, a Blockchain Distribution Network, has been introduced to Polygon. It is a network solution that facilitates web3.0 scalability for blockchain projects. The result is higher throughput and faster transactions.

Star graph, the first Monza Circuit NFTs collection to engage Formula 1 fans interactively and intuitively, has made its launch on Polygon. Over time, Polygon has emerged as the go-to scaling platform, enabling fans to immerse themselves in their passion for NFTs. It has more than 300 NFT DApps in its ecosystem, including Opensea, Aavegotchi, Zed Run, Neon District, Megacryptopolis, etc.

Polygon staking vs. mining

Transactions on a blockchain are stored in public ledgers, which are in turn copied into nodes or computers to secure users’ transaction data. Validation of data in nodes can be done by staking or mining. The primary difference between staking and mining is the algorithm used to validate transactions and add new blocks to the blockchain. The table summarizes the difference between the two processes:

| Requirements/Results | Mining (Proof-of-Work) | Staking (Proof-of-Stake) |

| Energy | Extensive | Lesser |

| Equipment | Powerful and Expensive GPUs | Internet connection |

| Rewards | Higher | Smaller |

In Proof of Stake (PoS), miners validating transactions don’t exist. Some forgers stake their coins in exchange for incentives, called transaction fees, for the opportunity of being selected to confirm transactions and validate the next block. The validators are chosen either randomly or are designated.

In a Proof-of-Stake system, the blockchain network aspires to reach distributed consensus. Anyone with enough tokens can lock them up, and the economic incentive comes from the network’s shared value. Individuals who stake their assets validate transactions by voting on them, and the consensus is achieved when a transaction or set of transactions in a block or checkpoint receives

The threshold is the amount of weight in terms of stake required to cast a vote. In Polygon, for example, consensus on committing checkpoints for Polygon blocks to the Ethereum network is reached when at least ⅔ +1 of the total staking power votes for it.

Through staking, blocks can be produced without any particular mining software. Instead of competing for blocks, staking relies on the invested coins. With the increase in crypto staking, the chances of your funds being selected for blocks on the blockchain also increases.

A miner can also do staking to get new blocks on the blockchain. Staking conception is making a refundable deposit that aims to prove that you have invested in the profit of anything you’re mining off.

“Cold staking,” which means the staking of coins without an internet connection, is also possible. You can leave the stock in your wallet and keep on earning interest even if you forget that you’re staking. A small investment is enough for staking.

Liquid Staking

Liquid staking is one of the most inventive aspects of Defi. It allows users to release trapped tokens and reinvest them, effectively freeing up funds trapped in staking contracts. By eliminating lengthy lockup periods associated with traditional crypto staking, liquid staking removes the need for users to wait before withdrawing their funds.

However, with the introduction of Defi, new models for improving financial efficiency in native assets (such as lending and farming) have emerged, which are now eating a growing proportion of staked assets (as Defi offers a higher return than staking). Clay Stack addresses this by allowing customers to stake their money without giving up control.

Benefits of staking Matic tokens

The average APY for staking Polygon is 8%. According to Polygon, more than 2.39 billion MATIC tokens are staked in different providers. Aside from these, the following are the benefits of staking MATIC tokens:

Staking MATIC tokens is one of the most effective methods to earn rewards on your investment. Here are some of the most significant advantages of staking MATIC tokens:

- You can earn interest on your investment.

When you stake MATIC tokens, you can earn interest on your investment. This means that your investment will grow over time, and you can earn more MATIC tokens in the long-term. All that matters is the number of tokens you staked at the beginning and the Annual Percentage Yield (APY).

- You have access to exclusive rewards programs.

MATIC also has a variety of rewards programs that you can take advantage of when you stake MATIC tokens. These include special promotions, access to exclusive events, and even discounts on products or services within the network.

- You get more control over your cryptocurrency investments.

You get more control over your cryptocurrency investments. When you stake MATIC tokens, you can vote on network decisions, contribute to the growth of the network, and be a part of this exciting new industry.

Drawback/risk of staking Polygon

- When you stake Polygon, you are essentially locking up your tokens for a specified time. This implies that you will be unable to trade or transfer your tokens during this period.

- Furthermore, if the value of your Polygon drops significantly, you might lose money and pay transaction fees on top.

- Whenever the blockchain notices discrepancies in the activities of validators, it will “ slash ” the staked funds of the culprits. and yours, together with the pool. Slashing is the term used for when an Ethereum 2.0 validator purposefully breaks network rules and is forcefully removed.

- Finally, you need to unstake Polygon before the lock-up expires.

However, if you can keep your Polygon for the duration of the lock-up period, it may be an excellent method to earn a high-interest rate on your polygon assets. As more individuals in staking Polygon and making them unavailable for trading, the number available on the market will decrease.

Conclusion

Polygon staking has many benefits. It can be done without internet access, which means that the digital wallet stocks keep increasing even if you forget. Staking rewards depend on your investing style; the more you invest, the more chances you get to earn rewards.

Overall, staking your Polygon might be an excellent method to earn interest while keeping your investment safe. However, there are dangers involved in slashing staked funds, so it’s critical to consider them before fully taking action on the native token. It’s all down to personal risk tolerance, preferences, and transaction fees. So, do some research and choose the best solution for you.

[the_ad_placement id=”writers”]