The first week of June the crypto market experienced a sharp decline in Ethereum network gas fees, which fell to $7.34 from a peak of $20 in May. Miner Extractable Value (MEV) bot usage and the waning memecoin mania are blamed for the fall. This decrease in gas costs might benefit Ethereum and its native currency, ETH, in the long run.

Memecoin frenzy and MEV bots contribute to lower gas prices on Ethereum

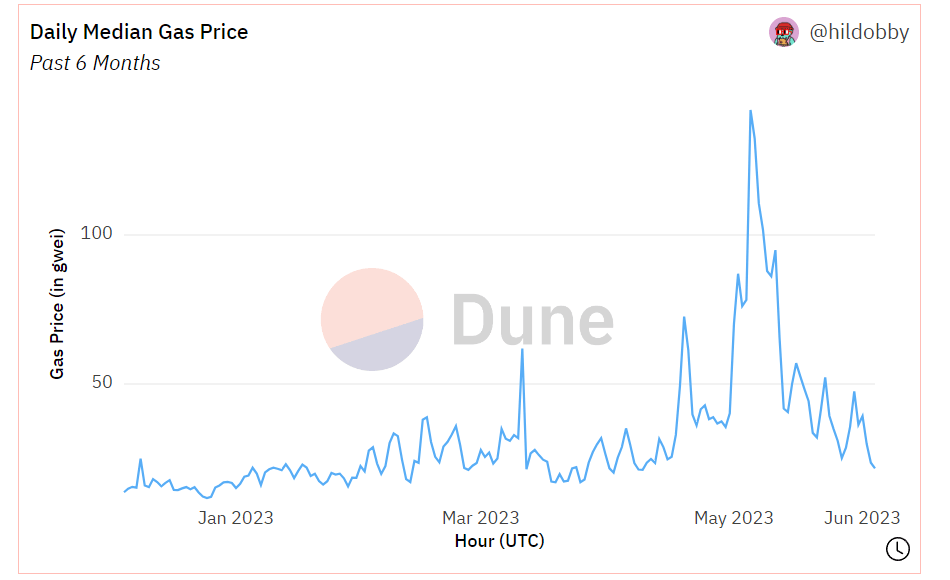

According to on-data, the average gas price, or transaction fee, on the Ethereum network dramatically dropped in the first week of June after reaching a multimonth high in May. This occurred as a result of the memecoin frenzy and multiple maximal extractable value (MEV) bot activity.

The typical gas price is now $7.34, down almost a third from the peak of $20 last month. The market experienced the release of numerous new memecoins, including Aped (APED), Bobo Coin (BOBO), and others, as a result of the memecoin frenzy, which began in late April and gained prominence in May.

Average gas fees on Ethereum in the past six months. Source: Dune Analytics

There was an interesting movement in the top 10 gas-burning altcoins as a result of memecoins’ overwhelming dominance in network activity. Memecoins like Troll (TROLL), APED, and BOBO ranked in the top 10 spenders rather than ETH, Wrapped Ether (WETH), or Tether.

⛽️ A highly unusual shift in top 10 gas burning #altcoins has emerged today. Instead of $ETH, $WETH, and $USDT being at the top of the fee distribution list, we're seeing new assets like $TROLL, $APED, and $BOBO among them. Read our latest deep dive. 👇 https://t.co/7SlmJ59k2m pic.twitter.com/Y2kaLKZTrL

— Santiment (@santimentfeed) April 19, 2023

According to the report, memecoins are becoming increasingly popular on decentralized platforms. As a result, mainstream centralized exchanges are taking longer to list them, which is another significant factor in the increase in Ethereum gas fees.

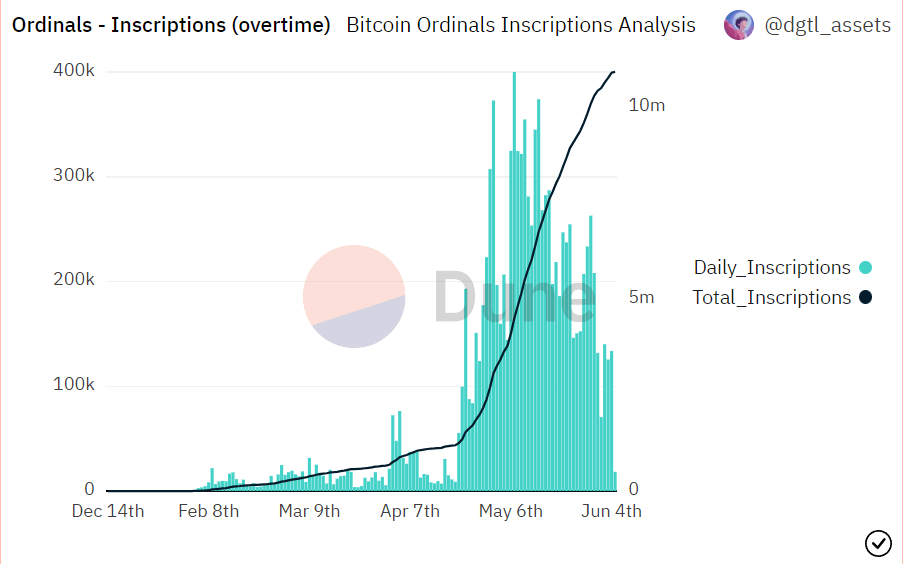

Not only was the Ethereum memecoin craze in May, but Bitcoin Ordinals also saw a substantial increase in popularity. On the bitcoin blockchain, ordinals allow for decentralized storage of digital art. The bitcoin network, as a result, recorded numerous new memecoins, with Pepecoin (PEPE) reaching a $1 billion market cap.

The first Ordinals were released in January, and by the end of May, there were over 10 million inscriptions of them on the bitcoin blockchain. In May, the total fees paid for inscriptions on Ordinals increased by 700%, and they now stand at 1,639 Bitcoin.

Due to the waning memecoin mania, Ethereum gas fees have been reduced and there have been sharp drops in both Ordinals inscriptions and gas fees.

How the rise of memecoins influenced Ethereum’s gas charges

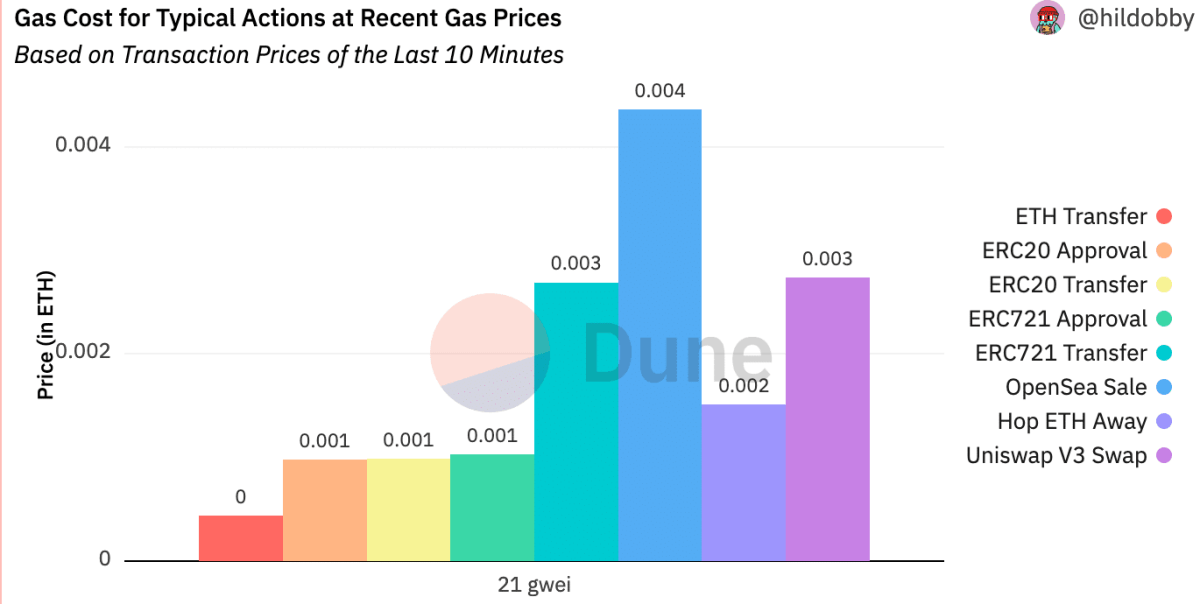

ETH’s historically high gas prices have frequently discouraged users from utilizing the network, prompting them to investigate alternative protocols. However, the current drop in gas consumption may have favorable long-term effects for both Ethereum and ETH.

Ethereum is gassed up

According to Dune Analytics, the daily average gas price for Ethereum dropped to its lowest point in the preceding two months. As of June 3, the national average gas price was 24 gwei; at press time, it was 17 gwei. Gas prices may have fallen as a result of the current hullabaloo surrounding memecoins, which has increased activity on the network. The use of MEV bots (Miner Extractable Value) may have also contributed to the decline.

The NFT Angle

Automated systems called MEV bots use transaction sequencing to take advantage of lucrative Ethereum network opportunities. By enhancing transaction execution, these bots’ ubiquity may have an effect on gas prices, possibly lowering user expenses.

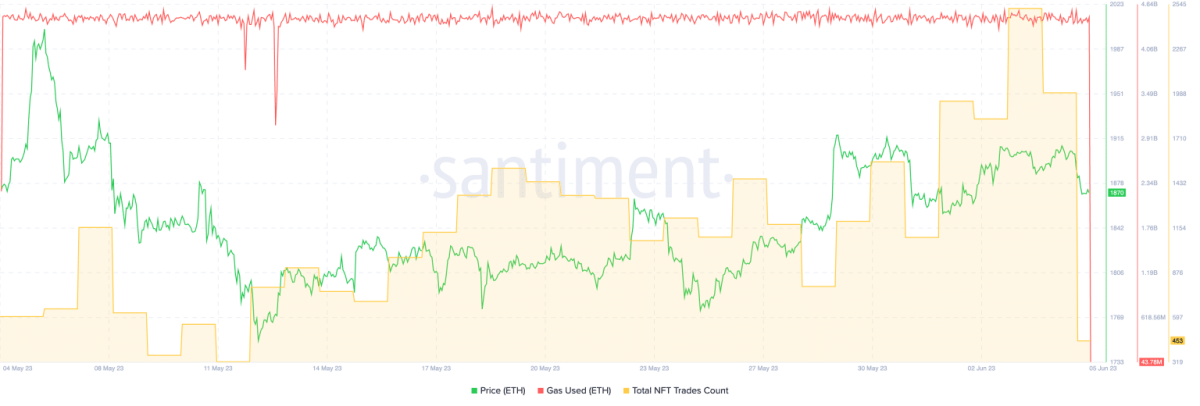

Low gas prices made it possible for the Ethereum protocol to have consistent gas usage. The quantity of NFT trades on the Ethereum network also increased at the same time.

Notably, the increase in NFT volume was driven by well-known blue-chip NFTs like MAYC and Azuki. According to DappRadar’s data, these NFTs’ volume climbed by 29.9% and 129%, respectively, over the previous week.

At the time of publication, the price of ETH, the native crypto of Ethereum, was $1,873. The coin’s MVRV (Market-Value-to-Realized-Value) ratio grew over the previous month, indicating that addresses holding ETH are profitable to some extent.

This would encourage the owners of these addresses to sell and collect gains, which might have an effect on the price of ETH soon.

Shapella hard fork and ETH’s price surge: Uncertain impact

Hopes that ETH would prosper after switching from a proof-of-work (PoW) to a proof-of-stake (PoS) consensus mechanism were dashed, at least temporarily. The price of the coin dropped by 25% in the three months from the date of The Merge to the beginning of 2023, and it didn’t recover to its pre-transition levels until six months later.

The price of ETH threatened to surpass $2,000 for the first time since May 2022 after the Shapella hard fork on April 12, 2023, but given the post-Merge depression, it is unclear what effect the move will have on the price of the coin.

Following a planned takeover by Binance (BNB) and its eventual cancellation, the FTX (FTT) exchange filed for bankruptcy in November 2022, causing a market drop that negatively impacted ETH.