A recent crypto market study report published and examined by the University of Cambridge reveals the market’s perspective of cryptocurrency, Bitcoin mining, crypto-asset user profiling, and most importantly, security concerns. The school’s Center for Alternative Finance also participated in this in-depth research. The study dubbed the “Global Cryptocurrency Benchmarking Study”.

A large number of cryptocurrency users and data mining experts took part in the massive research conducted by the Alternative Finance to conclude the crypto market study report. The research came across in two different parts from March 2020 to September 2020. The research also classified the types and order of cloud computing, data mining, crypto custodians, and wallet providers. Several parts of the report suggest different types of changes and adaptations amid global situations and market progress.

Major highlights of crypto market study report

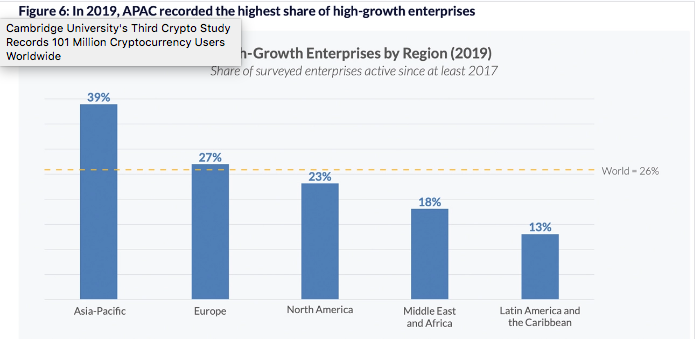

The first part of the crypto market study report comprises the crypto currency’s employment eco-system. The report highlights a massive decrease in the employment rate in the industry. The factual data represents a downfall of 21 percent in 2019. The 2019 data was 57 percent down from the data of 2018. Furthermore, Asia-Pacific has the highest share in the business than any other else.

The second part of the crypto market study report discusses the environment of cryptocurrency mining on an industrial scale. The data further shows the leverages and drawbacks of mining. Moreover, the data further shows the mining of different types of coins. As far as the growth rate of coins is concerned, Bitcoin stands first again followed by the Ethereum and Litecoin. Bitcoin, in particular, is the most famous coin for the miners and other wallet consumers.

The utility costs are also briefly described by the 71-page report. Since the introduction of new tariffs by the Chinese government, the US miners have to pay a lot; then it has to be in a few years. The factual data reports a 28 percent increase in the utility cost for and American miner.

The research also examined a clear view of renewable energy in terms of Bitcoin mining. Hydropower energy, ranked top by the researchers, as the miners and hashers are empowered by this sector in the U.S. This part comprises of around 76 percent. The other part, which includes solar and winds energy, further declines to 36 percent.

The security perspective of the report was quite satisfying for the consumers, miners, and other sectors related to this industry. The report contains a variety of subjects such as stable coins, the I.T industry, and other regulations imposed by governments around the world. Stable coins like tether are becoming more significant for the miners and hashers. Tether alone increases from 4 to 32 percent according to the market value.

Apart from the report, a cryptocurrency bill is likely to be presented at the U.S congress. The bill will be 2nd of its kind as the first one was already presented by the U.S congressman in March 2020, also known as the Cryptocurrency Act of 2020.