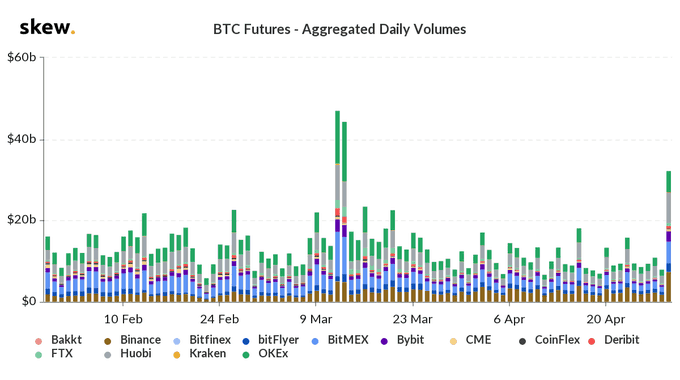

On April 29, the bitcoin futures market soared, corresponding to the favorable price action that saw BTC break past the $9,000 level. Yesterday marked the busiest day the bitcoin futures market has seen since the mid-March market crash.

According to data published by cryptocurrency market analysis firm, Skew, on Wednesday futures trading volume hiked to just above $30 billion. The figure represents just 40% less of the $50 billion in volume that the BTC futures market saw on March 12, when the BTC price dropped to under $4,000.

The bitcoin futures market volume increase is owed to a 13% increase that saw BTC price rise from $7,600 to a daily close of $8,750. Yesterday the price of BTC rose past the $9,000 level to briefly hit the $9,400 level.

Binance, Bitfinex and Huobi enjoy lion’s share of bitcoin futures market volume

Furthermore, cryptocurrency exchange platforms, Bitfinex, Binance and Huobi enjoyed the largest share of the futures volume, netting $23.2 billion between themselves. Once the figureheads of the bitcoin futures market, Bitmex, only saw a volume of $5.3 billion. Bitmex’s dominion of the futures market has rapidly diminished since the black-Thursday market crash.

Moreover, the total open interest in the BTC futures market has increased back to $2 billion. On Feb 12, the futures market volume hit an all-time high of $5 billion in open interest, only to see the interest plummet massively to $1.8 billion one month later.

BTC pre-halving price rally

The price of BTC has skyrocketed, just 12 days before the block rewards halving event. The price of the flagship cryptocurrency rose by 20% earlier today, hitting the $9,400 price level. This marked the first time in over 60 days that the price has broken off the $8,000 level, ahead of the significant blocks halving event.

As a result of the massive rally, American cryptocurrency exchange platform, Coinbase, suffered outages. The last time the cryptocurrency exchange platform crashed due to massive trading volumes, BTC saw its largest bull run.